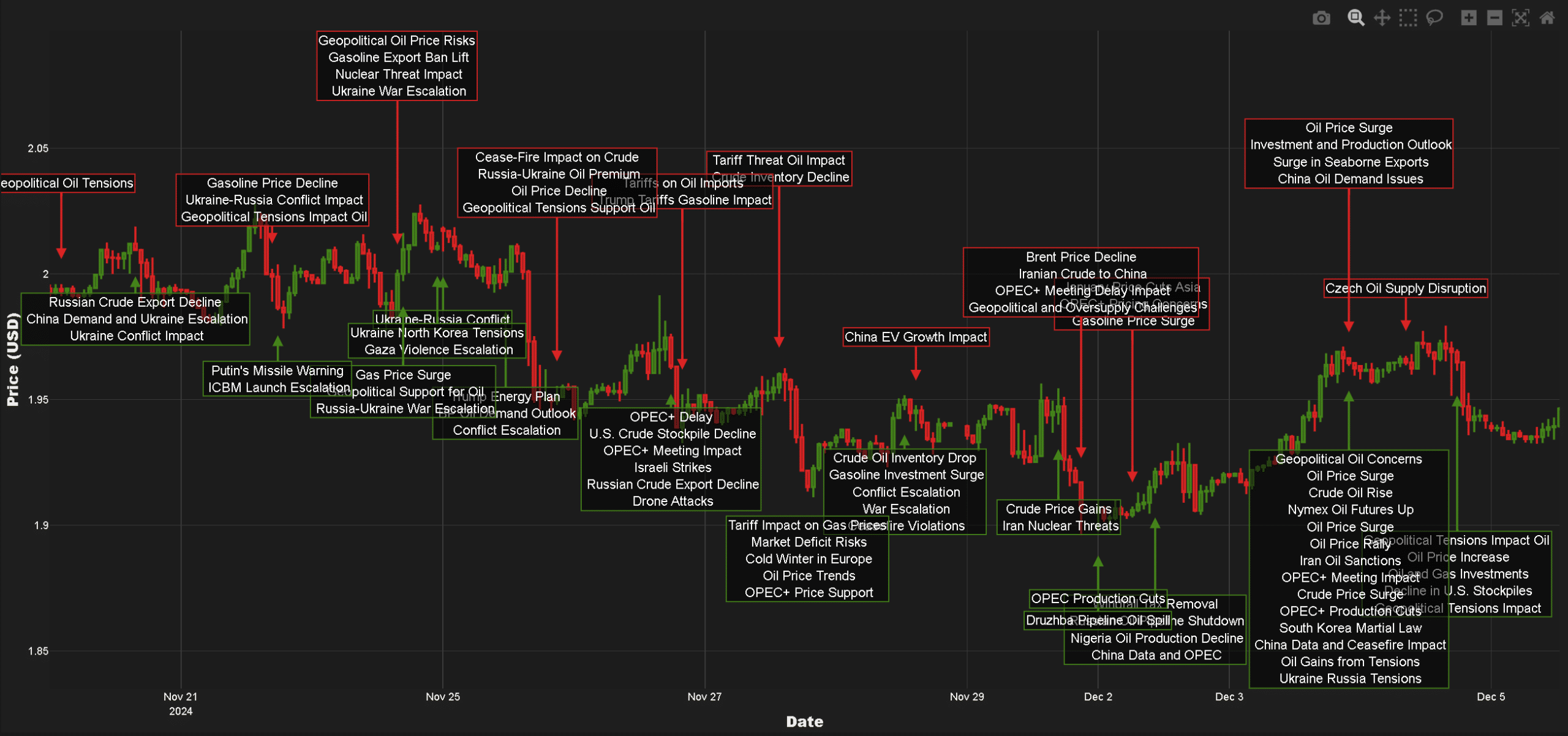

In a wave of new asset roll outs, we are pleased to announce the addition of gasoline markets coverage to our Trading Co-Pilot and API. The launch of our gasoline markets coverage on our Trading Co-Pilot platform and Commodities API comes at a time when fuel product prices are experiencing increasing volatility. This expansion delivers sophisticated AI-driven insights for gasoline markets, enabling traders to track price movements through our proprietary multi-threaded analysis system. This launch marks the first in a series of new asset deployments planned ahead of 2025.

“Gasoline markets require a high level of analytical precision,” says Wilson Chan, CEO of Permutable AI. “Our AI technology has proven its worth in oil trading with several energy trading houses already signed up as early-adopters now seeing its value, and we’re now bringing that same level of opportunity to gasoline markets. Early testing shows our platform identifying correlations between weather patterns, geopolitical events, and price movements that traditional analysis often misses.”

Our enhanced Trading Co-Pilot features:

- Real-time aggregation of global news sources

- Automated price driver analysis

- AI-powered directional insights

- Customisable strategy alignment

- Refinery impact assessment

- Supply-chain disruption tracking

“We have already seen how our actionable intelligence has been adding value across oil markets. We’ve been seeing significant uptake from major energy trading houses who value our ability to cut through market noise and deliver precise, actionable insights and now we’re looking forward to be delivering that across gasoline markets also”, commented Talya Stone, CMO.

The platform’s gasoline markets coverage includes:

- 15-minute market updates

- Geopolitical risk assessment

- Inventory level analysis

- Seasonal demand pattern tracking

- Cross-commodity correlations

- Supply-demand dynamics

This expansion – alongside the roll out of additional assets this quarter including heating oil and TTF Natural Gas – comes at an exciting time as we continue to strengthen our position as a leading provider of AI-driven trading intelligence across energy markets, with further asset launches planned into 2025.

For more information about gasoline markets results, coverage, use cases or to schedule a demo to learn how using our Trading Co-Pilot and API can support your trading strategies, contact our team at enquiries@permutable.ai or reach out using the form below.