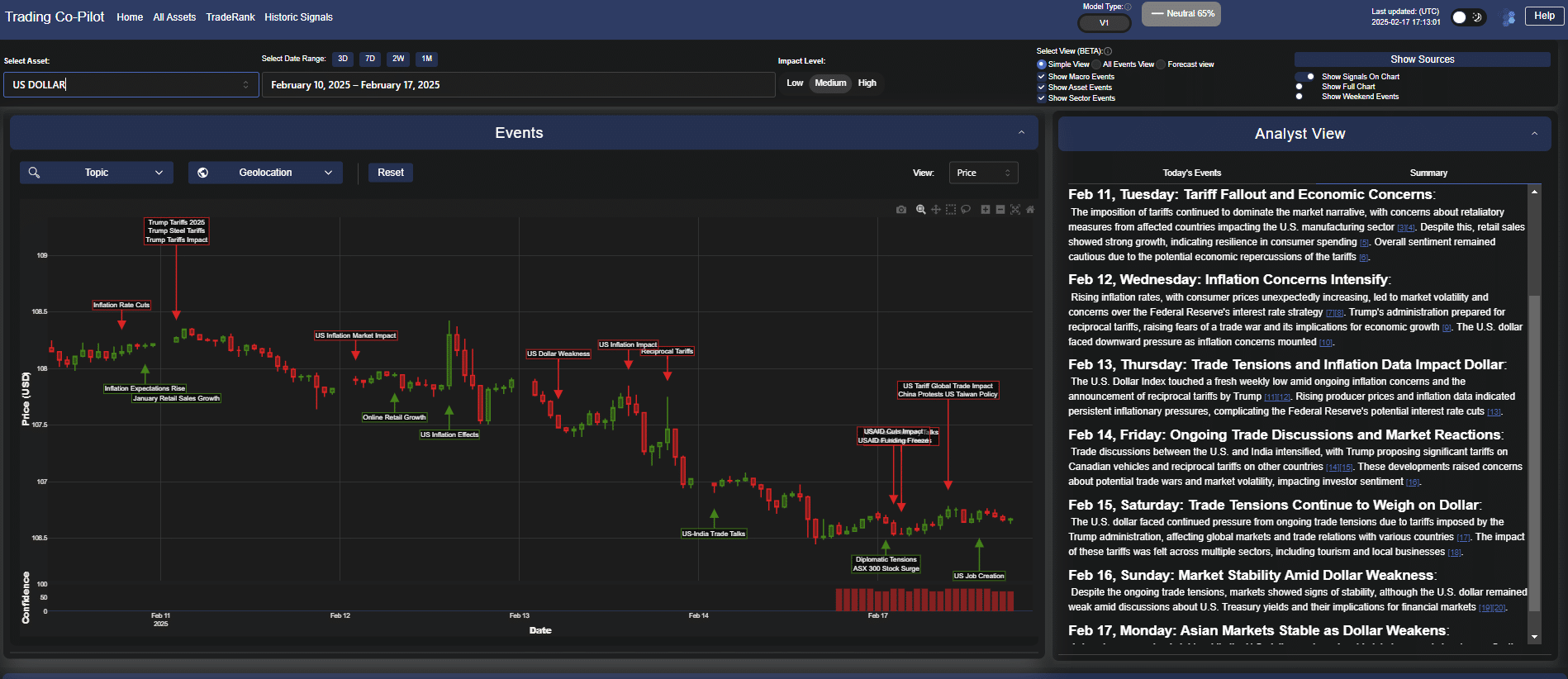

Our Trading Co-Pilot’s analysis of recent market movements reveals a clear correlation between the proposed Trump Tariff Plan and emerging weakness in the US Dollar. The plan, which outlines a sweeping 25% tariff on imports including automobiles, pharmaceuticals, and semiconductor components, has triggered significant market reactions that our AI models have been tracking in real-time.

As a matter of fact, the tariff announcement created immediate ripples across currency markets, with the dollar index showing particular vulnerability during the February 11-17 trading week. Our signals clearly identified increased volatility coinciding precisely with escalating rhetoric around the Trump Tariff Plan.

Inflation concerns: The primary driver of dollar weakness

The market narrative has been dominated by inflation concerns stemming directly from the Trump Tariff Plan. Our sentiment analysis model detected a marked shift in market psychology following the February 11 announcement, with inflation expectations rising significantly.

Furthermore, the data indicates consumer prices reacted unexpectedly to tariff discussions, with particular sensitivity observed in sectors directly targeted by the proposed measures. The correlation between tariff announcements and inflation data strengthened notably mid-week, suggesting traders are pricing in potential supply chain disruptions.

To add to this, the Federal Reserve‘s interest rate strategy now faces additional complications, and as our models suggest, the Trump Tariff Plan creates a challenging policy environment. Rising producer prices and persistent inflationary pressures are complicating potential interest rate adjustments, directly impacting dollar strength.

Global trade tensions and reciprocal measures

Another critical dimension of the Trump Tariff Plan involves potential retaliatory measures from trading partners. Our analysis indicates significant concern about reciprocal tariffs, particularly following the February 13 market reactions. The dollar index tracked lower amid these growing tensions, reflecting investor uncertainty about escalating trade conflicts.

Given the interconnected nature of global markets, the Trump Tariff Plan unsurprisingly appears to be creating feedback loops across multiple economies. Trade discussions between the US and India intensified directly following the tariff proposals, with our sentiment indicators capturing growing concerns about potential trade wars affecting investor positioning.

Speaking more broadly, our Trading Co-Pilot has observed consistent pressure from ongoing trade tensions tied directly to the Trump Tariff Plan. The impact has been felt across multiple sectors, with tourism and local businesses showing particular vulnerability in our cross-asset correlation models.

Market stability and Treasury yield implications

Despite these pressures, there have been periods of surprising market stability amid dollar weakness. Our historical context models suggest this pattern resembles previous tariff-related market reactions, though the current Trump Tariff Plan appears to be creating more pronounced effects on Treasury yields.

In essence, the financial markets are displaying a complex reaction to the Trump Tariff Plan, balancing inflationary concerns against potential economic growth implications. In all of this, our confidence metrics indicate high certainty in the correlation between tariff announcements and subsequent dollar movements throughout the analysed period.

Regional market reactions to the Trump tariff plan

Asian markets demonstrated particular sensitivity to the Trump Tariff Plan, with our macro sentiment analysis detecting significant positioning shifts following the February 17 trading session. The dollar weakened notably against Asian currencies as market participants assessed the regional impact of proposed tariffs.

To put it differently, the Trump Tariff Plan appears to be creating asymmetric effects across different market segments, with our models indicating varying levels of resilience in different economic sectors. Manufacturing has shown particular vulnerability, while consumer spending has demonstrated unexpected resilience despite tariff concerns.

Trade policy uncertainty and investment implications

Our Trading Co-Pilot’s LLM-driven analysis suggests the Trump Tariff Plan is introducing a new layer of policy uncertainty that institutional investors must navigate carefully. Historical confidence metrics indicate similar tariff proposals have typically led to extended periods of dollar weakness as markets adjust to changing trade dynamics.

The potential economic repercussions of the Trump Tariff Plan extend beyond immediate market reactions. Our models indicate growing concerns about long-term growth trajectories, with particular focus on how sustained trade tensions might impact investment decisions and capital flows.

Navigating Dollar weakness amid the Trump tariff plan

The Trump Tariff Plan represents a significant shift in trade policy with direct implications for US Dollar strength. Our AI market sentiment analysis reveals a clear connection between tariff announcements and subsequent currency market reactions, with inflation concerns serving as the primary transmission mechanism.

For institutional investors, these geopolitical and macroeconomic developments require careful positioning given the potential for continued volatility. Our Trading Co-Pilot’s signal confidence remains high regarding the correlation between the Trump Tariff Plan and dollar weakness, though our systems continue to monitor for stabilising factors that might emerge in response to market dislocations.

While the full impact of the Trump Tariff Plan continues to evolve, our AI-driven analysis strongly suggests that dollar weakness remains the primary market reaction to date. Continued monitoring of inflation metrics, trade negotiations, and policy responses will be essential for anticipating future market movements as this situation develops.

Experience our enterprise market intelligence for institutional traders

Discover how our Trading Co-Pilot platform can help your team navigate complex trade policy implications and currency volatility with confidence. Qualified institutional users can book a personalised demonstration of our platform, featuring real-time tariff impact analysis, cross-asset correlation heatmaps, automated geopolitical sentiment tracking, and historical confidence metrics. Select institutional trading desks and macro hedge funds may qualify for a 14-day trial of our Trading Co-Pilot platform. Simply email enquiries@permutable.ai to experience our AI-driven market analysis capabilities firsthand or fill in the form below.