From algorithms that power its search engine to strategic acquisitions that reshape the tech landscape, Google is a company that never fails to captivate investors and analysts. The stock price of this tech giant is a reflection of the complexities that drive the market. In this article, we delve into the intricacies of Google stock price fluctuations, uncovering the factors that influence its rise and fall.

Table of Contents

ToggleUnderstanding the factors that influence Google stock price (goog stocks)

Google’s stock price is influenced by a multitude of factors, ranging from algorithm changes to acquisitions and market trends. Understanding these factors is crucial for investors looking to navigate the complexities of Google’s stock performance.

Google’s algorithm changes and their impact on stock prices (goo stocks)

Google’s algorithms are at the heart of its business, constantly adapting and evolving to deliver the most relevant search results to users. These algorithm changes can have a significant impact on the company’s stock price.

When Google announces algorithm updates, it often leads to speculation and anticipation among investors. Major changes, such as the introduction of the Panda and Penguin updates, have been known to cause fluctuations in Google’s stock price. For example, when the Panda algorithm was first rolled out in 2011, Google’s stock price initially dropped, reflecting concerns about the potential impact on the company’s search engine dominance. However, as the algorithm changes proved successful in improving search quality, investor confidence was restored, and the stock price eventually recovered.

Algorithm changes can also have indirect effects on Google’s stock price. For instance, updates that prioritize mobile-friendly websites can impact revenue from mobile advertising, which in turn can affect investor sentiment and the stock price. It is essential for investors to closely monitor algorithm changes and understand their potential implications on Google’s business and financials.

New product launches and how they affect Google stock price

Google’s prowess in introducing innovative products and services holds a significant sway over its stock performance. Successful launches often propel the stock price upwards, reflecting investors’ confidence in the company’s ability to stay at the forefront of technological advancements.

However, the flip side is equally true—failed launches can exert downward pressure on the stock, signaling potential challenges or missteps in Google’s strategic initiatives. The market closely watches the outcome of each launch, as it serves as a barometer of Google’s resilience and adaptability in the ever-evolving tech landscape.

How competition affects Google stock price and Google stock projections

In the highly competitive realm of technology, Google contends with formidable rivals, including Microsoft, Amazon, and Apple. The dynamics of this competition are crucial factors influencing Google’s stock performance. Any indications or developments hinting at Google ceding market share to its counterparts can exert substantial pressure on the stock price.

The stock market is sensitive to shifts in market share, viewing them as potential indicators of a company’s standing in the industry. If there are signs that Google is losing ground to competitors, investors may interpret it as a potential erosion of the company’s dominance, raising concerns about its ability to innovate or adapt to evolving market trends.

The role of acquisitions on Google stock price movements

Google’s strategic acquisitions have played a significant role in shaping its stock performance. The company has a history of acquiring both established tech companies and promising startups to expand its product offerings and strengthen its market position.

Notable acquisitions like YouTube and Nest have had a transformative impact on Google’s business. When Google acquired YouTube in 2006, it solidified its position as a dominant player in online video. This acquisition not only contributed to revenue growth but also enhanced Google’s overall brand value. Similarly, the acquisition of Nest, a smart home technology company, positioned Google at the forefront of the emerging Internet of Things market.

Investors closely monitor Google’s acquisition strategy as it can provide insights into the company’s future growth prospects. Successful acquisitions can boost investor confidence and lead to upward trends in the stock price. On the other hand, failed acquisitions or concerns about overpaying for acquisitions can negatively impact the stock price.

Analyzing market trends and investor sentiment

In addition to algorithm changes and acquisitions, market trends and investor sentiment also influence Google’s stock price fluctuations. Market trends, such as overall market conditions, industry performance, and macroeconomic factors, can have a significant impact on the stock price.

During periods of economic uncertainty or market volatility, investors may become more cautious and sell off their shares, leading to a decline in Google’s stock price. On the other hand, positive market trends and strong investor sentiment can drive the stock price higher.

Investor sentiment, which reflects the overall perception and confidence in the company, can be influenced by various factors such as news, analyst reports, and earnings announcements. Positive news, such as strong financial results or innovative product launches, can boost investor sentiment and drive the stock price up. Conversely, negative news or concerns about regulatory issues, privacy concerns, or competition can lead to a decline in investor confidence and a subsequent drop in the stock price.

Expert opinions and forecasts on Google stock prices

Investors often rely on expert opinions and forecasts to make informed investment decisions. Analysts and financial institutions closely follow Google’s stock performance and provide their insights on its future prospects.

Analyst reports and forecasts can provide valuable information about the expected trajectory of Google’s stock price. These reports often analyze various factors, such as revenue growth, market share, competitive landscape, and industry trends, to project the company’s future performance. Investors should consider a range of expert opinions and forecasts to get a comprehensive view of Google’s stock potential.

However, it’s important to note that no forecast can guarantee accurate predictions of stock price movements. Investors should use expert opinions as one of many tools in their investment decision-making process and conduct their own thorough analysis.

Examples of significant Google stock price fluctuations

To understand the complexities of Google stock price fluctuations, let’s examine a few notable case studies:

The 2008 financial crisis: Like many other companies, Google experienced a significant drop in its stock price during the 2008 financial crisis. The global economic downturn and investor concerns about advertising revenues led to a decline in the stock price. However, Google’s strong fundamentals and ability to weather the storm allowed it to recover and reach new highs in subsequent years.

The Google and Alphabet restructuring: In 2015, Google announced a major restructuring, creating a new holding company called Alphabet. This move aimed to separate Google’s core businesses from its other ventures and provide more transparency to investors. The announcement initially led to a surge in the stock price, reflecting positive investor sentiment and confidence in the company’s strategic direction.

Antitrust investigations and regulatory concerns: In recent years, Google has faced increased scrutiny from regulators regarding its market dominance and potential antitrust violations. News of antitrust investigations or regulatory actions can negatively impact investor sentiment and lead to stock price declines. Investors should closely monitor regulatory developments and assess their potential implications on Google’s business

Google ticker 2024 update: Key factors influencing Google stock price in 2024

As we approach the earnings date on October 22, 2024, it’s crucial to reflect on the key developments impacting Google’s stock performance this year. The first half of 2024 has been marked by significant movements in Google’s stock price, driven by a combination of short-term and long-term factors. Investors should pay close attention to the following elements as they assess Google’s prospects for the remainder of the year:

Dividend yield and stock price forecasts

Google’s decision to maintain a conservative dividend yield has continued to shape investor sentiment. While the company’s dividend policy remains a topic of debate among shareholders, many analysts are focusing on the stock price forecast for the coming quarters. The outlook remains cautiously optimistic, with forecasts suggesting potential growth driven by robust net income and strategic initiatives. However, these projections are tempered by broader market uncertainties and the impact of ongoing macroeconomic trends.

Impact of net income on long-term prospects

Google’s strong net income figures have been a key driver of its stock performance in 2024. The company’s ability to consistently generate high levels of profitability, even amidst a challenging economic environment, underscores its resilience and long-term potential. Investors are closely monitoring these financial metrics as they consider Google’s position in their portfolios over the long term.

Short-term volatility and earnings date significance

With the earnings date set for October 22, 2024, short-term volatility is expected as the market anticipates Google’s financial results. Historically, earnings reports have been pivotal in driving stock price fluctuations, and this upcoming date is likely to be no different. Investors should be prepared for potential swings in the stock price as new information becomes available, particularly in relation to Google’s performance in its core business segments and any updates on strategic acquisitions.

Navigating the second half of 2024

As we move into the latter half of the year, investors should continue to monitor key factors such as dividend yield trends, net income performance, and stock price forecasts. Understanding the interplay between these elements and how they influence Google’s stock price will be essential for making informed investment decisions.

In conclusion, navigating the complexities of Google stock price fluctuations requires a deep understanding of the factors that influence its rise and fall. Algorithm changes, acquisitions, market trends, and investor sentiment all play a role in shaping Google’s stock performance. By closely monitoring these factors, considering expert opinions, and employing sound investment strategies, investors can make informed decisions when it comes to investing in Google stock.

Google Stock Price FAQ

What are the main factors that influence Google's stock price?

The main factors influencing Google’s stock price include:

- Algorithm changes and their impact on search quality

- New product launches and their success or failure

- Competition from other tech giants

- Strategic acquisitions

- Market trends and overall economic conditions

- Investor sentiment

- Regulatory developments and antitrust concerns

- Financial performance, including net income and revenue growth

How do Google's algorithm changes affect its stock price?

Google’s algorithm changes can have significant impacts on its stock price. Major updates can cause short-term fluctuations due to investor speculation. Successful updates that improve search quality often lead to positive long-term effects on the stock price, while unsuccessful changes can negatively impact investor confidence.

How does competition affect Google's stock price?

Competition from companies like Microsoft, Amazon, and Apple can significantly influence Google’s stock price. Any signs of Google losing market share or falling behind in innovation can lead to downward pressure on the stock price. Conversely, when Google outperforms its competitors, it often results in positive stock price movements.

What role do acquisitions play in Google's stock price movements?

Acquisitions play a crucial role in Google’s stock price movements. Successful acquisitions that expand Google’s product offerings or strengthen its market position often lead to increases in stock price. However, overpaying for acquisitions or integrating them poorly can negatively impact the stock price.

How do market trends and investor sentiment affect Google's stock price?

Market trends and investor sentiment can cause significant fluctuations in Google’s stock price. Positive market conditions and strong investor confidence can drive the stock price up, while economic uncertainty or negative sentiment can lead to declines.

How reliable are expert forecasts on Google's stock price?

While expert forecasts can provide valuable insights, they should not be considered guarantees. These forecasts are based on analysis of various factors, but unexpected events or market shifts can always occur. Investors should use expert opinions as one of many tools in their decision-making process.

How does Google's dividend yield affect its stock price?

Google’s dividend yield policy can influence investor sentiment and stock price. While Google maintains a conservative dividend yield, changes to this policy or comparisons with other tech companies’ dividend yields can impact investor perceptions and the stock price.

What should investors look for in Google's earnings reports?

When reviewing Google’s earnings reports, investors should pay attention to:

- Revenue growth, especially in key areas like advertising

- Net income and profitability metrics

- User engagement statistics

- Updates on new products or services

- Information about strategic acquisitions

- Guidance for future quarters

- Any comments on regulatory challenges or market competition

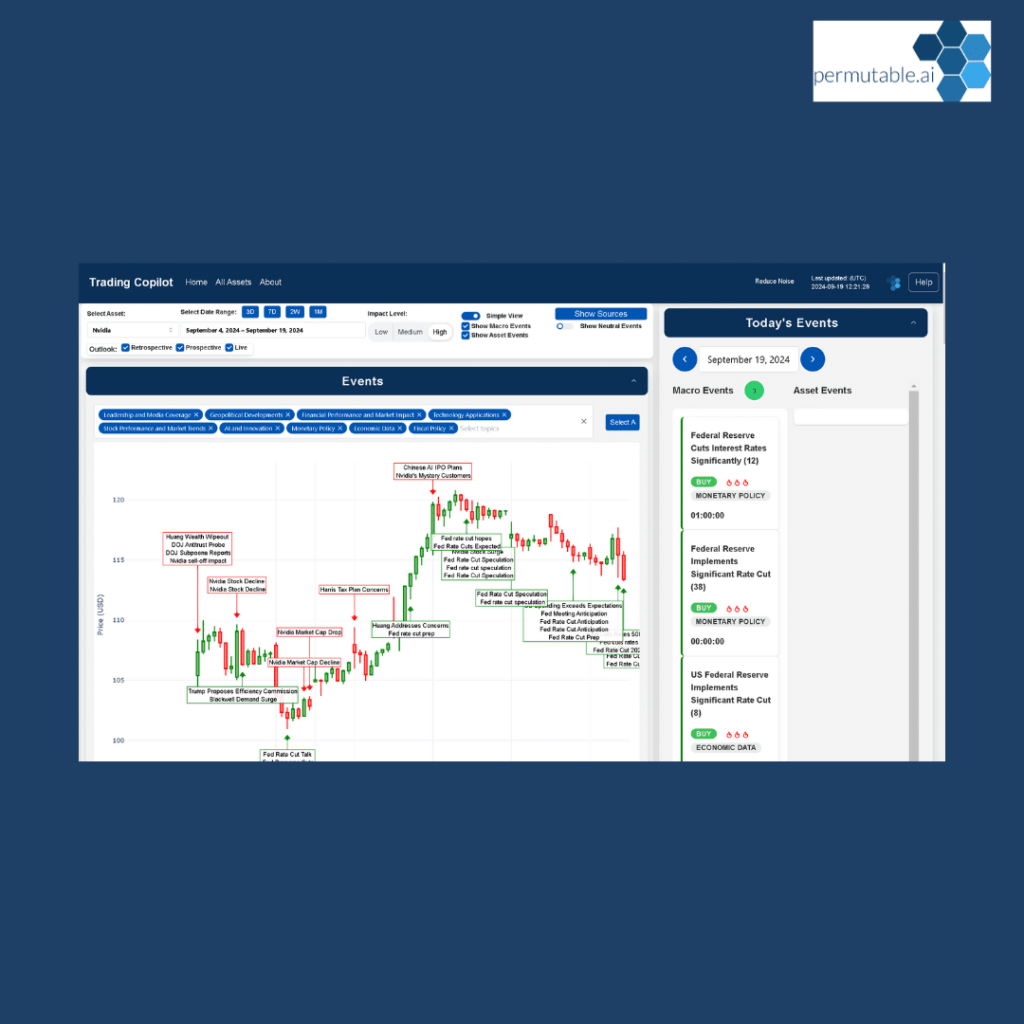

Trading Co-Pilot exclusive access

Are you ready to be part of the future of trading? At Permutable AI, we’re extending an exclusive opportunity to a select group of corporate partners to gain early access to our advanced Trading Co-Pilot, powered by cutting-edge machine learning for contextual understanding.

This is a rare chance to stay ahead of the competition by leveraging AI that not only processes data but also grasps the global context—analysing real-time sentiment and market-shaping events to deliver more precise and risk-aware trading strategies.

If your firm is ready to lead the way in AI-driven trading innovation, get in touch today to explore this limited opportunity and discover how our Trading Co-Pilot can transform your approach to the market by contacting us at enquiries@permutable.ai or fill in the form below.

Your trading is about to take off

Schedule a free enterprise demo to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.