Energy markets are becoming increasingly complex to navigate and as they continue to evolve, those who are able to stay ahead of increasingly volatile market dynamics will be, in our opinion, those who embrace AI-powered trading insights for energy markets. While the AI race continues to develop at a unprecedented rate – within energy markets particularly – technological strides are already fundamentally changing how traders operate. And all this is thanks to AI’s ability to process vast amounts of market data in real-time, offering powerful visibility into market movements, correlations and emerging patterns.

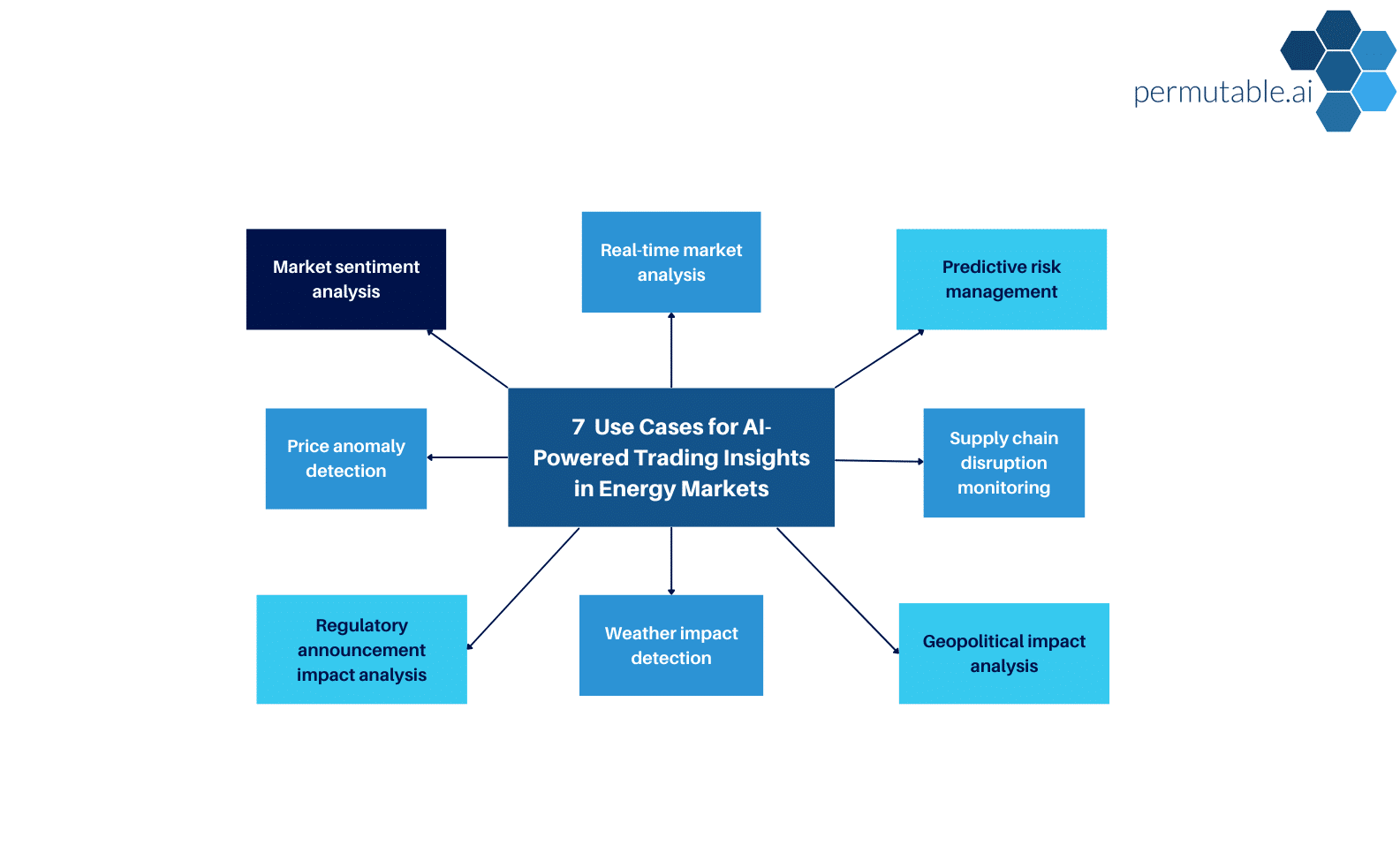

In this article we’ll take a brief look at some use cases of our AI-powered trading insights in energy markets, looking at how these can be using to predict price movements, reduce trading risk and unearth trade ideas.

1. Real-time market analysis

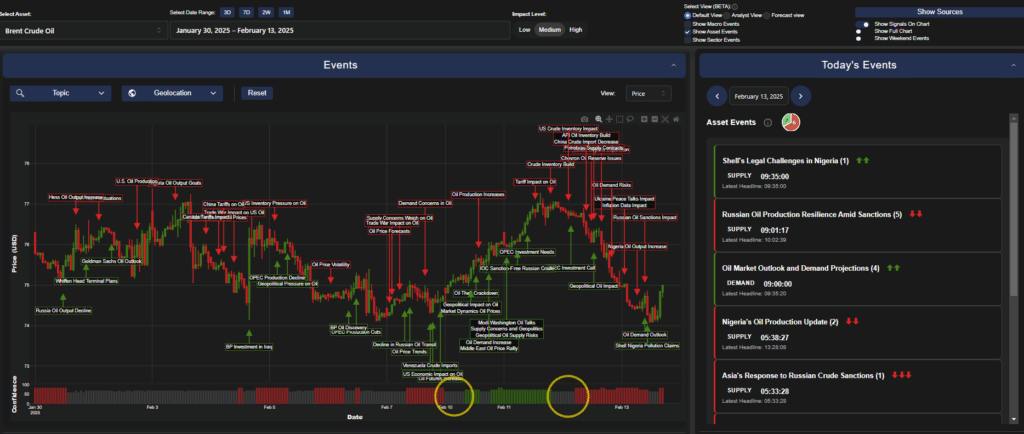

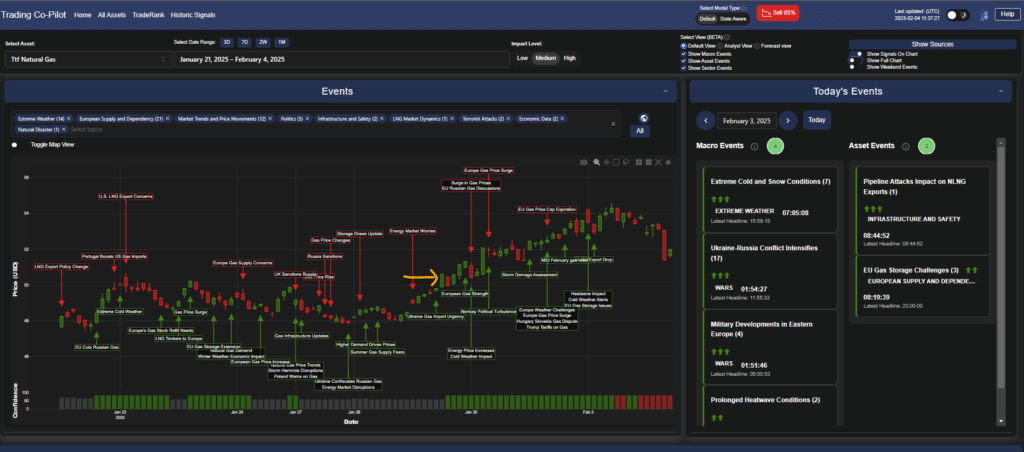

We think on of the most powerful applications of AI-powered trading insights in energy markets is in their ability to provide a 360 degree market view by simultaneously process multiple data streams. As an example, our Trading Co-Pilot platform analyses price movements, geopolitical events, and supply-demand dynamics in real-time, providing energy traders with comprehensive market intelligence, spotting trends before they become mainstream. Perhaps the most powerful aspect of this is that this analysis happens at a speed and scale impossible for even the best human traders and team of analysts to match.

2. Predictive risk management

Coming back to the critical aspect of trading risk management, our AI-powered insights offer a powerful approach to risk assessment. Indeed, we’ve seen even the most experienced traders benefit from our system’s ability to identify potential risks before they materially impact the market. Here, the hard truth is that the vast majority of traditional risk management systems simply cannot match this predictive capability that our system is able to offer.

3. Supply chain disruption monitoring

At this point, it’s worth noting how our AI-powered trading insights for energy markets provide crucial early warnings about supply chain disruptions. For example, our platform continuously monitors news on global shipping movements, refinery operations, and production facilities, instantly alerting traders to potential disruptions reported on in the news and how that could impact market sentiment and dynamics. That said, this real-time monitoring capability represents just one aspect of our broader value proposition.

4. Geopolitical impact analysis

Perhaps then, we had better move onto just how vital it has become to understand how geopolitical events affect energy markets. Perhaps there is no guarantee, of course, that every political development will impact prices, but our AI systems excel at reducing noise and identifying which events truly matter. Contrary to common notions, not all political developments carry equal weight in energy markets. And it is our AI’s ability to decipher the most important events in terms of market impact through years of meticulously training which can provide some of the most powerful market insights available to energy traders.

5. Weather pattern integration

How, then, does one incorporate weather patterns and their impacts into trading decisions? Well, our AI-powered trading insights for energy markets can process complex meteorological news, related sentiment and its potential impact on energy demand and supply. Even though energy traders now have access to more weather data than ever, the hard truth is that making sense of its impact on energy markets alongside a myriad of other market moving factors can be challenging to sat the least. However, the good news is that this is made light work of through our sophisticated AI analysis and the safe pair of hands it provides.

6. Regulatory compliance monitoring

At the same time, regulatory announcements can dramatically shift market dynamics. Here, our AI systems not only monitor these announcements in real-time but also assess their potential market impact before it materialises. This means traders using our system are given early indication and advance warning of how specific regulatory changes might affect different aspects of the energy markets as stories unfold, from production quotas to environmental compliance requirements and everything in-between.

7. Market sentiment analysis

The vast majority of traditional trading systems struggle to effectively capture market sentiment and this is something our Trading Co-Pilot excels. Our AI-powered trading insights in energy markets provide analysis on various sentiment indicators, from social media to news reports, providing a comprehensive view of market psychology. Here, what truly sets our platform apart is its ability to contextualise sentiment data within broader market movements. For example, our AI systems can distinguish between temporary market noise and genuine sentiment shifts that could impact trading decisions. Perhaps more importantly, it’s able to analyse sentiment across multiple timeframes, from intraday movements to longer-term trends.

8. Price anomaly detection and market dislocation

While appreciating the complexity of energy markets, identifying price anomalies and market dislocations becomes increasingly key. Our AI-powered trading insights for energy markets excel at surfacing unusual price movements and market behaviour patterns that might indicate trading opportunities. For example, our Trading Co-Pilot platform can identify price disparities across different energy products and geographical regions, spotting potential arbitrage opportunities before they become widely apparent. The vast majority of these opportunities require quick action, making our real-time alerting capability particularly valuable.

We are already seeing validation of our AI-powered trading insights from those energy trading houses who have already adopted them into their trading strategies. And so we know that, for energy markets, this represents more than just technological advancement. Instead, we believe that what we’re witnessing is a fundamental shift in how energy trading desks are operating. Some might say that this transformation is just beginning and in some ways it is – but we also believe the benefits are already clear.

To sum up, it’s clear to see that the starting point for successful energy trading has shifted to embracing these technological advances while maintaining human oversight. And as we continue to see rapid technological change, we know that the key to success for energy trading desks will lie in their ability to combine AI capabilities like ours, alongside human expertise.

Experience the advantage of AI-powered trading insights in energy markets

Ready to transform your energy trading strategies with advanced AI analytics? Our Trading Co-Pilot is already helping leading energy firms navigate market complexity with unprecedented confidence and precision. And so, we would like to invite you to experience firsthand how our platform can enhance your trading operations through a personalised demonstration.

Qualified organisations can access a complimentary enterprise trial, where you’ll discover how our AI-powered platform delivers real-time market intelligence, identifies emerging opportunities before they become apparent, provides early warning of market-moving events, and offers sophisticated sentiment analysis and price anomaly detection.

Contact us today at enquiries@permutable.ai to arrange a personalised demo or request a free enterprise trial, or simply fill in the form below.