This article explores how market sentiment data has become the crucial alpha source for modern hedge funds, showcasing Permutable AI’s systematic data feeds and proven track record in transforming unstructured information into exceptional trading returns. The article is written for hedge fund managers, systematic traders, and institutional investors seeking innovative alpha sources through AI-powered market sentiment analysis and alternative data strategies.

In the relentless pursuit of outperformance, hedge funds are discovering that traditional alpha sources may no longer deliver the edge they once did. The new frontier? Market sentiment data powered by sophisticated AI systems like ours that can decode subtle signals hidden within vast amounts of information flows. This transformation isn’t just theoretical – we’ve seen this delivering measurable results in our end-to-end systematic trading.

At Permutable AI, we’ve spent years perfecting the technology that makes our market sentiment data a reliable alpha source. Our systematic data feeds process over 120,000 sources daily, transforming unstructured text into actionable trading intelligence. Our results speak for themselves: a 4.14 Sharpe ratio and 31% annualised returns since October 2024, with outperforming traditional benchmarks.

The evolution of alpha generation

Pf course, the quest for a sustainable alpha source has always been the holy grail, but we’ve seen how this has evolved dramatically in recent times. Where once fundamental analysis and technical indicators alone sufficed, today’s markets demand something more sophisticated. Enter market sentiment data, which is at the very heart of this evolution – a quantifiable measure of collective market psychology that traditional metrics simply cannot capture.

Our proprietary LLM-based analysis goes beyond simple keyword searches or basic sentiment scoring. By processing 1.2 billion event records spanning over a decade, we’ve created an alpha source that detects complex market relationships invisible to conventional approaches. It is this depth of analysis that is precisely what leading systematic funds and commodity houses are recognising as the future of alpha generation.

Consider our recent silver trade execution below. Our reasoning model identified a tactical short opportunity by synthesising multiple sentiment signals: rising volatility, fresh U.S. tariff threats, and cracks in previously bullish narratives. The result? We captured a 15% decline in just two trading days. This wasn’t luck, but the systematic application of our market sentiment data as a primary alpha source.

Above: Our market sentiment indicators captured a 15% silver price decline from 3-4 April 2025, demonstrating how sentiment data serves as a powerful alpha source. The chart illustrates our LLM’s precise timing, entering a short position at $34.19 as bullish narratives cracked under U.S. tariff threats and rising volatility. This real-world execution showcases why systematic funds are increasingly using our AI-driven sentiment analysis for market-beating returns.

Why sentiment data outperforms traditional approaches

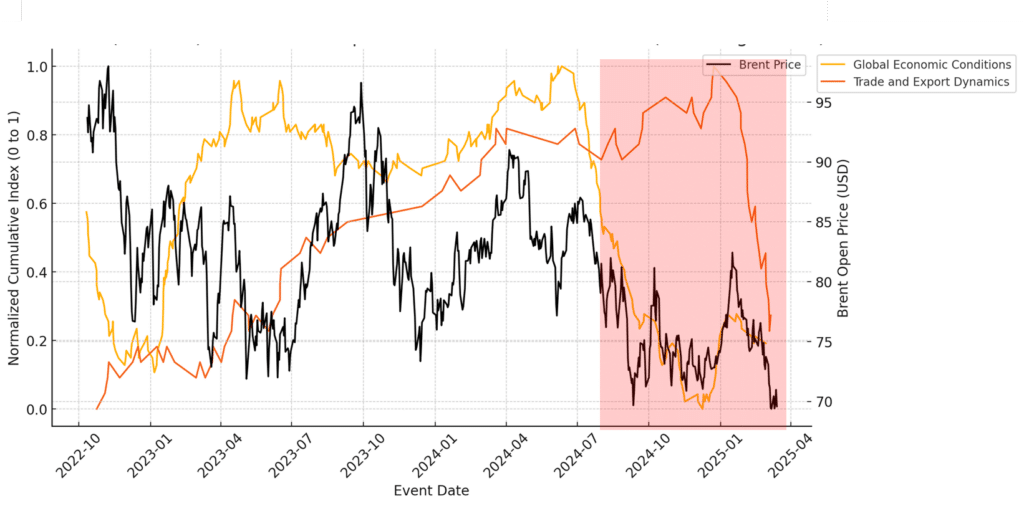

The superiority of sentiment data as an alpha source lies in its predictive nature. Traditional price commentary and technical analysis lag market movements, but sentiment shifts often precede them as a leading indicator. Our global economic sentiment indicators, for instance, predicted crude oil price declines whilst forecast momentum signalled upside opportunities – a divergence that created profitable trading opportunities.

This predictive capability stems from our comprehensive LLM-driven infrastructure. Over the years, we’ve engineered a state-of-the-art technology stack that transforms massive volumes of unstructured data into precise market insights. From initial data collection through sophisticated AI processing, every step is optimised to extract alpha from information flows that others miss.

The institutional-grade nature of our alternative data sets us apart. Operating across 34+ assets including commodities, currencies, and US treasuries, we provide the breadth and depth that systematic investment strategies require. Our custom-trained LLMs perform multi-level processing: entity recognition, event detection, topic classification, and sentiment analysis – all tailored to individual asset classes.

Above: Our market sentiment indicators demonstrate predictive power as an alpha source, showing how global economic conditions and trade dynamics diverged before Brent crude’s sharp decline in Q4 2024. Our AI-driven analysis captured weakening economic sentiment (yellow line) whilst trade indicators remained elevated (orange line), signalling the impending price collapse weeks before it materialised. This forward-looking capability exemplifies why sophisticated hedge funds view sentiment data as an essential alpha source for systematic trading strategies.

Real-world performance validates the approach

Of course, the ultimate test of any alpha source is live trading performance. Since implementing our end-to-end LLM trading system, we’ve been consistently outperforming major commodity benchmarks whilst maintaining a -15% correlation with the S&P 500. This negative correlation provides powerful diversification benefits – exactly what hedge funds seek in an alpha source.

That said, our success extends beyond isolated trades. The systematic nature of our approach means consistent performance across various market conditions. Whether it’s detecting supply chain disruptions, geopolitical tensions, or shifts in investor sentiment, our models adapt to changing market dynamics whilst maintaining their edge.

Our silver trade exemplifies this adaptability. When bullish narratives began showing cracks, our system immediately flagged the sentiment shift. Traditional models focusing solely on price action or fundamental data missed these early warning signs. By the time conventional indicators caught up, the opportunity had largely passed.

Institutional adoption accelerates

As we speak, our market sentiment data is gaining increasing attention from leading systematic funds who already recognise the value of our market sentiment data as an alpha source. The scalability of our infrastructure – processing daily sources across multiple years with billions of event records – meeting the demands of large-scale systematic strategies. We deliver trading-ready intelligence that integrates seamlessly with existing systems, enabling immediate implementation without operational disruption.

This combination of proven performance, institutional-grade infrastructure, and seamless integration explains why our market sentiment data is becoming increasingly sought after within the industry. As markets become more efficient and traditional edges erode with overcrowding of outdated data providers and technologies, the ability to quantify and trade on constantly refreshed and fine-tuned market sentiment data like our is becoming nothing short of invaluable for minimising alpha decay.

The future of systematic trading

As we continue to expand from our successful commodities and currencies base into crypto, and equities, the potential of our market sentiment data as an alpha source continues to grow. Our specialist research team – which is constantly working to refresh our LLM-driven technology and market insights – ensure we remain at the forefront of this evolution.

Ultimately, market sentiment isn’t just another data point – it’s the alpha source that has the ability to capture what drives markets: human psychology, information flows, and collective decision-making. In an era where microseconds matter and traditional edges have been arbitraged away, understanding and trading on market sentiment has the potential to provide the sustainable advantage hedge funds need.

The evidence is clear: market-sentiment data has evolved from an experimental alternative dataset to a core alpha source for sophisticated investors. Those who recognise this shift and act on it are already seeing the results in their performance metrics.

Partner with the future of systematic trading

Partner with us to unlock our market sentiment data as your next alpha source. Leading systematic funds are already collaborating with us to gain a competitive edge in the market. Let’s discuss how our data feeds and institutional expertise can complement your trading strategy. Simply get in touch with us at enquiries@permutable.ai or fill in the form below to set up an introductory call.