In recent months, natural gas markets have become increasingly complex, with our Trading Co-Pilot platform identifying several significant developments affecting the Henry Hub natural gas spot price, pointing towards a generally bullish outlook. Many will think this optimism premature given recent volatility, yet ultimately, the data suggests a compelling story unfolding.

Market evolution and current dynamics

Of course, the past week has shown notable demand surges, with our platform tracking several major infrastructure developments. In particular, Kinder Morgan’s new pipeline approval and ongoing exploration activities by ExxonMobil and Qatar Energy have emerged as significant positive indicators. It may well be true that these developments alone don’t guarantee Henry Hub natural gas spot price increases, but in contrast with previous market cycles, the infrastructure buildout comes at a crucial juncture.

Supply-demand complexities

Suffice to say, there is more than one way to skin a cat when it comes to analysing market dynamics, but clearly, the current situation presents a scathing challenge to traditional approaches. The EIA has been asserting rising wholesale power prices due to increased demand, and with it being recently reported that there’s been a significant drop in oil and gas rig counts, this actually strengthens the bullish case.

Many are now believing that perhaps fears that production constraints might limit market growth have been overblown with the baton soon picked up again by major infrastructure projects. Though it is still early days, but the Transco pipeline approval reinstatement and new drilling activities in Cyprus suggest robust development pipeline. This will not be the same as previous infrastructure cycles – instead, we’re seeing more strategic, targeted expansions.

Weather patterns and market response

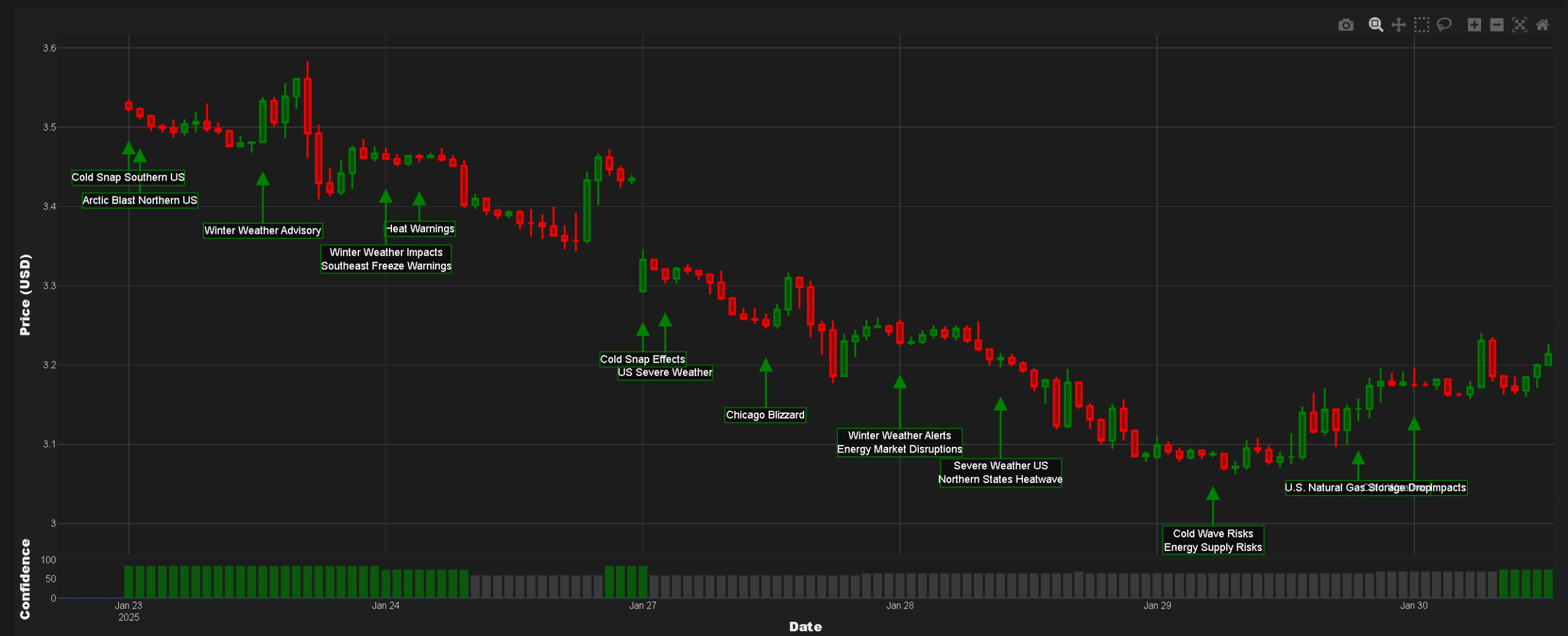

Thus far this Winter, weather has played a key role in Henry Hub natural gas spot price movements. In part, Goldman Sachs’ raised forecast for US gas prices reflects this reality, aligning with our platform’s detection of weather-related sentiment shifts. Rather, it is more like a perfect storm of factors affecting the Henry Hub natural gas spot price, as temperature forecasts increasingly drive market sentiment.

Our Trading Co-Pilot has detected a notable correlation between weather forecast updates and immediate price reactions, with even minor temperature revisions triggering significant market moves. This heightened sensitivity to weather patterns suggests that traders are positioning themselves more reactively to meteorological data than in previous seasons, creating both risks and opportunities for market participants.

Market implications and trading strategy

So the question is, what does this all mean for traders? At its core, our Trading Co-Pilot‘s analysis suggests a favourable risk-reward setup for the Henry Hub natural gas spot price. So we will soon see whether the market validates this view, but with current prices at 3.17, our Trading Co-Pilot’s recommended strategy balances prudent risk management with upside potential.

In short, this is a problem too complex for simple solutions, and is also a reflection of how complex global market dynamics have once again come back to the fore, – particularly with strengthening European gas markets suggesting a tightening supply environment. Ultimately, what is needed is careful monitoring of our identified timeline triggers. Thankfully, this is made easily accessible through our Trading Co-Pilot, exemplified by the chart above, with our platform continuing to monitor these developments in real-time, providing our users with actionable insights as market conditions evolve and careful analysis of multiple data streams.

We help traders navigate complex market dynamics

Our Trading Co-Pilot platform delivers real-time insights across commodities markets, processing over 10,000 articles daily to identify market-moving events before they impact prices. Through advanced geolocation filtering, comprehensive sentiment tracking, and real-time event detection, we provide traders with the tools they need to make informed decisions in rapidly evolving markets.

If you’re interested in seeing how our market intelligence platform can enhance your trading strategy, we’d be delighted to show you a personalised demonstration of our capabilities for enterprise clients. Email enquiries@permutable.ai to schedule your enterprise demo, subject to approval or fill out the form below to learn more about how we’re transforming market intelligence for enterprise traders