*This article explores the fundamental regime shift occurring in oil markets due to geopolitical disruptions, particularly aimed at traders and analysts seeking to navigate unprecedented volatility in the current landscape.

The world is in a period of rapid change, particularly within energy markets where traditional relationships between supply, demand, and price are being fundamentally reshaped during the current regime shift. This disruption by Trump’s administration has reached new heights with the implementation of sweeping tariffs that have sent shockwaves through global commodity markets. For those engaged in crude oil markets, the landscape has become increasingly complex and challenging to navigate.

Understanding the new energy market paradigm

It’s becoming clear to us that we’re witnessing not just a temporary disruption but a fundamental regime shift in energy markets. Beyond all the drama of daily price movements, structural changes are occurring that require a complete rethinking of analytical frameworks. Trump and his team have introduced policies that have altered longstanding trade relationships, diplomatic norms, and market expectations.

The recent economic meltdown triggered by tariff announcements demonstrates how quickly sentiment can shift and cascade through interconnected markets. It has struck us that conventional crude oil market approaches are no longer sufficient in this environment. As Trump wreaks havoc on our entire way of life – or at least on established economic orthodoxies – traders and analysts must adapt their methodologies to remain competitive.

Geopolitics of Trump fundamentals

This is all very unsettling for traditional energy traders accustomed to focusing primarily on supply-demand balances. The oil industry, facing ongoing volatility due to tariffs and geopolitical tensions, now finds itself in uncharted territory where news flow drives price action more than inventory reports or production data.

Our view is that Trump the disruptor has fundamentally altered how markets function, particularly in the energy sector where his foreign policy decisions regarding Iran, Russia, and China have immediate price implications. Clearly, successful navigation of crude oil markets now requires equal attention to Washington politics as to OPEC meetings.

This puts the onus on traders to develop new analytical frameworks that can properly weight and contextualise geopolitical developments. We believe that Trump’s tariff bazooka has obliterated conventional wisdom about free trade and global cooperation, introducing new variables into market equations that previously didn’t exist or mattered much less.

Above: Our sentiment heatmaps enable the delayering of different sentiment drivers (WTI crude oil)

Breaking correlations and creating opportunities

The invisible hand of the market seems to be operating with new constraints as government interventions reshape trade flows. Trump’s attack on free trade has created distortions that, while challenging to navigate, create significant opportunities for well-informed traders.

On balance, we know that these disruptions benefit those with superior information and analytical capabilities as we have seen from our own trading performance. Across all these fronts – tariffs, geopolitical tensions, and supply uncertainties – the key differentiation is timely access to contextualised intelligence.

What’s painfully apparent is this: traditional correlations are breaking down. As such, assets that historically moved in tandem now diverge, creating arbitrage opportunities for alert traders.

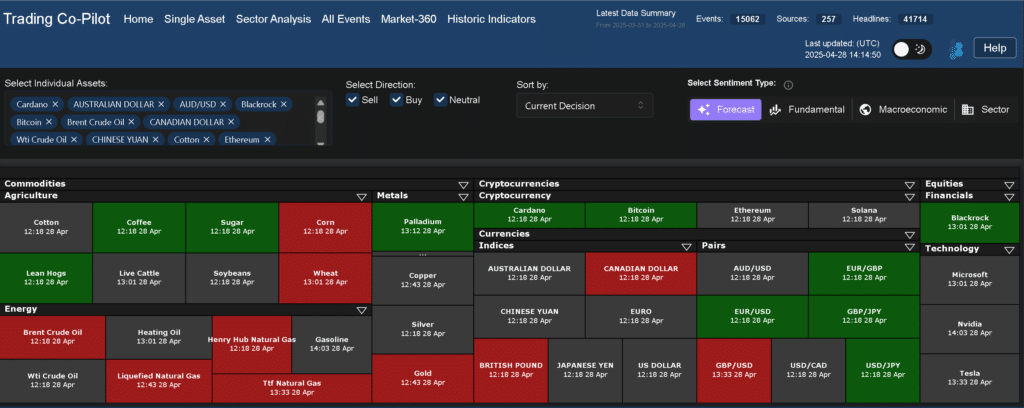

Above: Our Trading Co-Pilot Market 360 feature showing cross asset correlations and dislocations

Market implications

In all of this, volatile crude prices demand nimble positioning. As previously mentioned, traditional correlations are breaking down as geopolitics trumps fundamentals. Meanwhile, hedging strategies require urgent review in light of new market dynamics. Case in point – the historical relationships between crude and currencies, between WTI and Brent spreads, and between futures curves are all being tested by current market conditions.

Companies engaged in crude oil markets are reassessing their risk management frameworks entirely. When fundamental analysis can be rendered irrelevant by a single tweet or policy announcement, traders need access to real-time information processing tools like our Trading Co-Pilot and API that can rapidly contextualise developments.

Trading opportunities

Ultimately, price dislocations create asymmetric risk/reward setups. Here, divergence between sentiment and fundamentals presents arbitrage potential for informed traders who can separate signal from noise. The current environment is particularly rich with opportunities for those who can identify when markets have overreacted to headlines.

The challenge here lies in processing the overwhelming volume of information. Our experience shows that traders who integrate API-driven intelligence systems into their workflow demonstrate significantly improved performance in volatile markets compared to those relying on conventional news sources.

What happens now?

We’re witnessing a fundamental regime shift in energy markets. Old models no longer apply as tariffs, conflict and supply uncertainty converge. Those who adapt their analysis framework fastest will be the ones who capture outsized returns. This adaptive capacity is no longer optional but essential for survival in the current trading environment.

In sum, crude oil market analysis evolved from a primarily fundamental exercise to a multi-dimensional analysis incorporating geopolitical risk assessment, sentiment analysis, and rapid information processing. Traders who continue relying solely on supply-demand analyses will find themselves consistently caught off-guard by market movements that seem disconnected from fundamentals.

Strategic positioning with our Trading Co-Pilot and API

Our Trading Co-Pilot delivers crucial insights when timing matters, helping you turn volatility into opportunity. In an environment where market-moving news can emerge from multiple sources simultaneously, having a system that can prioritise, contextualise, and deliver actionable intelligence creates a meaningful edge.

Our Trading Co-Pilot and API services are designed specifically for this new paradigm. Rather than simply aggregating news, our systems evaluate developments against historical patterns, assess likely market impacts, and deliver insights directly into your existing workflow. This integration allows traders to respond to regime-shifting events before markets fully price in their implications.

Stay ahead with real-time intelligence on market-moving events

The current regime shift in energy markets presents both unprecedented challenges and opportunities. Those who can process information faster, contextualize developments more accurately, and execute more decisively will thrive in this environment. Don’t navigate these turbulent energy markets with outdated tools. Access our Trading Co-Pilot for real-time intelligence on market-moving events before they impact your positions. Request your demonstration today at enquiries@permutable.ai or simply fill in the form below to transform market chaos into opportunity.