Over the past week, Microsoft’s stock has experienced a noticeable decline. So then, the expectation that tech giants like Microsoft would continue their upward trajectory has been challenged. So much of the past year has seen remarkable growth in tech stocks, and it seemed that tech stocks were unstoppable but with Microsoft’s recent tumble, it begs the questions – but what of the future? Get our latest thinking on the key factors that have led many to ask the question “why is Microsoft stock down” in recent performance, with insights taken from our Trading Co-Pilot.

Why is Microsoft stock down? It all started with geopolitical tensions

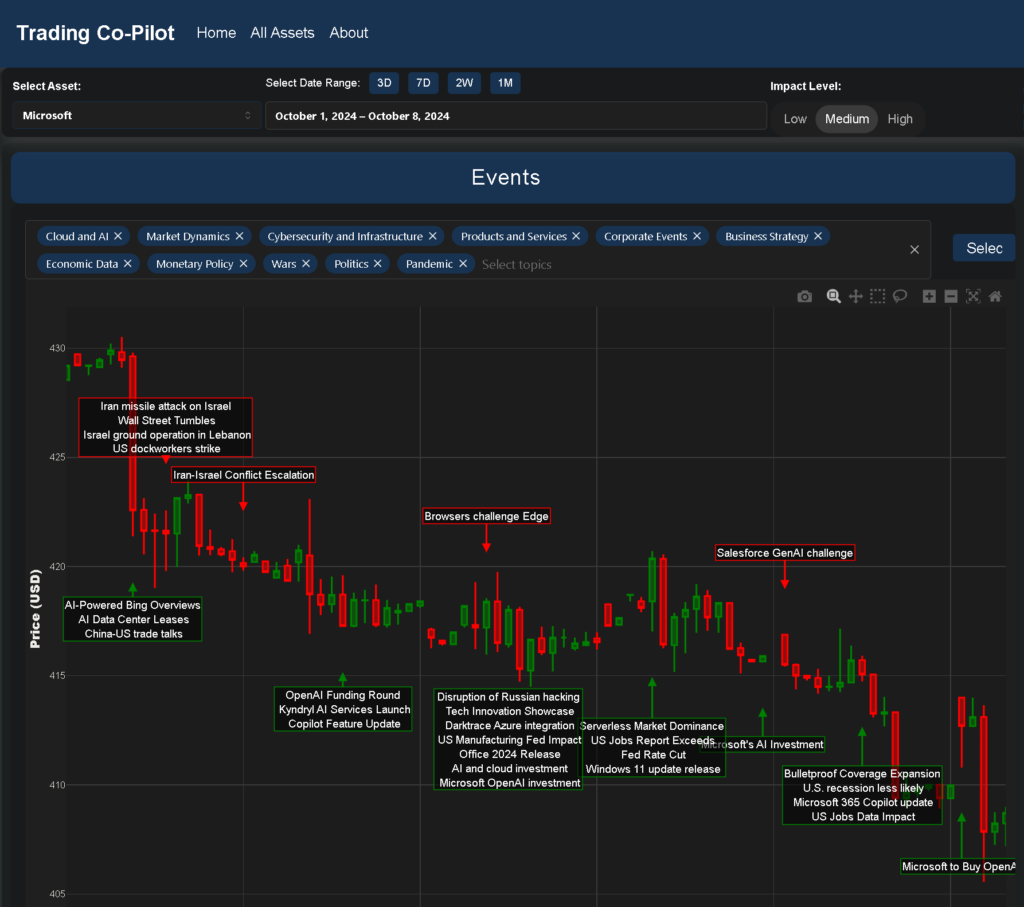

In recent weeks, global events have cast a long shadow over the markets. The catalyst for the initial sharp drop in Microsoft’s stock appears to be the escalating conflict between Iran and Israel which left markets on tenterhooks. This geopolitical situation has sent shockwaves through Wall Street, causing a broader market tumble, contributing to the stock’s decline.

There is broad consensus that geopolitical stability is crucial for market confidence. The present state of play, with missile attacks and ground operations, has injected a significant dose of uncertainty into the market. This uncertainty is a key factor that investors are grappling with, leading to cautious trading and downward pressure on stocks like Microsoft. But this is just one factor at play.

AI competition: A tech industry challenge explaining why Microsoft stock is down

Meanwhile, beneath the facade of geopolitical tensions, another significant factor is at play in the tech sector. It has now very clearly emerged that the AI race is heating up, with implications for Microsoft’s market position. With Salesforce challenging Microsoft with a GenAI copilot and rival browsers challenging Microsoft’s Edge practices are signs that competition is intensifying, potentially being a contributing factor to why Microsoft stock is down.

Some reckon the mood is shifting as investors reassess the AI landscape. Microsoft’s significant investments in AI, including its involvement with OpenAI, have been a key driver of its stock performance. However, as other players enter the field, there’s growing uncertainty about who will emerge as the dominant force in AI, contributing to the reasons why Microsoft stock is down.

Economic indicators and market sentiment: Broader factors in why Microsoft stock is down

The same principle applies to broader economic factors. With the US jobs report exceeding expectations and discussions about potential Fed rate cuts, it’s important to remember that these elements that influence the entire market, including tech stocks. These economic indicators can be double-edged swords, as strong employment figures might delay anticipated rate cuts. There is an argument that this could potentially impact growth stocks like Microsoft and offering another explanation for why Microsoft stock is down.

Microsoft’s internal developments: Do they explain why Microsoft stock is down?

Achieving its goals is crucial for Microsoft, and several internal developments are worth noting. The Windows 11 update release and Microsoft 365 Copilot update demonstrate the company’s continued focus on its core products. However, a key question is how these updates will be received by consumers and enterprises, and whether they can drive growth in an increasingly competitive landscape.

The cloud and AI investment landscape: Long-term factors

This trend has ramped up significantly in recent years, with Microsoft making substantial investments in AI and cloud technologies. However, the crucial aspect lies in how these investments will translate into tangible market advantages and revenue growth in the face of fierce competition from the likes of Google, and Amazon, for instance, potentially influencing why Microsoft stock is down in the short term.

Looking ahead: The factors shaping Microsoft’s future and stock performance

So much of the past has been about Microsoft’s dominance in enterprise software and its successful pivot to cloud computing. But most industry insiders think that the future will be defined by AI integration and innovation. A key consideration here is how well Microsoft can leverage its world-class research and development capabilities to stay ahead of the curve.

The broader tech landscape and why Microsoft stock is down

Meanwhile, it’s easy to forget that, amid the many distractions of recent weeks, the tech industry as a whole is undergoing significant changes. The disruption of Russian hacking, tech innovation showcases, and the growing importance of serverless architectures are all elements that could influence Microsoft’s position in the market and contribute to why Microsoft stock is down.

Final thoughts of why Microsoft stock is down

In a bizarre twist, the very elements that have driven Microsoft’s growth in recent years – AI, cloud computing, and global market dominance – are now contributing to the uncertainty surrounding its stock performance. This has all been bubbling under the surface for years, but recent events have brought these factors into sharp focus, offering a potential yet complex answer to why Microsoft stock is down.

As predicted by many analysts, the tech sector is entering a period of recalibration. Growth is important – actually, it’s essential for companies like Microsoft. But achieving sustainable growth in the face of geopolitical tensions, economic uncertainty, and intense competition requires a delicate balance.

There’s a big wheel moving in the right direction for Microsoft in terms of its long-term strategy and investments. However, in the short term, the factors we’ve discussed are creating headwinds that are reflected in the company’s stock performance and offer some explanation as to why Microsoft stock is down.

The catalyst for future growth will likely come from Microsoft’s ability to navigate these complex challenges successfully. By leveraging its world-class resources and adaptability, Microsoft has the potential to turn these challenges into opportunities. However, investors should be prepared for a period of volatility as the market adjusts to the new realities of the tech landscape.

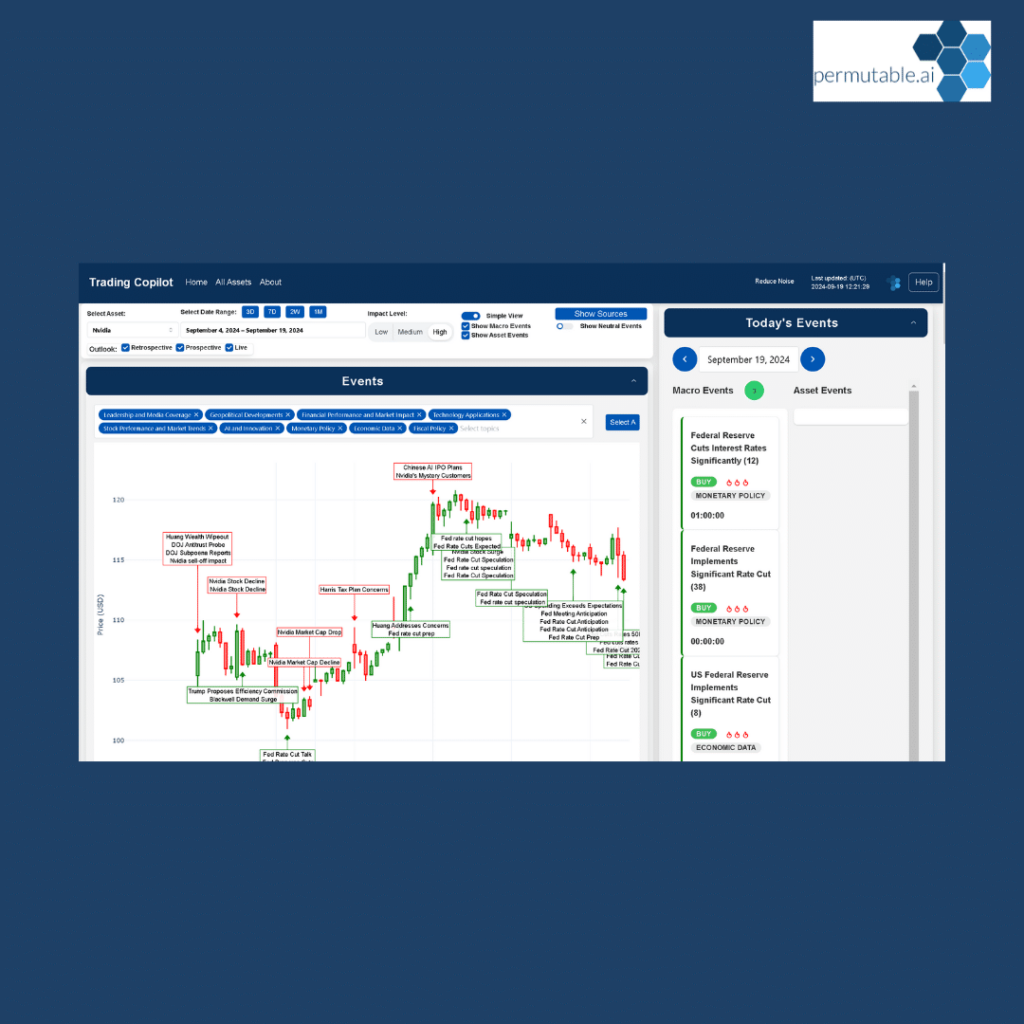

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of trading? Our Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.