In the evolving landscape of business, the significance of Environmental, Social, and Governance (ESG) factors is increasingly paramount. Companies are being assessed not solely on their financial performance, but also on their commitment to sustainability, ethical practices, and sound governance. One such company that has been making significant strides in the ESG arena is the Drax Group, a British electrical power generation company that has been transforming its business model to focus on renewable energy sources. In this article, we will delve deeper into the 2023 ESG rating of Drax Group, its evolution over time, and the initiatives the company has undertaken to enhance its score.

Understanding Drax Group’s ESG Score

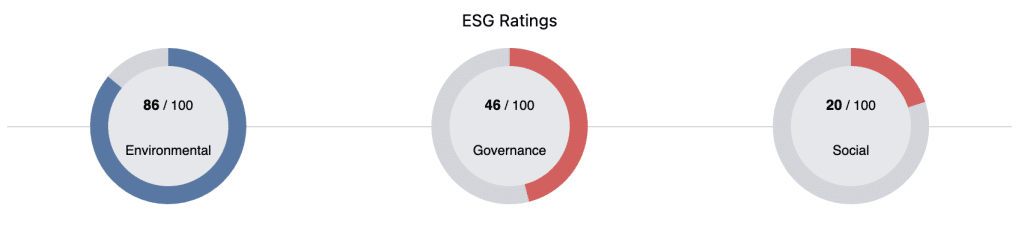

Drax Group’s ESG performance has been evaluated by several organisations, each with their unique criteria and methodologies. Here’s a snapshot of their ratings:

- Sustainalytics ESG Risk Rating: 25.9 (Low Risk 0 to High Risk 100)

- Moody’s ESG Solutions: 62 (0 to 100, with 100 being the highest score)

- MSCI ESG Ratings: AA (AAA-CCC)

To access the full ESG report click here . These ratings reflect Drax Group’s commitment to ESG principles and its efforts to manage related risks. However, it’s important to note that these scores may change over time.

Drax Group’s Actions to Improve ESG Score

Drax Group has taken several actions to improve its ESG score. These include participating in the UN Global Compact since 2018, being a constituent of the FTSE4Good Index Series, and receiving a B rating in the CDP Climate Change Programme and CDP Forests Programme.

They’ve implemented numerous ESG-linked initiatives, including a trailblazing ESG-linked foreign exchange (FX) derivatives initiative. In 2019, Drax secured a £125m ESG CO2 emission-linked loan facility, which was a global first for a power generator and also rolled out the first sustainable CO2 emission-linked deferred letter of credit facility. In late 2020, the group refinanced its existing revolving credit facility (RCF), replacing it with a new £300m ESG RCF, thereby incorporating ESG methodology across the full corporate finance spectrum.

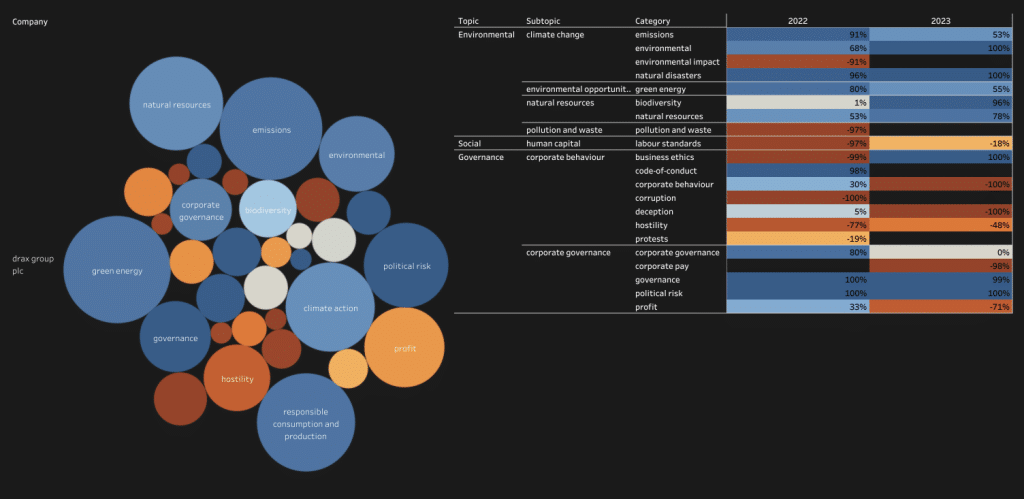

Following is a snapshot of Drax Group’s public sentiment analyiss provided by our sustainability analytic models:

to access our company ESG Reports dashboard with 7000 comprehensive live reports click here.

Initiatives to Address Climate Change

Drax Group has set an ambitious target of becoming a carbon negative business by 2030. To achieve this, Drax has embarked on several ground-breaking initiatives. One such initiative has been reducing its generation Scope 1 and 2 carbon emissions by approximately 99% since 2012. The group is also actively investing in the UK’s journey towards a net zero economy and is collaborating with the University of Nottingham and Promethean Particles on an innovative new carbon capture technology.

In a further bid to achieve its carbon-negative goal, Drax Group has recently signed a Memorandum of Understanding (MoU) with Respira International, an impact-driven carbon finance business. This agreement has the potential to lead to the largest volume of carbon dioxide removals (CDRs) traded so far globally. Under this MoU, Respira will be able to secure up to 2 million metric tonnes of CDRs from Drax over a five-year period. These CDRs are linked to the future deployment of Drax’s pioneering Bioenergy with Carbon Capture and Storage (BECCS) technology in North America.

The CDRs that Respira purchases from Drax will then be sold on a voluntary carbon market. This will enable corporations and financial institutions to buy these CDRs and achieve their own carbon emissions reduction targets.

This agreement between Drax and Respira is expected to play a pivotal role in the development of voluntary carbon markets globally and the deployment of BECCS. It showcases the increasing demand for engineered carbon removals and the supportive policies being developed by progressive governments in the US and UK. This deal is likely to stimulate the necessary investment to kickstart a new sector of the economy, potentially creating tens of thousands of jobs. It represents a landmark moment for Drax, the fight against climate change, and the global transition towards a sustainable future.

Achieving Carbon Negative Goal by 2030

To achieve its carbon negative goal by 2030, Drax Group plans to close its two remaining coal-fired power generation units at Drax Power Station, use bioenergy with carbon capture and storage (BECCS) to remove more CO2 from the atmosphere than is emitted during power generation, and submit plans to build the world’s largest carbon capture and storage project.

What is the BECCS technology that Drax is using?

ECCS, or Bioenergy with Carbon Capture and Storage, is a technology that provides reliable, renewable power while simultaneously removing carbon dioxide from the atmosphere. It’s considered a critical technology required globally to combat climate change.

Drax Group’s Role in the Supply Chain

Drax Group’s commitment to sustainability extends beyond its own operations to its supply chain. The company recognises the importance of ensuring that its suppliers also adhere to high environmental and social standards. This is particularly relevant given the company’s reliance on biomass as a key source of renewable energy. Drax Group has implemented stringent supplier selection criteria and conducts regular audits to ensure compliance with its sustainability standards.

The Impact of Regulatory Changes on Drax Group

The regulatory landscape for ESG is rapidly evolving, and companies like Drax Group are continuously adapting to these changes. The European Commission’s recent proposal on ESG rating regulation is one such development that could have significant implications for the company. By standardising ESG ratings, the proposal aims to enhance transparency and comparability across companies and sectors.

The Role of Technology in Drax Group’s ESG Journey

Technology plays a crucial role in Drax Group’s ESG journey. From using innovative carbon capture technology to achieve its carbon negative goal, to leveraging data analytics for real-time monitoring of its ESG performance, the company is at the forefront of using technology to drive sustainability.

The Future of Drax Group’s ESG Performance

Looking ahead, Drax Group is well-positioned to continue improving its ESG performance. The company’s ambitious goals, combined with its commitment to transparency and accountability, set a strong foundation for future progress. However, achieving these goals will require ongoing effort, innovation, and collaboration with various stakeholders.

In conclusion, Drax Group’s ESG performance is a testament to the company’s commitment to sustainability. As the company continues to innovate and adapt, it serves as a model for other companies striving to improve their own ESG performance.

For more insights into how companies can improve their supply chain resilience through ESG due diligence, check out our article on Improving Supply Chain Resilience. To understand the implications of the EU Parliament’s approval of the Supply Chain Due Diligence Directive, read our EU Parliament Approves Supply Chain Due Diligence Directive article.