This analysis examines how Trump’s 90-day pause on China tariffs is impacting ag commodity prices during the week of May 6-13, 2025, highlighting key market drivers and sentiment shifts across major agricultural commodities using our Trading Co-Pilot data feeds. It is written for commodities traders, agricultural investors, and market analysts seeking data-driven insights into how the tariff pause is reshaping ag commodity prices trends and creating new trading opportunities.

Trump’s 90-day pause on China tariffs has created an interesting moment for ag commodity prices, with our Trading Co-Pilot revealing how different agricultural markets are responding to this temporary trade détente. For starters, the announcement has sparked immediate divergences across commodities, with soybeans showing mixed signals whilst live cattle leads with exceptional strength.

Over the last week, what’s been particularly telling has been how ag commodity prices reflected both optimism from the tariff pause and sector-specific challenges. Crucially, our LLM-driven analysis has been tracking these movements and sentiment shifts across multiple data sources, capturing how traders are positioning for this.

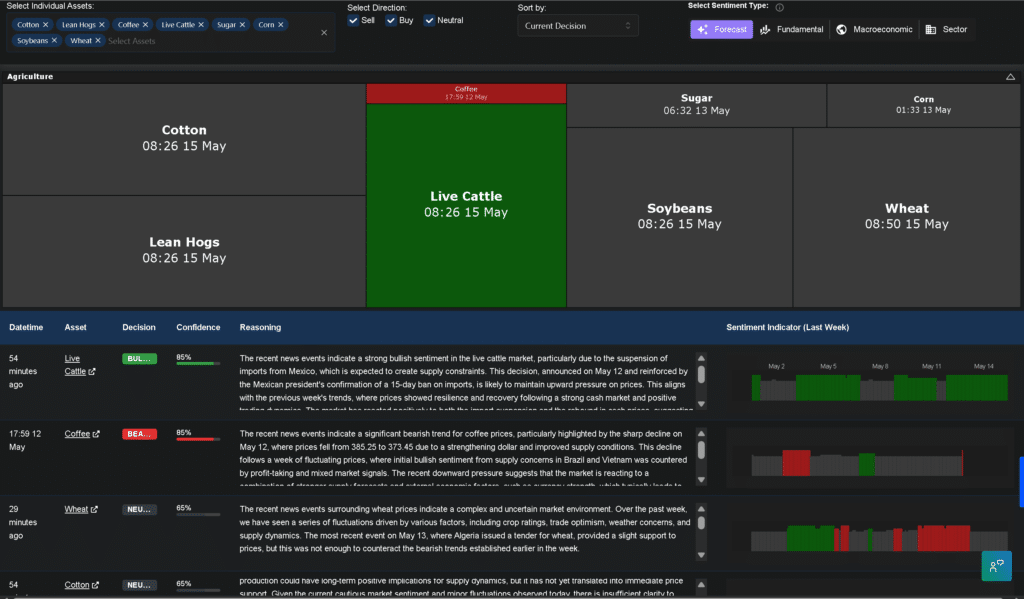

Above: Market sentiment analysis from our Trading Co-Pilot data feeds showing how ag commodity prices responded to Trump’s tariff pause announcement.

Table of Contents

ToggleSoybeans face mixed signals despite trade relief

Interestingly, soybeans now show a more complex picture with a 65% neutral sentiment. While positive trade talks and favourable USDA data initially boosted prices from 1042.75 to 1075.25, recent concerns about China’s light soybean imports have tempered enthusiasm. The tariff pause benefits remain, but profit-taking and uncertainty regarding actual import levels have created a more cautious market stance.

Of course, this response reflects soybeans’ sensitivity to US-China trade relations. Much of this is due to China being the world’s largest soybean importer. And this is why our Trading Co-Pilot alert system now signals caution – the tariff pause removes the primary headwind, but execution risk around actual Chinese purchasing remains.

Live cattle dominates on supply constraints

Quite clearly, live cattle has emerged as the strongest performer with our sentiment indicator showing 85% bullish confidence. The suspension of imports from Mexico, announced on May 12 and reinforced by the Mexican president’s confirmation of a 15-day ban, has created immediate supply constraints. Combined with the China tariff pause providing improved feed cost outlooks through stabilising soybean meal prices, cattle margins have improved substantially.

In light of the Mexico import suspension, here the China tariff pause provides offsetting support. Assuming that feed costs remain manageable during this period, ag commodity prices in livestock may very well maintain upward pressure. The market has reacted positively to both the import suspension and the tariff developments, with traders anticipating continued upward momentum.

Coffee remains pressured

But, in reality, not all ag commodity prices benefited from the tariff announcement. Most important, coffee continued its bearish trajectory, suggesting that Trump’s China policy has limited impact on markets not directly tied to Chinese demand. That’s what’s made our Trading Co-Pilot maintain its 85% bearish signal – dollar strength and Brazilian supply improvements outweigh any trade optimism.

It may be that the tariff pause’s selective impact reveals deeper market structures. In other words, ag commodity prices are responding based on their specific exposure to China trade rather than broad sentiment. This assumption is reinforced by coffee’s continued weakness despite the generally positive trade news.

Neutral markets await direction

Wheat (65% neutral) and cotton (65% neutral) remained in wait-and-see territory despite the tariff pause. For wheat, Algeria’s tender provided slight support, but couldn’t counteract bearish trends from weather concerns and competition from other exporters. The market saw a 4% decline over the week, dropping from 537.50 to 514.75.

There is also the question of whether the 90-day timeframe is too short for meaningful structural changes – and that’s what seems to be happening as these markets adopt cautious approaches. Cotton showed similar uncertainty, with prices declining from 68.70 to 65.55 amid weather concerns, though a recycled fiber joint venture offers long-term potential.

Strategic implications of the 90-day window

The idea that Trump’s tariff pause might uniformly boost ag commodity prices is all too overly simplistic. For example, whilst grain markets show a degree of enthusiasm, soft commodities remain subdued. Of course, this creates opportunities for traders who understand the nuanced impacts across different agricultural sectors.

But it is more likely that market volatility will increase as the 90-day deadline approaches. Over the next few weeks, we can expect that ag commodity prices will increasingly reflect speculation about whether Trump will extend the pause or reimpose tariffs. That said, the immediate impact has clearly favoured commodities with direct China exposure.

Our Trading Co-Pilot’s analysis reveals how the tariff pause acts as a magnifying glass for existing market dynamics. Commodities already positioned for strength, like soybeans and cattle, received additional boosts. Conversely, structurally challenged markets like coffee saw limited relief.

Our Trading Co-Pilot feeds displaying real-time buy/sell signals for major agricultural commodities during the Trump tariff pause week, confirming that not all ag commodity prices benefit equally from the tariff pause, as sector-specific fundamentals continue to drive individual market performance.

Added to this, the temporary nature of Trump’s decision adds complexity to ag commodity prices forecasting. Traders must balance short-term opportunities against the risk of tariff reimposition. This environment particularly rewards data-driven analysis that can quickly identify shifting sentiment patterns.

For agricultural producers, the 90-day window offers crucial breathing room for strategic planning. Soybean farmers, especially, face decisions about forward sales and hedging strategies. The pause provides temporary certainty but doesn’t resolve underlying trade structure questions.

As this critical period unfolds, ag commodity prices will likely remain hypersensitive to any signals about the tariff pause’s future. Success in this environment requires continuous monitoring of both market fundamentals and political developments – precisely what our Trading Co-Pilot delivers through real-time, AI-powered analysis and data feeds.

Get our data to work hard for you

Every business knows data must work harder – the future demands it. Markets drown in endless noise whilst traditional analysis limps behind, but at Permutable, we have built the solution. Navigate the tariff pause opportunity with our Trading Co-Pilot, powered by AI we’ve spent years perfecting to make data earn its keep – processing half a million articles daily, instantly. Capture macro movements in ag commodity prices. Decode sentiment shifts. Know precisely when markets pivot during Trump’s critical 90-day window and beyond. Our LLM-driven strategies don’t just compete – they dominate, outperforming major indices by 26%.

The world’s sharpest trading desks and hedge funds already trust us to stay ahead. Stop wasting time analysing these time-sensitive opportunities. Move decisively whilst others hesitate. Get in touch to request a demo or trial of our data feeds by emailing enquiries@permutable.ai of filling in the form below.