Gold has always been a barometer for the global economy, with investors traditionally turning to the precious metal during periods of uncertainty. The recent outlook for gold has been one of rising prices. But what actually is going on here? Everywhere you look, the question persists: why is the price of gold going up? And how long can this last? The truth is more complicated than a simple explanation, but through our analysis and insights from our Trading Co-Pilot, we can be reasonably confident that several key factors are contributing to this surge.

Why is the price of gold going up?

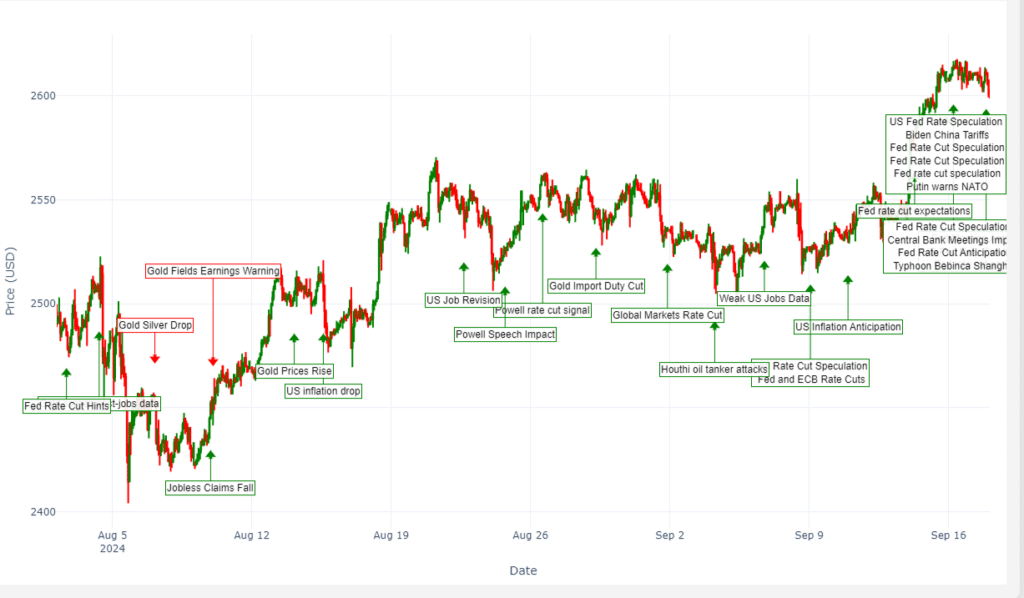

Above: Gold’s price movements: Data-driven insights from our Trading Co-Pilot

Inflation concerns

One of the most frequently cited reasons for gold’s price increase is inflation. We live in an age of highly volatile geopolitics, and the economic impact of post-pandemic recovery, supply chain disruptions, and increased government spending has fuelled inflationary pressures globally. As such, the crisis in rising inflation has seen central banks respond with aggressive monetary tightening measures, including interest rate hikes. And yet, perhaps, we can expect inflationary fears to persist for some time, given the unstable economic climate.

While core inflation numbers showed a slight decrease last week, many analysts argue that these figures can be misleading. The continued increase in government spending may be a more representative indicator of the economy’s health. This recent decrease in inflation has shifted market expectations from a 50 basis point rate cut to a more modest 25 point one. However, the underlying inflationary pressures remain a concern for many investors

Much of that is due to fears that monetary policies alone cannot temper inflation. The loss of trust in governments’ ability to manage economic volatility is driving more investors toward gold, a traditional hedge against inflation. In addition, the escalating costs of living are feeding into an ongoing uncertainty about the future. This method applies to both individual investors seeking a safe haven and institutional investors looking for stability.

Why is the price of gold going up: Geopolitical uncertainty

You can’t argue with the fact that gold thrives in times of geopolitical unrest. This is especially true given that we live in a world of highly complex and rapidly changing global dynamics. The war in Ukraine, rising tensions in the South China Sea, and general instability across various regions all play a part in the price of gold. The hardest part is predicting how these events will unfold, but the truth is, gold provides a cushion for investors seeking refuge from volatile global markets.

As long as we rely on traditional safe havens like gold, we can expect its price to increase whenever there is uncertainty on the global stage. The present outlook for geopolitical stability is far from optimistic, which is likely to keep gold in demand for the foreseeable future.

Decline in bond yields

Another key factor driving the price of gold is the decline in bond yields. With real yields (adjusted for inflation) either low or negative, investors are increasingly looking for alternative stores of value. Defining what is classed as a “good” return has shifted over the past few years, especially as central banks have kept interest rates low for an extended period. This dynamic puts gold in an attractive position since it does not pay interest or dividends, but offers long-term value preservation, making it a more appealing investment compared to bonds.

In a way, this shift reflects broader market concerns about the ability of traditional investments to deliver the kinds of returns seen in the past. The keys to gold’s appeal lie in its historical track record of retaining value, especially when other asset classes underperform.

Why is the price of going going up: US dollar weakness

If you’re asking “Why is the price of gold going up?”, the next question you should be asking is what about the US dollar? Gold and the US dollar typically have an inverse relationship. When the dollar weakens, gold prices tend to rise, and vice versa. Recently, the dollar has experienced bouts of weakness due to various factors, including trade deficits and changes in monetary policy.

Recent central bank decisions have further influenced the dollar’s strength and, consequently, gold prices. The European Central Bank’s recent rate cut, coupled with the anticipated Federal Reserve rate decision, have been key factors in shaping market expectations. These expectations have been building since Federal Reserve Chairman Jerome Powell’s speech in late August, signaling a potential shift in monetary policy. Such changes in interest rate policies often lead to fluctuations in currency strengths, impacting gold prices. As the US dollar potentially weakens in response to these rate cuts, we may see a corresponding rise in gold prices

Despite this, there are things that can be done to stabilise the dollar in the long run. However, the game changer will be how investors react to continued fluctuations in global currencies. Just as notably, gold serves as an alternative when confidence in fiat currencies, like the US dollar, wanes. We must therefore be ready to reject the argument being made that gold’s rise is merely temporary—it is tied to structural concerns about global currency values.

Gold as a hedge against economic volatility

If experience tells us anything, it’s that gold has always been viewed as a safe haven during times of economic turmoil. The present moment is no different. Increasingly, investors are turning to gold as a hedge against stock market volatility, political uncertainty, and inflationary pressures. In addition, economic instability caused by high debt levels, especially in developing countries, further supports gold’s ascent.

The keys to understanding gold’s current trajectory, therefore, is looking at both short-term market forces and long-term systemic challenges in the global economy. Ultimately, what is needed is a comprehensive view of how these elements converge to shape the price of gold.

Supply and demand dynamics

Another often-overlooked factor to consider when mulling over the question “Why is the price of gold going up” is the supply and demand for gold itself. Imagine too the impact of reduced mining outputs or increased demand from countries like China and India. For the avoidance of doubt, gold is still viewed as a tangible store of wealth in many cultures, which supports long-term demand. While central banks across the globe continue to increase their gold reserves, retail investors and sovereign wealth funds alike are also adding gold to their portfolios.

However, the question remains: how sustainable is this trend? The truth is more complicated. What we’ve found is that supply constraints in the gold market—whether due to geopolitical risks in mining regions or environmental regulations—add to upward price pressure.

Why is the price of gold going up and what does the future have in store?

So, what actually is going on here, and what can we expect? Everywhere you look, the signs point to continued growth in gold prices, at least in the near future. But we live in an uncertain world, and sometimes it feels like anything is possible – especially when it comes to the rollercoaster of the markets. It’s important to remember the rise will almost certainly not be linear or without setbacks. The truth is, gold is likely to experience fluctuations, but the long-term trajectory suggests that it will remain a vital asset in the portfolios of investors around the world.

For the avoidance of doubt, we must acknowledge that gold’s role in the global economy has shifted over time. But there is no doubting its current relevance, particularly in a world marked by volatility, inflationary pressures, and geopolitical risks. And at least let’s debate it: gold may not be the solution to every economic problem, but it has proven time and again to be a reliable hedge against instability.

Trading Co-Pilot exclusive access

Are you ready to be part of the future of trading? At Permutable AI, we’re extending an exclusive opportunity to a select group of corporate partners to gain early access to our advanced Trading Co-Pilot, powered by cutting-edge machine learning for contextual understanding.

This is a rare chance to stay ahead of the competition by leveraging AI that not only processes data but also grasps the global context—analysing real-time sentiment and market-shaping events to deliver more precise and risk-aware trading strategies.

If your firm is ready to lead the way in AI-driven trading innovation, get in touch today to explore this limited opportunity and discover how our Trading Co-Pilot can transform your approach to the market by contacting us at enquiries@permutable.ai or fill in the form below.

Get in touch

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.