In this brief article, we’ll share how our Trading Co-Pilot data has uncovered valuable insights through advanced crude oil technical analysis using sentiment data from 2022 to present. These findings reveal distinctive patterns that traditional crude oil technical analysis often misses when relying solely on price and volume indicators.

Table of Contents

ToggleCrude oil technical analysis – key findings

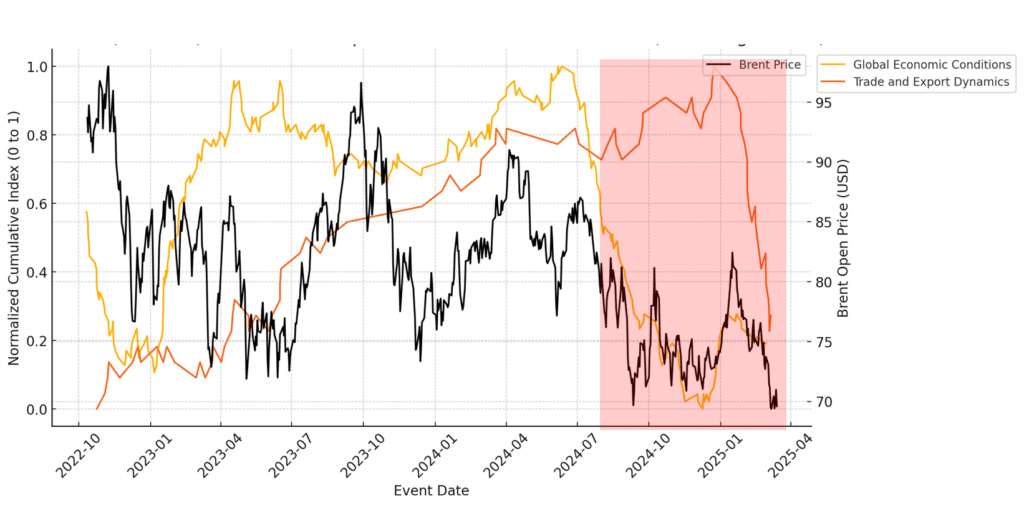

Downside risk

Our data shows that weakening global economic sentiment and trade dynamics are strongly correlated with price declines in crude oil markets. These macroeconomic indicators have consistently preceded downward price movements, providing valuable early warning signals that conventional crude oil technical analysis might overlook.

Source: Permutable Trading Co-Pilot data 2022 – present

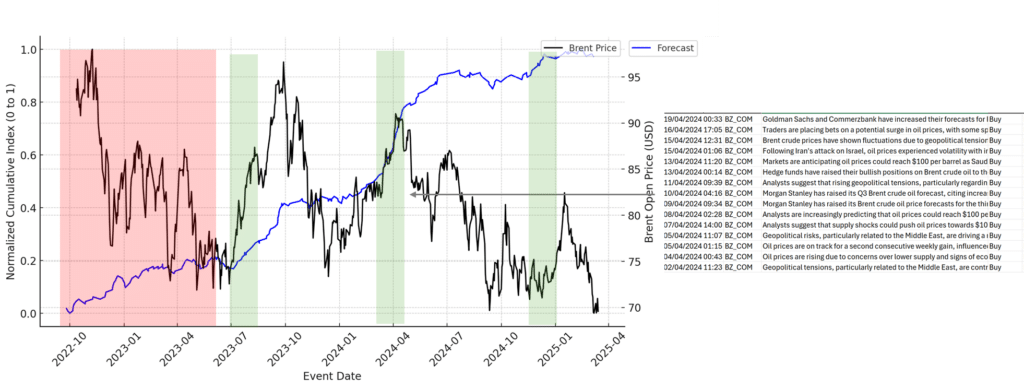

Upside signal

Price forecast momentum has proven to be a reliable indicator for upward movements in crude oil prices. Our Trading Co-Pilot’s sentiment analysis demonstrates that incorporating these forecast trends into crude oil technical analysis can effectively signal potential upside opportunities before they fully materialise in the market.

Source: Permutable Trading Co-Pilot data 2022 – present

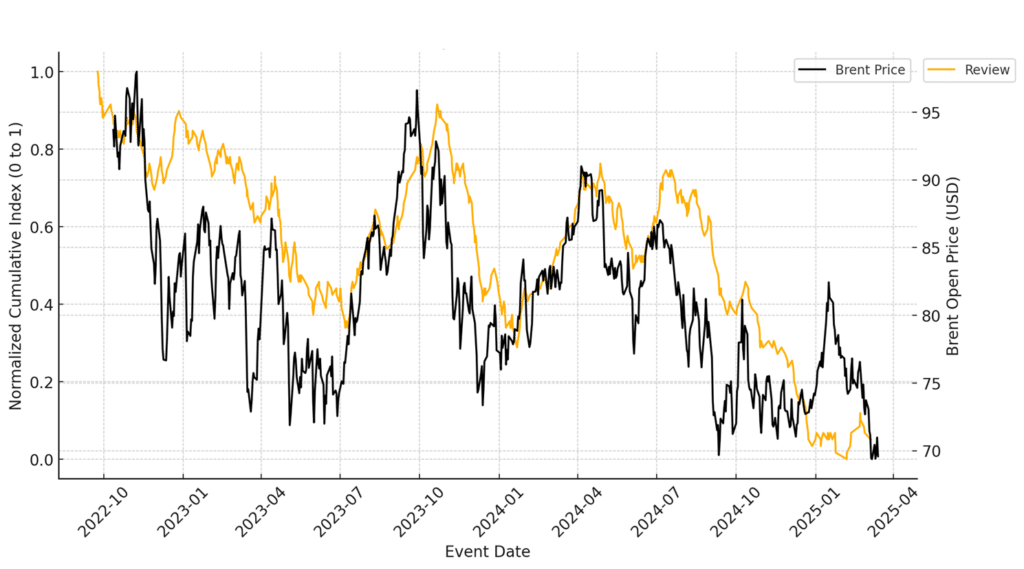

Confirmation that price commentary only lags

Our insights conclusively shows that price commentary is a persistent lagging indicator in both directions, containing no inherent biases that would provide predictive value. This confirms what many traders suspect but haven’t been able to quantify – commentary follows rather than leads market movements, making it a poor foundation for serious crude oil technical analysis.

Implications for crude oil technical analysis and trading strategies

These insights from our Trading Co-Pilot data offer significant value for positioning within crude oil markets for both manual and systematic trading. By understanding which sentiment indicators provide genuine predictive value and which merely follow price action, traders can develop more effective strategies that go beyond conventional crude oil technical analysis methods.

Our Trading Co-Pilot continues to refine these models, providing our partners with increasingly accurate sentiment-enhanced crude oil technical analysis across commodity markets.

For more detailed analysis or to discuss how these insights might enhance your trading strategy, please contact us at enquiries@permutable.ai. To request a demo or enterprise trial of our Trading Co-Pilot simply fill in the form below.