As we move into mid February, the obvious pattern emerging across commodity markets is that of an intensifying impact of trade tensions and extreme weather events. There is no doubting that each commodity class is responding uniquely to these catalysts, creating a complex trading environment that demands sophisticated analysis. In this article, we take a look at the commodity prices outlook for this week, using analysis from our Trading Co-Pilot.

Energy markets

Henry Hub natural gas

You can make the argument that this has been the most dramatic mover in terms of commodity prices, with a 9% surge on February 3rd reaching significant technical levels. The hardest part is distinguishing between weather-driven spikes and structural shifts. Severe winter storms across the Midwest and Northeast have created a significant uptick in energy demand, while critical supply shortfalls in southern regions reinforce bullish momentum. Current Henry Hub market dynamics suggest this strength could persist beyond the immediate weather impact. Regional supply constraints and increased demand for gas-fired power generation create a supportive backdrop for prices. The question is how long these conditions will maintain their influence over price action, particularly as we approach the shoulder season.

TTF natural gas

Then there is the challenge of European gas markets, where prices reflect multiple pressures. Slovakia’s increased imports and resumed Russian gas flows provided initial stability, but escalating Ukraine conflict creates persistent uncertainty. Critical gas needs in southern Ukraine add another layer of complexity to the supply picture. The market’s response to these developments has been notably volatile, with traders attempting to price in both immediate supply concerns and longer-term structural changes to European gas markets. Supply diversification efforts, including rare Australian shipments, indicate the market’s adaptation to new geopolitical realities.

Heating oil

Looking an the broader issue of commodity prices, one finds that the situation is little more complicated in heating oil markets, where tariffs on Canadian oil combine with extreme weather to drive prices higher. The fact that NYC landlords are switching to less clean heating oil due to high gas bills indicates a structural demand shift that could have lasting implications for the market. This transition in consumer behaviour, particularly in the Northeast, suggests a fundamental change in regional energy dynamics. The impact of tariffs extends beyond immediate price effects, potentially reshaping traditional supply routes and trading patterns. Storage levels and distribution challenges in key consumption areas add another layer of complexity to the current market structure.

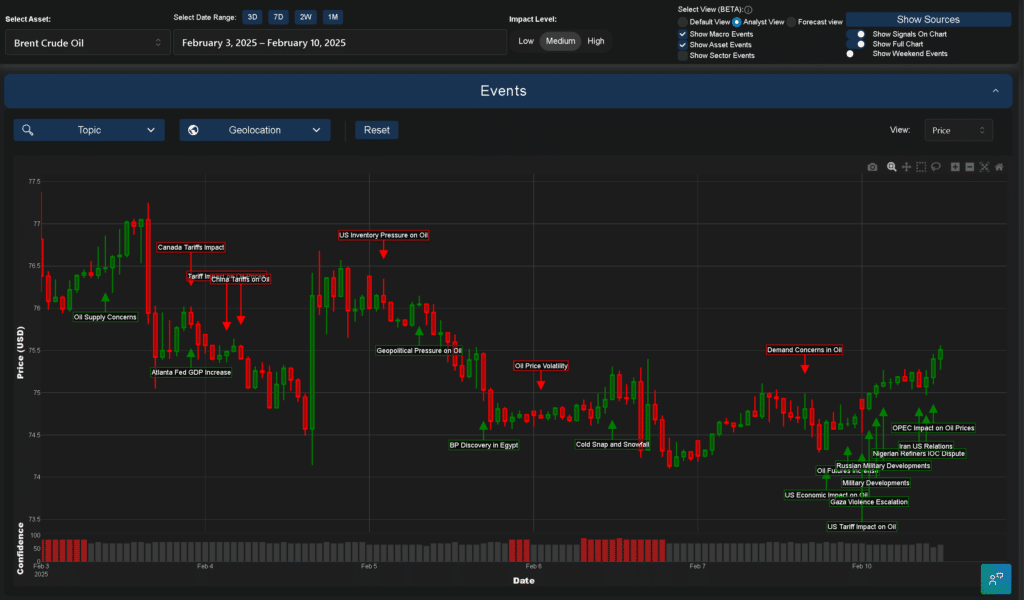

Brent Crude

Of course, recent cold snaps in the US have supported prices, countering earlier bearish sentiment. Meanwhile, ongoing military tensions in Ukraine and Middle East sanctions continue to influence supply concerns, despite rising inventories in key storage hubs. The market’s reaction to these conflicting signals has been notably measured, suggesting traders are carefully weighing immediate weather-driven demand against broader macroeconomic concerns. The interplay between OPEC+ output decisions and US inventory builds creates an additional dynamic that warrants close monitoring.

Metals market

Gold

The big recent news across commodity prices is that gold continues to see remarkable strength near $3,000. The game changer here has been combined monetary easing signals from central banks (RBI and BOE) alongside escalating geopolitical tensions. Safe-haven demand remains robust amid uncertain economic conditions. Technical analysis suggests the current price levels could establish new support zones, particularly if trade tensions escalate further. The correlation between gold prices and real yields continues to provide a helpful framework for understanding price movements, while physical demand from key Asian markets adds fundamental support.

Platinum

Here, we’re seeing the impact of China’s manufacturing slowdown (PMI at 50.1) combined with Anglo American Platinum’s profit decline. The automotive sector’s weakness, particularly in Germany, has created significant headwinds for demand, leading to the current bearish outlook. Supply-side dynamics, including potential production cuts and recycling rates, could provide some price support. However, the structural shift in automotive technology preferences continues to cast a shadow over longer-term demand prospects.

Palladium

The question here is whether positive US manufacturing data can offset European automotive weakness. This divergence in regional industrial activity creates a complex trading environment for a metal heavily dependent on automotive catalytic converter demand. Recent market behaviour suggests a delicate balance between supply constraints and demand concerns. While US economic resilience provides some support, the German industrial production drop signals potential weakness in a key consumption center. For now, the automotive sector’s ongoing transition toward electric vehicles adds another layer of uncertainty to longer-term demand projections.

Silver

Despite initial bullish signals from strong demand and positive drill results, inflation fears and trade tensions have created choppy trading conditions for silver. The metal’s dual role as both an industrial and precious metal continues to create complex price dynamics. While safe-haven demand provides some support during periods of market stress, industrial demand concerns and correlation with gold prices remain key drivers of market sentiment for silver.

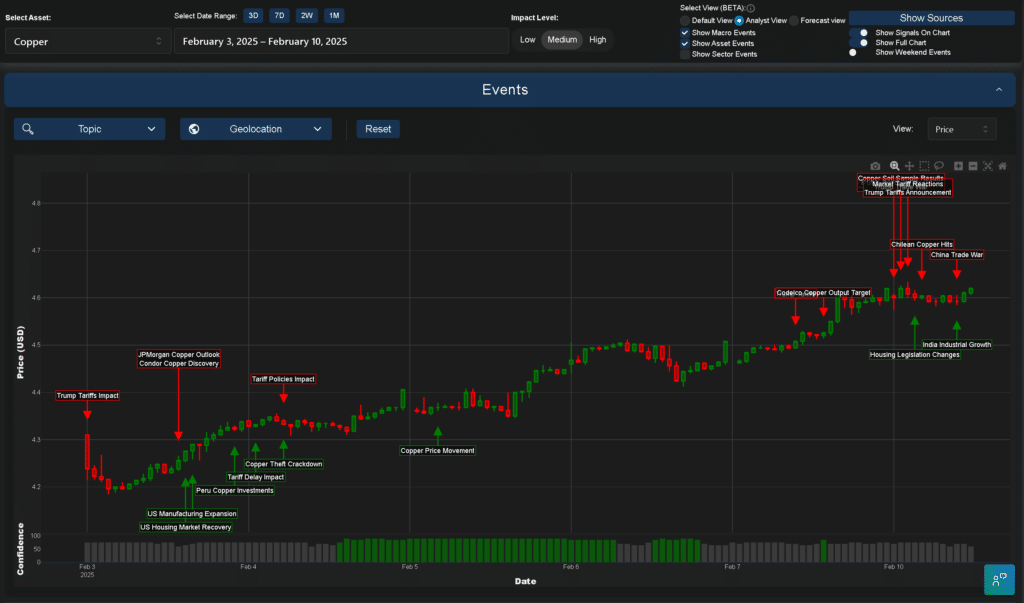

Copper

While housing market recovery provides some support, trade tensions create significant uncertainty for copper. Recent price movements reflect the market’s struggle to balance positive economic indicators against rising geopolitical risks. The broader implications of Trump’s reciprocal tariffs could fundamentally alter trading patterns in industrial metals. Concurrently, infrastructure development plans in key economies remain a potential catalyst for demand growth, but uncertainty around implementation and timing keeps market sentiment cautious.

Agricultural markets

Wheat

Coffee

We live in an age of highly volatile geopolitics and commodity prices, with coffee prices have reached record highs driven by fundamental supply fears and severe weather impacts. Arabica’s recent price action reflects both immediate supply constraints and longer-term structural changes in production patterns. Nestlé’s Indian market expansion signals growing demand in emerging markets, while weather-related supply disruptions continue to support prices. The potential for further supply chain disruptions, particularly in key growing regions, suggests continued price strength in the near term.

Corn

The present outlook for corn reflects complex crosscurrents in both supply and demand. Argentina’s severe drought has tightened supply expectations, while Mexico’s decision to rescind its ban on U.S. biotech corn provides some positive sentiment for traders. However, the broader impact of trade tensions and potential new tariffs creates significant headwinds. Fund positioning indicates some market confidence, but recent declines in Chicago corn futures suggest traders remain cautious amid these conflicting signals.

Cotton

Cotton markets are facing multiple challenges from both weather events and trade tensions. Queensland flooding and California’s adverse weather conditions raise significant concerns about agricultural productivity and potential supply shortages. The market’s recent rally gave way to more cautious sentiment as traders assessed the implications of new U.S. tariffs on China. These developments raise broader concerns about inflation impacts and potential demand destruction in key consumption markets.

Sugar

The sugar market presents a particularly nuanced picture amid current volatility. Once again, severe flooding in Queensland and ongoing drought challenges in Argentina have raised serious concerns about agricultural output and potential supply disruptions. While temporary support came from reduced Indian production and improved realisations for sugar companies, the stronger US dollar and projections of a global surplus create counterbalancing pressures. Recent developments suggest potential for recovery, but weather concerns and mixed economic indicators maintain market uncertainty.

Milling wheat

Markets have now pushed to four-month high levels amid severe flooding in North Queensland and ongoing Ukraine-Russia supply disruptions. The impact of these weather events on global supply chains has been particularly acute given the already strained market conditions. The announcement of retaliatory tariffs by China and Trump’s reciprocal measures adds another layer of complexity to traditional trading patterns. While some weakness emerged towards the end of the week, the overall trend remains bullish as markets continue to price in supply risks and shifting trade flows.

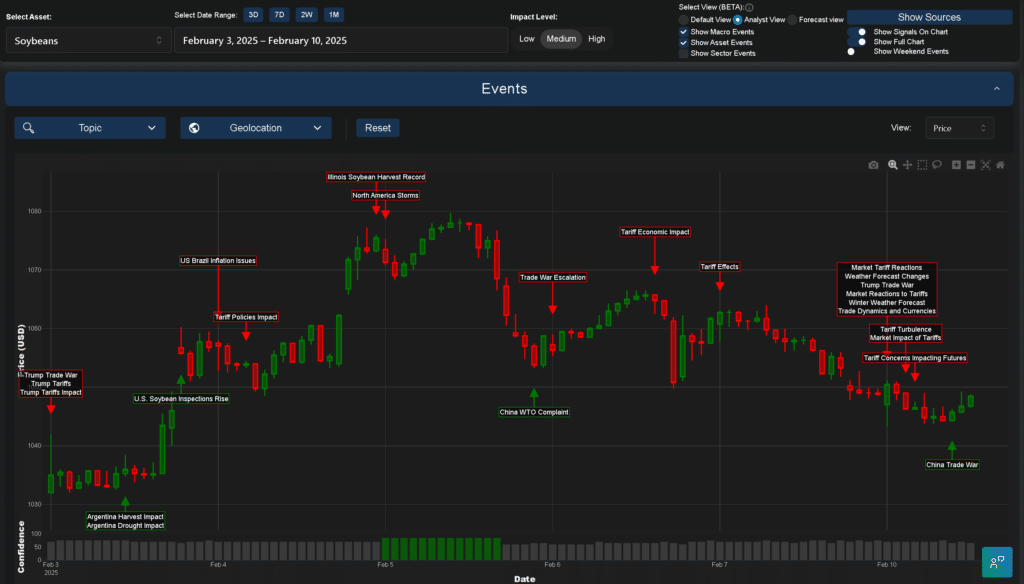

Soybeans

There are several areas where trade tensions impact is evident, none more so than soybeans. Recent tariff announcements have amplified bearish sentiment, with prices declining as traders anticipate further volatility and potential supply chain disruptions. This dovetails with weather-related concerns in Argentina and North America, creating a complex market dynamic. The combination of trade uncertainty and adverse weather conditions suggests continued pressure on prices, with particular attention needed on Chinese demand patterns and South American production levels.

Looking ahead on commodity prices

If narratives shape politics, then current trade tensions suggest continued market volatility across commodity sectors. What this reveals is the increasing importance of real-time market intelligence in navigating these complex conditions. Commodity traders must remain vigilant to both immediate catalysts and longer-term structural shifts, particularly as weather patterns and geopolitical developments continue to drive price action.

The interconnectedness of commodity markets has never been more evident, with developments in one sector frequently creating spillover effects in others. Successful trading strategies will require careful monitoring of cross-commodity correlations by using tools like our Trading Co-Pilot and the ability to quickly adapt to changing market conditions.

Get ahead of commodity price movements

Our Trading Co-Pilot can enhance your commodity trading operations with real-time cross-asset insights. It works by analysing the complex interplay of weather events, trade policies, and supply chain dynamics as well as other market factors across energy, metals, and agricultural markets, helping you identify price movements before they emerge. Our enterprise solution offers real-time analysis of market-moving events, cross-commodity correlation insights, early warning signals for price movements, and comprehensive monitoring of supply chain announcements, weather impacts, and trade flows.

To arrange a demo or request a free enterprise trial get in touch with our team at enquiries@permutable.ai or simply fill in the form below to see how our AI-driven market intelligence can complement your existing trading strategies. We’re currently offering a 14-day trial for qualified institutional traders (subject to approval) to experience our next-generation market intelligence . Find out how it can start maximising your trading potential today.