*This article examines whether we’re approaching a significant gold revaluation amidst current market volatility, using market sentiment analysis from the Forecast View of our Trading Co-Pilot. It’s aimed at serious investors, wealth managers and financial professionals seeking to understand the complex interplay between short-term price movements and long-term structural factors affecting gold valuations.

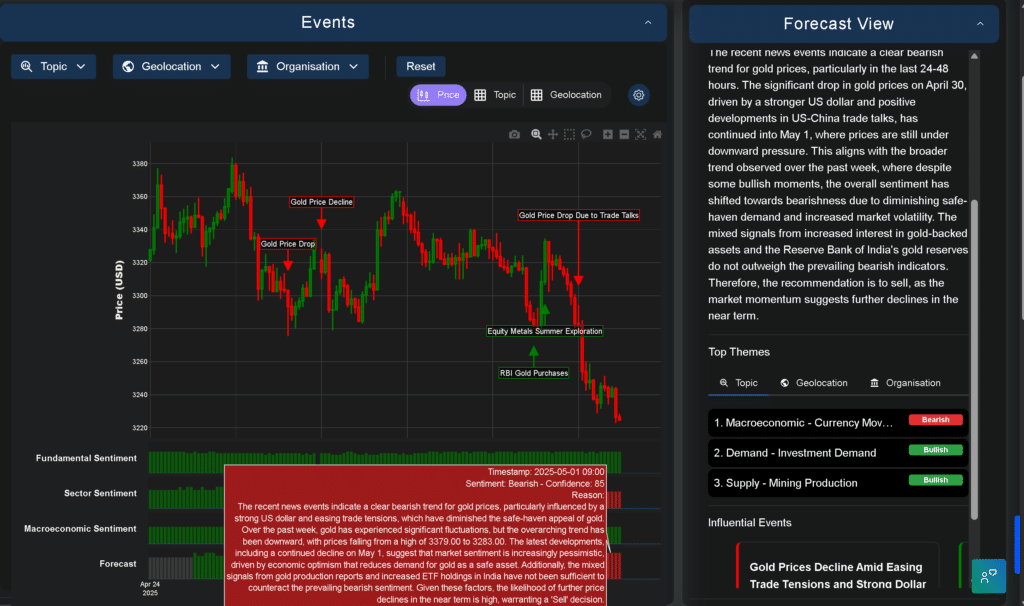

The global economic tremors reverberating through financial markets have once again brought gold into sharp focus as investors question whether we are witnessing the early stages of a significant gold revaluation. Recent market sentiment analysis from our Trading Co-Pilot shows gold experiencing substantial fluctuations, with prices dipping from a high of 3379.00 to 3283.00 in just one week.

This isn’t just because of normal market volatility – the turbulence has been caused by a complex interplay of easing US-China trade tensions, a strengthening US dollar, and shifting investor sentiment away from safe-haven assets. But while these immediate factors are driving short-term price movements, deeper structural forces may be building toward a potential gold revaluation event that could reshape the precious metals landscape.

Recent price trends and market sentiment

For now, our Trading Co-Pilot analysis indicates a clear bearish trend for gold prices. Recent reports show gold prices retreating across various regions, including a Rs 3,400 decline per tola in India. The situation has been exacerbated by diminished buyer interest as prices surged earlier this year.

As so often happens in gold markets, sentiment can shift rapidly. Given market volatility and the current macroeconomic landscape, the question is whether these short-term price movements represent a temporary correction or the beginning of a larger realignment. Our market sentiment analysis suggests that investors remain cautious but have not abandoned their longer-term bullish outlook on gold.

Above: Gold market faces bearish pressure as US dollar strengthens and trade tensions ease — Despite isolated bullish signals such as central bank purchases and exploration news, prevailing macroeconomic and sentiment indicators point to continued downside risk for gold prices into May 2025.

Factors pointing toward a potential gold revaluation

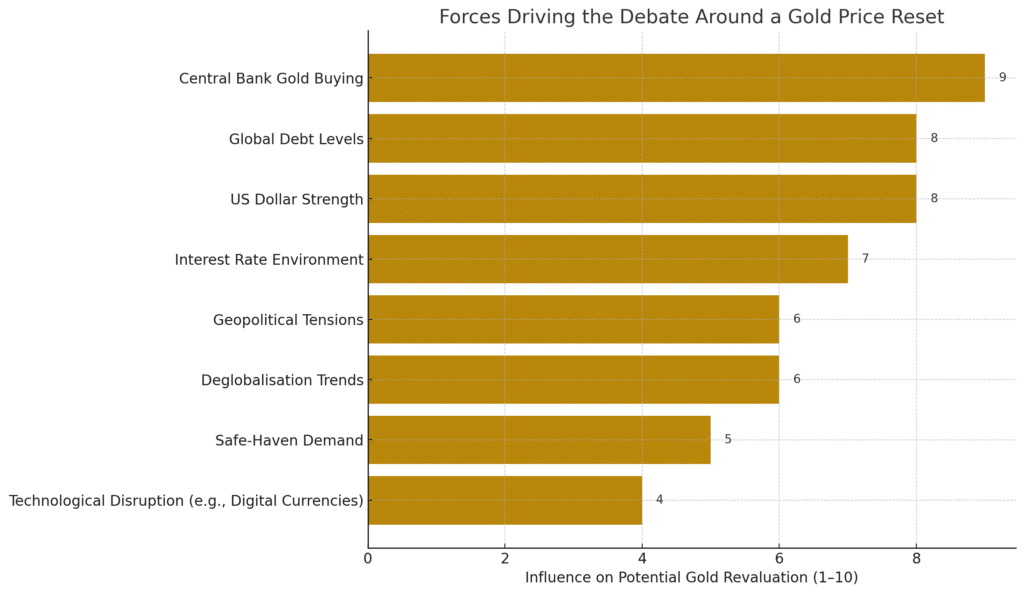

First, the unprecedented expansion of central bank balance sheets since the 2008 financial crisis has created what many analysts view as unsustainable monetary conditions. The blowback could eventually necessitate a significant revaluation of hard assets like gold relative to fiat currencies.

Specifically, central banks themselves have become net buyers of gold, with countries like Russia, China, and Turkey significantly increasing their reserves. These insights from our data suggest that major economic powers are hedging against potential currency instability by accumulating gold reserves at a pace not seen in decades.

The upending of world economic order through deglobalisation trends and increasing geopolitical tensions between major powers adds another layer of complexity. As for the recent trade tensions between the US and China, their temporary easing has contributed to gold’s price decline, but the underlying strategic competition continues to create long-term support for gold prices.

Those who ask whether a gold revaluation is imminent point to strengthening economic data and the resilience of the US dollar as evidence against such a scenario. As the reality of higher-for-longer interest rates sets in, the opportunity cost of holding non-yielding assets like gold increases. Then there are the increasing acceptance of digital currencies as an alternative safe haven asset which could potentially diminish gold’s monetary role in the future.

All of these points suggest that while the structural conditions for a gold revaluation exist, however the timing remains highly uncertain. But that outcome isn’t necessarily a negative for strategic gold investors with long-term horizons.

Above: Key macroeconomic and geopolitical drivers shaping the debate around a potential gold price reset, with central bank gold buying and global debt levels emerging as the most influential factors in early 2025.

Market implications and considerations

The unpredictability of gold price movements in the current environment makes tactical trading challenging. For better or worse, gold remains both a safe-haven asset and a speculative vehicle, with its price influenced by everything from inflation expectations to jewellery demand in major consumer markets like India and China.

There is a great deal of fear amongst investors about missing out on potential protection should a gold revaluation occur. As well as traditional investment channels, we’re seeing increased interest in gold-backed cryptocurrencies and other innovative vehicles that allow investors to gain exposure to potential gold price appreciation.

Unlocking the potential means understanding gold’s dual nature as both a commodity and a monetary asset. This brings us back to the fundamental question: are we heading toward a gold revaluation event? We believe that while current price action suggests bearishness, the underlying structural factors supporting a significant gold revaluation remain intact.

The path forward

Amid all of this speculation, predicting the exact timing of a potential gold revaluation remains challenging. For investors concerned about preserving wealth through periods of monetary uncertainty, maintaining a strategic allocation to gold may be prudent regardless of short-term price movements.

The question is not whether gold will experience volatility – it certainly will – but whether it continues to serve its historical role as a store of value during periods of financial stress and currency debasement. These concerns shape how forward-thinking investors are positioning themselves despite recent price declines.

For now, our analysis suggests maintaining a cautious approach to gold investments while acknowledging the legitimate structural forces that could eventually drive a significant gold revaluation. The path forward may be volatile, but the role of gold in preserving wealth through monetary upheaval remains as relevant as ever in today’s uncertain financial landscape.

Stay ahead of gold market movements with our powerful market intelligence

Ready to navigate the complexities of gold markets with confidence? Access our comprehensive market intelligence through our Trading Co-Pilot Terminal or integrate our API directly into your trading infrastructure. Our real-time analysis and sentiment tracking provide the critical insights you need to position your portfolio effectively, whether we’re heading for a gold revaluation or continued market volatility. Simply email enquiries@permutable.ai to request a demo or fill in the form below.