Trading Co-Pilot: Global data signals and decision intelligence

INFORMATION IS ABUNDANT. ACTIONABLE INSIGHT IS NOT.

Teams working with global markets face an overwhelming volume of unstructured information across news, media, macro data and events. Signals are scattered across sources, regions and asset classes, making it difficult to form a coherent view. As a result, analysis becomes manual, inconsistent and heavily dependent on individual interpretation rather than repeatable processes.

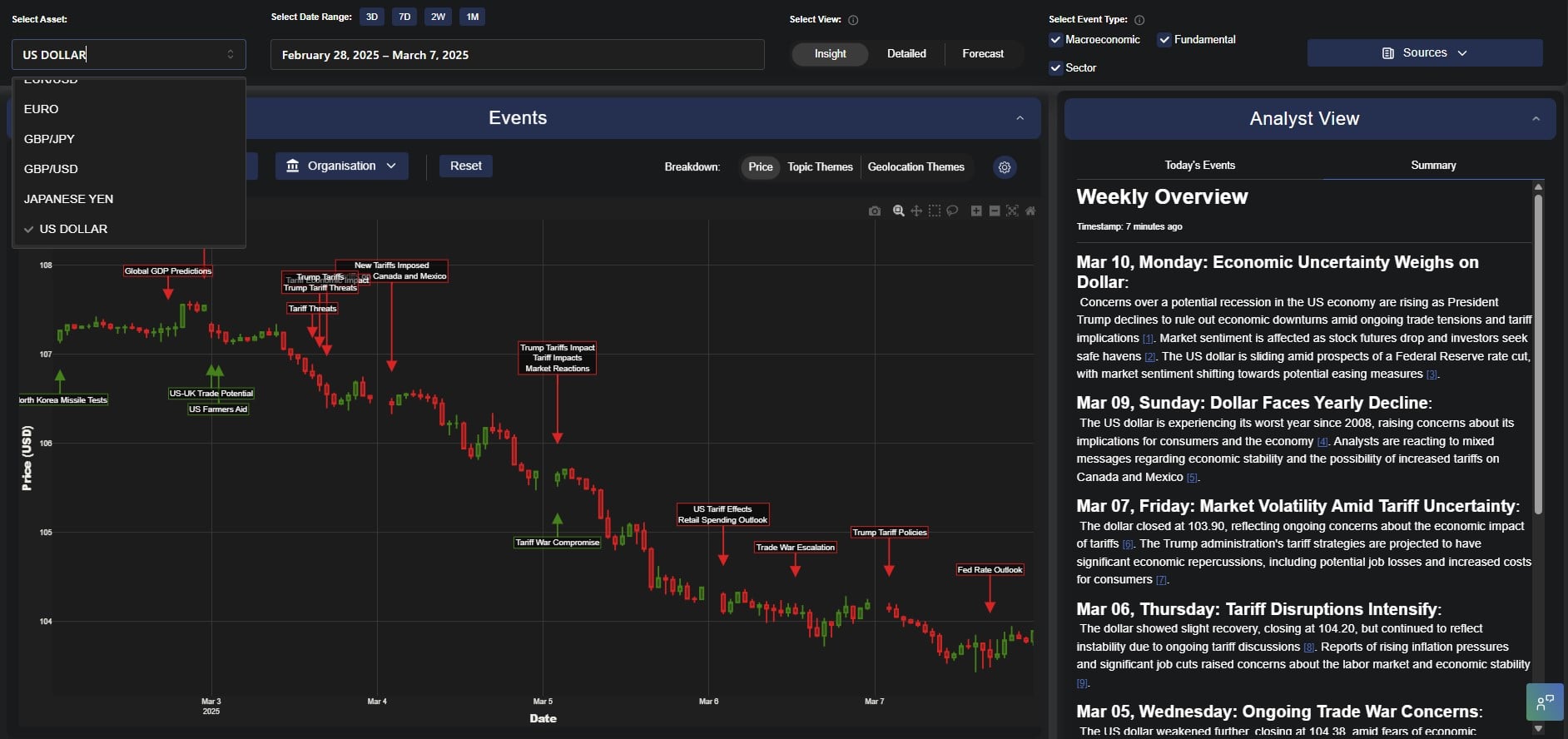

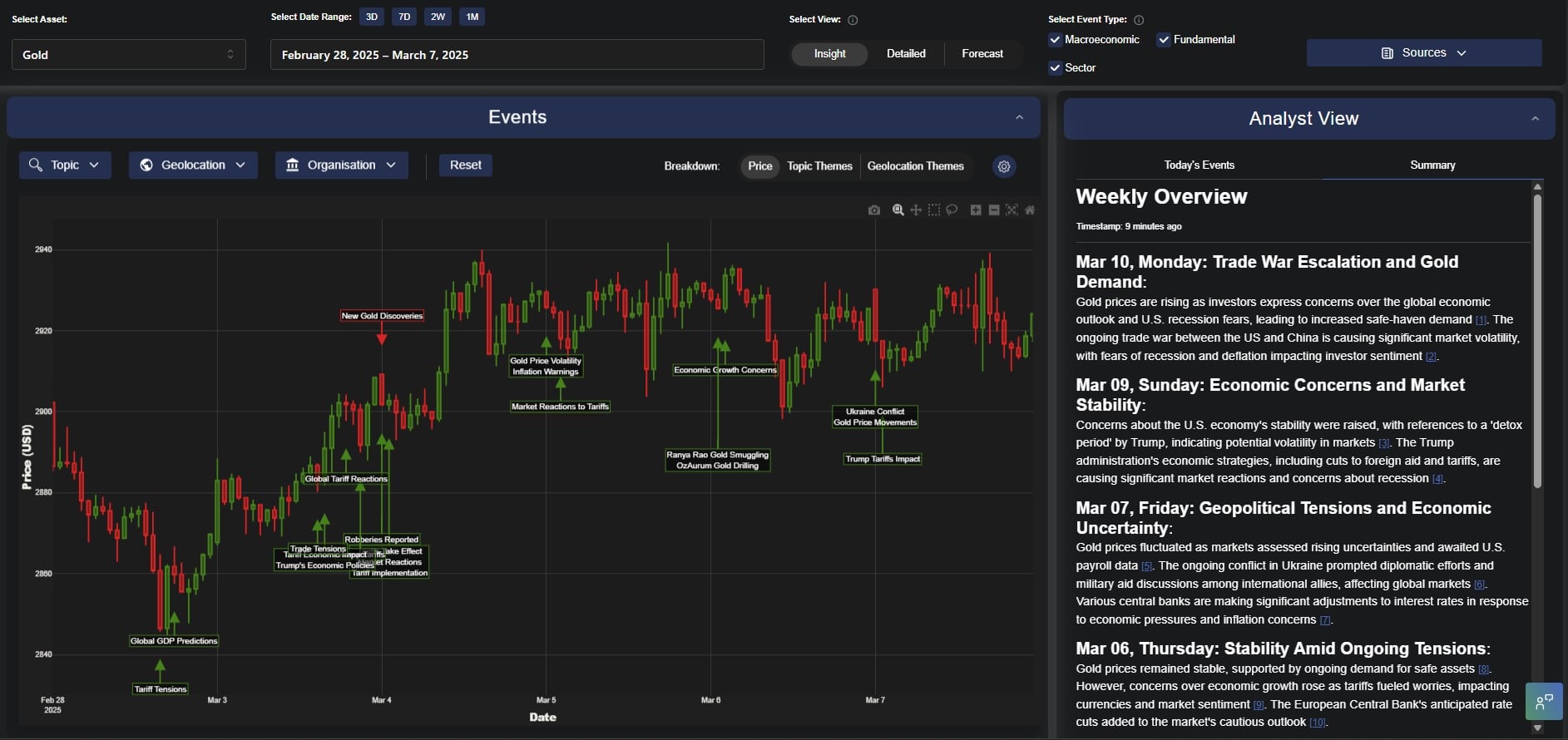

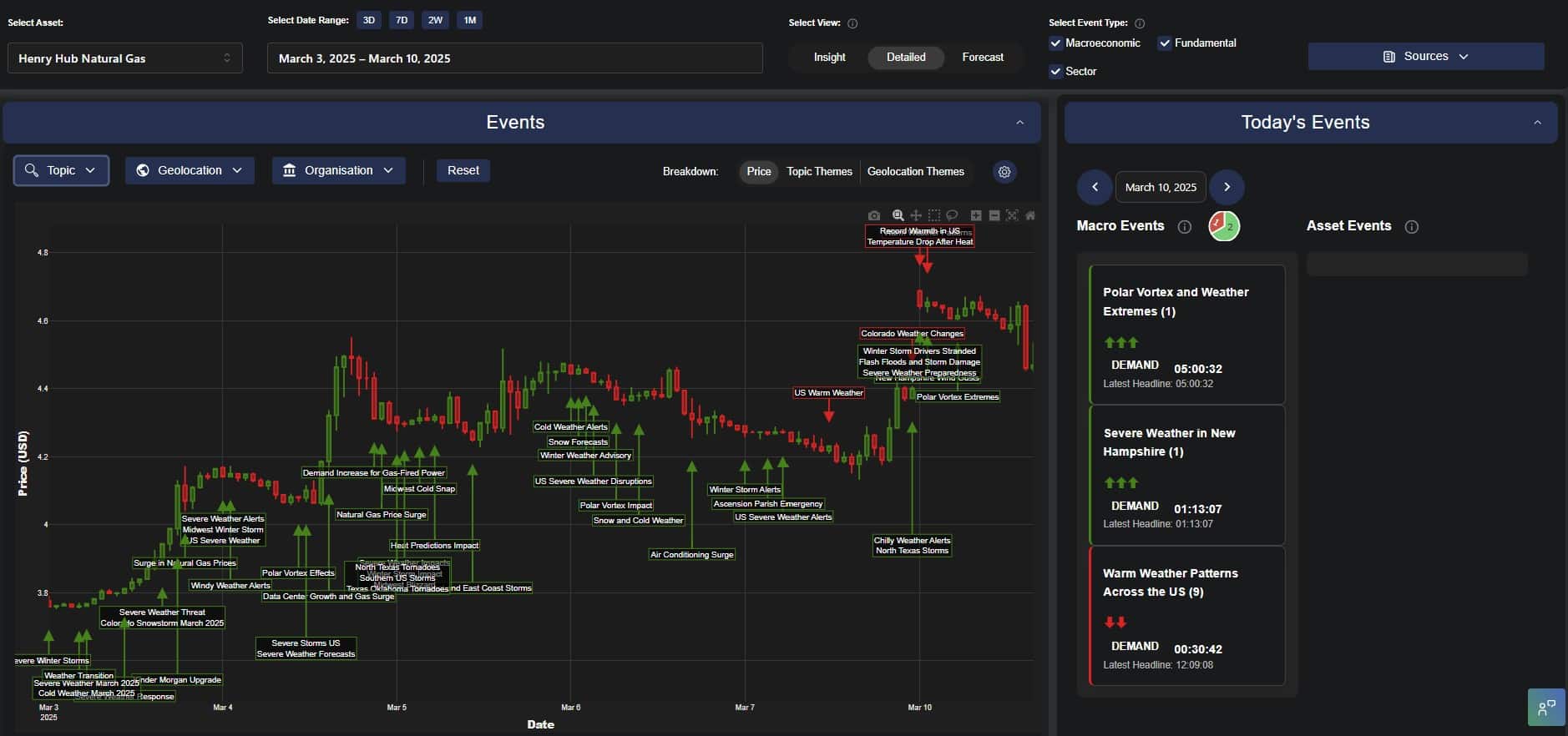

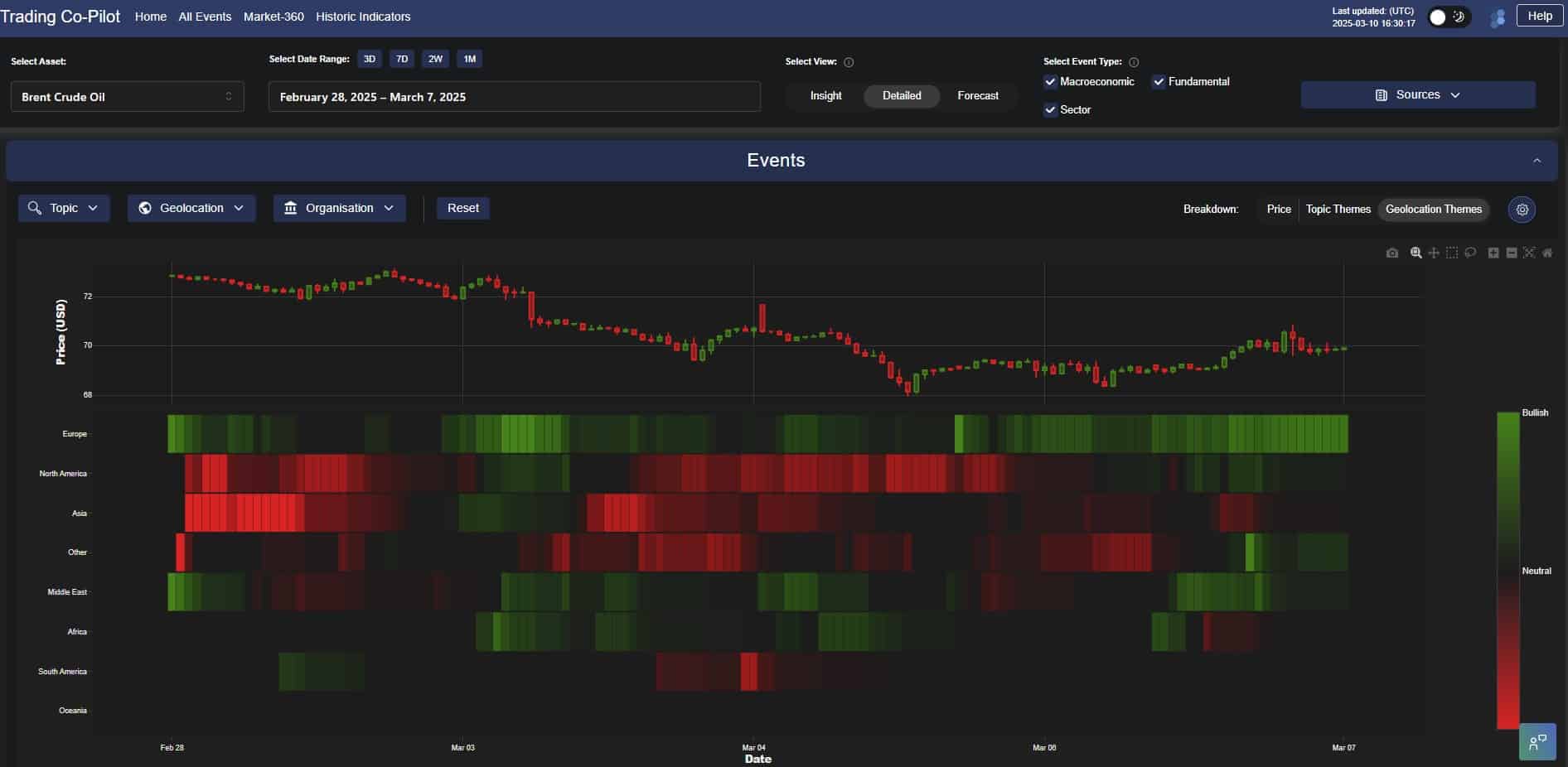

Our Trading Co-Pilot is an application layer built on Permutable AI’s world and macro data intelligence.

It is designed to translate complex global signals – across geopolitics, economics, energy, commodities and media – into structured, systematic insight for decision-makers.

Th Trading Co-Pilot represents how Permutable’s data and intelligence can be operationalised into workflows, signals and decisions.

The Co-Pilot is designed to make global context usable at scale. Built on Permutable AI’s intelligence infrastructure, it helps translate unstructured information into structured outputs that can be applied consistently. By focusing on repeatability rather than one-off analysis, the Co-Pilot supports clearer reasoning, stronger signal detection and more reliable decision-making.

Live Reliable Global Data

Live world and macro data feeds capture geopolitical, economic and market developments in real time, providing a reliable, continuously updated foundation for analysis, modelling and decision systems at scale for your teams.

Structured Narrative Intelligence

Multi-entity sentiment and narrative analysis structures unstructured information, revealing how actors, themes and stories interact across regions and assets, enabling consistent interpretation rather than ad hoc, analyst-led judgement over time.

Systematic Signals, Not Noise

Event detection and systematic signal generation convert global context into repeatable outputs, delivering data, indicators and decision-ready intelligence that can be integrated into workflows, models and applications as needs evolve.

Permutable brings structure to global signals. The Co-Pilot helps us understand what’s moving markets - and why.

Co-Pilot Components

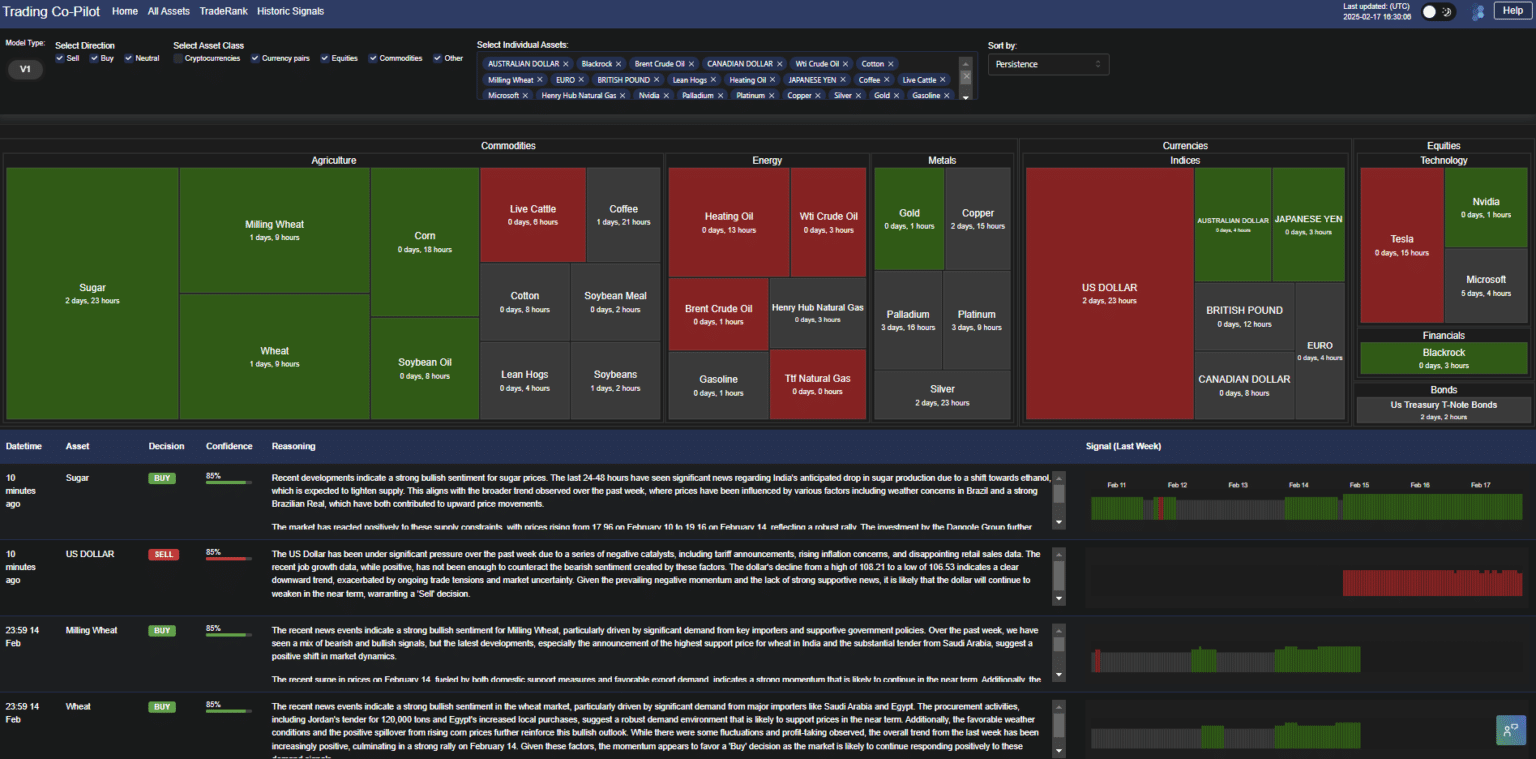

Core Intelligence & Analytics Suite

Key Market Drivers & Thematics Showcase

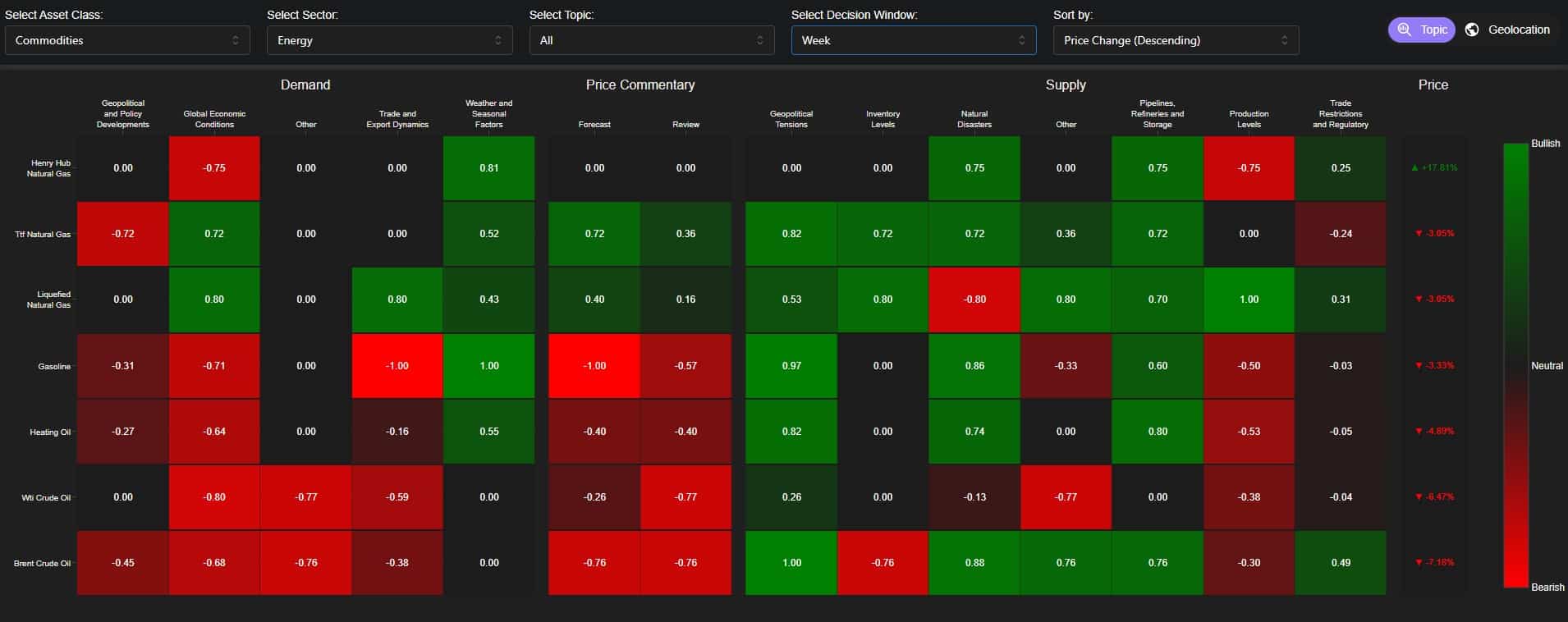

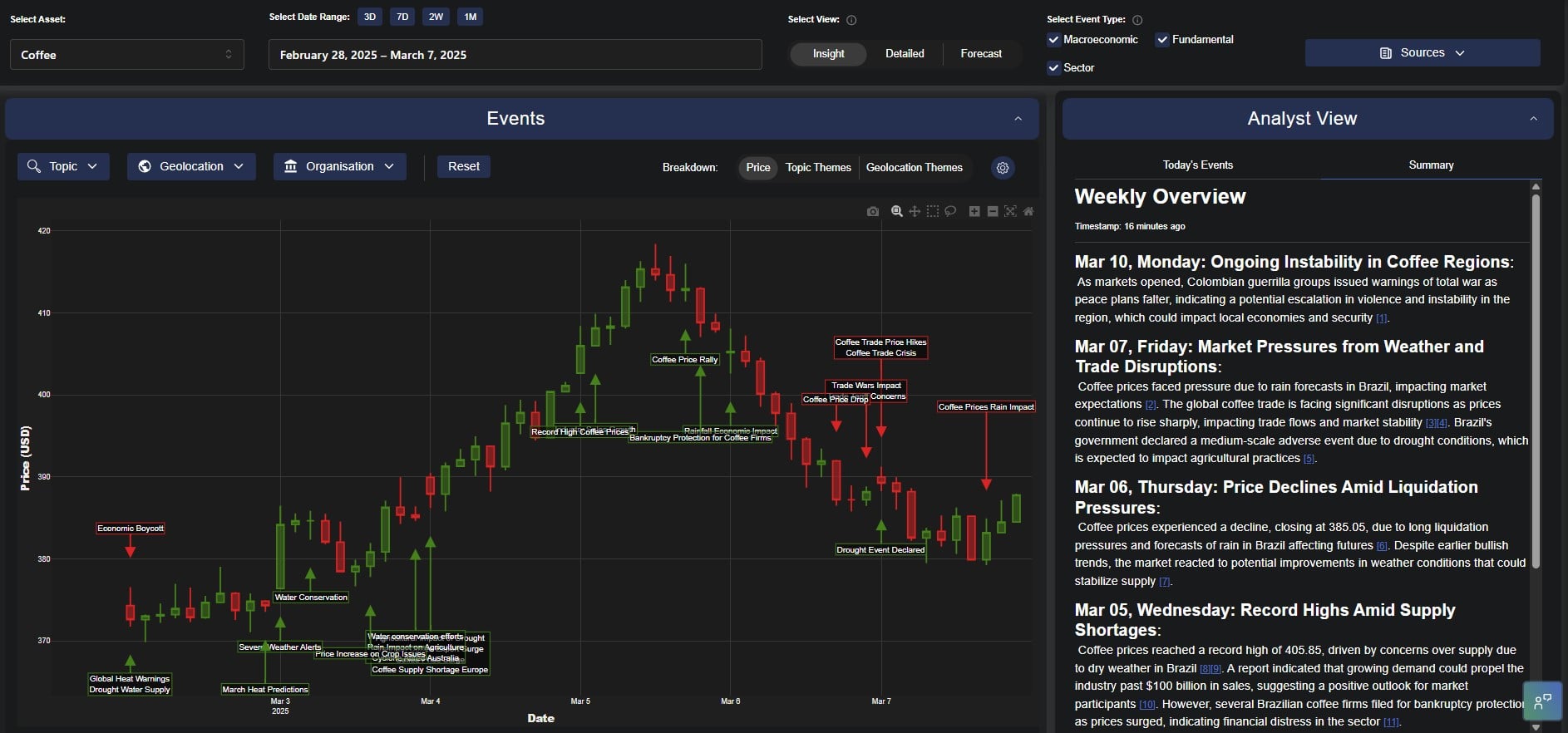

Price Insights

Thematic Insights

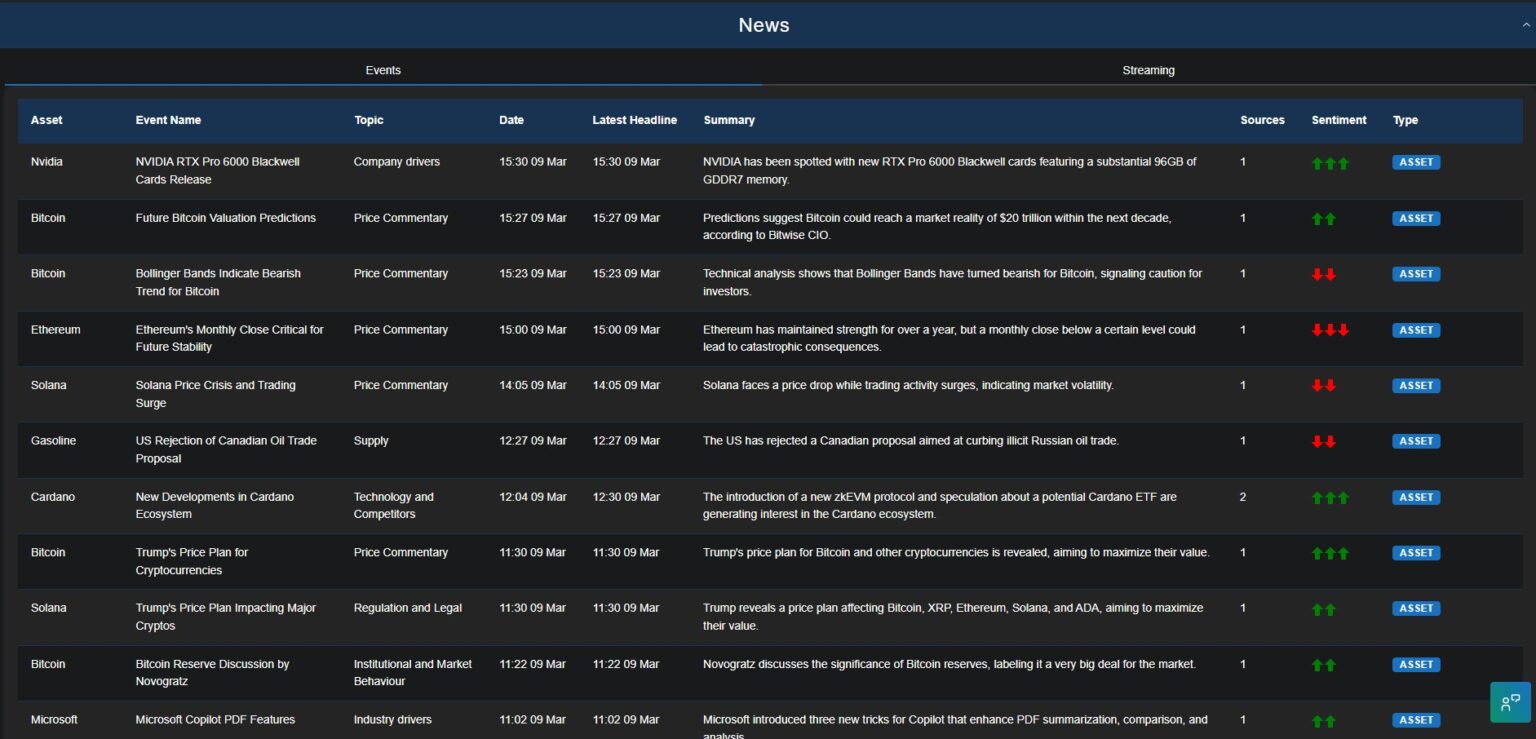

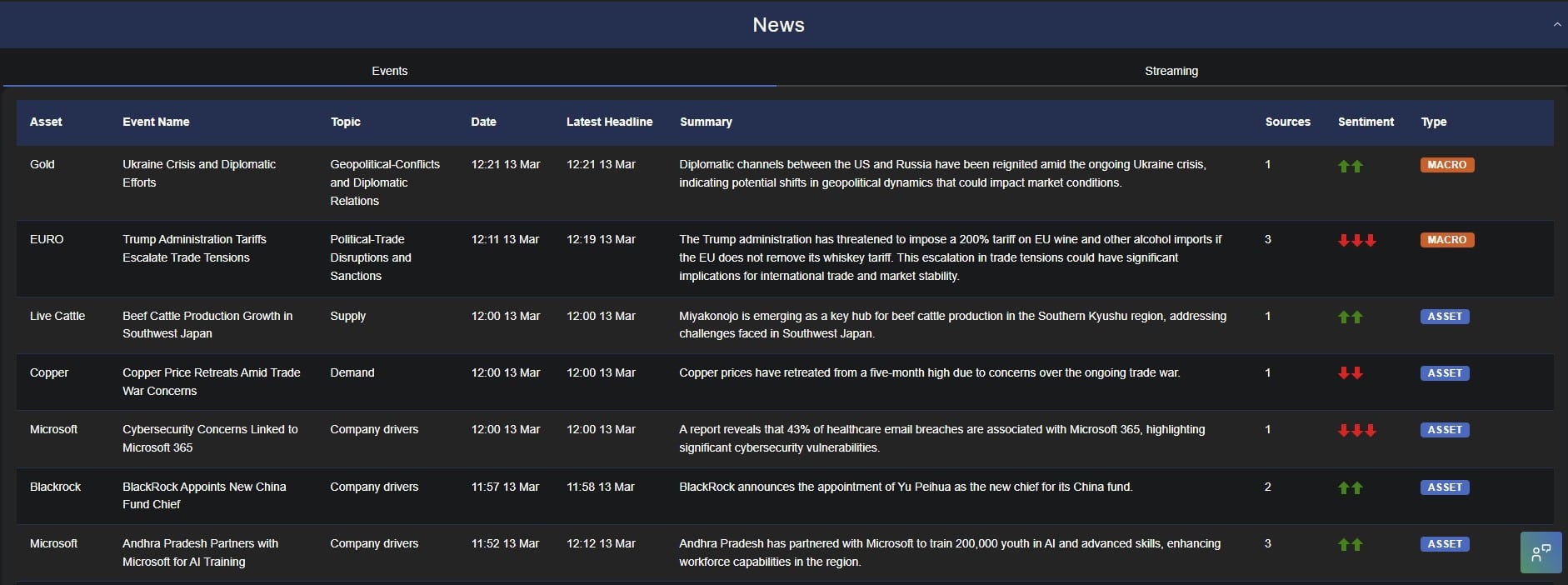

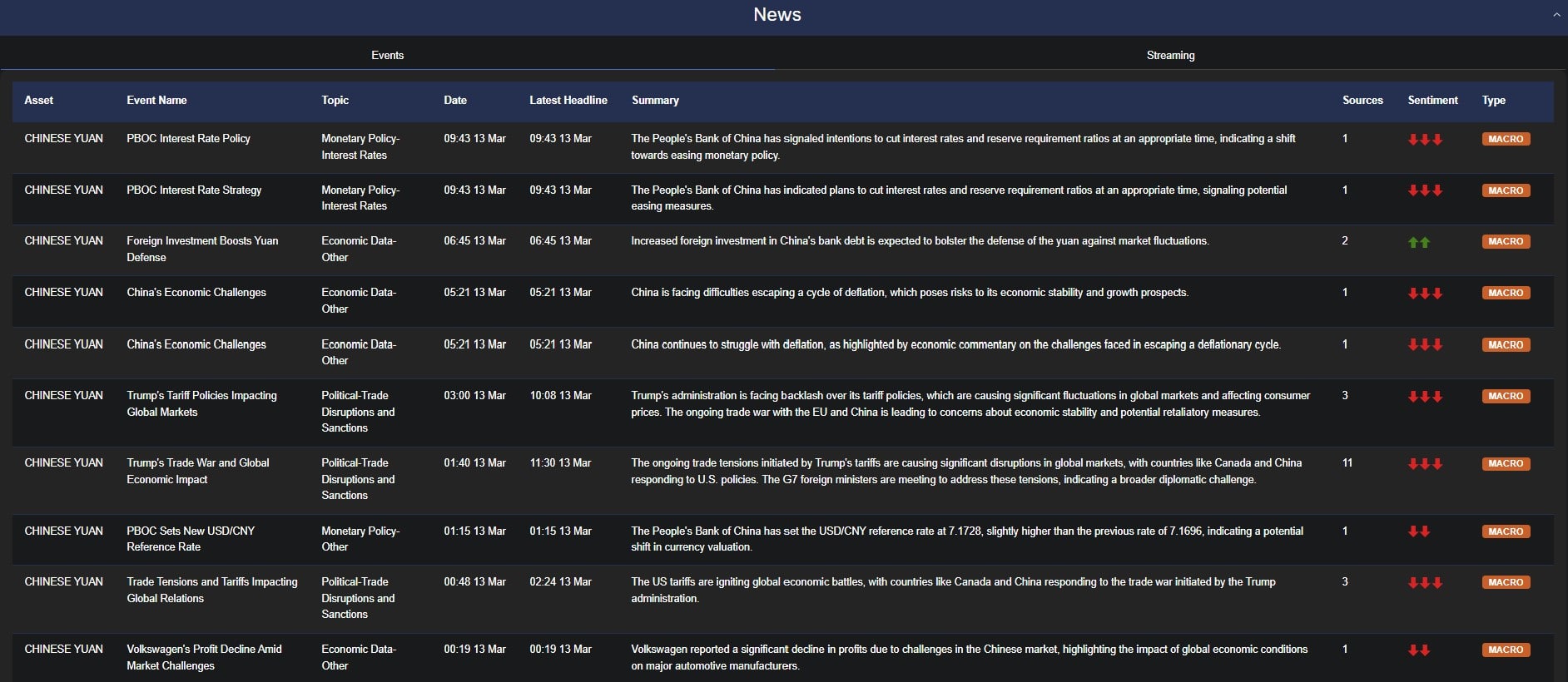

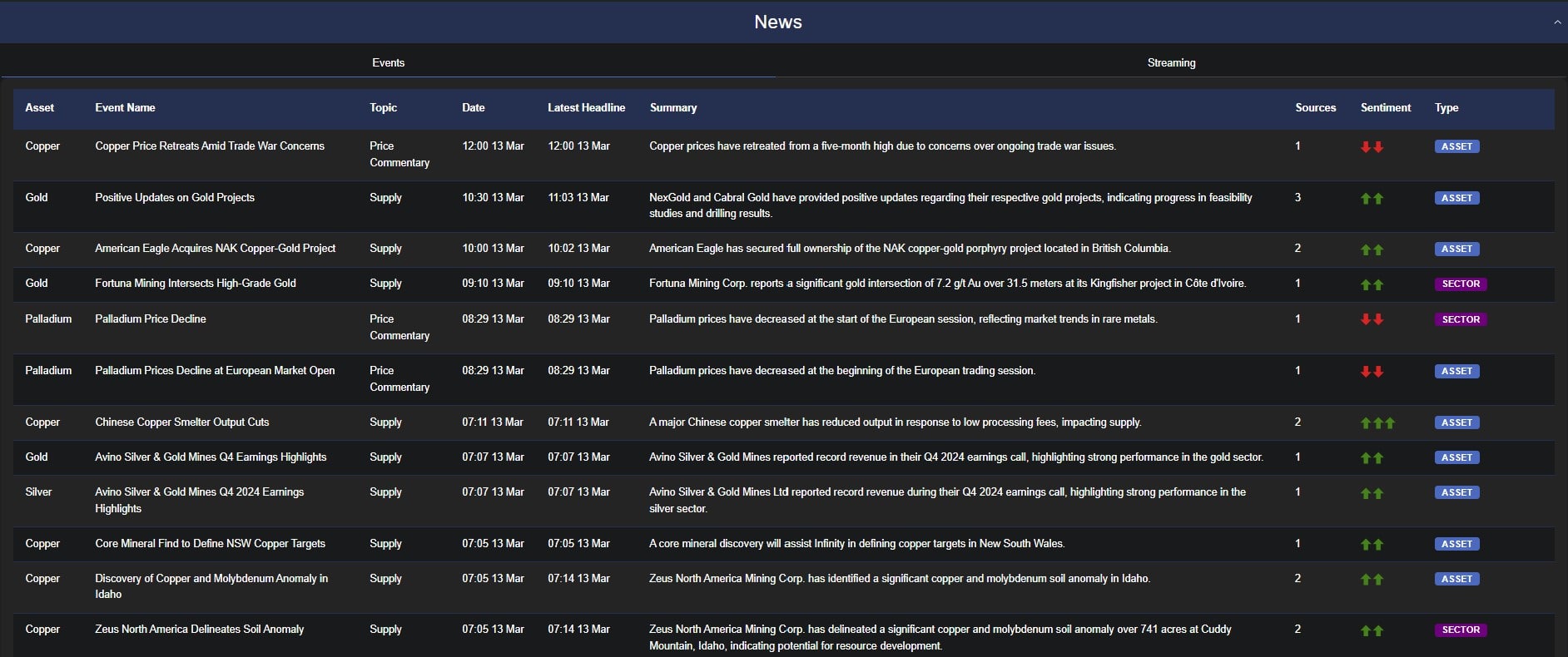

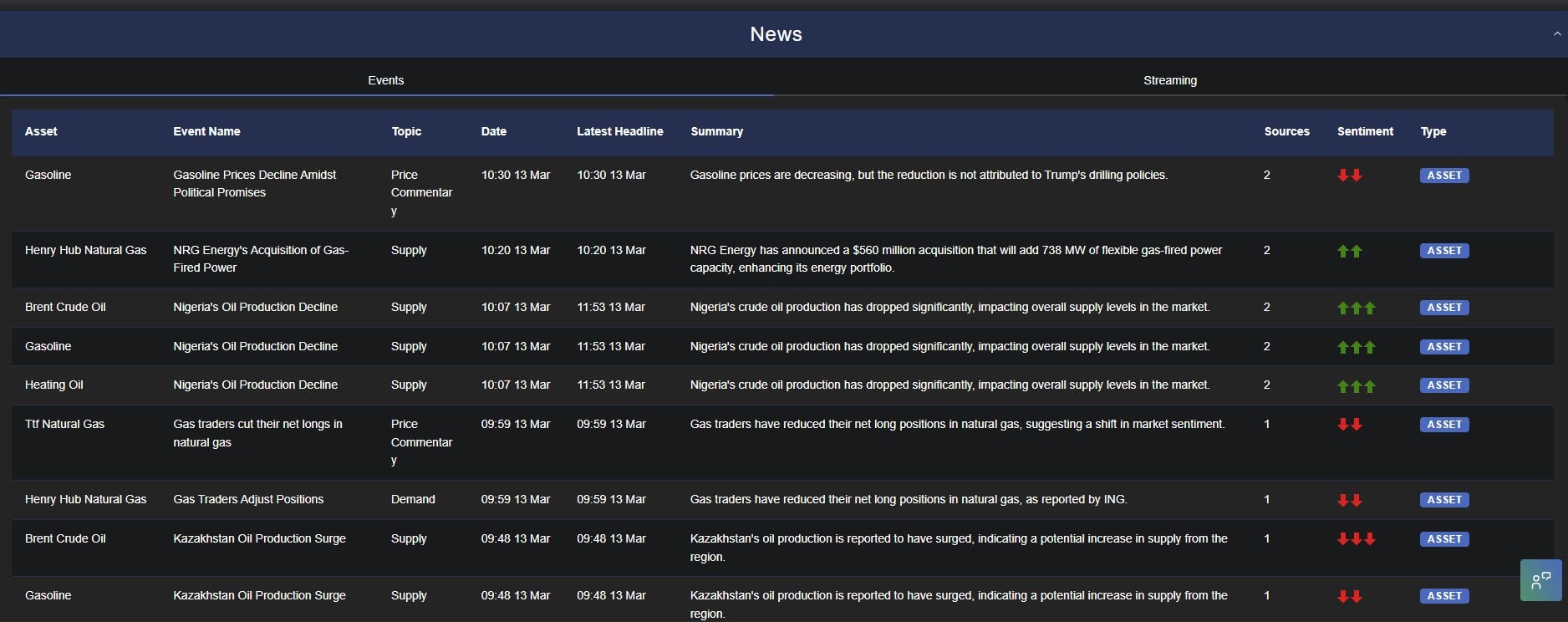

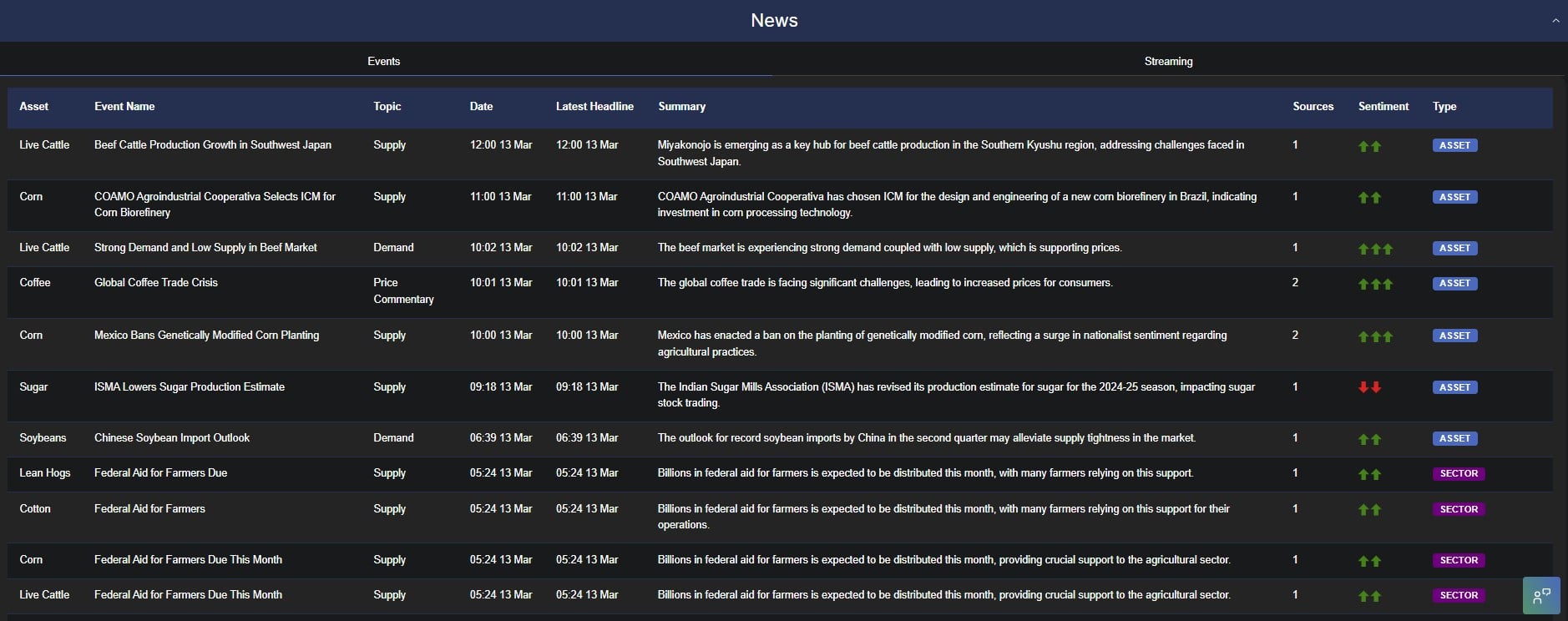

News Intelligence

Ready to Get Started?

Experience the power of Permutable's Trading Co-Pilot firsthand. Request a trial to see how our AI-driven insights can transform your investment strategy.

Our platform integrates with globally recognized and trusted news and data providers.

Impactful Metrics

50k+

Global Sources

Access a vast network of diverse information feeds.

300M+

Articles Processed

Leverage insights from an extensive content base.

200k+

Assets Tracked

Monitor a wide universe of financial instruments.

120+

Countries Covered

Gain global perspective with data from across the world.

What Our Clients Say

"As a trader, I found the tool extremely useful in managing the overwhelming influx of news and translating it into actionable bullish or bearish signals. I was particularly impressed with the regular updates every 2-3 weeks and the seamless, bug-free experience. This tool is beneficial for physical and paper traders as well as market analysts, and I appreciate its valuable features and potential."

— Trader, Harvest Group

Seamless API Integration

Integrate Permutable Co-Pilot's powerful data streams directly into your existing workflows and platforms. Our robust API offers flexible access to real-time insights, sentiment scores, and forecasts, with comprehensive documentation and client libraries in Python, R, and Java.

import requests

# Replace with your actual credentials

API_KEY = "your-api-key"

# Headers

headers = {

"x-api-key": API_KEY,

}

# Query parameters

params = {'start_date': '2024-11-25', 'end_date': '2024-11-25', 'limit': 10, 'offset': 0}

# Make the request

response = requests.get(

"https://copilot-api.permutable.ai/1/events/fundamental/ticker/BZ_COM",

headers=headers,

params=params

)

# Check for errors

response.raise_for_status()

# Get the response data

data = response.json()

print(data)Request a Trial / Demo

Please fill out the form below and we'll get back to you within 24 hours.

Let us answer your questions

What is the Trading Co-Pilot?

The Trading Co-Pilot is an application layer built on Permutable AI’s world, macro and asset data intelligence. It demonstrates how global data, narrative signals and systematic analysis can be operationalised into decision-support workflows.

How does the Co-Pilot fit into Permutable AI’s roadmap?

The Co-Pilot represents one expression of the platform. As Permutable AI expands its data coverage and systematic capabilities, the Co-Pilot will increasingly reflect how those primitives can be applied through interfaces, workflows and integrations.

Who should engage with the Co-Pilot?

The Co-Pilot is most relevant for organisations exploring how global context, macro signals and narrative intelligence can be applied systematically – including trading, research, risk and strategy teams, as well as fintech platforms evaluating future integrations.

How does the Trading Co-Pilot differ from off-the-shelf trading tools?

Most trading tools optimise execution or visualisation. The Trading Co-Pilot is focused on intelligence – helping teams understand how global events, narratives and macro signals interact before decisions are made.

How does the Co-Pilot handle rapidly changing global events?

The Co-Pilot draws on live world and macro data feeds combined with event detection and narrative analysis. This allows shifts in geopolitical, economic and media-driven signals to be identified and contextualised as they emerge.

Will the Co-Pilot support different asset classes over time?

Yes. The intelligence layer behind the Co-Pilot is asset-agnostic by design. As data coverage expands, the same systematic logic can be applied across commodities, energy, equities, fixed income and other markets.

Can Auto Analyst be integrated into existing systems?

Each insight includes a plain-English explanation of the market movement, its likely causes, and sentiment direction – supported by specific events and themes (e.g. monetary policy, trade disruption). There are no black-box outputs. Transparency is central to how Co-Pilot works.

Does the Trading Co-Pilot replace human judgement?

No. The Trading Co-Pilot is built to augment decision-making, not automate it. By structuring global context systematically, it enables analysts and traders to focus on judgement, scenario evaluation and strategy rather than manual data synthesis.

Can we try it before committing?

Yes. We offer access to a live trial environment, demo walkthroughs tailored to your asset focus, and sample API outputs. You’ll be able to evaluate the platform’s relevance and impact within days – not months.

To request a trial, contact us at: enquiries@permutable.ai