In a world that has started to spin in ever faster geopolitical tension, gold continues to maintain its position as the safe-haven asset of choice for investors seeking stability. The precious metal recently surged past the $3,000 mark, reaching unprecedented heights as market volatility continues to shape investment strategies globally, with some saying this is just the beginning. In this article we’ll take a closer look at market volatility impact on gold, with insights taken from Analyst View of our Trading Co-Pilot.

The current crisis and gold’s reaction

The current crisis spanning multiple regions has created a perfect storm for gold markets. Humanitarian crises in Gaza, escalating tensions in Ukraine, and military actions in Yemen have all contributed to a climate of uncertainty that typically benefits gold prices. By the time markets opened this Monday, gold had already marked its third consecutive weekly gain, with analysts projecting further increases toward $3,100.

Consider the facts: gold prices reached a record high of $3,051 per ounce last Tuesday, driven primarily by safe-haven demand amidst growing geopolitical uncertainties. This wasn’t merely a speculative bubble. Indeed, the fundamental drivers behind gold’s rise reflect deep-seated concerns about global stability and economic outlook.

Market volatility impact on gold: Historical context

Let’s take a step back and examine how market volatility has historically influenced gold prices. Back when financial markets faced similar turbulence during the 2008 global financial crisis, gold demonstrated its resilience as a store of value. The same goes for periods of heightened geopolitical tension, where investors consistently turn to gold as a hedge against uncertainty.

Many believe that gold’s inverse relationship with market volatility is what makes it an essential component of a diversified portfolio. But the story of how gold responds to volatility is more nuanced than conventional wisdom might suggest. Insiders say that the current gold rally differs from previous surges in several key aspects. The reason for this is fairly straightforward. Unlike previous periods of volatility, we’re seeing a confluence of factors – geopolitical tensions, persistent inflation concerns, and central bank policies – all creating a particularly supportive environment for gold.”

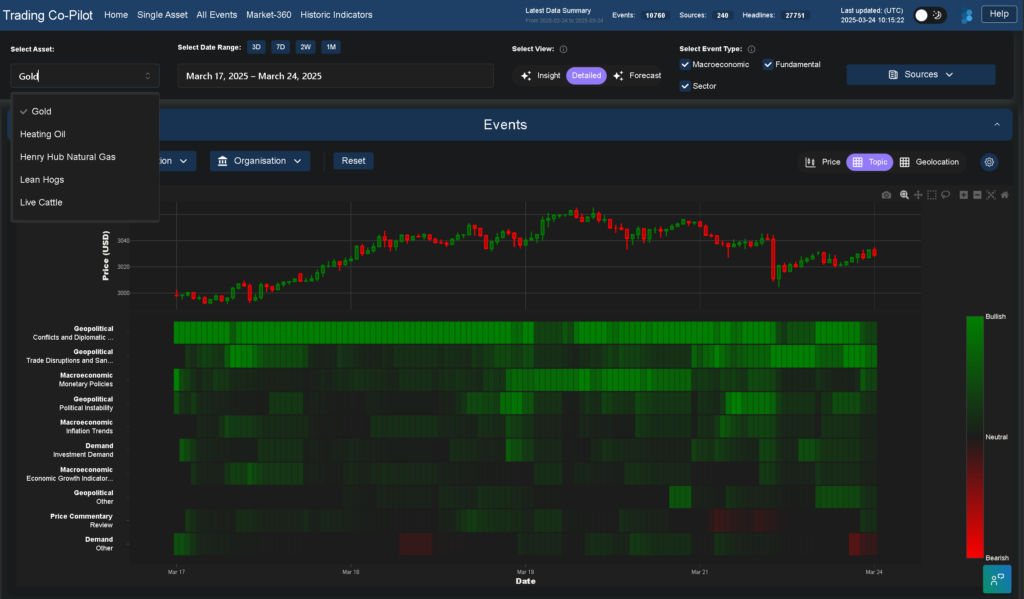

Above: Our Trading Co-Pilot‘s Sentiment Heatmap clearly showing a confluence of factors impacting gold prices

The inflation factor and central bank policies

The Federal Reserve’s decision to maintain interest rates has significantly contributed to market volatility impact on gold. Such doubts withered away when markets began pricing in potential rate cuts later this year, providing additional support for non-yielding assets like gold.

However, many seasoned onlookers see this as a double-edged sword. There is no prospect of immediate monetary easing, especially with inflation remaining above target levels in many economies. This is the context in which investors must navigate their gold investment strategies. It is also the result of central banks themselves becoming substantial gold buyers, adding to their reserves at the fastest pace in decades. The Bank of England’s decision to maintain interest rates at 4.5% amidst global uncertainties further bolstered the case for gold as a portfolio stabiliser.

Geopolitical tensions: The primary driver

Why did this happen? The mists are lifting, revealing geopolitical tension as the primary catalyst for gold’s recent performance. Simply put, the ongoing conflict in Gaza, military actions in Ukraine, and tensions in Yemen have created a climate where investors prioritise capital preservation over growth. These are not isolated problems but interconnected challenges that continue to shape market sentiment. One of the big targets is achieving portfolio resilience in the face of such multifaceted risks, and gold has traditionally served this purpose well.

More generally, the market volatility impact on gold extends beyond price appreciation to include its role as a liquidity provider during market stress. To see what we mean, just look at how gold has maintained its trading volume and market depth even as other asset classes experienced liquidity constraints.

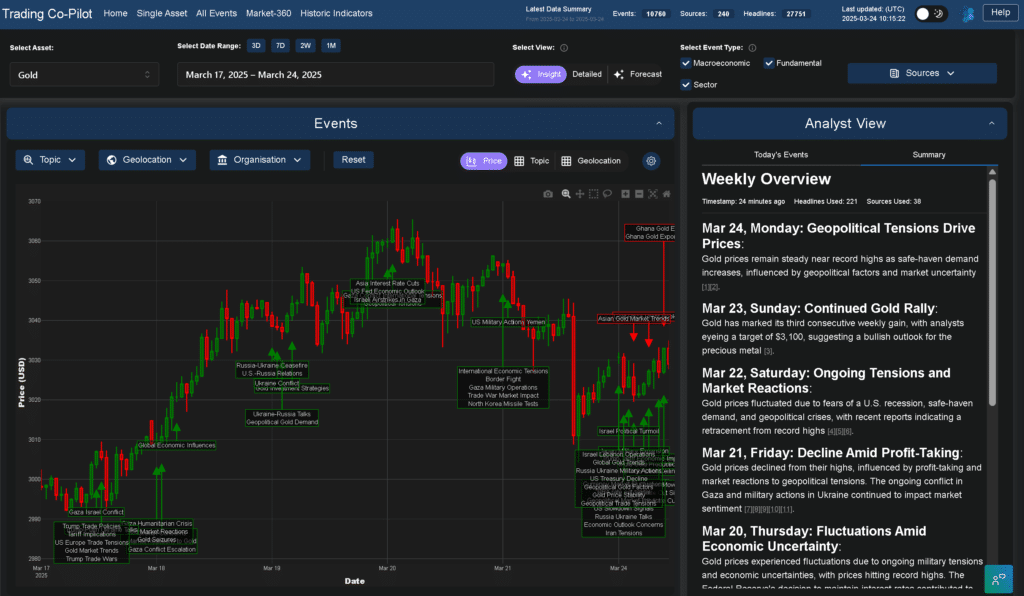

Above: Analyst Insight Mode from our Trading Co-Pilot showing gold price movements amid market volatility over the last week

Investment strategies amid volatility

What to do about it? For investors navigating this complex landscape, it normally just takes a strategic approach to incorporate gold effectively into portfolios. And yet we still see many investors under-allocated to this asset class relative to historical norms. That said, diversification remains essential. It’s the same with any investment strategy – concentration creates vulnerability. Gold should complement other assets rather than dominate portfolios.

It may, however, already be too late to capture the initial surge. The list goes on of factors that could influence gold’s trajectory from here – potential rate cuts, inflation persistence, and evolving geopolitical situations all remain in play. Like much of financial market dynamics, the market volatility impact on gold requires nuanced understanding. This isn’t to say that gold is immune to price fluctuations; recent profit-taking after reaching record highs demonstrates that gold prices can retrace even amid supportive conditions.

The outlook for gold amid continued volatility

And what of gold’s prospects moving forward? Ultimately, the outlook depends on how several key factors evolve:

- The duration and intensity of current geopolitical conflicts

- Central banks’ monetary policy decisions

- Inflation trajectory in major economies

- Physical demand trends, particularly from China and India

The market volatility impact on gold will likely remain positive as long as uncertainty persists. However, any resolution to current conflicts or shifts toward monetary tightening could temper enthusiasm. Yet, ultimately, gold isn’t merely responding to short-term headlines but to fundamental shifts in the global economic and political landscape.

Market volatility impact on gold: Final thoughts

In sum, the market volatility impact on gold has been profound, driving prices to historic highs amid a perfect storm of geopolitical tensions, monetary policy uncertainty, and safe-haven demand. As investors continue to navigate this volatile environment, gold’s role as a portfolio stabiliser and store of value remains as relevant as ever.

For those seeking to understand and potentially benefit from gold’s relationship with market volatility, a balanced approach that acknowledges both opportunities and risks remains essential. The precious metal’s current strength reflects genuine concerns about global stability – concerns that show little sign of abating in the near term.

Harness our AI-driven gold market intelligence in volatile times

Take your market analysis to the next level with our Trading Co-Pilot. Our advanced AI-driven platform delivers real-time intelligence on gold market movements, helping you navigate volatility with precision and confidence. Don’t let crucial market shifts catch you off guard – sign up today for a free 14-day trial and experience how our cutting-edge technology can give you the edge in today’s unpredictable markets. Simply get in touch with us at enquiries@permutable.ai or fill in the form below to request a demo or trial.