This case study examines how Permutable AI’s Trading Co-Pilot accurately predicted a successful Brent crude oil trade, demonstrating the power of AI-driven sentiment analysis for forecasting crude oil prices, and is written for energy traders, commodity fund managers, and institutional investors seeking advanced methods for forecasting crude oil prices through sentiment-driven market intelligence.

In the volatile world of energy markets, accurately forecasting crude oil prices requires more than traditional technical analysis. Our Trading Co-Pilot demonstrated this principle with precision recently during a recent Brent crude trade that delivered a 2.2% return in three days. This case study reveals how our LLM-driven sentiment analysis identified a market shift before price action confirmed it, showcasing the transformative power of advanced technology in commodity trading.

The challenge of forecasting crude oil prices has become increasingly complex as geopolitical events, supply dynamics, and market sentiment interact in unpredictable ways. Traditional approaches often miss the subtle sentiment shifts that precede major price movements. Our Trading Co-Pilot addresses this gap by processing vast amounts of unstructured data to detect these crucial inflection points.

The setup: Detecting sentiment shift

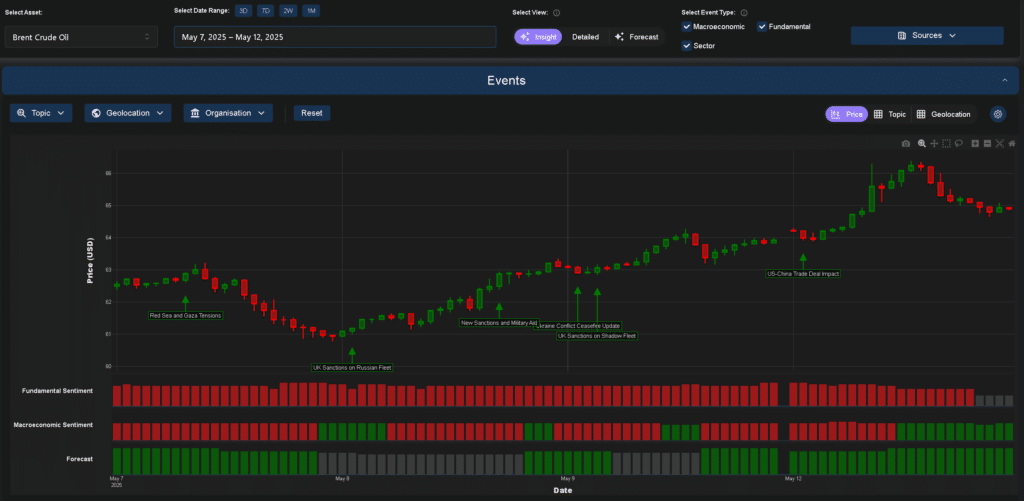

On May 9th at 2pm, our sentiment indicators began to turn. What had been neutral market sentiment turned to bullish with 85% confidence – a clear signal that market dynamics were changing. The catalyst emerged from multiple converging factors. US sanctions on Chinese refiners over Iranian oil dealings created immediate supply concerns, whilst simultaneously, optimism surrounding a potential US-UK trade deal began permeating market psychology.

Above: Permutable AI’s Trading Co-Pilot data feeds showing Brent crude oil price movements and sentiment indicators from May 7-12, 2025. This visual representation demonstrates how our sentiment analysis technology transforms complex market dynamics into actionable intelligence for forecasting crude oil prices.

The trade execution

With Brent crude trading at $60.94, our Trading Co-Pilot generated a buy signal based on the confluence of bullish sentiment indicators. Our AI’s analysis suggested that the market hadn’t yet fully priced in the implications of these developing narratives – a classic opportunity for those forecasting crude oil prices through sentiment analysis.

Our system’s confidence stemmed from its ability to process and contextualise multiple information streams simultaneously. While human traders might struggle to weight the relative importance of sanctions versus trade optimism, our AI quantified these factors’ collective impact on market sentiment with mathematical precision.

Market development and results

Over the subsequent three days, Brent crude prices validated our sentiment-based forecast. The commodity rallied from $60.94 to $63.78, delivering a 2.2% return by the trade’s closure on May 12th. This move represented not just profitable execution but vindication of our approach to forecasting crude oil prices through advanced sentiment analysis.

Throughout this period, our Trading Co-Pilot continued monitoring sentiment indicators, tracking how market participants digested the sanctions’ implications and trade negotiations’ progress. The sustained bullish sentiment confirmed our initial analysis, with the compound effect of multiple catalysts reinforcing the upward trajectory.

Technical innovation behind the success

Our sentiment engine’s successful prediction showcased several key aspects to our approach to forecasting crude oil prices. Our custom-trained LLMs processed information from over 120,000 daily sources, identifying relevant narratives and quantifying their potential market impact. This comprehensive coverage ensures no important sentiment shift goes undetected.

To add to that, our AI’s ability to distinguish between noise and signal proved crucial. While countless news items flow through markets daily, our system identified this specific combination as materially significant for price direction. This selectivity represents years of refinement in our machine learning models.

Implications for energy trading

The three-day window from sentiment shift to take profit illustrates how our technology provides actionable intelligence with sufficient lead time for position establishment. For institutional investors navigating energy markets, the ability to detect sentiment inflection points before they manifest in price action represents substantial alpha potential. Our Trading Co-Pilot transforms this capability from theoretical possibility to practical reality, as evidenced by consistent outperformance across multiple market conditions.

Summing up

This Brent crude trade example illustrates the advantage of using our sophisticated LLMs for forecasting crude oil prices and sentiment shifts. As energy markets grow increasingly complex, the gap between AI-driven sentiment predictions and traditional analysis will only continue to widen. Ultimately, this case study proves that it will be the institutions equipped with sophisticated AI tools that will possess decisive advantage in identifying and capitalising on market opportunities.

Gain your edge in energy markets

Improve your approach to forecasting crude oil prices and market shifts with our Trading Co-Pilot data feeds. Request a demonstration of our sentiment analysis platform and data feeds at enquiries@permutable.ai or simply fill in the form below and discover how AI-driven intelligence can enhance your energy trading strategies.