*This article examines the key macroeconomic factors affecting currencies in today’s global markets, aimed at forex traders and financial professionals seeking to understand the complex interplay of trade relations, monetary policies, and economic indicators that drive currency valuations in 2025.

Tensions have been rising across global financial markets with a complex web of macroeconomic factors affecting currencies in early 2025. From monetary policy divergence to inflation concerns and geopolitical tensions, this year has so far been one of cross currents, uncertainty and risk.

Yet even now, amidst this uncertainty, patterns are emerging that savvy currency traders can leverage. The interplay between central bank policies, inflation trajectories, and political developments continues to create both challenges and opportunities in currency markets. In this article, we’ll explore key macroeconomic factors affecting currencies with insights taken from our Trading Co-Pilot and macroeconomic data feeds.

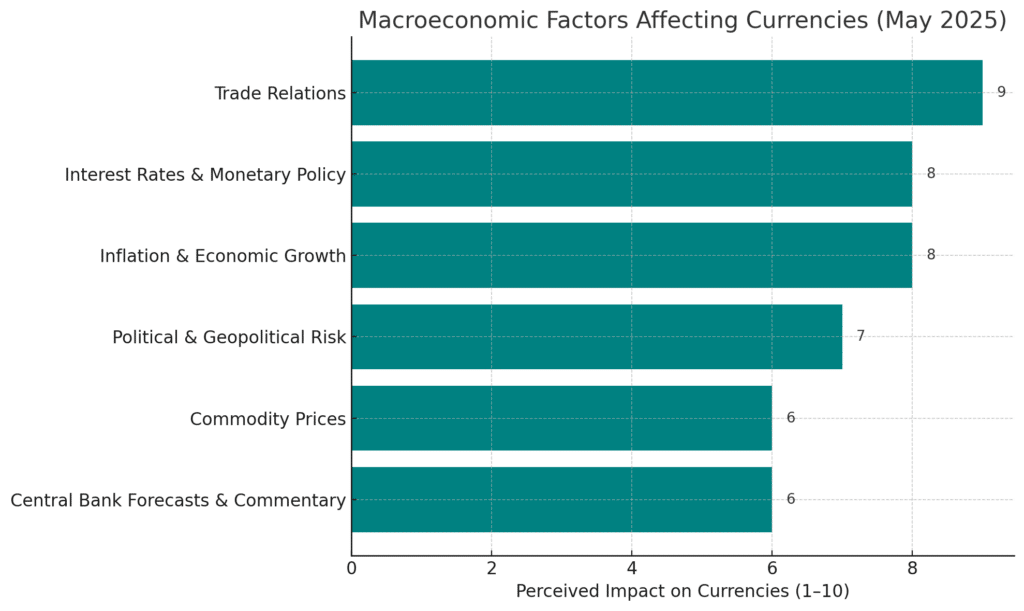

Key macroeconomic forces shaping global currency markets in May 2025 according to our market sentiment data, with trade relations and monetary policy emerging as the most influential drivers amid ongoing economic uncertainty.

Table of Contents

ToggleTrade relations: The dominant force in currency movements

Let us rattle through the current state of global trade relations and their impact on currencies. The ongoing US-China trade tensions have continued to cast a long shadow over the yuan, though the currency has been maintaining stability despite escalating rhetoric. According to sources within financial markets, China has indicated a willingness to engage in trade discussions with the United States, potentially providing optimism for traders amid ongoing economic challenges.

The same applies to the euro, which has remained relatively stable despite warnings from ECB President Christine Lagarde that US tariffs could slow Eurozone growth. The point here is that trade relations have become the primary driver of currency movements, often overshadowing traditional macroeconomic factors affecting currencies like interest rate differentials.

Interest rate dynamics and monetary policy divergence

For when you look again at recent central bank actions, a clear picture emerges of diverging monetary policies. The ECB has signalled potential rate cuts, while the Bank of Japan has maintained its policy rate unchanged at around 0.5% and downgraded its growth forecasts.

Not long ago, these policy divergences would have created more dramatic currency movements. Yet as central banks increasingly align their concerns around global trade tensions, we’re seeing a dampening effect on what would typically be significant drivers of forex markets.

The trouble is, this new reality creates unpredictable correlations between macroeconomic data releases and currency responses. Almost everyone we speak to in the industry confirms that traditional models for currency forecasting are becoming less reliable in this environment.

Inflation concerns and economic growth

Let’s briefly look at how inflation is affecting major currencies. Tokyo’s Consumer Price Index inflation increased to 3.5% year-over-year, yet this didn’t translate into price movement for the Yen. The US economy contracted by 0.3% in the first quarter, attributed to the impacts of trade policies, while the dollar has experienced what some analysts term as its worst first 100 days of a presidency since Nixon.

There’s a sense of foreboding in markets about how these inflationary pressures might evolve. This concern has three components: first, the potential for stagflation in major economies; second, the diverging inflation trajectories between developed and emerging markets; and third, the uncertain response from central banks caught between fighting inflation and supporting growth.

And the bad news is that all of this is likely to continue in currency markets throughout 2025.

Political developments and their currency impact

The other element in the mix? Political developments have taken centre stage in driving currency movements. So when it emerged that Mark Carney’s election victory in Canada on an anti-Trump platform led to a positive market reaction for the Canadian Dollar, traders took notice. The currency has shown continued strength, remaining stable at 0.73 and strengthening against most major currencies.

Except that political stability doesn’t always translate to currency strength. The British Pound, despite a relatively stable government, decreased to 1.33, influenced by a significant drop in UK house prices marking the fastest decline in two years. There’s plenty of evidence that macroeconomic factors affecting currencies sometimes override political considerations.

Commodity prices and resource-dependent currencies

The Australian Dollar – a commodity currency – presents an interesting case study in how commodity prices affect currency valuations. The AUD showed signs of strength following positive trade balance data, with Australia’s trade surplus climbing to 6,900M MoM in March, significantly exceeding expectations.

Yet the World Bank reported that commodity prices are expected to fall to pre-COVID levels, raising concerns about the impact on the Australian economy. It is claimed that these projections could significantly weigh on the AUD in coming months, particularly if China’s demand for resources continues to moderate.

The interplay of multiple factors

So there it is – a complex web of macroeconomic factors affecting currencies that traders must navigate daily. Of course, no single factor dominates currency movements consistently. Instead, it’s the interaction between trade relations, monetary policy, inflation trends, political developments, and commodity prices that determines currency trajectories.

And if it is the case that trade tensions continue to escalate, we could see traditional correlations between economic data and currency movements further break down. In this light, traders must adapt their strategies to account for this new reality.

The good news is that adaptive trading strategies focusing on multiple macroeconomic factors affecting currencies can still yield results. To address this complexity, traders should consider employing more sophisticated multi-factor models that weigh various inputs dynamically based on market conditions, such as those we offer through our market sentiment data feeds.

Looking ahead: Currency trends for the remainder of 2025

If we don’t make progress on resolving global trade tensions, currency markets will likely remain uncertain throughout 2025. There’s a sense that markets are waiting for clarity on US trade policy, with significant implications for all major currency pairs.

And this is why monitoring developments in US-China relations, ECB policy decisions, and commodity price trends will be crucial for currency traders in the coming months. These macroeconomic factors affecting currencies will continue to interact in complex ways, creating both risks and opportunities for market participants.

Stay ahead of currency markets with real-time insights

Ready to leverage our real-time market sentiment insights for your trading strategy? Access our comprehensive data feeds through our Trading Co-Pilot terminal or integrate directly with our API for real-time analysis of macroeconomic factors affecting currencies. Our advanced trading intelligence delivers the powerful information you need, precisely when you need it – ensuring you make informed decisions in today’s uncertain currency markets. Simply email us at enquiries@permutable.ai to request a demo or fill in form below.