The past six months have witnessed extraordinary market turbulence in response to Trump’s tariffs, no more so than in recent days. At time of writing, the S&P has plunged 6% to one-year low a one amid market turmoil as the shellshock of global trade wars takes hold. Traditional investment approaches struggled to maintain stability – even some of the world’s biggest hedge funds, including Millennium Management and Citadel, have faced losses in navigating these choppy waters. At times like these, such volatility highlights an urgent need for effective risk management strategies and alternative data sources that can help traders and portfolio managers navigate uncertain market conditions.

In light of this, we are publishing our latest live commodity trading results achieved running our macro and commodities datasets that we’re making available only to select partners. These findings demonstrate how our approach has delivered meaningful portfolio protection during precisely the period when conventional strategies have faltered.

Table of Contents

ToggleOur commodity market performance: The data speaks

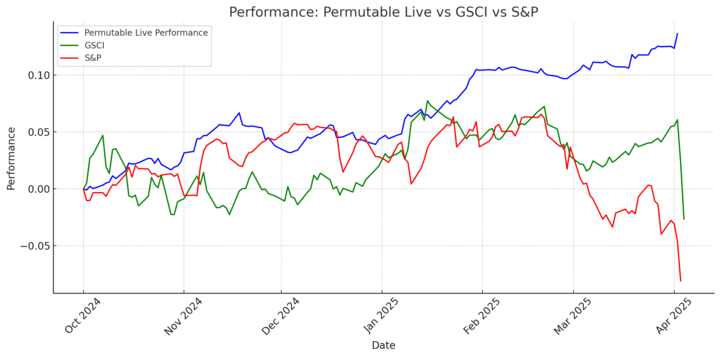

Our live trading performance from October 2024 to April 2025 makes a powerful case for the value of our specialised commodities and macro datasets during market stress:

- Return since launch: 13.7%

- Annualised Sharpe ratio: 4.04

- Maximum drawdown: Only 4%

- Correlation with S&P 500: -15%

As illustrated in the performance chart, whilst the S&P index (red line) suffered steep decline beginning in February 2025 and continuing through April, our performance (blue line) demonstrated remarkable resilience, actually accelerating upward during this challenging period in a negative correlation. This divergence reflects our commodity market performance – and its potential to be a powerful strategic portfolio diversifier and risk management tool.

Here, our macro and geopolitical data has been especially useful for regime steering during the past two months. By identifying shifts in market regimes early, we’ve been able to reposition before traditional indicators signalled danger. Our portfolio allocation remains evenly variance-weighted across key CME contracts: Henry Hub, Brent Crude, Gold, Silver, Wheat and Soy. This diversification within the commodities space has provided natural hedging against market turbulence. With approximately 600 transactions over the six-month period and typical holding times of 1-3 days, our approach is neither high-frequency trading nor passive investing, but rather tactical positioning based on data-driven signals.

Negative correlation with struggling S&P 500

Perhaps the most valuable aspect of our commodity market performance has been its -15% correlation with the S&P 500. This negative relationship means that as equity markets declined, our strategy moved in the opposite direction – precisely the characteristic investors seek during such periods of market stress.

While titans like Millennium Management and Citadel have built their reputations partly on weathering market storms, even these sophisticated players have increasingly sought uncorrelated returns to protect capital during recent volatility. Our approach provides exactly this type of diversification benefit.

This goes beyond making profits during downturns; it’s about de-risking portfolios and increasing protection when it matters most. A strategy that can deliver positive returns whilst maintaining minimal or negative correlation to broad market indices during market turbulence represents the holy grail of diversification.

Technical considerations: Implementation and capacity

While we are in the process of securing our base set of data customers, we are acutely aware of liquidity and capacity usage when sharing these types of datasets. This consideration reflects our commitment to ensuring that the strategy’s edge remains viable as more capital is deployed and we agree partnerships with select funds. If you are interested in having a discussion around this then please do email us at enquiries@permutable.ai to discuss with our team.

The road ahead: Commodities in an evolving market landscape

Looking forward, we anticipate continued market volatility driven by both the new global world order which is currently being formed. In such an environment, we believe that our commodity market performance can1 serve an increasingly important role in portfolio construction.

At times like these, the commodities space offers unique characteristics that complement traditional asset classes including:

- Physical Underpinnings: Direct connection to real-world supply and demand

- Inflation Sensitivity: Natural hedge against monetary policy shifts

- Geopolitical Responsiveness: Price movements that reflect changing global power dynamics

And it is these attributes that position commodities as a natural counterbalance to equity volatility, particularly when informed by sophisticated macro and geopolitical data.

Data-driven protection in uncertain markets

Our commodity market performance and approach makes a strong case for the power of our LLM-driven data-driven investment strategies during periods of market stress. While past performance doesn’t guarantee future results, the principles underlying our methodology – diversification, regime identification, and tactical positioning – provide a robust framework for navigating market volatility.

As the current investment landscape continues to evolve, we will continue to refine our approach and share our insights with partners who understand the value portfolio our data provides in terms of protection alongside return generation. At a time when funds and trading desks are focused on reducing portfolio vulnerability during market stress, our results suggest that appropriate exposure to commodities – guided by our sophisticated LLM-driven data insights – can offer meaningful protection without sacrificing return potential.