With the increasing focus on ESG, more organizations, including banks, have started incorporating ESG considerations into their investment decisions. One of the leading investment banks, Goldman Sachs, is seen to be one of the leaders in its field. Here we take a look at the Goldman Sachs ESG report and the bank’s expectations for integrating ESGs into its business activities.

Goldman Sachs ESG Investment Policy

Goldman Sachs launched its ESG investment policy in 2017. The policy aimed to support the firm’s commitment to environmental and social policies aligned with its core values. The firm’s ESG strategy includes the following key initiatives:

– Establishing a robust ESG investing program to build an investment portfolio that provides long-term return and creates positive social and environmental impact.

– Creating an internal network of investing experts to assist in the ESG investment process and ensure consistency across investing teams. This network has been designed to include individuals with a diverse range of experiences, expertise, and backgrounds.

– Partnering with industry organizations to help foster awareness and adoption of ESG investing within the financial services community.

– Engaging clients in ESG investment education and adoption initiatives.

Goldman Sachs ESG Investment Portfolio

While the firm set a goal to invest $50 billion in ESG assets by 2022, it was then fined $4m by the SEC over misleading ESG fund claims. In its latest report, the firm detailed its plans to:

– Expand investment activities in emerging markets.

– Work with a variety of asset managers and other financial institutions to increase access to its investment portfolio.

– Improve the operation of its ESG investment portfolio manager, Goldman SRI.

– Educating and advising clients on how to incorporate ESG into their investment process.

Goldman Sachs ESG Investment Strategies

The report details how the firm hopes to engage with clients on the benefits of incorporating ESG factors into their investment decisions. In order to do so, it has partnered with the World Bank’s Sustainable Financial Institute (SFI) to create a new program called NextGen Impact Investing: The program aims to provide educational material and resources to help investors better understand the relationship between ESG factors and investment returns. The report has also highlighted the firm’s future plans to expand its branded fund offerings including ESG-focused funds and the expansion of existing funds to include ESG factors.

Goldman Sachs’ Expectations For Incorporating ESG

Goldman Sachs has set high expectations for its investment business, aiming to incorporate more ESG factors into its decision-making. The firm has concluded that incorporating ESG factors has multiple benefits, including the potential to:

– Improve the long-term return on investments.

– Increase the probability of generating positive social and environmental impact. This is demonstrated by its impressive environmental score of 96/100 and its above average social score of 68/100.

– Reduce the risk of financial losses.

– Reduce the impact of environmental and social risks faced by the firm.

Of course, in light of the SEC penalty, the company will need to be ultra vigilant and close any gaps between its policies, practices and public statements about ESG. Its current governance score is 19/100 which has been a black mark against it due to its general corporate behaviour and governance regarding ESG funds. In addition, the company concluded that while many investments are now indirectly assessing their ESG factors, it is still necessary to conduct an in-depth evaluation of them in order to make informed independent investment decisions.

The company has concluded that one of the most powerful ways it can promote ESG investing is through its institutional and retail clients. It can also promote ESG investing through its investment management business and by educating stakeholders on the benefits of incorporating ESG factors into their investment decisions.

Insights From Our In-House Goldman Sachs ESG report

While Goldman has increased its clean energy financing, recognizing the climate change impertive, and is sourcing renewable energy for its operations, its approximately $11 billion in clean energy financing over 14 years is substantially outweighed by its fossil fuel funding activities.

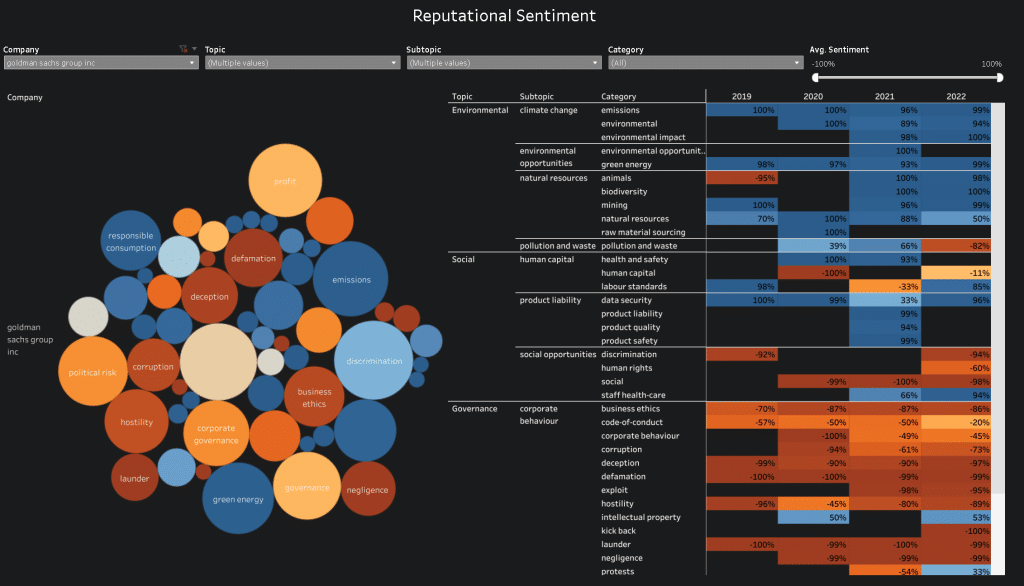

At the time of writing, Goldman Sachs does not yet measure or disclose the full carbon footprint associated with its lending, nor has it adopted targets to reduce its lending related greenhouse gas (GHG) emissions. Banks that finance carbon intensive fossil fuel activities through their lending are putting themselves and society at risk. This creates a significant reputation risk for the company in terms outfits corporate behaviour, which the below data highlights.

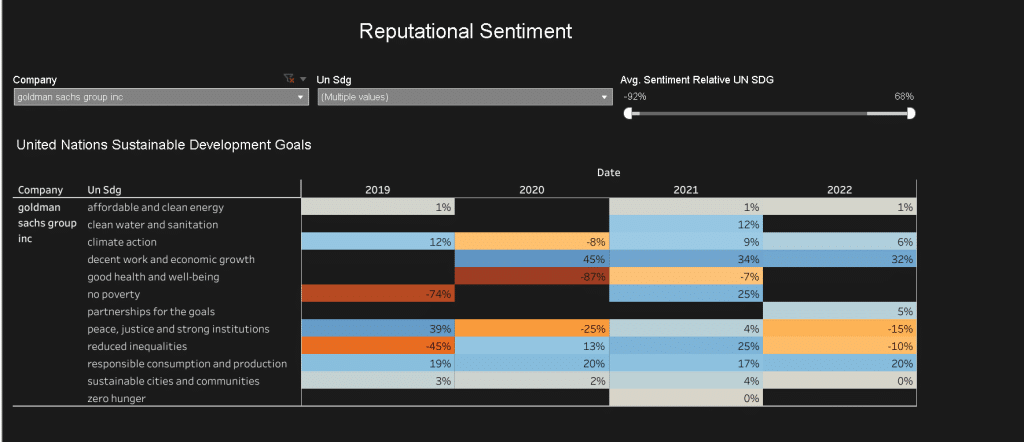

So while this data shows high scores for climate change factors such as emissions, environmental impact and green energy, the aforementioned is most likely why our data shows the company is marred by governance issues including business ethics, code-of-conduct, corporate behaviour, deception and the like.

There is also plenty room for improvement on social factors where the company often comes under fire for discrimination with accusations of gender bias prevalent. This is flagged under the SDG reduced inequalities which has historically been a thorn in the company’s side, although reportedly improving.

Summing Up

Goldman Sachs is one of the most highly regarded investment banks and one of the most profitable financial services firms of all time. Through a combination of financial expertise, technology and integrity, it has built a solid reputation as a trusted advisor.

The company recognises that incorporating ESG factors into investment decisions can have a positive impact on both the financial performance of the company and its community stakeholders. While they have made a number of positive moves towards the environment, including funding funding granted through the Goldman Sachs Foundation which supports a variety of projects that promote environmental justice and build a more sustainable future, there is still room for improvement when it comes to incorporating ESG factors into its decision making processes.

See how Goldman Sachs stacks up against their competitors

JPMorgan Chase & Co. ESG report

Credit Suisse Group ESG report