In today’s fractured geopolitical landscape, quantitative traders face unprecedented challenges interpreting the vast web of interconnected market signals. The exponential growth in data volume has transformed quantitative trading from a purely mathematical discipline into one requiring sophisticated interpretation of macro events, sentiment shifts, and complex correlations.

At Permutable, we’ve spent the last three years quietly developing what many institutional clients now consider the definitive solution to this evolving challenge: a quantitative trading AI intelligence platform specifically engineered for institutional applications. This article explores seven powerful use cases that demonstrate how our technology is reshaping financial decision-making.

Table of Contents

ToggleUse case 1: Geopolitical risk integration for commodity trading

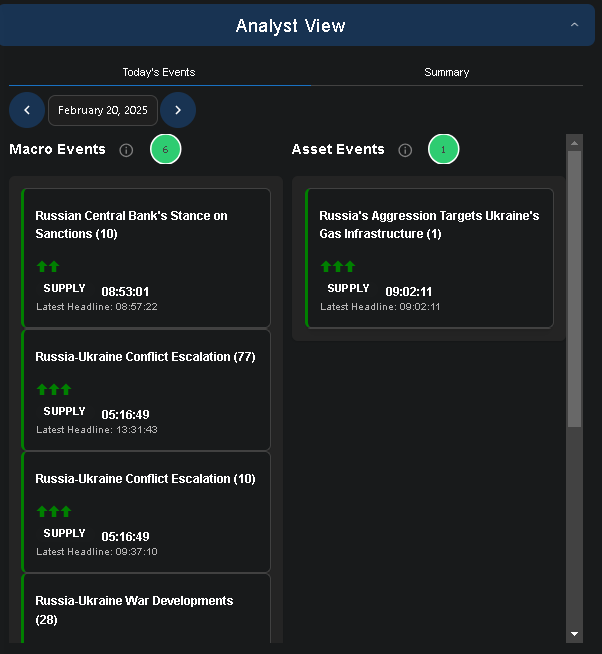

It’s a hard truth that traditional quantitative trading models often struggle to incorporate unstructured geopolitical developments to a standard this is robust enough. However, our quantitative trading AI intelligence platform continuously monitors global events, automatically assessing how shifting alliances, trade disputes and regulatory changes affect commodity valuations.

Ultimately, our mission is to fully automate geopolitical analysis, representing a reimagining of institutional trading intelligence. Our system detects correlations between seemingly unrelated political events and commodity price movements with remarkable accuracy, which can be extremely valuable. This approach obviously helps our institutional clients navigate ever-present market risks including resource nationalism, sanctions regimes, and supply chain disruptions – factors that traditional quantitative models are not as adept at factoring in. And it is this which is particularly powerful when trading energy futures and precious metals during periods of international tension which are seemingly becoming the norm.

Above: European Natural Gas AI trading insights filtered by geopolitical factors

Use case 2: Earnings sentiment analysis for equity trading

Quarterly earnings present both opportunities and risks for quantitative equity strategies. Our quantitative trading AI intelligence goes beyond simple beat/miss analysis to deliver more granular insights into market reactions. In a lab environment, we’ve seen the system processes earnings calls in real-time, analysing everything from management tone, linguistic patterns, to question-answer dynamics. This multi-dimensional sentiment analysis helps quantitative traders anticipate market responses to earnings announcements with great accuracy.

Use case 3: Volatility regime prediction for options trading

Options trading strategies require accurate volatility forecasting – an area where traditional quantitative models often struggle during market transitions. Here, our quantitative trading AI intelligence platform excels at identifying precursors to volatility regime changes. The system monitors global liquidity conditions, central bank communications, and institutional positioning across markets to predict volatility spikes before they materialise.

This integrated approach allows options traders to adjust their strategies before major market shifts and we believe what’s particularly valuable for a volatility trading desk is the system’s ability to provide advance warning of correlation breakdowns. Unlike traditional VIX-based indicators, our platform captures the subtle intermarket relationships that often precede volatility events.

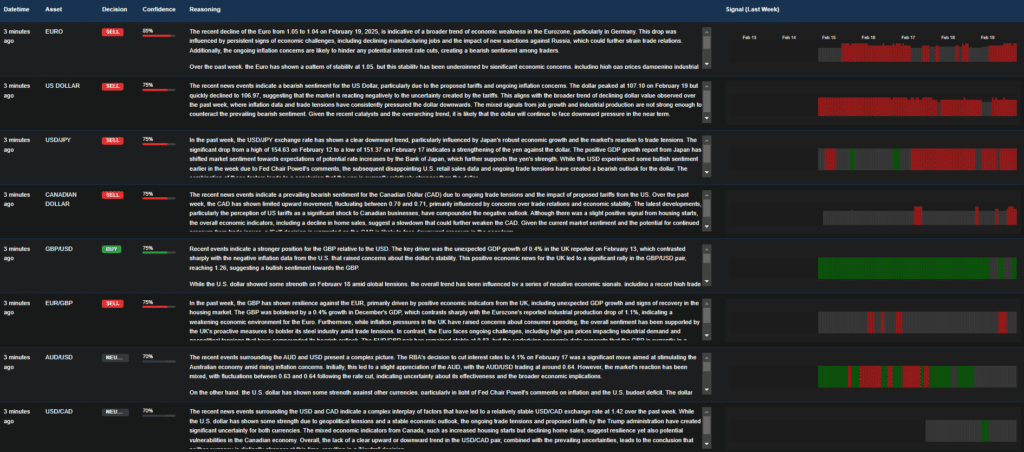

Use case 4: Currency market regime shift detection

Currency markets present unique challenges for quantitative trading strategies, particularly when long-established correlations suddenly break down. Thankfully, our quantitative trading AI intelligence platform excels at identifying these regime shifts before they become obvious in price action.

What distinguishes our approach is the ability to detect subtle changes in central bank communication patterns. Our Trading Co-Pilot platform analyses everything from monetary policy statements to unscripted comments by financial officials, identifying linguistic shifts that often precede policy changes. This is obviously resonated with institutional FX desks, particularly because of our system’s historical confidence metrics which show how similar communication patterns influenced previous market regimes, allowing traders to adjust their quantitative models before major moves occur.

Above: Currency markets AI intelligence overview

Use case 5: Cross-asset correlation detection during market stress

As previously mentioned, during periods of market turbulence, traditional correlation patterns often break down – creating both risks and opportunities for quantitative strategies. It is precisely during these times that our quantitative trading AI intelligence platform excels at identifying these shifting relationships in real-time.

We’ve been working tirelessly over the last 18 months to develop systems that detect cross-asset correlation changes before they become obvious in price action. Our Trading Co-Pilot platform continuously monitors thousands of asset pairs, identifying structural shifts that often precede major market movements. This approach obviously enables quantitative traders adjust their risk models during regime changes. The system’s historical confidence metrics show how similar correlation breakdowns influenced previous market crises, allowing traders to implement appropriate hedging strategies before contagion spreads across asset classes.

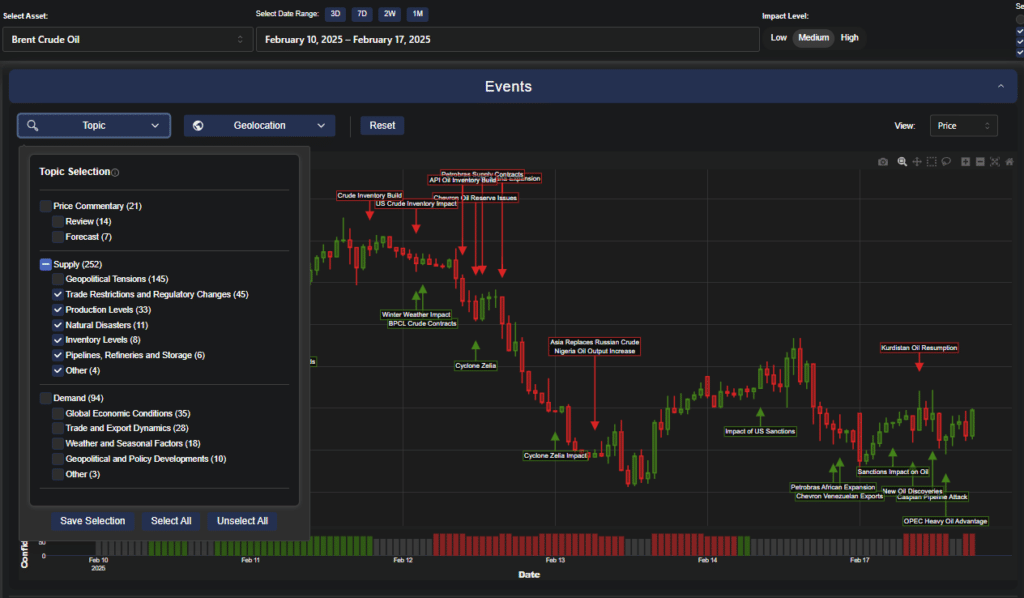

Use case 6: Automated macro narrative construction

Quantitative traders increasingly recognise that understanding the prevailing market narrative provides vital context for model performance. Enter our quantitative trading AI intelligence platform, which automatically constructs and updates macro narratives based on global developments.

Here, the system synthesises information from central bank communications, economic data releases, geopolitical events, and market positioning to create coherent explanations for current market behaviour. These narratives – or stories – help quantitative teams understand when their models might underperform due to shifts in market drivers. We believe our platform’s ability to explain why certain factors are dominating market behaviour is particularly valuable for systematic trading desks, compared to black-box approaches.

This has obviously resonated with institutional clients seeking to bridge the gap between purely quantitative approaches and discretionary macro trading. As a result, our platform serves as a powerful sense-checking mechanism for sophisticated quantitative strategies during unusual market conditions.

Above: Inventory impact on Brent Crude AI intelligence for quant trading

Use case 7: Geopolitical risk quantification for portfolio construction

Geopolitical risks have traditionally been difficult to incorporate into quantitative portfolio construction due to their qualitative nature. However, our quantitative trading AI intelligence transforms these risks into measurable inputs for systematic strategies.

Powered by AI agents, our Trading Co-Pilot analyses global political developments, regulatory changes, trade tensions, and resource nationalism to create quantifiable risk metrics for different countries, sectors, and assets. This approach allows quantitative portfolio managers to incorporate geopolitical considerations without abandoning their systematic framework.

In fact, our quantitative trading AI intelligence was specifically designed to transform unstructured geopolitical information into structured data points. Over the last three years, we’ve developed proprietary methodologies for quantifying concepts like political stability, regulatory uncertainty, and trade risk that were previously considered too subjective for quant models.”

And it is this capability that provides quantitative traders with a significant advantage in markets increasingly influenced by geopolitical developments – from emerging market equities to sovereign debt and commodity futures.

The future of quantitative trading AI intelligence

As these seven use cases demonstrate, our Trading Co-Pilot platform represents a significant advance in quantitative trading intelligence. By bridging the gap between mathematical precision and contextual awareness, we’re helping redefine what’s possible in institutional trading.

For quantitative traders seeking to navigate increasingly complex global markets, the message is clear: the future belongs to hybrid approaches that combine traditional quant techniques with sophisticated AI interpretation. Our Trading Co-Pilot platform offers a compelling glimpse into this future – one where quantitative trading becomes as much about understanding the world as it is about modelling it mathematically.

As geopolitical complexities continue mounting and markets grow increasingly interconnected, we believe that quantitative trading AI intelligence of the kind surfaced through our Trading Co-Pilot will become essential components of institutional investment infrastructure – not replacing human judgment, but enhancing it with capabilities that exceed what either humans or algorithms could achieve independently.

Experience the future of quantitative trading intelligence

Ready to see how our quantitative trading AI intelligence can transform your trading operations? To request a personalised demonstration tailored to your specific requirements or to apply for a 14-day trial of our platform, contact our team at enquiries@permutable.ai or simply fill in the form below.