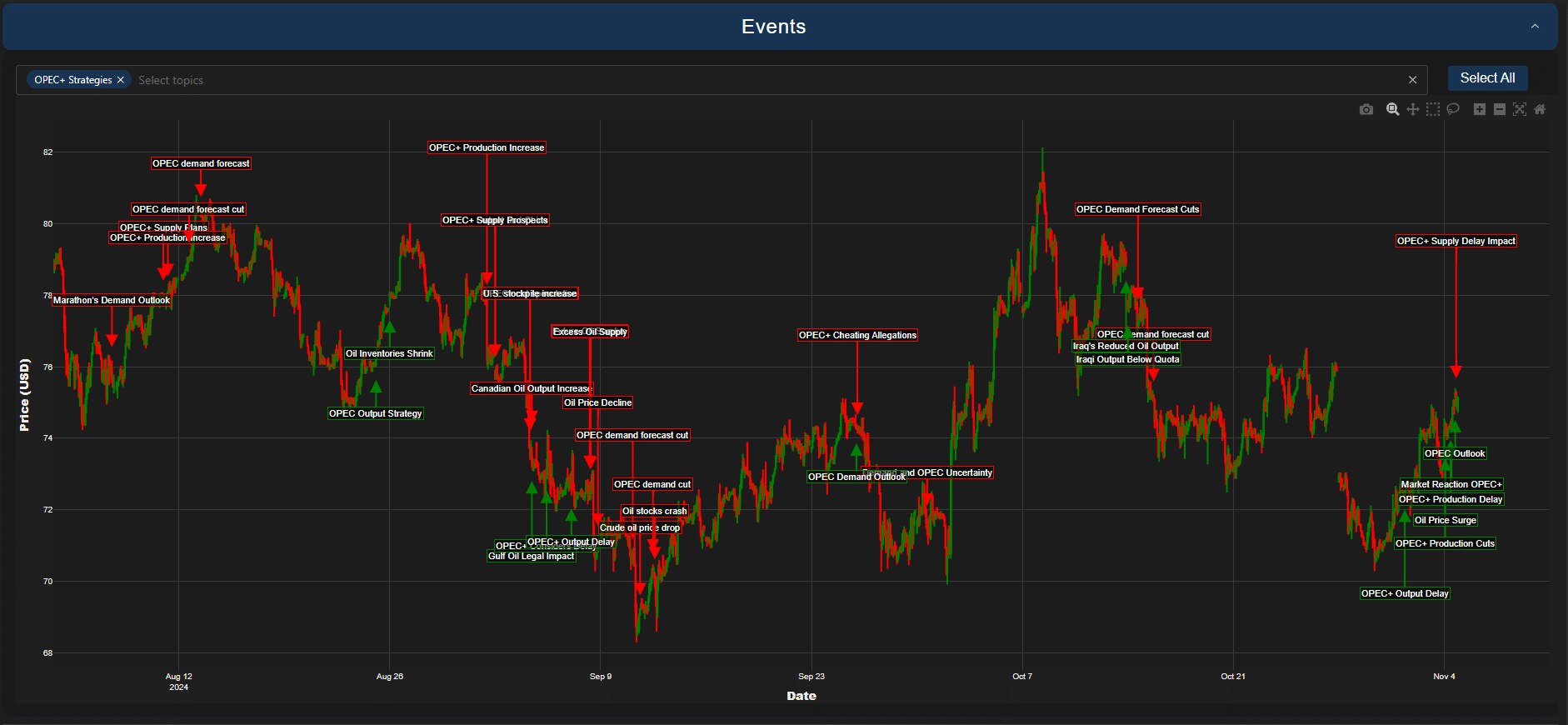

For a long time, we have seen OPEC’s commanding presence in global oil markets, wielding influence through both direct and indirect means. A look at event and announcement data from our Trading Co-Pilot over the selected period of August to November 2024 (see above image) particularly illustrates the way OPEC influenced the price of oil and associated market responses.

Even before the recent price fluctuations, the way OPEC influences the price of oil has been a cornerstone of global energy markets. On closer inspection of the above chart from our Trading Co-Pilot, we can observe multiple instances where OPEC’s announcements regarding production strategies triggered immediate price movements.

Sketching out OPEC’s primary mechanisms for influencing oil prices, we can identify several key drivers. Let’s take a closer look at 8 ways OPEC influences the price of oil below, with insights taken from our Trading Co-Pilot:

5 ways OPEC influences the price of oil

1. Production quota management

OPEC’s quota system is the first major factor to mention here. The chart clearly shows how OPEC+ production increases and cuts directly correlate with price movements. There have been concerns that this level of market control could be challenged, but historically, OPEC’s ability to influence the price of oil through quota management has remained robust.

2. Market psychology and announcements

So how is OPEC seemingly able to move markets with mere words? The idea is to understand that oil markets are highly responsive to signals, and this is one of the primary ways OPEC influences the price of oil. Today, it’s evident from the trading data that OPEC demand forecasts and supply prospects can trigger substantial price movements even before actual production changes occur.

3. Strategic supply delays

In recent weeks, we’ve observed how OPEC’s supply delay impact has affected market dynamics. Supporters of this strategy argue it helps maintain market stability, while critics contending that it leads to artificially inflated prices, which may strain energy-dependent industries and consumers. Meanwhile, optimists believe that such measures are necessary for long-term market health.

4. Member compliance

But, fundamentally, OPEC’s influence on oil prices depends heavily on member compliance. Building that back up will take consistent effort, as highlighted by the “OPEC+ Cheating Allegations” marker in our Trading Co-Pilot chart, which highlights the challenges associated with compliance monitoring in order to maintain trust and the system’s credibility.

5. Demand forecasting

There may sometimes be exceptions to the rule, but predominantly, OPEC’s demand forecasts significantly influence market sentiment – although some may argue that they are losing their influence in the global oil market. However, our Trading Co-Pilot tells a different story, with the image above highlighting that OPEC’s announcements have become increasingly impactful on price movements.

Amid global shifts in energy, for the time being at least, OPEC’s influence on oil prices remains substantial. Perhaps this shouldn’t be attributed to market power alone, but rather to the organisation’s unique position in global energy markets. Though skeptics will say that OPEC’s power is finally failing – and perhaps this argument holds water to a certain extent, insights from our Trading Co-Pilot show that OPEC is still able to shape market narratives. In fact, the our analysis shows multiple instances where OPEC’s strategic communications led to significant price movements.

Of course, it is expected that OPEC’s influence on oil prices will diminish as energy markets transform. Until then, the data suggests that while the mechanisms of influence may change, OPEC’s ability to impact oil prices remains significant. Looking at the recent price surge following OPEC+ production cuts, it’s clear that the organisation continues to wield substantial market power.

Track OPEC’s market impact in real time with our Trading Co-Pilot

The relationship between OPEC announcements and oil price movements requires sophisticated real-time monitoring to capture trading opportunities in an increasingly volatile market. Our Trading Co-Pilot platform helps you do exactly that.

As our analysis demonstrates, timing and insight are everything when it comes to trading around OPEC events. With our Trading Co-Pilot, you’ll get access to:

- Real-time alerts on OPEC announcements and market responses

- AI-powered analysis of price impact patterns

- Historical context for current market movements

- Predictive insights on potential market reactions

Don’t let critical OPEC-driven trading opportunities slip by. Experience how our Trading Co-Pilot can enhance your market intelligence and trading decisions by requesting a free trial or demo. Simply fill in the form below to speak to a member of our team.