In 2024, the world faces more macro risks that are changing financial markets and shaping global decisions that ever before. With rising prices global tensions, supply chain issues, and the growing effects of climate change, businesses and investors must navigate a complex and unstable scene.

At Permutable AI, we use advanced, real-time macro data intelligence to help businesses, financial institutions, and policymakers stay informed and respond to new macro risks as they are emerging. This article will explore the main macro risks that are influencing markets in 2024 and will also look at how using AI-driven insights can give a competitive edge.

Macro risks, inflationary pressures and interest rate policies

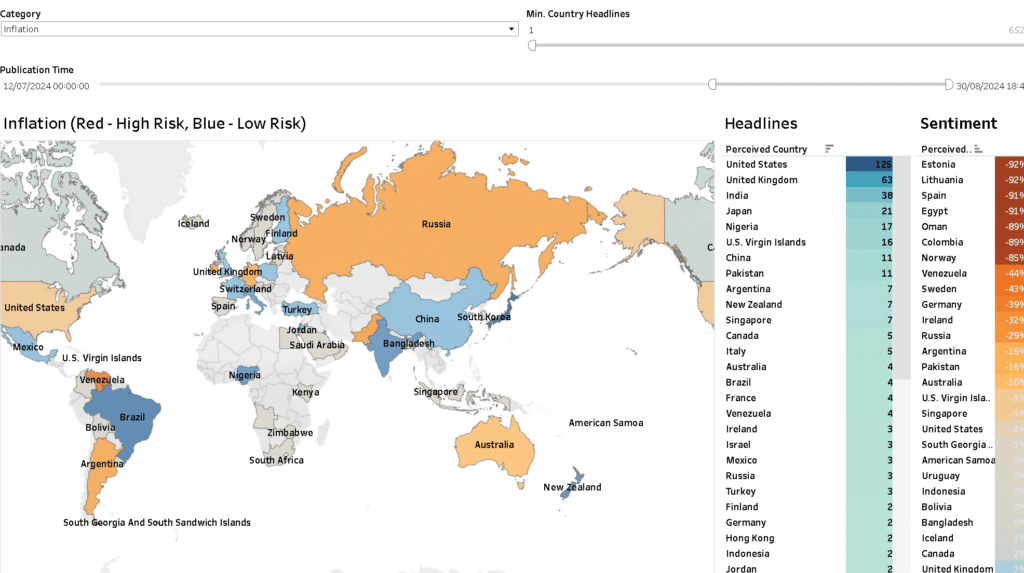

High inflation continues to be a major economic risk in 2024 for many developed and growing economies. To address this central banks worldwide have hiked interest rates, which has caused big swings in financial markets. Inflation has an impact on everything from how much consumers can buy to how much companies can earn, and its ongoing effects are a concern for businesses and investors alike.

We’ve all seen how inflation affects different areas and industries, with food, energy, and housing seeing the biggest price hikes. Our big-picture data shows that even though inflation has slowed down in some places, it’s still perceived to be a problem because of ongoing supply chain issues and job market imbalances.

Key insights

- Energy price volatility: Events in Eastern Europe and the Middle East keep causing volatility in oil and gas prices. This has a ripple effect on industries that depend on energy such as manufacturing and transportation.

- Food supply disruptions: Bad weather, limits on trade, and global tensions have teamed up to create big problems in worldwide food supply chains. Because of this, food prices stay unpredictable, with inflation in this area growing much faster than in other sectors.

For businesses, the current climate calls for ongoing vigilance and the ability to act quickly. Companies that don’t adjust to rising costs or protect against inflation put themselves at a market disadvantage. Our inflation sentiment data give up-to-the-minute information on price shifts across sectors helping businesses predict cost hikes and adjust their strategies accordingly.

Macro risks, geopolitical strains and world trade

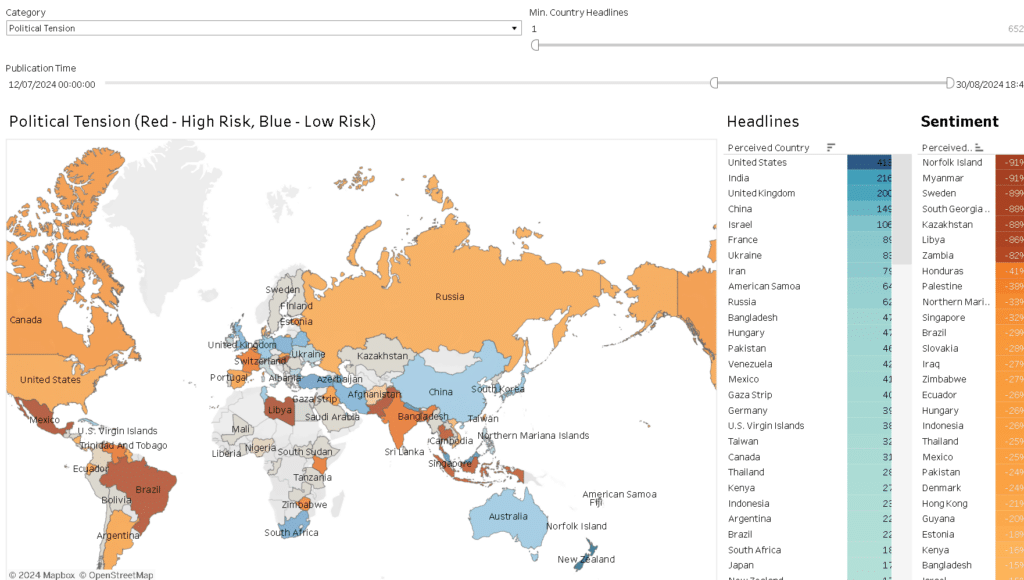

The global political scene in 2024 remains tense, with friction between major powers—the United States, China, and Russia—still affecting world trade. Trade conflicts punitive measures, and diplomatic clashes disrupt supply chains and create uncertainty for companies doing business in global markets.

Our platform for monitoring geopolitical risks looks at news and sentiment data in real time to see how these tensions affect global trade flows. Our data shows several important trends.

Key insights

- U.S.-China decoupling: The ongoing economic split between the United States and China has caused a big shake-up in global supply chains. Companies are now spreading out their manufacturing bases moving production to other areas like Southeast Asia and India.

- Russian sanctions: Sanctions put on Russia because of its military actions are having sustained implications for trade in energy, metals, and agriculture. Europe, in particular, has had to look for other energy sources, which has pushed up costs and made inflation worse.

- Emerging markets: While big economies’ political risks grab the headlines smaller markets are also feeling the pinch. Countries in Africa, South America, and Southeast Asia are struggling with the aftermath of disrupted trade routes and pricier goods.

Companies involved in global commerce need to stay flexible and ready to adapt to geopolitical changes. Our geopolitical data gives a thorough grasp of these patterns helping businesses evaluate potential risks to their supply chains and investments and spot new opportunities in more stable areas.

Climate change as a growing macro risk

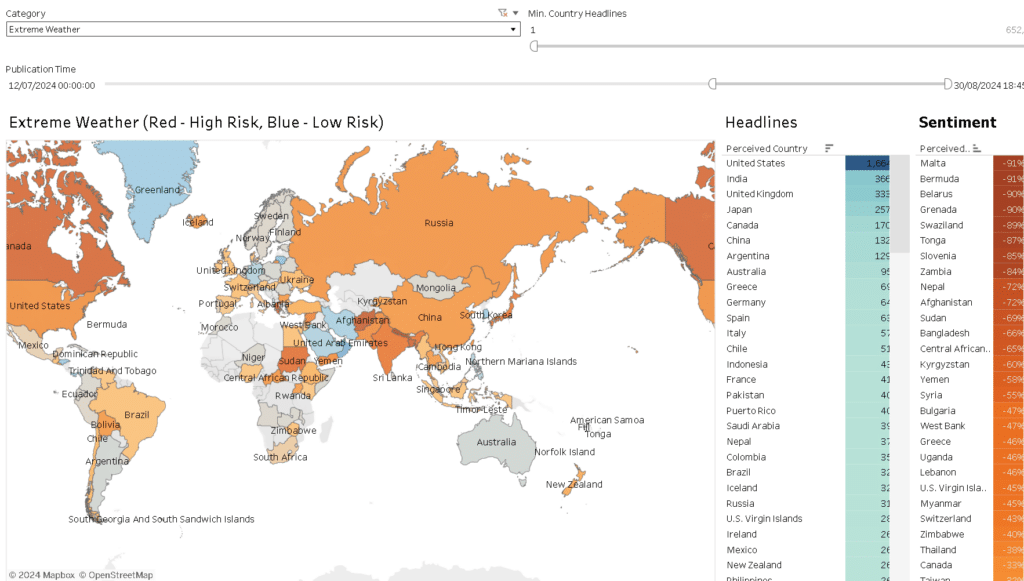

Perhaps then the most overlooked economic risk in 2024 is the growing effect of climate change on financial markets and business operations. Extreme weather events, higher sea levels, and changing farming zones are already affecting industries from insurance to farming and more.

At Permutable AI, our extreme weather events data helps businesses and investors grasp the long-term risks climate change poses. Our AI-driven news sentiment analysis point out several key areas where climate risks are getting worse.

Key insights

- Agricultural production: Droughts, floods, and other extreme weather events have a big impact on global food production. Our extreme weather events data shows concern around crop yields in key areas like the United States Brazil, and India as well as around higher food prices and volatility around agricultural commodities is dominating the news narrative.

- Insurance sector stress: As extreme weather events happen more often and get worse, the insurance industry will become increasingly under pressure with more claims and pleas to change premium rates. Companies that are already significantly exposed to climate risks are seeing their financial performance take a hit from rising payouts.

- Transition risks: As governments speed up their efforts to meet climate targets, companies in carbon-heavy industries like energy, mining, and manufacturing face growing pressure to cut their carbon emissions. Businesses that don’t adjust to new rules or invest in green tech risk falling behind as we move to a low-carbon economy.

Macro risks, supply chain disruptions and globalisation shifts

The Covid-19 pandemic showed how fragile global supply chains are, and problems have kept going into 2024 because of ongoing political tensions, weather events, and a shortage of workers. These issues have made businesses rethink how they manage their supply chains and adopt more local and tough models.

Key insights

- Reshoring and nearshoring: Companies in key industries like pharmaceuticals, semiconductors, and car manufacturing are moving production closer to home more often in order to cut down on risks from global supply chain problems. This shift is clear in Europe and North America where governments are pushing for local production through money and other perks.

- Logistics bottlenecks: Ongoing worker shortages in important areas like shipping, warehousing, and transport and logistics have made supply chain issues all the more worse. Our sources indicate these problems will continue into 2025, driving up . shipping costs and causing delays in production schedules.

Permutable AI’s macro risk data intelligence: An essential tool

In today’s complex and unpredictable economic landscape, businesses need data that’s timely, correct, and usable to handle risks. Our macro data intelligence combines advanced machine learning with large number of high-quality data sources to provide up-to-the-minute insights on key global trends. Our platform keeps track of current news sentiment, including inflationary pressures, extreme weather events and geopolitical risks, helping businesses stay one step ahead. To request a free trial of our data, get in touch by emailing us at enquiries@permutable.ai or filling in the form below.