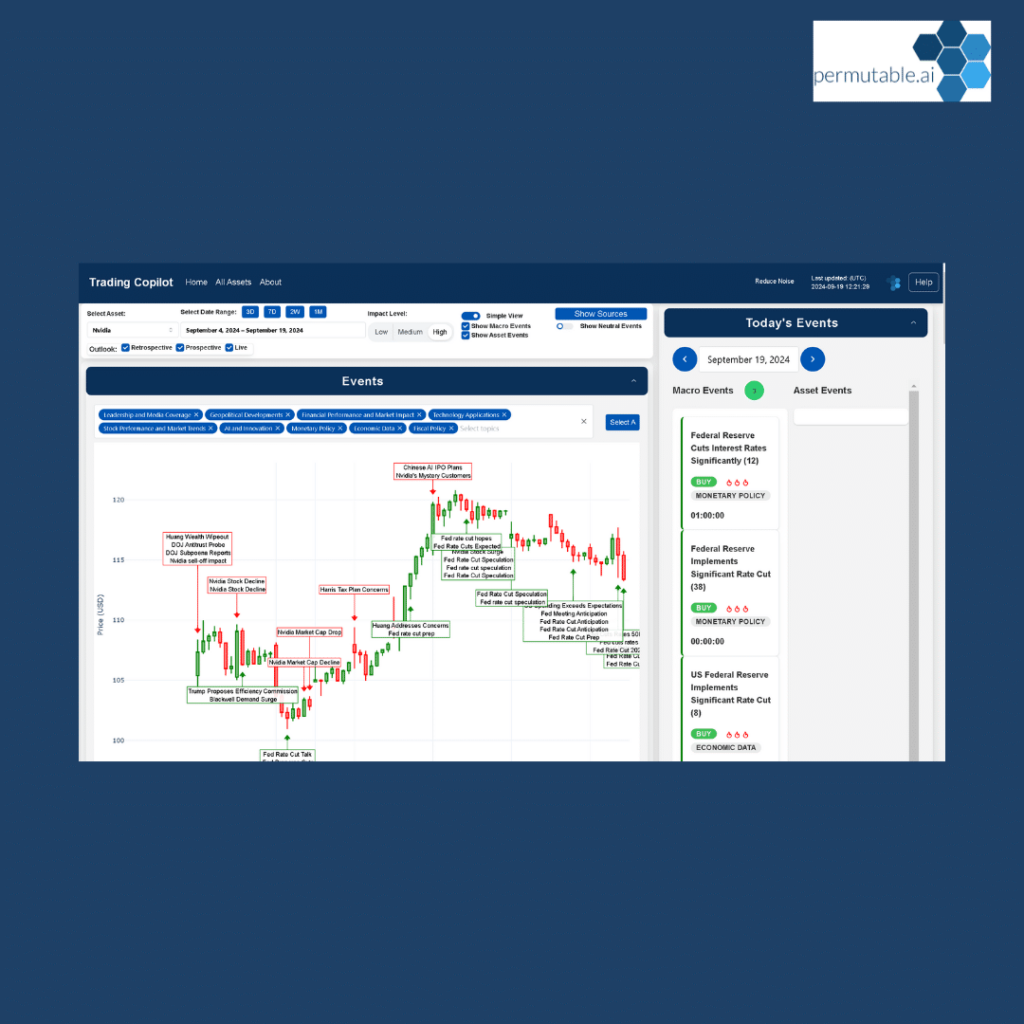

The expectation that Moderna’s stock would continue its upward trajectory has been challenged in recent weeks. Why is Moderna stock dropping? This question is on the minds of investors and industry watchers alike. The present state of play shows a clear downward trend from early October 2024, with several key events punctuating this decline. In this article, we’ll answer the question “why is Moderna stock dropping” with insights from our Trading Co-Pilot.

Why is Moderna stock dropping? Contributing factors

Phase III trial start: A double-edged sword

Separately, the start of a Phase III trial, typically a positive development, seems to have had a mixed impact. While it demonstrates progress in Moderna’s pipeline, it also introduces uncertainty. Some reckon the mood is cautious, as Phase III trials are costly and success is never guaranteed. This event marks the beginning of the observed decline in Moderna’s stock price.

The Moderna Taiwan agreement: Global expansion meets market scepticism

It has now emerged that Moderna’s agreement with Taiwan’s Cenra Healthcare, while potentially opening new markets, didn’t boost investor confidence for very long. Why is Moderna stock dropping despite this international expansion? This suggests that the market believes that global growth alone may not be sufficient to drive stock prices up in the current climate.

Patent lawsuits and legal challenges

Another factor contributing to why Moderna stock is dropping is the patent lawsuit highlighted in the timeline. Despite winning the battle against Alnylam, legal challenges can be costly and time-consuming, potentially diverting resources from R&D and commercial activities. This is at the core of investor concerns, as intellectual property disputes in the biotech sector can have long-lasting impacts.

Economic headwinds: US manufacturing and Fed decisions

The US Manufacturing Fed impact noted in the chart indicates broader economic factors at play. Meanwhile, the subsequent Fed Rate Cut seems to have provided only temporary relief to Moderna’s stock price. There is broad consensus that biotech stocks like Moderna are sensitive to economic indicators and monetary policy decisions.

Class action deadlines: A red flag for investors

Now let’s turn to the two class action deadlines. This has all been bubbling under the surface for years, but the proximity of these deadlines appears to have spooked investors. Why is Moderna stock dropping so sharply around these dates? It’s likely that the market fears potential financial and reputational damage from these legal proceedings.

Q3 decline: Financial performance under scrutiny

The Moderna Q3 decline marker on the chart is a clear catalyst for the stock’s continued downward trajectory. This suggests that the company’s financial performance hasn’t met market expectations. Achieving its goals is crucial for Moderna, and this quarterly decline raises questions about the company’s ability to deliver consistent results.

U.S. recession less likely: A silver lining?

Interestingly, with the U.S. recession is less likely appearing towards the end of the chart, however, this positive economic indicator doesn’t seem to have reversed Moderna’s stock decline. This requires us to look deeper into company-specific factors to understand why Moderna stock is dropping even as economic outlooks improve.

The broader context: Biotech sector challenges

Beneath the facade of individual events, the biotech sector as a whole faces challenges. Much has changed since the height of the pandemic when vaccine makers like Moderna saw soaring stock prices. The same principle applies to many companies in this space: adapting to a post-pandemic market as well as ongoing governance issues is proving difficult.

Innovation and pipeline development

The good news is, that by leveraging its world-class mRNA technology platform, Moderna has the potential to develop groundbreaking treatments beyond COVID-19 vaccines. However, the market appears to be in a “show me” phase. Why is Moderna stock dropping despite its innovative potential? The answer is that investors may be waiting for concrete results from the company’s diverse pipeline before regaining confidence.

Future outlook and market sentiment

So much of the past was defined by Moderna’s COVID-19 vaccine success, but what of the future? There’s a big wheel moving in the right direction in terms of Moderna’s research and development efforts. However, the stock price suggests that the market is recalibrating its expectations.

Why is Moderna stock dropping: Final thoughts

As predicted by many analysts and think tanks, the biotech sector is entering a new phase post-pandemic. Growth is important – actually, it’s essential for companies like Moderna. But most industry insiders think that the path forward will be more challenging than the rapid ascent seen during the height of vaccine development.

Why is Moderna stock dropping? Ultimately, it goes much deeper than any single factor. The combination of legal challenges, economic uncertainties, and the need to prove long-term value beyond COVID-19 vaccines has created a perfect storm for Moderna’s stock price. If we look back over the events highlighted by our Trading Co-Pilot, it’s clear that we’re looking at a company grappling with multiple challenges simultaneously. From clinical trial uncertainties to legal hurdles and economic headwinds, one thing’s for certain – Moderna faces a complex landscape.

Yet, it’s easy to forget that, amid the many distractions of recent weeks, Moderna remains a leader in mRNA technology with significant potential. The current stock slump may well be a recalibration rather than a fundamental shift in the company’s prospects. For investors and industry observers, the key will be watching how Moderna navigates these challenges. Will its pipeline deliver new breakthroughs? Can it overcome legal hurdles? And perhaps most importantly, can it adapt to a changing market where COVID-19 is no longer the primary driver of its stock price?

As the biotech sector evolves, Moderna’s journey will be one to watch closely. The reasons why Moderna stock is dropping are multifaceted, but so too are the opportunities that lie ahead. In the dynamic world of biotech, today’s challenges often pave the way for tomorrow’s breakthroughs.

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of trading? Permutable AI’s Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.