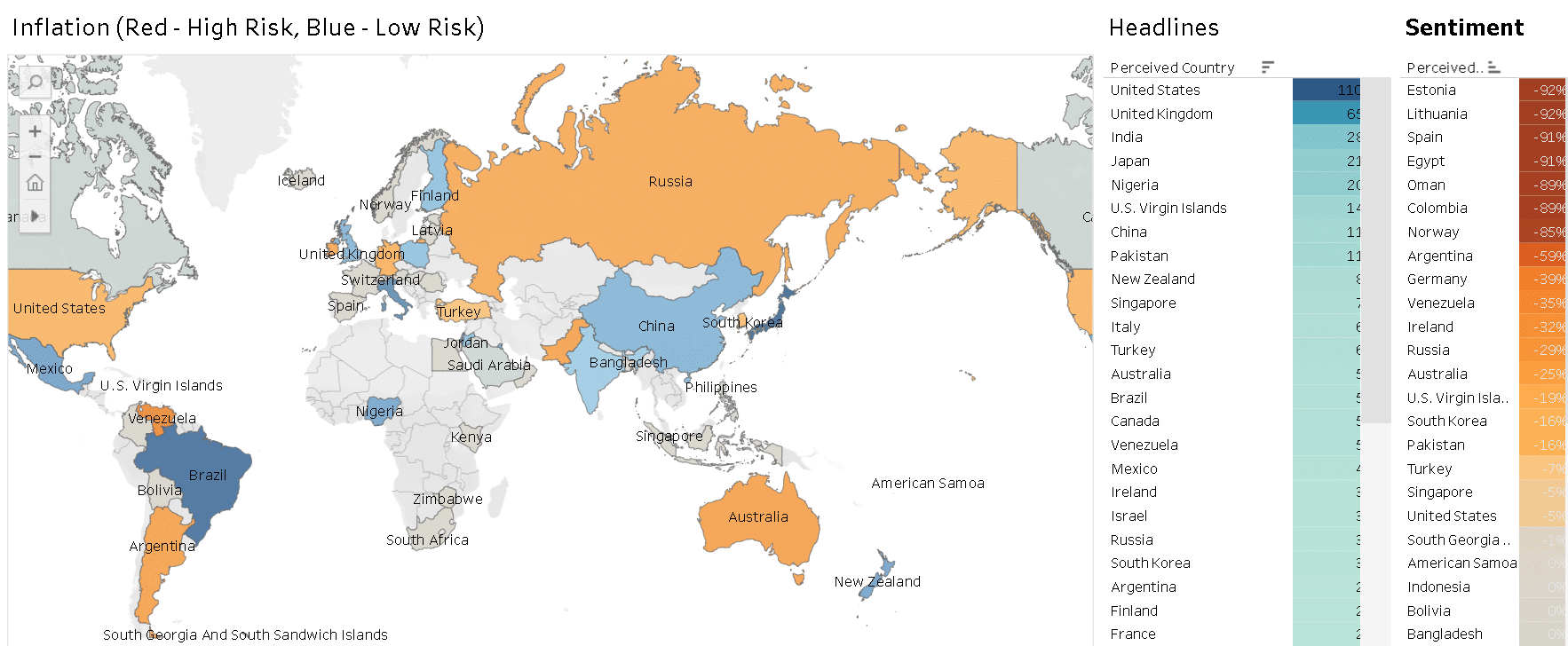

Regional variations in inflation sentiment

One thing above all stands out in our analysis: the striking regional differences in how inflation is perceived across the globe which provide valuable pieces of the puzzle for investors, policymakers, and businesses operating in the global economy.

High negative sentiment in Eastern Europe and South America

Estonia and Lithuania stand out with the most negative sentiment scores, indicating a high level of concern about inflation in these Baltic states. This isn’t surprising, especially considering their historical context. These economies have experienced significant economic transitions since gaining independence from the Soviet Union. Their integration into the European Union and adoption of the Euro have brought stability, but also new economic challenges, including inflationary pressures.

Similarly, countries like Spain and Argentina show high negative sentiment, reflecting ongoing economic struggles. For Argentina, this aligns with its history of hyperinflation and current economic challenges. Spain’s concerns likely stem from a combination of domestic economic factors and broader Eurozone inflation worries. In truth, these concerns are the tip of the iceberg when it comes to the complex economic landscapes of these regions.

Global inflation sentiment and moderate risk perceptions

Interestingly enough, major economies like the United States, United Kingdom, and Germany show moderate levels of inflation concern. This could indicate a level of confidence in these nations’ central banks to manage inflationary pressures effectively. At the same time, the presence of these countries in the top headlines suggests that inflation remains a hot topic in these economies.

Low-risk perceptions: Asia and Oceania

Countries like China, South Korea, and New Zealand appear to have lower levels of inflation concern. This could reflect a combination of effective monetary policies, different economic structures, or varying stages in the economic cycle. It’s worth noting that Japan, despite its long history of battling deflation, shows a moderate level of inflation-related headlines, possibly indicating a shift in economic dynamics.

Inflation sentiment – implications for the global economy

The varied inflation sentiment across different regions have significant implications for the global economy. In fact, these perceptions play an important role in shaping economic policies and market behaviours:

Monetary policy divergence

Countries with high inflation concerns may be more likely to implement tighter monetary policies, potentially leading to interest rate differentials across regions. This could impact currency markets and international capital flows in a big way.

Consumer behaviour

In countries where inflation is perceived as a high risk, it’s usual to see changes in consumer behaviour, such as increased saving or a rush to purchase durable goods before prices rise further. This is especially true in economies with a history of hyperinflation.

Investment strategies

Investors tend to shift their portfolios to hedge against inflation in high-risk countries whilst seeking growth opportunities in regions with lower inflation concerns. In this day and age, such strategic shifts can happen rapidly.

Global trade

Inflation perceptions can influence exchange rates, potentially affecting the competitiveness of a country’s exports and the cost of imports. This is particularly important for economies heavily reliant on international trade.

Challenges in interpreting the data

Whilst our sentiment analysis provides valuable insights, it’s important to remember to approach this data with nuance:

News coverage bias

The volume of headlines doesn’t always correlate directly with the severity of inflation. For instance, the United States has the highest number of headlines, which may reflect its global economic influence rather than the severity of its inflation concerns.

Cultural and economic context

Negative sentiment in one country may not be directly comparable to another due to differing economic structures, historical experiences with inflation, and cultural attitudes towards economic risk. In other words, context is key.

Temporal factors

This analysis provides a snapshot of sentiment, which can change rapidly based on new economic data, policy announcements, or global events. The truth is, economic sentiments are constantly evolving which is why using real time economic sentiment data is key.

Looking ahead

In today’s volatile global economic landscape where we have come to expect the unexpected, keeping on top of inflation perceptions and their potential impacts has become more important that ever. At Permutable AI, we’re committed to providing cutting-edge solutions to help our clients make sense of these economic signals in real-time.

Our Trading Co-pilot, currently in BETA testing with select corporate partners, is designed to help you stay ahead of market movements influenced by inflation and other economic factors. By analysing vast amounts of news data, events and economic indicators in real-time, it provides actionable insights to inform your trading and investment strategies. In short, it’s our secret sauce for cutting through the clutter of financial news and data.

We’re excited about the potential of this tool to help traders and investors navigate the challenges and opportunities presented by varying inflation risks across global markets. Where it’s application will be the most powerful is when it’s used with their own human insights and expertise. In our experience and as proven by our in-house testing, the art of successful trading lies in blending technology with human insight.

Find out more

If you’re a corporate trader looking to gain an edge in understanding and responding to global inflation trends, we invite you to explore the possibilities of our Trading Co-pilot. Currently available exclusively to select corporate beta testers, this powerful tool can help you stay on top of how inflation is affecting markets worldwide.

To learn more about being an early user and experiencing the power of our AI-driven market analysis, please reach out to our team at enquiries@permutable.ai or fill in the form below to get in touch.