The first principle of understanding GBPJPY movements lies in recognising the complex interplay between two major economies at crucial policy junctures. For several years, both nations have followed divergent monetary paths, but recent developments suggest a potential convergence that’s dramatically impacting the currency pair. In this article we’ll look at developments across one of the most volatile currency pairs, taken from our Trading Co-Pilot, where we are gearing up to a roll out of FX on our market intelligence platform.

Table of Contents

TogglePolicy evolution

Let’s start with the fact that the Bank of Japan’s monetary policy is undergoing its most significant transformation in decades. There is evidence of fundamental change as the BOJ raised rates to 0.5%, making it one of the most substantial policy shifts since 2008. This is obviously a pivotal moment for FX traders, with more than just rate differentials at stake. The BOJ’s planned balance sheet reduction of nearly $500 billion through quantitative tightening measures signals a fundamental shift in Japanese monetary policy that could support long-term yen strength, suggesting this may be just the beginning of a longer-term policy normalisation cycle.

Economic contrasts

It is the story of contrasting economic narratives. While Japan emerges out of the doldrums of deflation, the UK faces mounting challenges. Only after this week’s data releases did the full picture emerge, showing UK consumer confidence hitting its lowest level in over a year. This contrasts with Japan’s gradual but steady economic recovery. The compound effects are particularly visible in employment markets, where UK firms report the largest decline in output and profit since the pandemic.

Market sentiment and dynamics

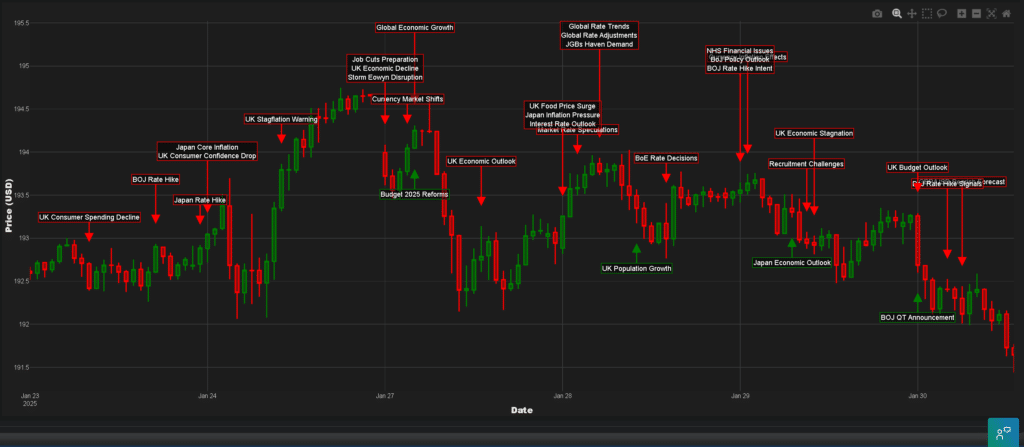

Market sentiment towards GBPJPY reflects these divergent economic trajectories, whilst technical aspects show no signs of abating volatility. The consequences of these movements are far-reaching, particularly given the pair’s sensitivity to risk sentiment. Trading volumes suggest institutional investors are actively repositioning their portfolios in response to these shifts. Meanwhile, our event analysis has identified a notable increase in correlation between GBPJPY movements and global risk sentiment indicators, suggesting the pair could become increasingly sensitive to broader market dynamics beyond purely bilateral economic factors

Structural changes

What many observers have found surprising is the pace of the BOJ’s policy evolution, especially considering Japan’s corporate service inflation reaching 2.9%. Part of this attitude has developed from years of ultra-loose monetary policy. Beyond the immediate rate decision, the UK’s projected population growth of five million by 2032 due to migration presents a complex economic variable that could influence long-term GBPJPY trends. Though the current situation has unique characteristics given the global monetary policy environment, previously similar policy transitions have typically led to sustained currency trends.

Trading considerations

However, we are not out of the woods yet with GBPJPY volatility. The acceleration of Japan’s policy normalisation, combined with UK economic uncertainty, creates an important reminder that currency markets can shift rapidly. A range of factors, from interest rate differentials to economic growth trajectories, continues to influence the pair’s direction, and particular attention should be paid to signs of BOJ policy normalisation acceleration and UK employment figures.

Market navigation

The compound effects of the above factors require a sophisticated approach to risk management, and so far, analysts reckon that the pair’s direction will heavily depend on both central banks’ next moves and economic performance indicators. This is magnified by the current global economic environment and shifting monetary policy landscapes. Ultimately, the answer will fall to several key factors in the coming weeks, but traders who maintain disciplined risk management and stay informed of both economies’ developments will be best positioned to navigate these challenging markets – and for that, there is the FX roll out on our Trading Co-Pilot.

Get early access to FX on our Trading Co-Pilot

As we prepare for the FX roll-out on our Trading Co-Pilot platform, our mission is to bring the same level of comprehensive market intelligence we’ve delivered in commodities markets to currency trading. Our platform processes over 10,000 articles daily, providing real-time event detection and analysis that helps traders stay ahead of market-moving developments.

Want to be among the first to experience our FX capabilities? We’re currently accepting registrations from enterprise clients for early access to our beta testing programme. Our platform offers real-time currency market event detection, advanced geolocation filtering, cross-asset correlation analysis, customisable event alerts, and comprehensive macro monitoring.

Contact us at enquiries@permutable.ai to learn more about how we can help you navigate FX market complexity together or fill in the form below to register interest.