In these early innings of the AI revolution, few sectors stand to benefit as dramatically as commodity trading, particularly in the volatile crude oil markets. One cannot escape the reality that traditional market analysis approaches are rapidly being outpaced by AI-driven alternatives. The impressive capability of these tools such as those that we have been working on for the last three years to process vast quantities of market data and news in real-time is fundamentally changing how traders understand oil market sentiment. In this article, we’ll take a look at seven use cases of our crude oil market sentiment, available through our Trading Co-Pilot subscription.

Why crude oil market sentiment matters now more than ever

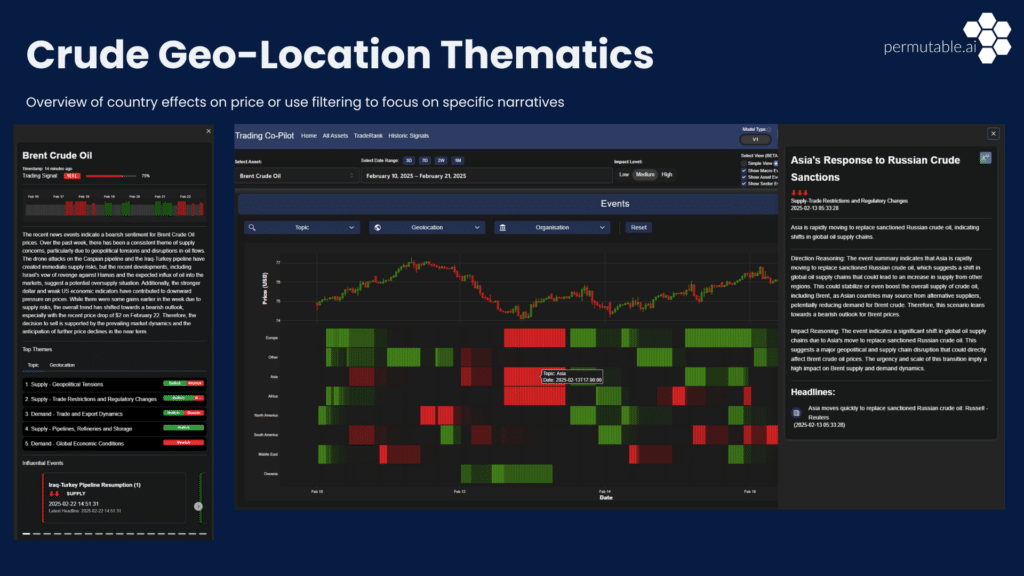

The financial and geopolitical forces shaping today’s oil markets are increasingly complex. After a spell of relative stability, recent events have dramatically shifted global supply chains. This includes the significant impact of Asia’s response to Russian crude sanctions, with markets rapidly adjusting to replace sanctioned Russian crude oil and causing major shifts in global supply dynamics.

One of the really remarkable things over the last year is how quickly these market movements can develop and cascade across different asset classes. As seen in Permutable’s visualisations, events like the Iraq-Turkey pipeline disruptions can trigger immediate supply risks, while US crude inventory reports can send ripples through global markets within minutes.

We’re already seeing how AI is taking centre stage in helping institutional traders navigate this complexity through our own work with our clients. Part of the battle here is simply organising the overwhelming amount of information that influences crude oil prices which AI excels at. And then there’s the very significant upside of its ability to spot emerging trends before they become obvious to the broader market and human eye.

7 use cases for our AI-driven crude oil market sentiment

1. Geo-location thematic analysis

The rise of regional market divergences means traders must monitor location-specific factors more closely than ever. Our geo-location thematic analysis provides an overview of country effects on price, filtering to focus on specific narratives. For example, our platform highlights how Asian markets are rapidly moving to replace sanctioned Russian crude oil, indicating shifts in global oil supply chains that could lead to increased supply from other regions. It is a good example of how geopolitical events can be translated into actionable trading insights.

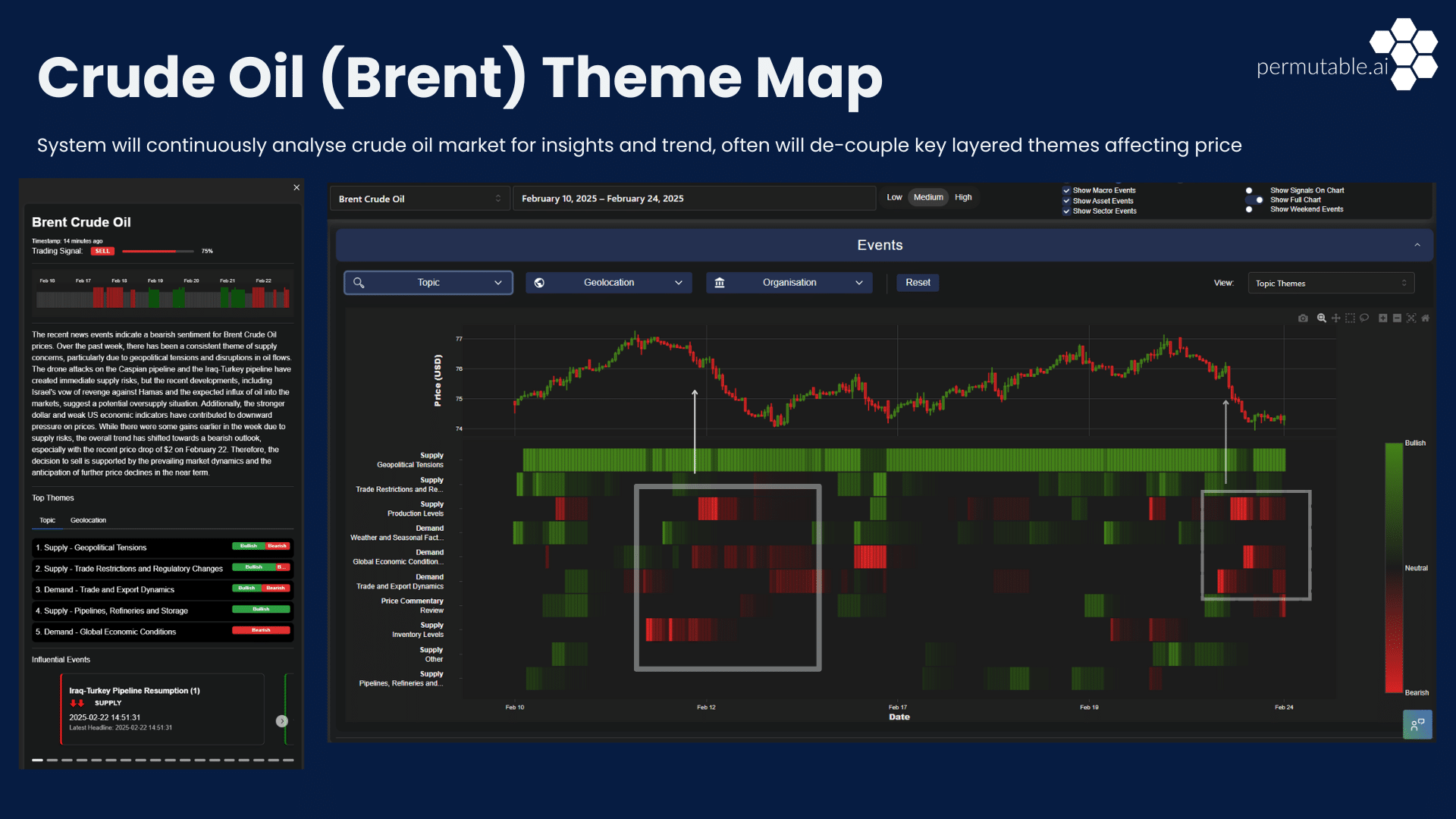

2. Theme mapping across supply and demand factors

Our theme map for Brent Crude market sentiment breaks down the market into colour-coded sentiment indicators across multiple factors. This includes supply considerations such as geopolitical tensions, trade restrictions and regulatory changes, and supply production levels. For demand factors, it tracks global economic conditions and trade and export dynamic. The tactics used by successful traders often involve identifying when these themes diverge, creating potential trading opportunities. But it is almost always the case that these relationships are complex and difficult to spot without advanced visualisation tools such as these.

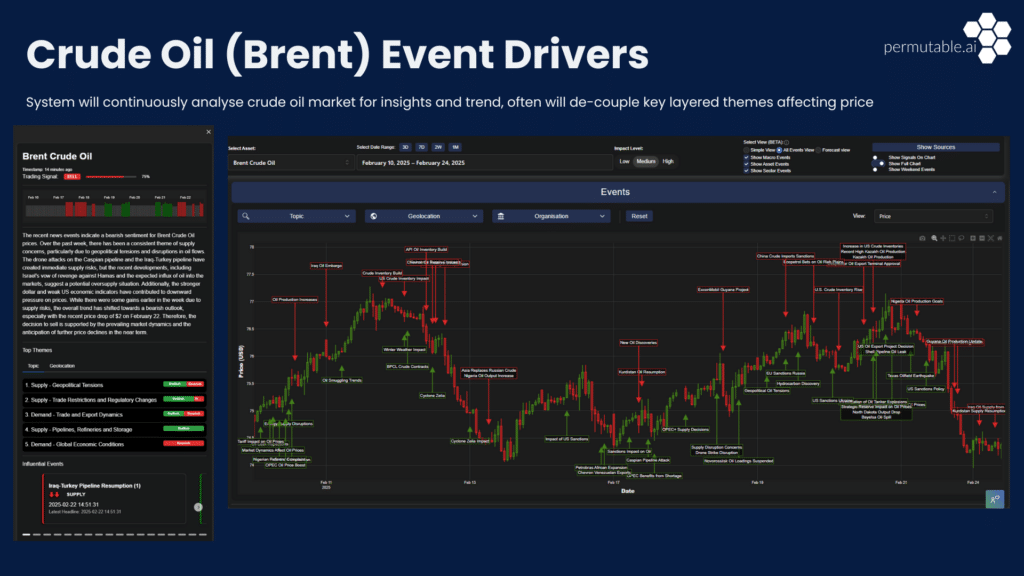

3. Event driver identification

In the previous era, traders were more dependent on manual news monitoring. Now, our event drivers visualisation specific market-moving events directly onto price charts. This includes inventory builds/draws (US, Japan, China), production increases/decreases, pipeline disruptions, geopolitical conflicts, OPEC+ decisions, and refinery outages. Each event is colour-coded (red for bearish, green for bullish) and positioned precisely where it impacts the price chart, creating a comprehensive narrative of market movements.

4. Real-time sentiment tracking

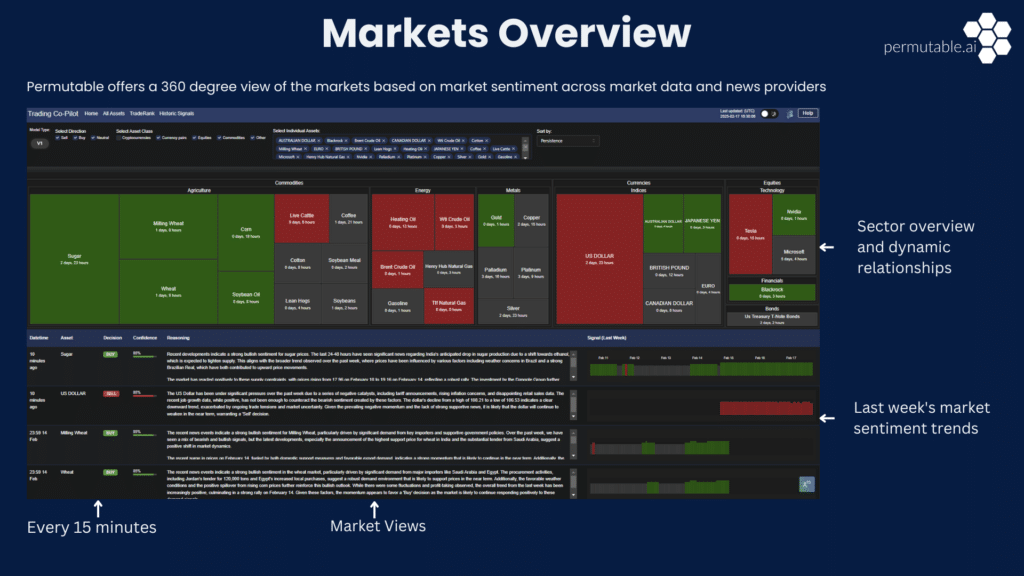

To say that AI’s capabilities are progressing at an incredible speed in the realm of natural language processing is somewhat of an understatement from where we stand. Our in-house trained LLM models analyse thousands of news sources, social media feeds, and market reports to generate real-time crude oil market sentiment. We know that the most frustrating thing about traditional sentiment analysis was its delay – by the time sentiment was identified, the market had often already moved. This is where our 15-minute update cycle comes into play, ensuring traders can identify shifting market sentiment as – or even before – it develops.

5. Cross-asset correlation visualisation

As oil markets jostle for supremacy with other asset classes, understanding correlations between market, becomes increasingly important. Our cross-asset visualisation demonstrates how crude oil price movements interact with currency pairs (particularly USD strength), other commodities (natural gas, agricultural products), equity markets (especially energy sector stocks), and bond yields. The latter, making connections between seemingly unrelated markets, cam often provides the earliest signals of changing crude oil market sentiment and dynamics.

6. Supply chain disruption alerts

With global supply chains increasingly vulnerable to disruption, our platform identifies potential chokepoints before they impact prices. Our recent data visualisations highlight pipeline attacks and resumptions (Iraq-Turkey), shipping lane disruptions, refinery outages, production capacity constraints, and weather-related disruptions. These early warnings allow traders to position themselves ahead of market-moving supply shocks.

7. Regulatory and policy impact assessment

Finally, our AI-driven market sentiment analysis excels at gauging the impact of regulatory and policy changes on crude oil markets. From sanctions to environmental regulations, our platform quantifies crude oil market sentiment shifts resulting from policy announcements across global markets.

The future of crude oil market sentiment analysis

As Permutable AI, we’re continuing to refine how traders interact with our crude oil market sentiment analysis through our Trading Co-Pilot platform. The latest roll out of our thematic visualisation, including our Market 360 tool, and other planned developments means that the line between market data and actionable intelligence is becoming increasingly blurred. With every 15-minute update, and weekly feedback loops, our system learns and adapts, providing increasingly nuanced views of crude oil market sentiment.

We know that – for institutional traders, portfolio and asset managers – the implications are powerful and that those who embrace our AI-driven tools will gain a potent edge in risk management and alpha generation. For example, by automating cross-asset correlation analysis that typically requires teams of analysts, our Market 360 allows institutions to reallocate human capital to higher-value activities while improving decision speed.

In today’s complex and volatile crude oil markets, understanding sentiment has never been more valuable – or more challenging. Yet, our crude oil market sentiment visualisations are transforming this challenge into an opportunity, giving traders the confidence to act on emerging trends before they become obvious to the broader market.

Experience our crude oil market sentiment analysis for yourself.

Find out how our crude oil market sentiment analysis can be embedding into your trading strategies by scheduling a personalised enterprise demonstration today to see how our Trading Co-Pilot platform can transform your trading decisions with real-time insights and visualisations. Limited complimentary trial access available for qualified institutional traders and asset managers. Contact our team at enquiries@permutable.ai or simply fill in the form below to book your session.