This is an analysis of immediate market conditions affecting the gold price forecast over the next 24 hours, to demonstrate the capability of our Trading Co-Pilot’s Forecast Agents and to provide institutional traders and precious metals investors with actionable intelligence for tomorrow’s session. This article is written for precious metals traders, commodity desk analysts, portfolio managers, and institutional investors requiring immediate positioning guidance for the next trading day in gold markets.

In recent times gold’s safe-haven status provided predictable support during periods of market uncertainty and geopolitical tension. However, current market dynamics are creating immediate challenges for traders. What matters is understanding how speculation regarding European Central Bank gold investments, combined with reduced safe-haven demand following tariff deadline extensions, is creating a complex environment.

The underlying intuition is that gold price forecast models must now account for a complex interplay of central bank policy speculation, geopolitical developments, and shifting investor sentiment that extends far beyond traditional inflation hedging considerations. Markets evolve and so must our mindsets regarding the factors that drive precious metals pricing in an increasingly interconnected global financial system.

Our Trading Co-Pilot Forecast Agents have identified a mixed narrative brewing, due to the confluence of factors weighing on gold prices, making the tactical outlook for tomorrow’s trading an interesting one.

Understanding today’s market dynamics

The assumption that gold automatically benefits from uncertainty has been challenged by recent developments surrounding European Central Bank policy speculation. Consider the significant shift in market sentiment that has emerged following discussions about potential ECB gold investment strategies, which paradoxically has reduced rather than enhanced gold’s appeal as a safe-haven asset.

Furthermore, the recent pullback following President Trump’s extension of the tariff deadline on EU goods has demonstrated how quickly safe-haven demand can evaporate when geopolitical tensions appear to ease. The resulting price action, showing nearly 1% decline, illustrates the delicate nature of gold’s recent rally attempts and suggests potential continued vulnerability heading into tomorrow’s session.

And so, gold price forecast models must now incorporate these evolving dynamics, where traditional safe-haven flows can reverse rapidly based on policy announcements and diplomatic developments. This is not an isolated example but rather represents a fundamental shift in how precious metals markets respond to geopolitical events in our current environment. Here, the power of our Trading Co-Pilot analysis lies in identifying these shifting correlations before they become consensus views, enabling tactical positioning that accounts for the reduced predictability of gold’s traditional support mechanisms.

ECB speculation and central bank policy implications

With regards to how central bank policy affects precious metals markets, the underlying intuition is that speculation about ECB gold investment strategies has created an unexpected headwind for gold prices, challenging traditional assumptions about central bank gold accumulation supporting precious metals valuations.

Consider the complexity of current market dynamics where speculation about potential ECB gold investments have paradoxically reduced gold’s appeal rather than enhancing it. This counterintuitive reaction suggests that markets are interpreting potential central bank involvement as introducing uncertainty rather than validation of gold’s value proposition.

Ultimately, gold price forecast models must account for this evolving relationship between central bank policy and precious metals pricing, where traditional positive correlations may no longer hold in all circumstances. What does this mean for tomorrow’s trading session? It allows us to understand why conventional safe-haven flows have failed to materialise despite ongoing geopolitical uncertainties and a complex interplay of factors.

Geopolitical factors and safe-haven demand evolution

There was a time when geopolitical tensions provided almost automatic support for gold prices, regardless of other market factors. However, it has become clear that the recent tariff deadline extension has demonstrated how quickly safe-haven demand can dissipate when diplomatic solutions appear more likely.

The power of our gold price forecast analysis lies in understanding how traditional safe-haven flows are becoming increasingly conditional on the perceived permanence of geopolitical tensions. Once you start considering how markets now differentiate between temporary diplomatic tensions and sustained geopolitical risk, the implications for precious metals positioning become more nuanced.

This is not an isolated shift but represents a broader evolution in how institutional investors approach precious metals allocation during periods of uncertainty. We are only just beginning to understand how this changing dynamic affects gold’s role within portfolio construction and risk management strategies. What does this mean for tomorrow’s trading environment?

The assumption that geopolitical headlines will automatically support gold prices requires careful reconsideration, particularly when diplomatic progress appears possible and safe-haven premiums begin to compress.

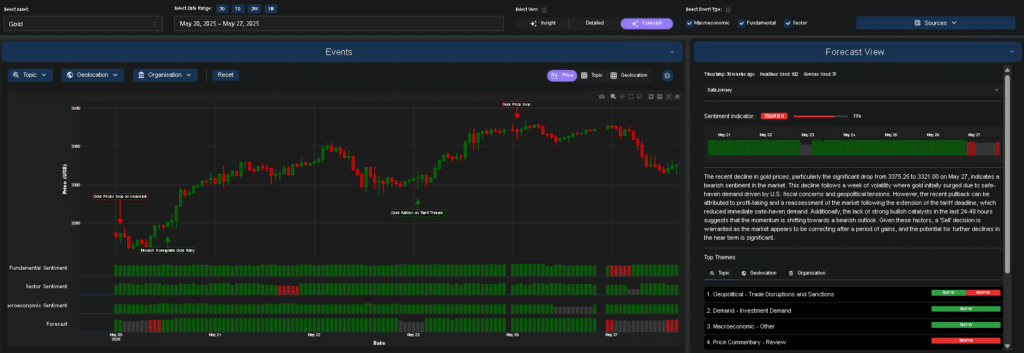

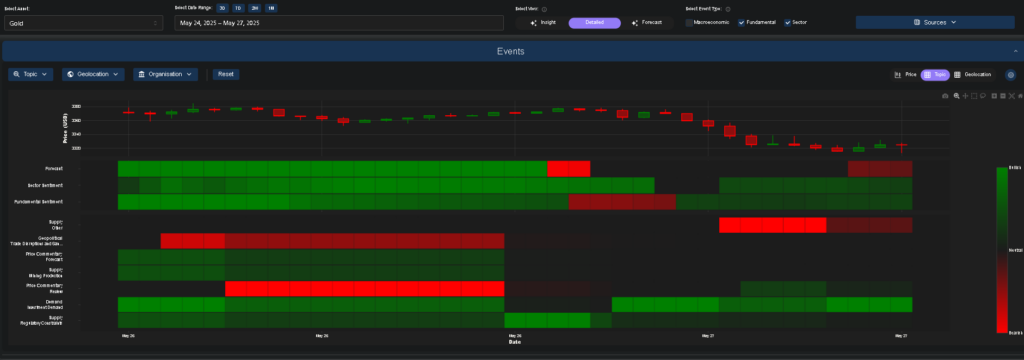

Above: Our comprehensive sentiment analysis dashboard for Gold (May 24-27, 2025) displays a complex interplay of factors and sentiment

Global demand patterns and import dynamics

Consider the interesting dichotomy between physical gold demand and financial market pricing that has emerged in recent trading sessions. Swiss monthly gold imports from the United States have reached their highest levels since 2012, whilst China’s gold imports from Hong Kong showed significant increases in April, suggesting robust physical demand despite declining financial market prices.

Furthermore, the surge in physical gold demand across multiple Asian markets indicates that the current gold price forecast disconnect between physical and financial markets may create opportunities for those who understand these divergent dynamics. It allows us to recognise that institutional selling in financial markets is occurring alongside robust physical accumulation in key consuming regions.

Navigating uncertain waters

This comprehensive analysis on immediate gold price forecast informed by our Trading Co-Pilot Forecast Agents indicates mixed sentiment that could lead to a small recovery, albeit a fragile one due to reduced safe-haven demand following geopolitical developments, and a strengthening dollar.

Given the weight of evidence supporting continued weakness over the next 24 hours, our Trading Co-Pilot analysis supports maintaining cautious positioning for tomorrow’s gold trading given that any recovery is likely to still be fragile and may not indicate a sustained upward trend. Market sentiment remains mixed, with economic uncertainties persisting. Therefore, while there is potential for short-term gains, the lack of a clear, strong trend and presence of conflicting signals should be taken as a sign that the market could easily swing in either direction.

Ready to navigate tomorrow’s gold market with confidence?

Discover how our Trading Co-Pilot Forecast Agents delivers real-time precious metals intelligence and tactical positioning guidance that can help you manage risk effectively through volatile market conditions. To request a demo, simply email enquiries@permutable.ai or fill in the form below.