This article provides s 24-hour analysis of silver market dynamics, incorporating real-time silver price forecast intelligence from our Trading Co-Pilot Forecast Agents to provide precious metals traders and institutional investors with actionable insights for tomorrow’s trading session, whilst showcasing our advanced forecasting capabilities.

In light of recent developments, silver markets have entered a particularly interesting phase that warrants close examination from both tactical and strategic perspectives. Having observed silver’s performance throughout the past week, it becomes evident that multiple convergent factors are creating a constructive environment for continued price appreciation over the next 24-hour period.

The underlying dynamics in our Trading Co-Pilot’s silver price forecast reflects not merely short-term technical momentum, but rather a fundamental shift in market structure driven by supply-side developments and evolving safe-haven demand patterns. As we continue to refine our analytical capabilities, it’s worth noting that our development team is actively working on extended 6-month forecasting models that will provide unprecedented long-term visibility into precious metals markets. But for now, our Trading Co-Pilot Forecast Agents have identified compelling evidence supporting continued bullish momentum through tomorrow’s session.

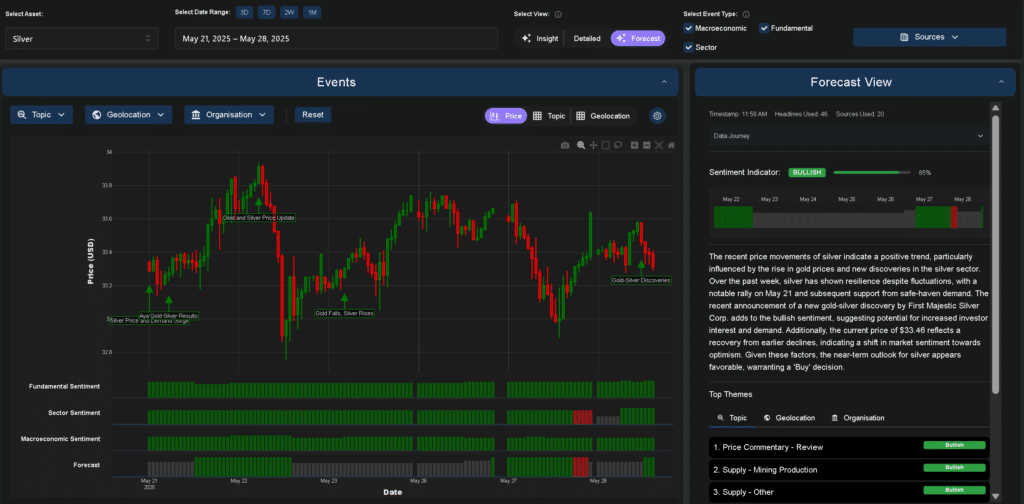

Above: Our Trading Co-Pilot’s silver analysis displays compelling bullish forecast sentiment at 85%.

Supply-side catalysts and mining sector developments

Notably, First Majestic Silver Corp.’s announcement of their second gold-silver discovery within twelve months at the Santa Elena project has created meaningful implications for sector sentiment. This development, combined with expanded high-grade mineralisation at the Navidad project, represents more than isolated good news – it signals a potential structural shift in supply expectations that could underpin the silver price forecast over multiple timeframes.

To add to this, the convergence of multiple mining announcements throughout the assessment period suggests an industry-wide acceleration in exploration success rates. Aya Gold & Silver Inc.’s high-grade results at depth, alongside new regional target identification at Zgounder, reinforces the narrative that silver supply dynamics are becoming increasingly favourable for sustained price appreciation.

What makes these developments particularly significant is their timing coincidence with broader macroeconomic uncertainty. While mining discoveries typically require years to translate into actual production, market participants are increasingly focused on the forward-looking implications for supply constraint scenarios. Therefore, our silver price forecast must account for this evolving narrative that extends well beyond immediate trading considerations.

In addition to discovery announcements, the operational developments across the sector – including Nicola Mining Inc.’s commencement of gold and silver production and Advance Mining’s completion of their maiden silver assessment in Chihuahua – collectively point towards an industry gaining momentum rather than facing headwinds.

Safe-haven dynamics and macroeconomic considerations

The role of safe-haven demand in supporting silver prices has become increasingly prominent of late, particularly as markets reassess traditional haven asset allocations. The sustained strength despite fluctuating gold prices suggests that silver is developing its own independent safe-haven premium, which significantly enhances the outlook surfaced in our Trading Co-Pilot’s silver price forecast and analysis.

Specifically, the impact of U.S. debt concerns and currency weakness has manifested differently in silver compared to historical patterns. Rather than simply following gold with a higher beta coefficient, silver has demonstrated periods of outperformance that suggest evolving investor preferences. This shift has important implications for tactical positioning over the next 24 hours.

Additionally, the recent credit downgrade referenced in our market intelligence feeds has created an environment where precious metals broadly benefit from increased uncertainty. However, silver’s relative affordability compared to gold positions it favourably for both institutional and retail investor interest, particularly during periods of economic uncertainty.

As we move into tomorrow’s trading session, the persistence of these macroeconomic themes suggests continued support for our silver price forecast, particularly if broader market volatility increases or currency pressures intensify.

Market sentiment and institutional positioning

Industry commentary from notable figures, including Peter Schiff’s observation that silver could surge significantly if it breaks the $35 mark, provides important context for understanding current market positioning. Such commentary typically reflects broader institutional sentiment rather than isolated opinions, suggesting that silver’s technical breakout potential is gaining recognition among sophisticated market participants.

Then let’s take the performance of silver-focused equities – with Avino Silver and MAG Silver showing weekly gains of 3.09% and 5.44% respectively – indicates that institutional investors are positioning for continued strength in the underlying commodity. This alignment between equity and commodity performance often precedes sustained price moves, supporting our Trading Co-Pilot’s silver price forecast for tomorrow’s session.

To add to this, the participation of companies like Coeur Mining in high-profile industry conferences, combined with the expansion of marketing agreements by firms like Magma Silver, suggests an industry increasingly confident in its medium-term prospects. These developments create a supportive backdrop for continued price appreciation.

Regulatory and policy considerations

The implementation of new import rules affecting precious metals, including silver, by various regulatory authorities adds another layer of complexity to supply-demand dynamics. While such regulations typically create short-term administrative challenges, they often result in supply constraints that support price levels over longer timeframes.

In particular, the regulatory environment’s evolution reflects growing governmental attention to precious metals markets, which historically correlates with increased investor interest and price appreciation.

Immediate outlook and trading considerations

As we approach tomorrow’s trading session, the confluence of supportive factors creates a compelling case for continued strength in silver prices. Opening price dynamics will be particularly important to monitor, given the tendency for precious metals to respond to overnight developments in Asian markets. However, the underlying momentum appears sufficiently strong to support continued appreciation regardless of short-term volatility.

That said, risk management considerations will remain important, particularly given the elevated volatility that has characterised precious metals markets recently. However, the balance of evidence suggests that silver’s current trajectory is more likely to continue than reverse over the immediate term.

Positioning for continued strength

Our analysis of silver market dynamics, incorporating intelligence from our Trading Co-Pilot Forecast Agents, presents a compelling case for continued strength over the next 24-hour period. The convergence of supply-side developments, technical momentum, and evolving safe-haven demand patterns creates a constructive environment for further price appreciation.

As we continue developing our extended forecasting capabilities, including the 6-month models currently in development, the current market conditions provide an excellent demonstration of how multiple analytical frameworks can be integrated to produce actionable trading intelligence. Our Trading Co-Pilot’s silver price forecast for tomorrow’s session reflects not just current momentum, but the fundamental shifts that are reshaping precious metals markets.

Ready to harness the power of advanced precious metals forecasting?

Discover how our Trading Co-Pilot data feeds deliver real-time silver market intelligence and to strengthen your trading strategy. To request a demo, simply reach out to our team at enquiries@permutable.ai or fill in the form below.