*This case study explores how our LLM-driven platform successfully identified market signals for a profitable silver short trade, aimed at institutional investors, hedge funds, and sophisticated traders seeking technological edge in commodities markets.

Table of Contents

ToggleExecutive summary | Market signals in commodities trading

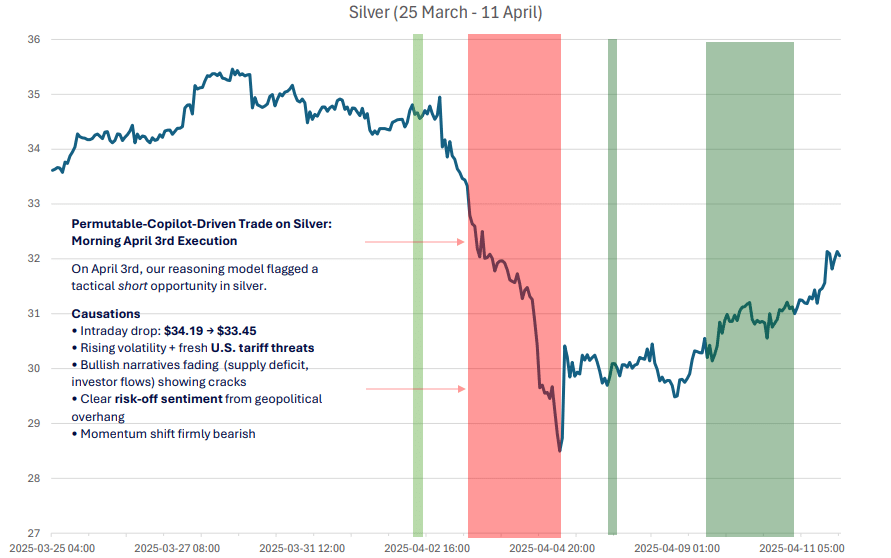

On 3rd April 2025, our reasoning model identified tactical short market signals in silver. The subsequent price action validated this insight, with silver experiencing a sharp decline from $33.45 to approximately $28.40 at its lowest point – representing a 15% drop over just two trading days. This case study examines how our proprietary LLM system successfully detected early warning market signals that preceded this significant market movement.

Above: Market signals chart: Silver price movement from 25 March to 11 April 2025, showing the detection of downward market signals and subsequent price decline

The market context

Silver had been trading in a generally bullish pattern from late March, reaching around $35.40 per ounce by the end of the month. However, on the morning of 3rd April, our system detected subtle market signals that suggested an imminent reversal.

Key signals detected by our AI system

Our reasoning model flagged several key market signals that collectively pointed to a high-probability short opportunity:

- Initial price weakness: An intraday decline from \$34.19 to \$33.45, representing the first significant crack in silver’s recent strength

- Volatility patterns: A notable increase in price volatility, often a precursor to directional moves

- Macroeconomic catalysts: Fresh U.S. tariff threats that appeared likely to impact industrial metals and broader commodity markets

- Sentiment analysis: Clear shift to risk-off positioning across financial markets due to geopolitical tensions

- Technical breakdown: A momentum shift from bullish to decidedly bearish, with key technical support levels being challenged

- Narrative analysis: Previously dominant bullish arguments around supply deficits and strong investor flows showing signs of deterioration

The trading signal and execution

Based on comprehensive analysis of these market signals, our LLM system generated a clear recommendation: “Enter sell — downside likely to continue.”

This actionable market signal was transmitted to trading algorithm, which executed a short position on silver on the morning of 3rd April. What followed exceeded even our model’s projections.

The outcome

The silver market experienced an unprecedented decline over the following 36 hours:

- Initial stage: Decline from $33.45 to approximately $31.50 (6% drop)

- Acceleration phase: Further collapse to around $28.40 (additional 10% decline)

- Total movement: Approximately 15% decline from signal generation to lowest point

The trade demonstrated exceptional precision in both timing and directional accuracy, capturing a significant portion of this market movement and validating our approach to market signals interpretation.

Technical differentiation

What distinguished our system’s analysis from conventional trading strategies was its ability to synthesise multiple market signals across different analytical domains, namely:

- Contextual understanding: Recognising how U.S. tariff threats would specifically impact industrial commodities

- Narrative analysis: Identifying weakening conviction in the prevailing bullish thesis

- Sentiment quantification: Measuring precise shifts in market risk appetite

- Technical pattern recognition: Detecting momentum reversal patterns with high reliability

Operational implementation of signals

This silver trade exemplifies how we’re operationalising our LLM-driven approach to market signals across commodity markets. Our systems continuously monitor metals, energy, and agricultural markets for similar high-confidence trading opportunities.

Conclusion

This silver trade represents a textbook example of how our advanced AI reasoning models can identify profitable trading opportunities by synthesising diverse market signals. As we continue developing our technology, we’re expanding these capabilities to detect subtle market signals across a broader range of asset classes and market conditions.

Partner with Permutable AI

Ready to harness the power of advanced market signals analysis for your trading strategy? Our team is available to discuss how our systematic data feeds could deliver similar results for your organisation.

Whether you’re an institutional investor, hedge fund, or proprietary trading firm, we offer systematic data feeds tailored to your specific trading requirements. Schedule a introductory call to explore how our market signals intelligence can enhance your trading decisions or get in touch to request sample data by emailing enquiries@permutable.ai or filling the form below.