In today’s turbulent global economy, we know that geopolitical risk exposure represents one of the most challenging variables for investors to quantify and manage. The real-time market sentiment data from our newly launched Geopolitical Insights & AI Market Sentiment Analysis Dashboard provides a fascinating window into how various asset classes are currently being positioned by market participants in response to evolving global tensions.

What becomes immediately apparent from analysing our sentiment data is the obvious divergence between asset classes. This divergence tells a compelling story about how different sectors of the global economy are being impacted by current geopolitical developments, offering valuable insights for portfolio construction and risk management.

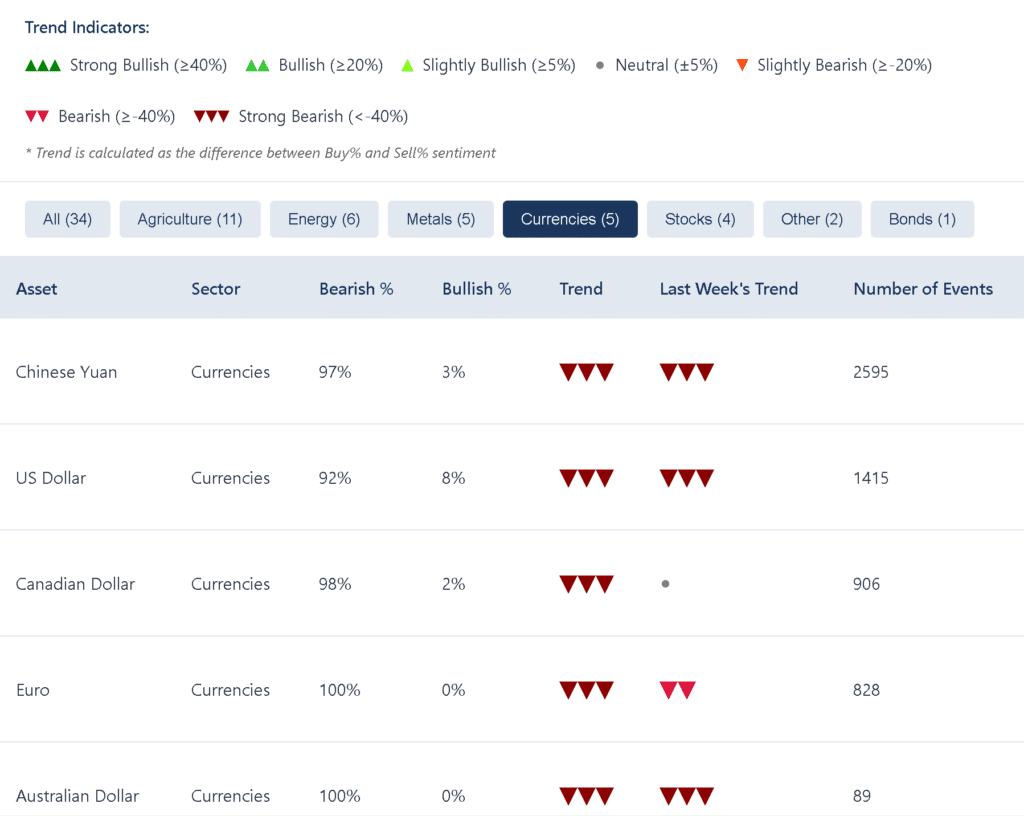

Currency markets: Strong bearish sentiment signals heightened risk aversion

Perhaps the most striking observation from our dashboard is the overwhelmingly bearish sentiment across all major currencies. According to our market sentiment analysis, the Chinese Yuan shows a remarkable 97% bearish sentiment against just 3% bullish, with the US Dollar not far behind at 92% bearish versus 8% bullish. This extreme positioning extends to the Canadian Dollar (98% bearish), while the Euro and Australian Dollar both register a complete 100% bearish sentiment with 0% bullish positioning.

Such uniform negativity across currency markets typically indicates a flight to safety, with investors potentially seeking alternative stores of value amidst concerns about monetary stability. It’s worth noting that all five major currencies display a “Strong Bearish” trend indicator, suggesting that geopolitical risk exposure is being priced aggressively into forex markets.

The consistency of this bearish sentiment across different currencies with varying economic fundamentals suggests a global rather than regional concern. Indeed, the fact that this bearish positioning has persisted from the previous week (with the exception of the Canadian Dollar, which shifted from neutral to strongly bearish) indicates this is not merely a reaction to short-term news cycles.

Above: Currencies sector market sentiment – our Geopolitical Dashboard showing strong bearish trends across major currencies including Chinese Yuan, US Dollar, Canadian Dollar, Euro, and Australian Dollar using AI-driven market sentiment analysis

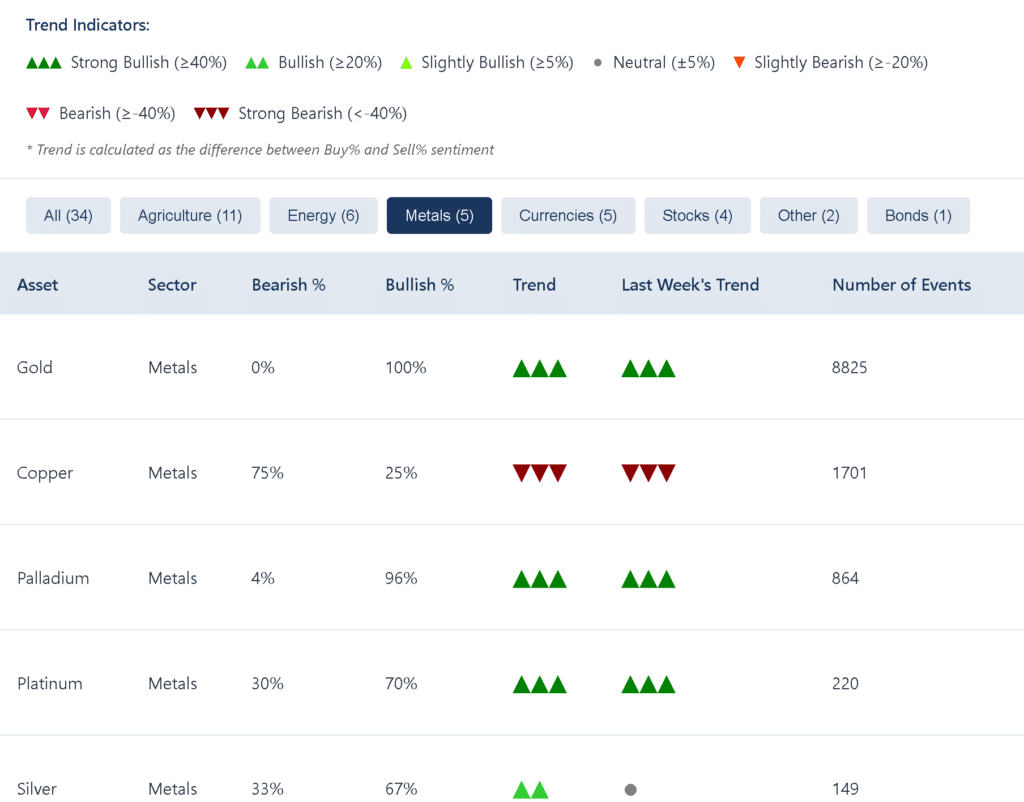

Precious metals: The traditional safe haven response

In stark contrast to currencies, the precious metals sector demonstrates predominantly bullish sentiment, confirming the traditional “risk-off” relationship between currencies and metals during periods of heightened geopolitical uncertainty.

Gold’s sentiment is particularly telling, with a perfect 100% bullish reading and 0% bearish – the exact inverse of the Euro and Australian Dollar. This extreme positioning, coupled with the highest number of events (8,825) among all tracked assets, suggests exceptional investor interest in gold as a geopolitical hedge. Palladium similarly shows strong bullish sentiment at 96%, with platinum also commanding a healthy 70% bullish reading.

Silver, while still bullish at 67%, shows more balanced sentiment than its precious metal counterparts. Interestingly, it’s the only metal that has shifted from a neutral position the previous week, suggesting more recent investor interest as geopolitical risk exposure concerns have intensified.

The outlier in the metals category is copper, with 75% bearish sentiment versus 25% bullish. As an industrial metal closely tied to global manufacturing activity, copper’s negative sentiment likely reflects concerns about economic growth impacts from geopolitical tensions, rather than safe-haven buying.

Above: Metals sector market sentiment – our Geopolitical Dashboard highlighting trends across Gold, Palladium, Copper, Silver and Platinum using AI-driven market sentiment analysis

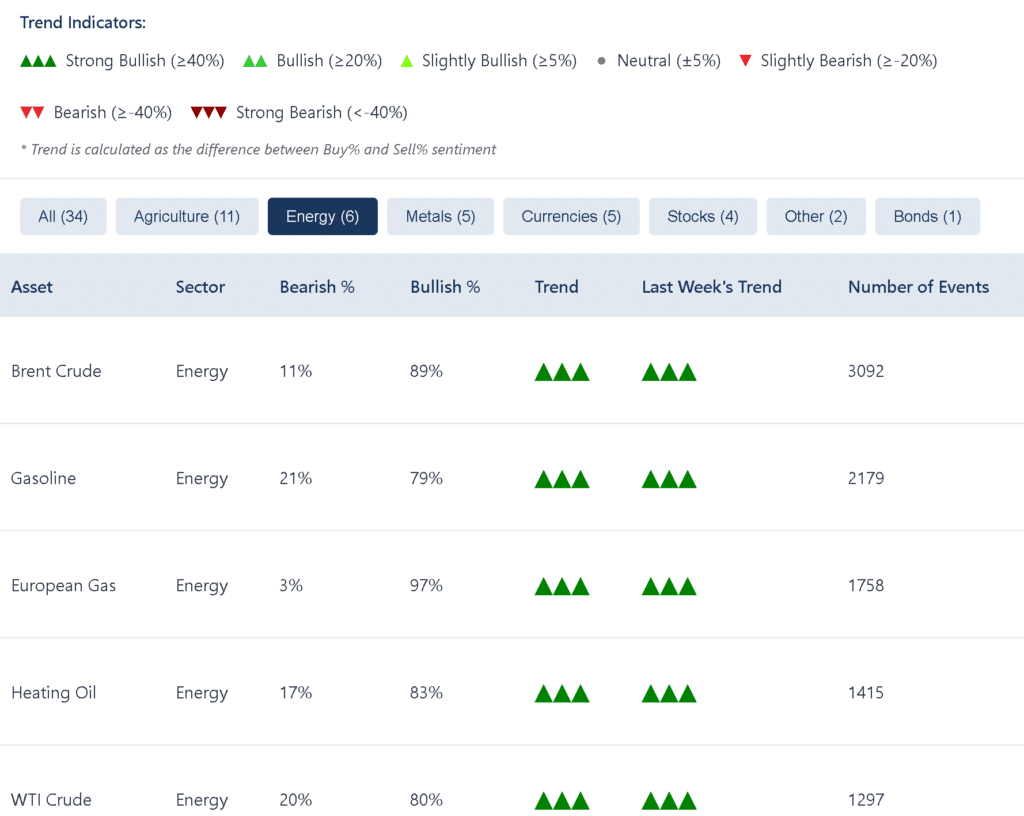

Energy markets: Bullish sentiment signals supply concerns

The energy sector presents another fascinating dimension of current geopolitical risk exposure. All tracked energy commodities display strongly bullish sentiment, with European gas leading at 97% bullish versus just 3% bearish. Brent crude (89% bullish), heating oil (83%), WTI crude (80%), and gasoline (79%) all show similar patterns of strong positive sentiment.

This uniformly bullish positioning across energy markets, maintained consistently from the previous week, points to concerns about potential supply disruptions rather than demand destruction. When geopolitical tensions threaten energy supply chains, particularly in major producing regions, prices typically rise in anticipation of potential shortages.

The strong bullish trend for European gas is especially noteworthy given Europe’s particular vulnerability to energy supply disruptions related to geopolitical developments. This suggests market participants are pricing in substantial risk premiums for European energy security.

Above: Energy sector market sentiment – our Geopolitical Dashboard revealing consistently strong bullish sentiment across all energy commodities including Brent crude, gasoline, European gas, heating oil and WTI Crude using AI-driven market sentiment

Agricultural commodities: Mixed sentiment reflects complex impacts

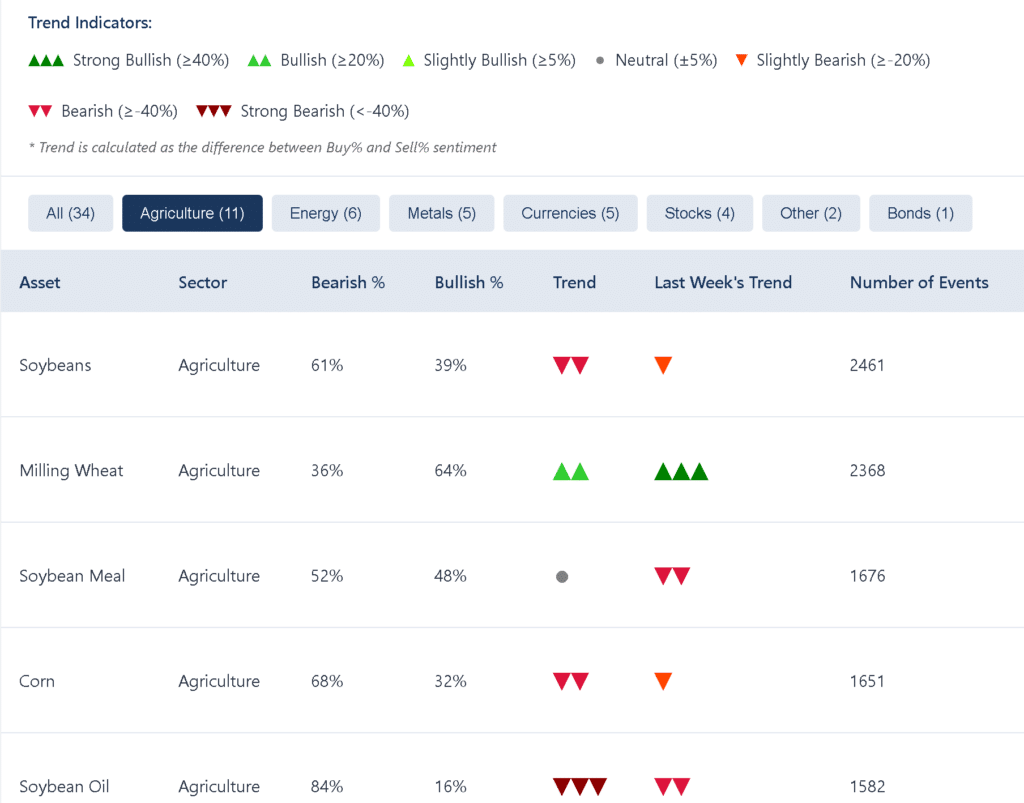

The agricultural sector displays the most varied sentiment among the asset classes, reflecting the complex and sometimes contradictory impacts of geopolitical developments on food production and distribution.

Soybean oil shows the most bearish sentiment at 84% versus 16% bullish, followed by corn at 68% bearish versus 32% bullish, and soybeans at 61% bearish versus 39% bullish. These bearish readings could reflect concerns about reduced global trade volumes or shifting consumption patterns in response to geopolitical tensions.

Conversely, milling wheat demonstrates bullish sentiment at 64% versus 36% bearish, while soybean meal sits almost at equilibrium with 52% bearish versus 48% bullish. The neutral trend indicator for soybean meal (replacing a bearish trend from the previous week) suggests evolving market assessments of its geopolitical risk exposure.

The varied positioning across agricultural commodities likely reflects their different roles in global food security and the complex interplay between production regions, shipping routes, and consumption markets. Some agricultural products may benefit from supply constraints, while others suffer from reduced international trade or changing consumption patterns.

Above: Agriculture sector market sentiment – our Geopolitical Dashboard displaying mixed market positioning with bearish sentiment dominating Soybeans, Corn, and Soybean Oil while Milling Wheat shows bullish sentiment and Soybean Meal presents near-equilibrium sentiment

Integrating geopolitical risk exposure into investment strategy

The clear sectoral divergences revealed by our sentiment analysis highlight the importance of nuanced, cross-asset approaches to managing geopolitical risk exposure. Rather than making binary “risk-on” or “risk-off” decisions, sophisticated investors should consider how different types of geopolitical developments might impact various asset classes differently.

Our data suggests that current market positioning reflects significant concerns about currency stability, expectations of energy supply constraints, and a flight to precious metals as a traditional safe haven. Agricultural commodities, meanwhile, show more varied impacts that require deeper analysis of specific supply chains and trade relationships.

For portfolio construction, these insights suggest potential hedging strategies that pair exposed assets with those that have historically benefited during similar geopolitical scenarios. The extreme bearish positioning in currencies coupled with strongly bullish sentiment in gold and energy points to a market that is pricing in substantial geopolitical premium across multiple asset classes.

As geopolitical developments continue to unfold, these sentiment indicators will likely shift, providing early signals of changing market assessment of risks and opportunities. By monitoring these shifts across different asset classes simultaneously, investors can gain deeper insights into evolving geopolitical risk exposure than would be possible from following any single market in isolation.

In this environment of heightened uncertainty, the ability to quantify market sentiment provides a valuable additional dimension to traditional risk assessment methods, helping investors navigate the complex relationship between geopolitical developments and market outcomes.

Take control of your geopolitical risk exposure

The insights shared in this analysis represent just a fraction of the comprehensive market intelligence available through our Real-Time Geopolitical Insights Dashboard. To gain the full picture and enhance your decision-making capabilities amid evolving global tensions, we invite you to experience our powerful AI-driven market sentiment analysis firsthand.

Our Geopolitical Dashboard – which we have made accessible to all – delivers broad market sentiment analysis across major asset classes, helping you identify emerging trends and cross-market correlations that might otherwise remain hidden. For investors and analysts requiring deeper, more granular real-time insights, our Trading Co-Pilot offers advanced analytics that break down sentiment shifts at the individual asset level, allowing for precise timing and positioning as geopolitical events unfold.

In today’s volatile environment, having access to timely sentiment data can provide the critical edge needed to stay ahead of market moves. Rather than reacting to news after the fact, our tools empower you to anticipate potential market shifts based on evolving sentiment patterns across multiple asset classes simultaneously. Don’t let current geopolitical uncertainty dictate your investment outcomes. Take control with data-driven insights that transform complexity into clarity. Visit our Geopolitical Dashboard or request a demo of our Trading Co-Pilot to better inform your approach to managing geopolitical risk exposure. Simply email enquiries@permutable.ai to speak with one of our team, or fill in the form below to request a demo.

Request Trading Co-Pilot demo

Disclaimer

The market sentiment data presented in this article was accurate and up to date at the time of publishing. However, it is important to note that our Real-Time Geopolitical Insights & AI Market Sentiment Analysis Dashboard updates on a 15-minute basis to capture evolving market dynamics. For the most current sentiment readings and trend indicators, we strongly recommend consulting the live dashboard directly. Market conditions and sentiment can shift rapidly in response to breaking news and geopolitical developments, particularly during periods of heightened volatility. The insights provided should be considered as a snapshot of market positioning at a specific point in time rather than as enduring investment recommendations. Always conduct appropriate due diligence and consider your specific investment objectives and risk tolerance before making investment decisions based on market sentiment data.