The Japanese yen has found itself in an interesting spot amidst the current global economic landscape. Our Trading Co-Pilot has been tracking the currency’s movements, providing insights into how the unravelling of traditional market dynamics is shaping Japanese yen market sentiment. To the extent that global geopolitical tensions have escalated, investors are increasingly turning to safe-haven assets, with the yen historically being a preferred choice during turbulent times.

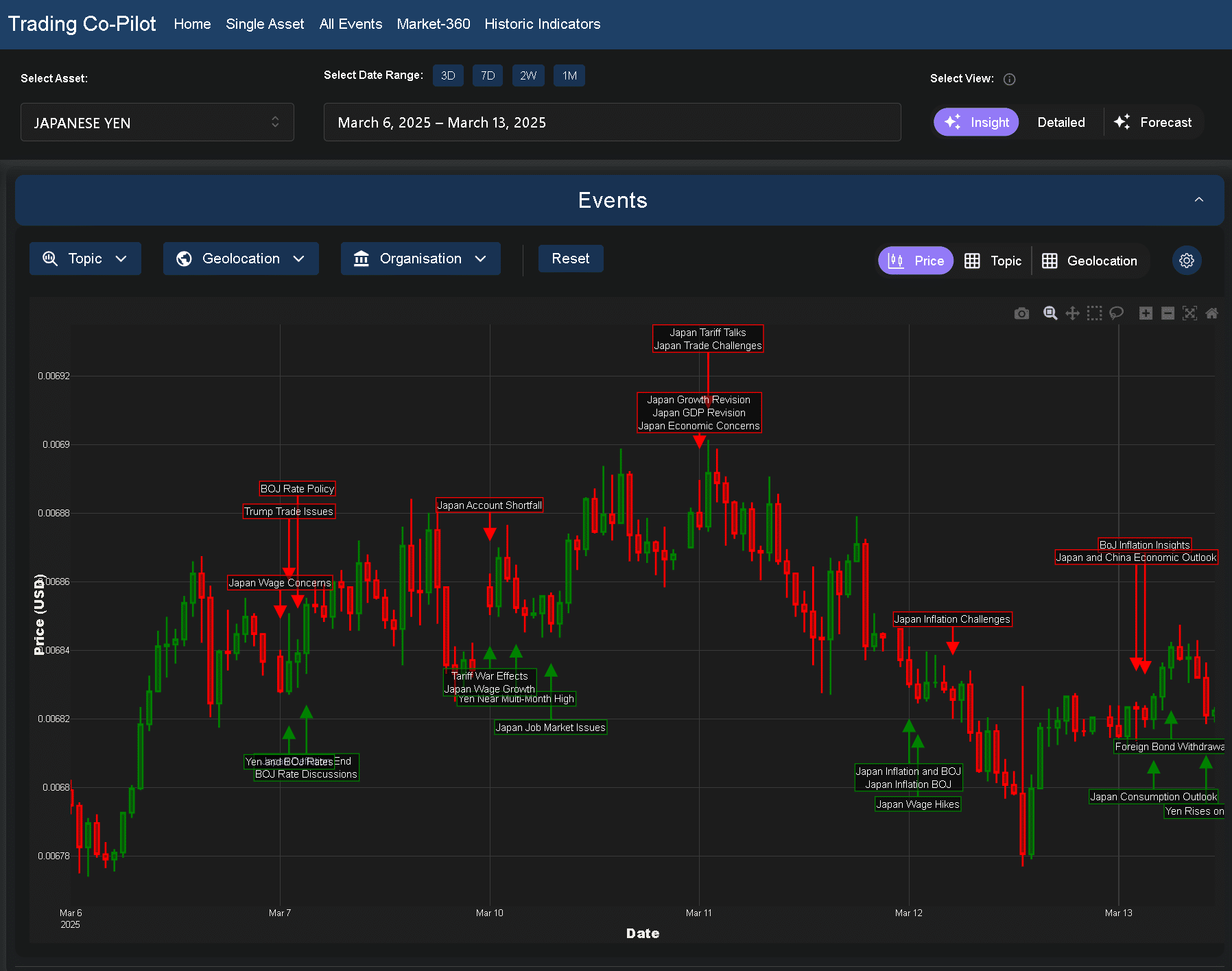

Above: Japanese yen market sentiment Analyst Insight View

Consumer expectations and economic indicators

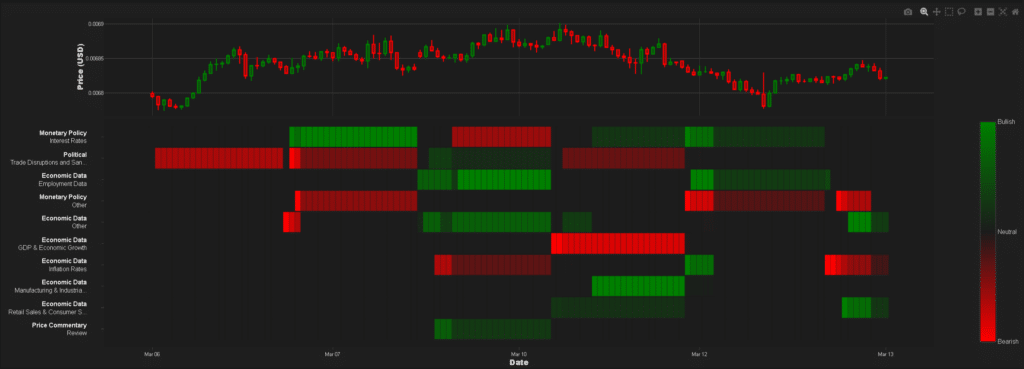

The most recent data from our Trading Co-Pilot indicates that despite maintaining a steady value, there are significant undercurrents affecting Japanese yen market sentiment. Bank of Japan’s Governor Ueda has highlighted expectations for improved consumer spending driven by solid wage gains. Needless to say, this economic optimism comes at a key time, as Japan experiences its fastest wage growth in 32 years, which will no doubt positively impact domestic economic resilience.

Meanwhile, Japanese investors are pulling out of foreign bonds following a selloff in European debt. This retreat to home markets reflects a cautious approach to international investments, understandably focused on minimising exposure to increasingly volatile external markets. This shift in investment strategy has waxed and waned over recent months, having initially shown promise of overseas expansion.

Inflation pressures and monetary policy

The impending challenges of inflation have emerged as wholesale inflation reached 4%, leading to speculation about potential rate hikes by the Bank of Japan. This is particularly significant as Japan’s 10-year bond yields have surged to their highest levels since June 2009. Such movements in Japanese yen market sentiment suggest that investors are preparing for a shift in monetary policy that could limit the pain of inflation on the domestic economy.

But the more significant news relates to Japan’s economic growth being revised lower just before the Bank of Japan’s policy meeting. These revisions soften the ground for potential shifts in monetary policy and economic outlook, as policymakers attempt to balance growth stimulation against inflationary pressures.

Trade challenges and tariff chaos

The uncertainty caused by ongoing trade negotiations presents another layer of complexity for Japanese yen market sentiment. Japan’s trade minister has faced setbacks in securing tariff exemptions from the US, highlighting ongoing challenges that could impact Japan’s economic stability. There is little doubt of the cause and effect of this diplomatic friction on currency markets, as investors closely monitor developments.

Additionally, as Trump plays with the dice in the ongoing US tariff war with China, this adds up to significant market volatility. The Trump tariff thrill ride has led to a flight to safe-haven currencies like the Yen, keeping the global economy on tenterhooks. At times like these, such tariff chaos creates an environment where traditional economic indicators cannot always compensate for the unpredictability of geopolitical decisions.

Above: Japanese yen market sentiment thematic heatmap

Current account and labour market concerns

To add to the mix, Japan reported a significant current account shortfall of ¥257.6 billion, indicating potential economic challenges ahead. This deficit raises questions about external balance and future Japanese yen market sentiment, particularly as global trade tensions mount.

Meanwhile, the labour market presents contradictory signals. While wage growth shows positive momentum, Japan faces its worst full-time worker shortage since Covid, with firms struggling to hire. This labour market tightness creates pressure on wages and potentially on inflation, further complicating the monetary policy landscape that influences Japanese yen market sentiment.

Global context and future outlook

The Japanese Yen is trading near a multi-month high against the USD, influenced by differing expectations between the Bank of Japan and the Federal Reserve. As measures such as these reflect diverging monetary policy paths, investors must carefully consider the implications for currency valuation and portfolio allocation.

The good news is that Japan’s economy minister has announced readiness to declare an end to deflation, indicating potential for economic recovery. However, this optimism must be tempered by the reality of global economic challenges and ongoing geopolitical tensions that continue to influence Japanese yen market sentiment.

Investment Implications

For investors looking to navigate this complex landscape, our Trading Co-Pilot suggests several considerations:

- Monitor Bank of Japan policy decisions closely, as any shift towards tightening could strengthen the yen significantly

- Consider the implications of US-China trade tensions on safe-haven flows towards the yen

- Track wage growth and inflation data as leading indicators for monetary policy changes

- Assess the impact of Japan’s labour shortage on productivity and economic growth potential

- Evaluate portfolio exposure to Japanese assets in light of changing Japanese yen market sentiment

Final thoughts on Japanese yen market sentiment this week

In short, the current state of Japanese yen market sentiment reflects a complex interplay of domestic economic factors and global geopolitical tensions. As we navigate through this new world order characterised by extreme uncertainty, our Trading Co-Pilot at continues to provide data-driven insights to help traders and investors make informed decisions and confirm trends. The journey ahead for the Japanese yen will likely be characterised by periodic volatility as markets digest new economic data and geopolitical developments.

Navigating Japanese yen market sentiment

For enterprise and institutional clients, we’re offering a two week trial to test out our Trading Co-Pilot to navigate the complexities of currency markets with confidence.

Our AI-powered platform delivers real-time analysis, predictive insights, and strategic recommendations that give you the edge in volatile markets. Whether you’re hedging currency risk or seeking trading opportunities, our solution provides the clarity you need when traditional analysis falls short.

Request a personalised demonstration today to see how our Trading Co-Pilot can transform your approach to the Japanese yen and other currency markets. Our team of experts is ready to show you how data-driven intelligence can help you stay ahead of market movements and make more informed trading decisions. Simply email enquiries@permutable.ai or fill in the form below.

Request enterprise demo/trial

Read associated currency market sentiment analysis

Canadian dollar market sentiment