Looking to use our data for your systematic trading strategy or run a book together? Email enquiries@permutable.ai

SYSTEMATIC TRADING

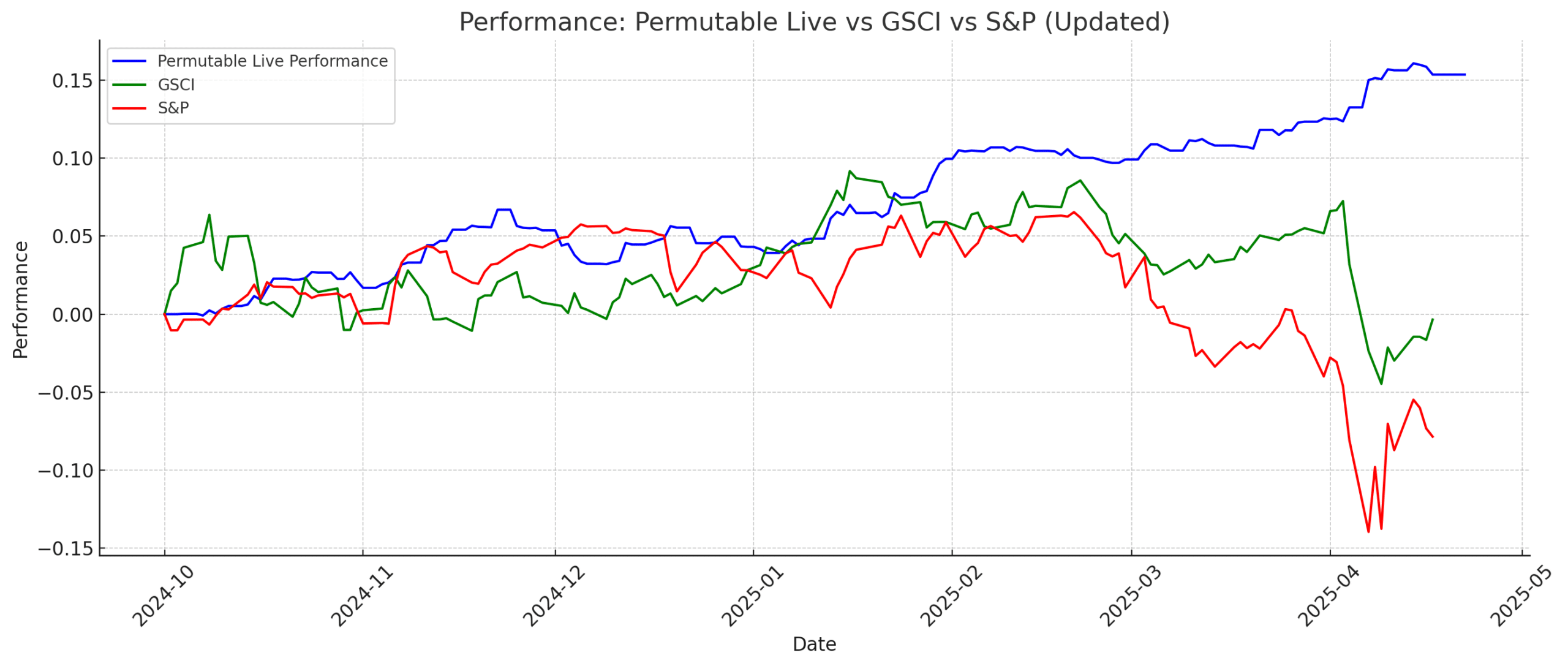

Our LLM-based trading platform has consistently outperformed major commodity indices across energy, metals, and agriculture over the last six months, including the S&P Global Macro Commodity Index. While traditional CTAs struggle with market volatility and geopolitical uncertainty, our system delivers consistent returns with negative S&P correlation – thriving precisely when conventional strategies falter.

6 MONTH PERFORMANCE (1 October 24 to 21 April 25)

Since October 2024, Permutable has been live-testing its strategic recommendations across energy, agriculture, and precious metals markets.

Powered by our proprietary co-pilot, these insights consistently outperform key benchmarks such as the GSCI and exhibit a strong inverse correlation to the S&P 500—demonstrating our ability to deliver persistent alpha in real-world conditions.

MARKET-BEATING RESULTS

- Operating one of the world’s first fully functional end-to-end LLM trading systems on international exchanges

- Sharpe 4.14 (over 6 months)

- Achieving a 31% annualised return with sub-8% annualised volatility

- Outperforming major commodities benchmark such as S&P SGMI and GSCI

- Maintaining a negative 15% correlation with the S&P 500 especially during the Trump Tariff period

- Trading an evenly diversified portfolio across global energy, agriculture, and metals markets.

- We are looking for actively looking for partners in the AUM space.

SYSTEMATIC NEWSLETTER

If you are from a fund and would like to be added to our weekly systematic newsletter please email enquiries@permutable.ai to request to be added to the distribution list.

STRATEGIC PARTNER PROGRAM

Permutable is looking for strategic partners on its trading datasets and LLM capability. Our team will contact you to discuss your specific requirements and how our systematic trading solutions can be used within your portfolio.