This analysis examines how gold and copper markets have responded differently to recent geopolitical tensions, offering valuable insights for commodity traders, institutional investors, and portfolio managers seeking to understand shifting correlations and optimise their positions in volatile conditions.

Introduction: Understanding the gold vs copper relationship

The past week has revealed a fascinating divergence gold vs copper market sentiment that provides a valuable window into broader market dynamics. While both commodities respond to global economic conditions, their recent price movements tell distinctly different stories. Gold continues to demonstrate remarkable strength, hovering above $3,300 per ounce despite daily fluctuations, while copper has shown vulnerability, declining from $4.80 to $4.60 per pound amid mixed economic signals.

As specialists in market intelligence, we’ve been carefully monitoring this evolving relationship through our proprietary LLM tools. The insights gained from analysing these divergent trends offer valuable perspective for investors navigating today’s complex and often contradictory market signals.

Gold’s resilience: Safe haven amid geopolitical storms

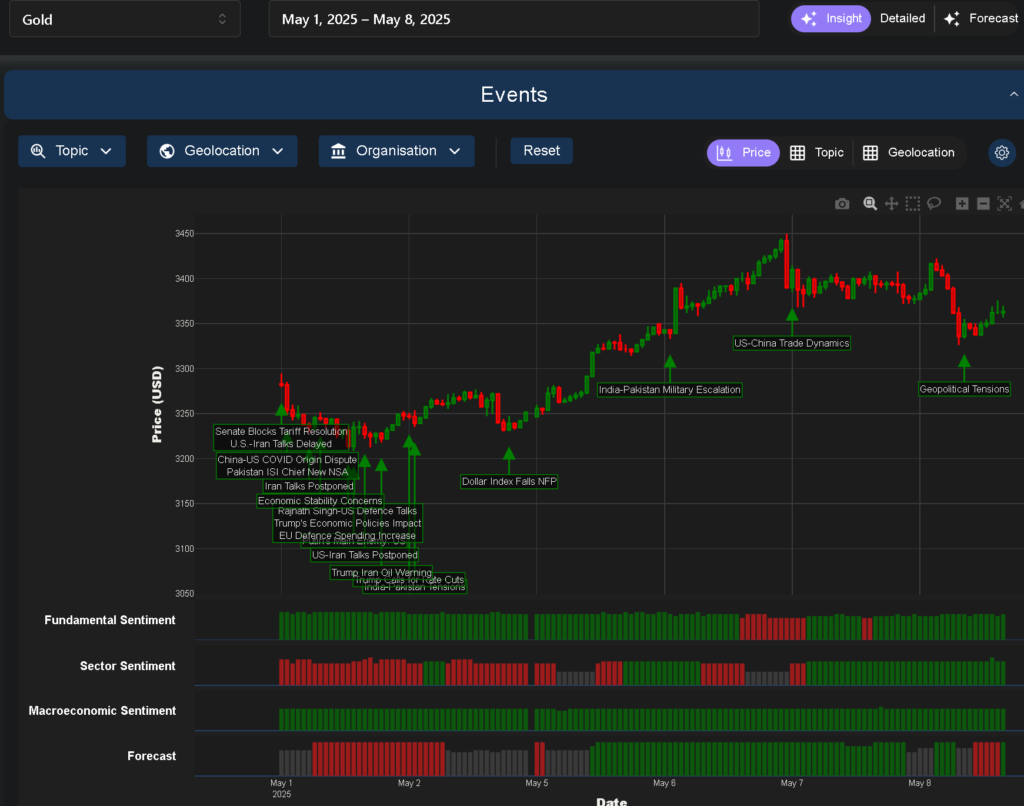

The gold vs copper narrative begins with gold’s impressive performance over the past week. Opening at $3,383.25 on Thursday, the precious metal has demonstrated remarkable resilience despite significant volatility. This performance has been primarily driven by escalating military tensions between India and Pakistan, with India’s “Operation Sindoor” missile strikes creating substantial geopolitical uncertainty.

Tuesday saw gold open at $3,343.00 and close at $3,390.00, continuing the previous day’s momentum as market sentiment remained positive despite the heightened tensions. This pattern has been consistent throughout the week, with gold effectively fulfilling its traditional role as a safe-haven asset during periods of geopolitical instability.

Most notable was Monday’s significant rally, when gold opened at $3,246.50 and surged to close at $3,339.75 – a single-day increase of nearly $93 per ounce. This movement coincided with a weakening dollar and growing expectations of potential Federal Reserve interest rate cuts, demonstrating how gold responds not only to geopolitical factors but also to monetary policy signals.

The gold vs copper relationship becomes particularly illuminating when we observe that gold’s strength has persisted despite daily fluctuations and mixed economic signals. This resilience highlights gold’s enduring appeal as a store of value during uncertain times.

Figure 1: Visualisation of gold price market sentiment drivers movements (1-8 May 2025)

Copper’s vulnerability: Economic concerns override supply constraints

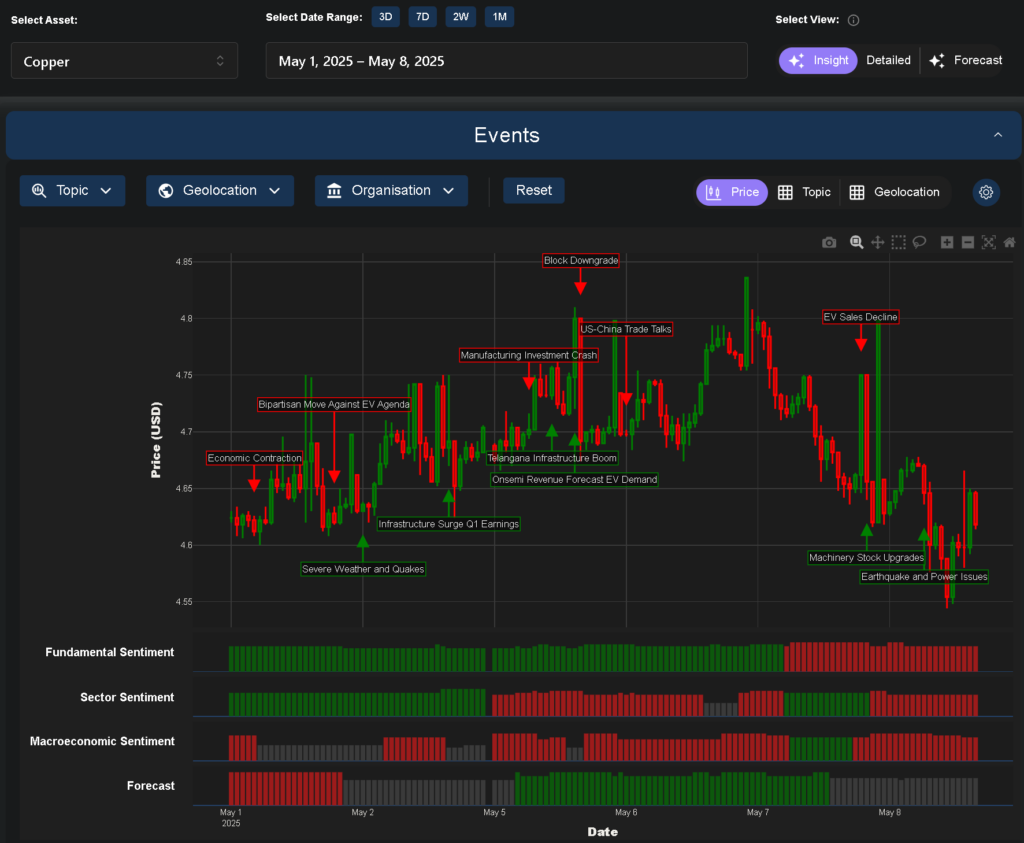

In stark contrast to gold’s performance, copper has demonstrated significant vulnerability over the past week, highlighting the divergence in the gold vs copper relationship. Opening at $4.64 on Thursday and currently trading at $4.60, copper has been primarily influenced by concerns about economic growth and shifting demand patterns rather than geopolitical tensions.

Wednesday saw copper decline from $4.80 to $4.63, a movement attributed to challenges in the electric vehicle market following Republican opposition to President Biden’s EV mandate. This political development has potentially significant implications for copper demand, as electric vehicles require substantially more copper than traditional combustion engine vehicles.

While Tuesday showed some positive momentum with copper opening at $4.80 and closing at $4.79, buoyed by the commencement of formal trade talks between the US and China, this optimism was tempered by ongoing concerns about rising costs and their potential impact on consumer demand. The gold vs copper divergence is particularly evident here, as the same geopolitical factors boosting gold failed to provide similar support for copper.

Monday’s performance initially seemed more positive, with copper opening at $4.70 and closing at $4.80, supported by news of a massive road infrastructure initiative in Telangana. However, this was offset by reports of manufacturing investments decreasing by 35% due to rising financing costs – a clear indication that economic concerns are predominating in the copper market despite potentially supportive supply-side news.

Figure 2: Visualisation of copper price market sentiment drivers movements (1-8 May 2025)

Analysing the gold vs copper correlation

The contrasting performance of these two metals offers valuable insights into the changing nature of the gold vs copper relationship. Traditionally, this relationship has served as an important economic indicator, with the copper-to-gold ratio often correlating with 10-year Treasury yields and reflecting expectations about economic growth.

In normal market conditions, rising copper prices relative to gold typically suggest economic optimism, as copper’s industrial applications make it sensitive to growth expectations. Conversely, gold strengthening against copper often indicates economic caution or uncertainty. What makes the current situation particularly interesting is how geopolitical factors are influencing this relationship.

The India-Pakistan tensions have created a classic risk-off scenario benefiting gold, while simultaneously raising concerns about global growth that weigh on copper. This divergence is further amplified by specific factors affecting each metal – monetary policy expectations supporting gold, while sector-specific challenges in electric vehicles and construction impact copper.

From a trading perspective, the widening gold vs copper price ratio suggests markets are pricing in significant risk premiums while simultaneously expressing concern about future economic growth. This combination often precedes periods of market adjustment and presents specific opportunities for well-informed traders.

Sector-specific influences on market sentiment

Beyond the broader macroeconomic and geopolitical factors driving the gold vs copper relationship, sector-specific developments have played a crucial role in shaping market sentiment for each metal.

For copper, the home improvement sector provided a rare bright spot, with Temple & Webster reporting increased sales that could potentially support demand. However, this positive influence was overshadowed by more significant concerns, particularly in the electric vehicle market where sales have decreased substantially. The gold vs copper divergence is particularly evident in how these sector-specific factors have affected each metal differently.

Meanwhile, gold’s performance has been more uniformly influenced by the geopolitical situation, with Pakistan labeling India’s military actions an “act of war” – language that naturally drives investors toward safe-haven assets. This consistent narrative contrasts sharply with the mixed signals affecting copper, further widening the gap in the gold vs copper relationship.

What’s particularly interesting is how investor sentiment has responded to these contrasting influences. While gold has attracted consistent buying interest from both central banks and retail investors seeking protection from uncertainty, copper’s investor base has been more hesitant, weighing potential infrastructure demand against broader economic concerns.

Market intelligence implications for traders

For commodity traders navigating this complex landscape, the evolving gold vs copper relationship offers several actionable insights. First, the current divergence suggests that traditional correlations between these metals may be temporarily disrupted, requiring more nuanced trading strategies that account for the different factors driving each market.

Second, the gold vs copper price ratio has moved significantly outside its typical range, suggesting potential mean-reversion opportunities for traders with appropriate risk management strategies. Historical patterns indicate that extreme divergences in this relationship often precede significant price adjustments.

Third, monitoring the specific catalysts affecting each metal – geopolitical developments for gold and sector-specific economic data for copper—may provide early signals of changing market sentiment before they manifest in price movements. Our Trading Co-Pilot and API has been particularly effective at identifying these early indicators through comprehensive analysis of global news sources.

Finally, the relationship between these metals and other financial markets, particularly bond yields and currency movements, bears close watching. The gold vs copper divergence often provides leading indications of shifts in broader market sentiment that subsequently affect multiple asset classes.

Looking forward: What to watch in the gold vs copper space

As we look ahead, several key factors will likely influence the gold vs copper relationship in the coming weeks. First and foremost, the evolution of India-Pakistan tensions will continue to impact gold, with any escalation likely to drive further safe-haven buying. Similarly, any diplomatic resolution could trigger profit-taking in gold while potentially supporting risk assets including copper.

On the economic front, upcoming Federal Reserve communications will be crucial for both metals, though likely in different ways. Signals of potential rate cuts would typically support both metals, but the extent of support may vary significantly based on whether markets interpret such signals as responding to economic weakness (potentially negative for copper) or simply as normalisation after a tightening cycle (potentially positive for both metals).

For copper specifically, developments in the electric vehicle market and construction sector will be particularly important to monitor. Any policy changes affecting EV incentives or mandates could have substantial implications for copper demand forecasts. Similarly, housing and construction data from major economies will provide crucial insights into another significant source of copper demand.

The gold vs copper relationship itself bears watching as a potential indicator of broader market sentiment. Extreme readings in this ratio have historically preceded significant market movements, making it a valuable tool for anticipating potential turning points across asset classes.

Navigating divergent commodity trends

The past week’s market activity has highlighted the complex and sometimes contradictory forces shaping the gold vs copper relationship. While gold has embraced its traditional safe-haven role amid geopolitical tensions, copper has remained more firmly tethered to economic growth concerns despite potentially supportive supply-side developments.

For traders and investors, this divergence creates both challenges and opportunities. The traditional correlations and indicators involving these metals may be less reliable in the current environment, requiring more sophisticated analytical approaches and a deeper understanding of the specific factors driving each market.

What remains clear is that both metals continue to tell important stories about the global economy and market sentiment. Gold’s resilience speaks to persistent uncertainty and the value investors place on proven safe havens during turbulent times. Copper’s vulnerability despite supply constraints highlights genuine concerns about economic growth and sector-specific challenges.

By closely monitoring the gold vs copper relationship and understanding the distinct narratives driving each metal, traders and investors can gain valuable insights that extend well beyond these specific commodities to inform broader investment and risk management strategies.

Enhance your trading strategy with expert market intelligence

Want to stay ahead of shifting market correlations and identify trading opportunities before they become obvious? Our market sentiment data provides real-time analysis of commodity relationships, including the gold vs copper sentiment, helping you navigate market complexity with confidence. Request a demo today to experience how our LLM-driven market intelligence can transform your approach to commodity markets.