In the current challenge to world diplomatic order, sentiment analysis has become crucial for commodity hedging strategies. The immediate result of analysing news flow, social media discourse, and market behaviour provides powerful insights into market psychology. Here, traditional hedging approaches that rely solely on price and volume data increasingly find themselves at a disadvantage in rapidly moving markets where sentiment shifts can trigger significant price movements before traditional indicators react.

Perhaps more importantly, this multi-layered approach to sentiment analysis enables hedgers to anticipate market movements before they materialise in price action. In short, by analysing the collective mood and behaviour of markets, trading houses are in a position to identify potential market shifts early. Thus, at least in the short term, we believe that those employing sophisticated market intelligence and sentiment analysis are likely to gain a significant advantage in positioning their hedges ahead of major market moves.

News flow analysis and market impact

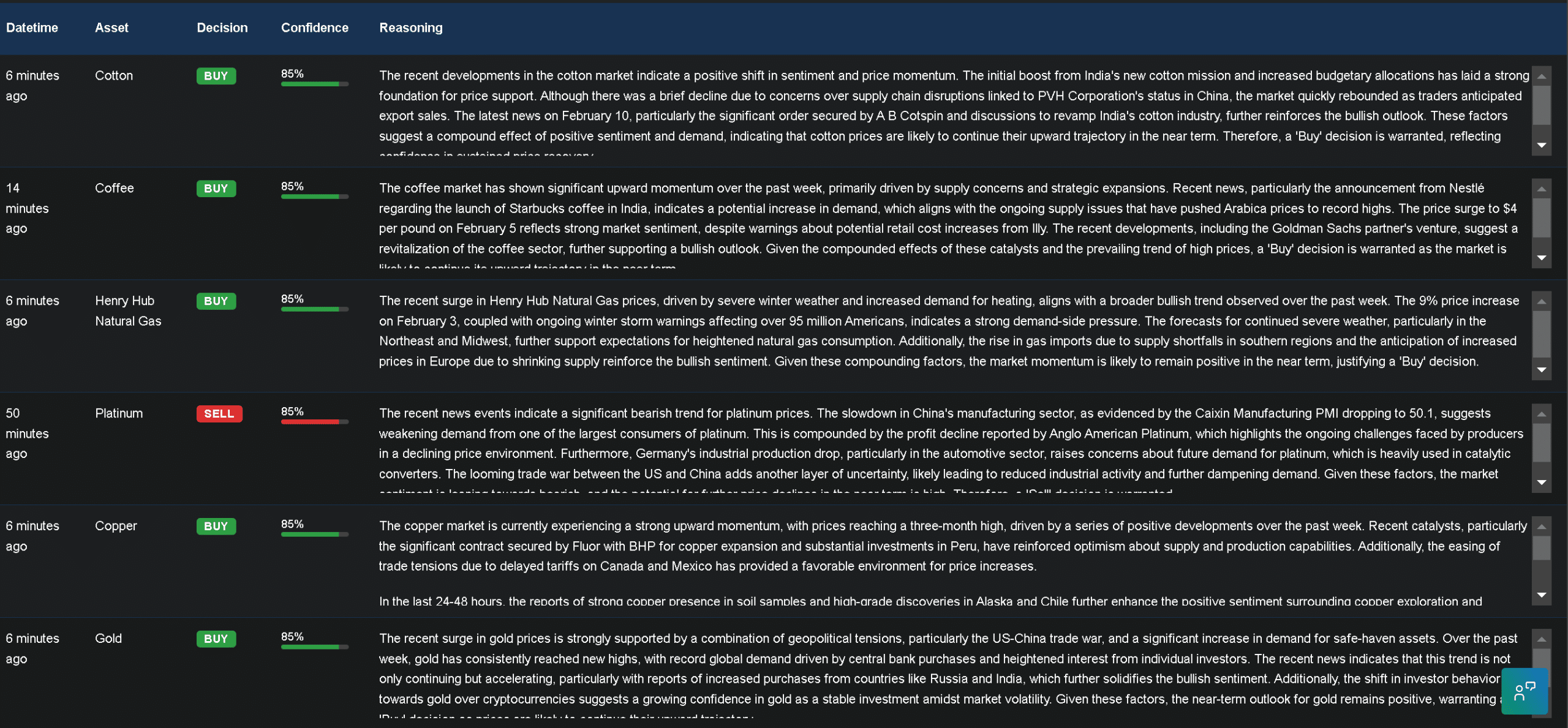

And so, when markets react to news faster than human analysts can process, the implications for commodity hedging strategies can be profound. Our Trading Co-Pilot can analyse thousands of news sources simultaneously, identifying potential market-moving events. Add to this the processing of news in multiple languages, across different time zones, and from various sources, providing a comprehensive view of market-moving information that would be impossible to achieve manually.

It’s safe to say that the big danger then lies in delayed responses to rapidly evolving narratives. While America turns inward with protectionist policies, global commodity markets remain highly sensitive to news flow. And we already know from those using our Trading Co-Pilot across commodities that employing this type of AI-driven news analysis achieves superior hedging outcomes by identifying and acting on market-moving news more quickly, creating competitive advantage.

Social media sentiment tracking

This has led to a fundamental shift in how successful hedgers approach market analysis. The truth is that once you cut through the noise, social media can become a key source of market sentiment, with platforms like Twitter/X especially providing valuable real-time insights into market participant thinking (and yes, we also offer this as a source on request). While many of the economies of traditional analysis remain important, perhaps where conventional hedging strategies fall is om their inability to process vast amounts of social media data effectively.

Trump’s second coming and China’s rising nationalism highlight how social media discourse increasingly influences market movements. Rather than relying on delayed analyst reports, modern hedging strategies must incorporate real-time social sentiment analysis. In this context, AI systems like ours are able to detect emerging trends, track sentiment shifts, and identify potential market catalysts through social media monitoring, providing crucial early warnings for hedge adjustment.

Trading pattern recognition

By the way, for the avoidance of any doubt, modern AI systems can now analyse trading patterns with unprecedented granularity. In this squalid era of politics, understanding how markets react to events has become absolutely vital for effective hedging. Fact: our systems track everything from order flow to position sizing, providing insights into market psychology that were previously impossible to quantify.

So imagine how much more effective hedging strategies become when powered by this detailed trading pattern analysis. It was, of course, unfathomable just a few years ago that we could identify and categorise complex trading behaviours automatically. Here, the implication is that hedgers can now adjust their strategies based on real-time analysis of market participant behaviour, rather than relying on historical patterns alone.

Real-time market commentary analysis

By now perhaps we shouldn’t be surprised by how quickly market commentary can shift sentiment, with modern markets reacting to analyst opinions and expert commentary faster than ever before. Case in point – our AI-driven systems can now process and analyse market commentary from thousands of sources simultaneously, identifying subtle shifts in expert opinion that might signal impending market moves.

This is where we must now argue loudly for the integration of real-time commentary analysis – which we provide through our Trading Co-Pilot – into hedging strategies. The immediate result of this integration is more nuanced hedge timing and positioning. More importantly, our systems can identify consensus shifts among market analysts before they become widely recognised, providing valuable lead time for hedge adjustments.

Regulatory and policy sentiment

Another pitfall in commodity hedging lies in the form of the misinterpretation of regulatory and policy signals. At the very least, modern hedging strategies must incorporate sophisticated analysis of policy statements, regulatory announcements, and official communications. Why? Because these sources often contain subtle linguistic shifts that can signal significant policy changes ahead.

But the lasting significance of AI-powered policy analysis extends beyond simple keyword matching. This is because AI systems like ours can detect changes in tone, emphasis, and context that might escape human analysts. And it is this capability that becomes particularly important during periods of regulatory uncertainty or policy transition.

Geographic sentiment distribution

While America enters a new period of nationalism, global commodity markets remain interconnected through complex trading relationships. The truth is that regional sentiment variations can create trading opportunities and risks that aren’t immediately apparent in global price movements. Our AI systems can track and analyse sentiment patterns across different regions through geo-location tagging, providing crucial insights into how local perspectives might influence global commodity prices.

Yes, many of the economies show distinct regional characteristics in their market sentiment. Another oversight in traditional commodity hedging strategies often comes from failing to account for these regional variations. Rather than treating sentiment as a global phenomenon, modern commodity hedging strategies must consider how regional differences might impact price movements.

Real-time event impact assessment

All of this means that the speed of event analysis has become more important than ever before for effective hedging. The implications for commodity hedging strategies are significant to say the least, as markets can now react to events within seconds of their occurrence. For instance, our Trading Co-Pilot can assess the potential impact of events as they unfold, analysing multiple data streams simultaneously to provide real-time impact assessments.

Perhaps even more importantly, it can go so far as to predict how markets might react to specific events. We are already seeing first hand how this is leading to a fundamental shift in how the trading houses we work with approach event risk management – with real-time event analysis becoming an essential component of modern hedging strategies.

Analysis of market behaviour

The truth is that understanding market behaviour has never been more fundamental – and complicated – for effective hedging. Ultimately, AI-driven analysis powered by AI agents can identify patterns in trading behaviour that signal potential market moves that is impossible for a human to do. Imagine – our systems track everything from order flow to position sizing, providing insights into market psychology that were previously impossible to quantify.

The immediate result of this analysis is more precise hedge timing and positioning. And let’s face it – in this squalid era of politics, understanding how different market participants might react to events has become essential for risk management.

Corporate communication analysis

Now let’s take a brief look at how corporate communications can significantly impact market sentiment. We all know how quickly markets can react to subtle changes in corporate tone and messaging. We see this playing out in real-time as our AI system analyses earnings calls, press releases, and corporate statements detecting subtle shifts that might signal changing market conditions.

Rather than relying on delayed analysis, modern hedging strategies require instant processing of corporate communications. So imagine how much more effective commodity hedging becomes when powered by real-time analysis of corporate sentiment of the like provided by our Trading Co-Pilot. In truth, the biggest challenge to traditional hedging strategies often comes from failing to detect these subtle shifts in corporate messaging and this is a pain point we are actively seeking to address with our real-time insights.

Looking forward: The evolution of sentiment analysis in commodity hedging

It is our opinion that all of this is leading to a transformative change in how companies are approaching commodity hedging. Fact: as sentiment analysis will continue to evolve, incorporating new data sources and analytical techniques into hedging strategies represents not just an evolution in risk management, but a necessary adaptation to modern market dynamics.

But the lasting significance of these developments extends beyond current capabilities. In any case, one thing that is blindingly clear is that organisations that embrace these technological advances whilst maintaining sound hedging principles will likely find themselves best positioned to navigate increasingly complex commodity markets. The upshot of all of this? That sentiment analysis will become an even more crucial component of successful hedging strategies in the years ahead – at least, that’s what we’re betting on.

Enhance your commodity hedging with real-time sentiment analysis

Experience how our Trading Co-Pilot can transform your hedging strategy with comprehensive sentiment analysis across markets. Our platform processes vast amounts of news flow, social media and corporate communications to provide real-time insights into market psychology and potential price movements. Our enterprise solution offers multi-source sentiment analysis, real-time event impact assessment, regional sentiment tracking, and cross-asset correlation insights, helping you identify market shifts before they impact your positions.

Contact our team at enquiries@@permutable.ai or schedule your personalised demo by filling in the form below to see how our AI-driven market intelligence can enhance your hedging decisions. Currently offering a 14-day trial for qualified institutional traders. Start protecting your positions with next-generation sentiment analysis.