Reputation Rankings and ESG Scores for US Funds

Core > ESG & Supply Chains > Funds

Core > Funds

Summary

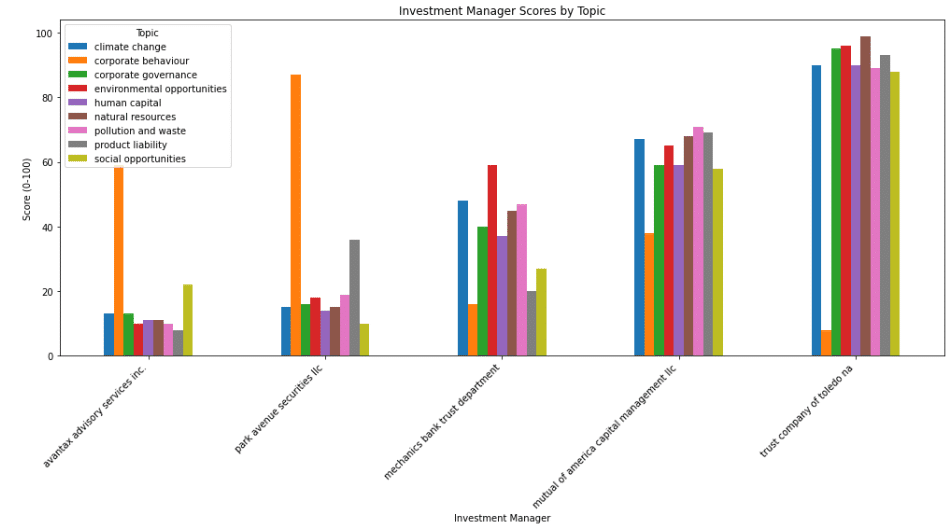

Our ESG scores for US funds offer a comprehensive assessment ideal for identifying which funds are most at risk of anti-ESG protests and attacks. These scores are derived from a continuous rolling 12-month analysis of media ESG sentiment for each stock holding within each investment entity. We rank each fund based on over 60 ESG indicators, including areas such as climate change, human rights, and corporate governance.

Data Specifications

Delivery Frequency | Static |

Data Frequency | Daily |

Reporting Lag | Monthly |

History | 2021 - Present |

Coverage | 4979 |

Availability | Premium |

Number of Datapoints | 82,909 |

Trial This Product

If you require a deeper sample for testing please contact us to set up a master agreement. Once your organization has a master agreement in place you can instantly trial all data product.

START FREE TRIAL NOWDocumentation

Summary

Reputation Rankings and ESG scores for US Funds

Key Features

- Reputational ESG Scores for institutional funds

- Level 1 : Environment, social and governance

- Level 2 : Climate change, pollution and waste, social opportunities, product liability

- Level 3 : Most granular level of taxonomy – including emissions, nuclear, green energy, labour standards, supply chain, corruption, prosecution etc.

- Percentile rankings across each metrics for funds

- Based on positive and negative reputation datapoints from 10,000+ news sources

- Updated each month

Supporting Documents

- For full taxonomy click on here

Delivery

- Our reputation and ESG Scores for US funds dataset is updated daily by 6 AM ET, Tuesday to Saturday, following each trading day with the previous day’s Consolidated Quotes & Trades data.

Coverage and Data Format

Our reputation and ESG scores for US funds dataset covers over 4979 US based funds.

Column Definitions

Table 1

Highest level of grouping (i.e. environmental, social or governance)

| |||

0 - 100. 0 lowest percentile, 100 is highest possible percentile | |||

Bottom (lowest 25% AUM) Middle (25-75% AUM) Top (top 25% AUM) | |||

Table 2

Mid-level ESG groups:

| Human Capital

| ||

0 - 100. 0 lowest percentile, 100 is highest possible percentile | |||

Table 3

Column | Data Type | Description | Example |

|---|---|---|---|

cik | String | CIK code | 2024-02-12 |

manager_name | String | Investment manager | Manager Fund |

category | Integer | Our most granular groups, examples include:

Social Opportunities, Human Capital, Regulatory Violation | Human Capital |

overall_score | Integer | ESG Scores between 0 and 100 | 60 |

overall_percentile | Integer | 0 - 100. 0 lowest percentile, 100 is highest possible percentile | 32 |

quartile | String | Bottom (lowest 25% AUM) Middle (25-75% AUM) Top (top 25% AUM) | Bottom |

quartile_percentile | Integer | Adjusted percentile score for based on AUM quartile | 61 |

last_holding_date | Date | Last filing date | 2024-03-01 |

Quick Start Example

A subset of this data is available for testing without a subscription. See below for an example or download here.

CSV

A subset of this data is available for testing without a subscription. See below for an example or download here.

date_of_holdings,investment_manager,subtopic,overall_score,overall_percentile_rank,quartile_level,quartile_based_percentile_rank

30/04/2024,harel insurance investments & financial servic...,corporate behaviour,47,88,bottom,87

30/04/2024,harel insurance investments & financial servic...,environmental opportunities,55,14,bottom,19

30/04/2024,harel insurance investments & financial servic...,corporate governance,51,6,bottom,4

30/04/2024,harel insurance investments & financial servic...,natural resources,54,8,bottom,7

30/04/2024,harel insurance investments & financial servic...,pollution and waste,54,18,bottom,30

30/04/2024,harel insurance investments & financial servic...,climate change,55,8,bottom,7

30/04/2024,harel insurance investments & financial servic...,social opportunities,52,7,bottom,6

30/04/2024,harel insurance investments & financial servic...,product liability,50,25,bottom,39

30/04/2024,harel insurance investments & financial servic...,human capital,52,7,bottom,6

12/04/2024,annex advisory services llc,climate change,60,17,top,13