This article provides a round up of current energy commodity market conditions across natural gas, LNG, crude oil, gasoline, and heating oil sectors, incorporating insights from our Trading Co-Pilot’s News Intelligence feed to provide energy traders and institutional investors with essential market insights. It is written for energy commodity traders, portfolio managers, research analysts, and institutional investors requiring comprehensive sector intelligence for strategic positioning across global energy markets.

Against the backdrop of evolving global energy dynamics, today’s commodity news landscape presents a fascinating tapestry of divergent market forces that demand careful analysis and strategic interpretation. As energy markets continue to grapple with the complex interplay of seasonal demand patterns, inventory fluctuations, and geopolitical developments, our Trading Co-Pilot analysis using our News Intelligence feeds reveals distinct sentiment patterns emerging across different energy sectors.

The current environment demonstrates how rapidly shifting fundamentals can create opportunities and challenges within individual commodity segments, even as broader energy themes continue to influence overall market direction. Through comprehensive analysis of recent price movements and underlying market drivers, we can discern clear patterns that will likely influence trading strategies across the immediate term.

What emerges from today’s commodity news assessment is a sector characterised by increasing differentiation, where traditional correlations between energy commodities are being challenged by asset-specific fundamental developments. This evolution requires sophisticated analytical approaches that can capture both macro themes and micro-level market dynamics affecting individual commodity performance.

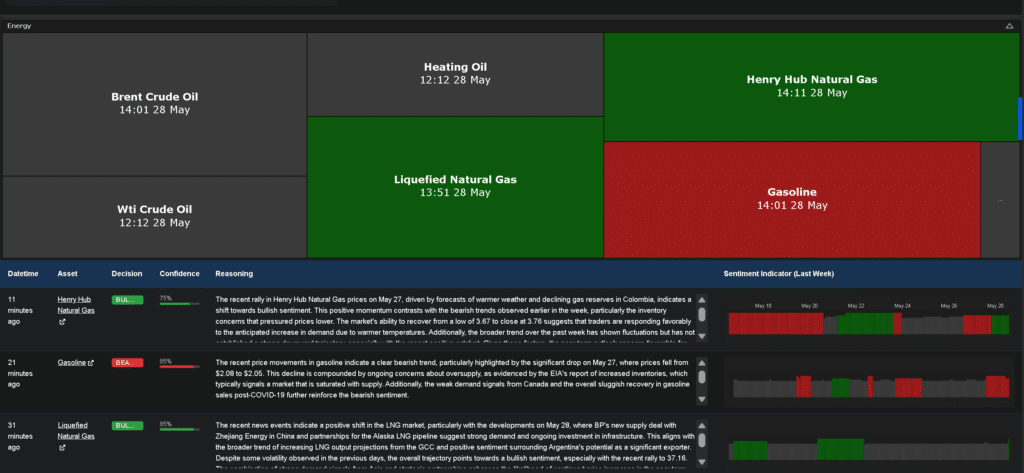

Above: Energy sector heat map visualisation: Our Trading Co-Pilot reveals sentiment divergence across energy commodity complex, with natural gas markets demonstrating strength whilst oil markets face significant headwinds.

Natural gas markets show seasonal strength

Examining the natural gas complex reveals evidence of seasonal dynamics beginning to assert themselves across both American and European markets. Henry Hub Natural Gas has demonstrated resilience, with our Trading Co-Pilot identifying a clear bullish sentiment indicator of 75% following Tuesday’s rally from $3.67 to $3.76.

The underlying drivers supporting this positive momentum reflect classic seasonal patterns enhanced by specific regional developments. Forecasts indicating warmer weather conditions have triggered anticipatory demand responses, whilst declining gas reserves in Colombia have introduced additional supply-side considerations that are supporting price levels across the complex.

Similarly, TTF Natural Gas markets have experienced their own unique set of challenges and opportunities, with our analysis revealing a neutral sentiment indicator of 65% that reflects the complex interplay between bearish inventory pressures and bullish supply disruption concerns. The recent Norwegian supply outage provided temporary price support, after earlier declines driven by rising EIA inventory reports.

The global LNG market presents an even more compelling bullish case, with our Trading Co-Pilot identifying a 85% bullish sentiment indicator driven by significant developments in international trade relationships. BP’s recent supply deal with Zhejiang Energy in China, combined with advancing partnerships for the Alaska LNG pipeline, demonstrates the robust demand fundamentals supporting this market segment.

This strength in LNG markets reflects broader structural shifts towards liquefied natural gas as a preferred energy transition fuel, particularly across Asian markets where demand growth continues to outpace supply expansion. The combination of increasing LNG output projections from the GCC and Argentina’s emerging potential as a significant exporter creates a compelling supply-demand narrative that supports sustained price appreciation.

Ultimately, the divergence within the natural gas complex illustrates how regional fundamentals can override broader market themes, creating specific opportunities for traders who understand the nuanced drivers affecting different geographic markets. The commodity news emerging from these developments suggests that natural gas markets are entering a phase where regional differentiation becomes increasingly important for successful positioning strategies.

Crude oil complex faces mixed signals

The crude oil sector presents perhaps the most complex picture within today’s commodity news analysis, with both Brent and WTI markets exhibiting neutral sentiment indicators that reflect competing fundamental pressures. Our Trading Co-Pilot’s analysis reveals how conflicting signals are creating uncertainty amongst market participants, requiring careful risk management approaches.

Brent Crude Oil’s neutral stance at 65% confidence reflects the ongoing tension between bullish demand expectations from India and bearish pressures stemming from U.S. inventory builds and OPEC+ output expectations. The recent Alberta wildfires have introduced potential supply disruption scenarios, yet these developments have been insufficient to overcome broader oversupply concerns that continue to weigh on market sentiment.

WTI Crude Oil faces similar fundamental challenges, with rising crude stocks and increased OPEC output creating downward pressure that has been partially offset by geopolitical developments including restrictions on Chevron’s Venezuelan oil exports. The market’s stability around the $61 level suggests traders are adopting cautious positioning whilst awaiting clearer directional signals.

These developments within the crude oil complex demonstrate how commodity news interpretation requires understanding not just individual market drivers, but also their relative importance within the broader fundamental picture and sentiment drivers. The current environment suggests that crude oil markets are experiencing a period of consolidation where competing forces are roughly balanced, creating challenges for directional trading strategies.

Refined products reflect demand concerns

Within the refined products sector, our Trading Co-Pilot’s commodity news analysis reveals clear evidence of demand-side pressures that are creating distinctly bearish conditions for gasoline markets. Our system’s 75% bearish sentiment indicator attributed to gasoline reflects consistent price declines, driven primarily by increasing inventory levels and mixed signals regarding demand recovery.

The gasoline market’s performance illustrates how downstream energy products can diverge significantly from crude oil fundamentals, particularly when inventory dynamics and consumption patterns create asset-specific pressures. Recent data showing significant price drops reinforces bearish sentiment, despite occasional recovery attempts that have proven insufficient to establish sustainable upward momentum.

Meanwhile, heating iil markets present a more balanced picture, with our system indicating neutral sentiment at 70% confidence reflecting the complex interplay between inventory increases and steady demand patterns with price movements suggesting a market attempting to find equilibrium between supply-side pressures and underlying consumption requirements.

This differentiation within refined products markets highlights how any commodity news analysis must account for specific demand patterns and inventory dynamics that can create independent market drivers separate from broader energy themes.

Cross-asset implications

The divergent sentiment patterns emerging from across the energy sector apparent in our Trading Co-Pilot’s commodity news analysis create important implications for cross-asset trading strategies and risk management approaches. The bullish stance in Henry Hub Natural Gas contrasts sharply with bearish gasoline conditions, whilst neutral readings across crude oil and other natural gas markets suggest selective opportunity identification rather than broad-based sector exposure.

These conditions require sophisticated analytical frameworks that can identify specific value opportunities within individual commodity segments rather than relying on broad energy sector themes – which is precisely what our Trading Co-Pilot has been developed to do. In short, the analysis demonstrates how granular fundamental assessment which our market insight technology surfaces can reveal trading opportunities that might be obscured by sector-wide analysis approaches.

Market outlook and strategic considerations

Looking ahead, our commodity news round up – powered by our Trading Co-Pilot’s Auto Analyst suggests that energy commodity markets are continuing to be characterised by increased differentiation between individual market segments. This evolution creates both opportunities and challenges, requiring more sophisticated analytical approaches and risk management strategies.

The neutral readings across crude oil markets suggest continued consolidation whilst markets await clearer fundamental signals, particularly regarding OPEC+ policy decisions and demand recovery patterns. Meanwhile, the seasonal strength emerging in natural gas markets provides tactical opportunities for traders who understand regional supply-demand dynamics.

Refined products markets present perhaps the most challenging environment, with gasoline facing clear headwinds whilst heating oil attempts to establish equilibrium between competing fundamental pressures. These conditions require careful position sizing and active risk management rather than passive exposure strategies.

Navigate complex energy commodity markets with confidence

Discover how our Trading Co-Pilot technology and feeds delivers comprehensive real-time analysis across all major energy sectors, providing the granular intelligence you need for successful commodity trading strategies. To request a demo simply email us at enquiries@permutable.ai or fill in the form below.