In today’s rapidly evolving financial landscape, understanding the importance of ESG (Environmental, Social, and Governance) factors in banking is crucial. In this article, we dive into the ESG review of HSBC to uncover what sets it apart as a sustainable bank and how it compares to other industry leaders.

HSBC’s ESG Performance and Rating

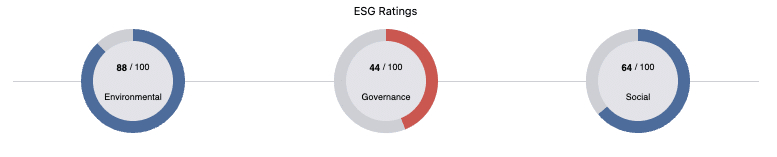

HSBC’s commitment to ESG is reflected in their efforts to promote sustainable practices and uphold strong governance. This includes investing in renewable energy, implementing responsible lending policies, and fostering a diverse and inclusive workplace. Their ESG rating, as assessed by top rating agencies, provides valuable insight into the bank’s sustainability performance. Permutable AI ranks HSBC as having a rating of 88 in environmental, 44 in governance, and 64 in social:

To access the full analysis and rating, head over to Permutable AI ESG Reports Home Page.

The Role of ESG at HSBC

ESG is important to HSBC because it allows the bank to stay competitive and future-proof its business model. By addressing environmental, social, and governance concerns, HSBC can better manage risks, attract investors, and ensure long-term value creation. The head of ESG at HSBC is responsible for overseeing the bank’s sustainability strategy and ensuring alignment with global ESG standards. This individual plays a critical role in driving HSBC’s commitment to responsible banking and shaping the organisation’s sustainable future.

Sustainable Banking: HSBC and Industry Leaders

Yes, HSBC is a sustainable bank. Their ESG performance demonstrates a strong commitment to addressing environmental and social issues, while maintaining robust governance practices. The bank is actively working towards reducing its carbon footprint and promoting responsible lending to create a more sustainable financial sector.

When it comes to ESG performance, HSBC is undoubtedly among the top contenders. Other banks with strong ESG credentials include Goldman Sachs, JPMorgan Chase, and Morgan Stanley. These institutions have demonstrated their commitment to sustainability by prioritising ESG integration, setting ambitious climate targets, and promoting responsible business practices.

ESG in Banking: Challenges and Opportunities

ESG means that banks must prioritise the integration of environmental, social, and governance factors into their operations and decision-making processes. By doing so, they can better manage risks, enhance their reputation, and ultimately, drive long-term value creation for stakeholders. While HSBC has historically invested in fossil fuels, the bank is now actively transitioning towards a low-carbon economy. This includes setting ambitious climate targets and increasing investments in renewable energy projects. However, as with many financial institutions, complete divestment from fossil fuels remains a complex and ongoing process.

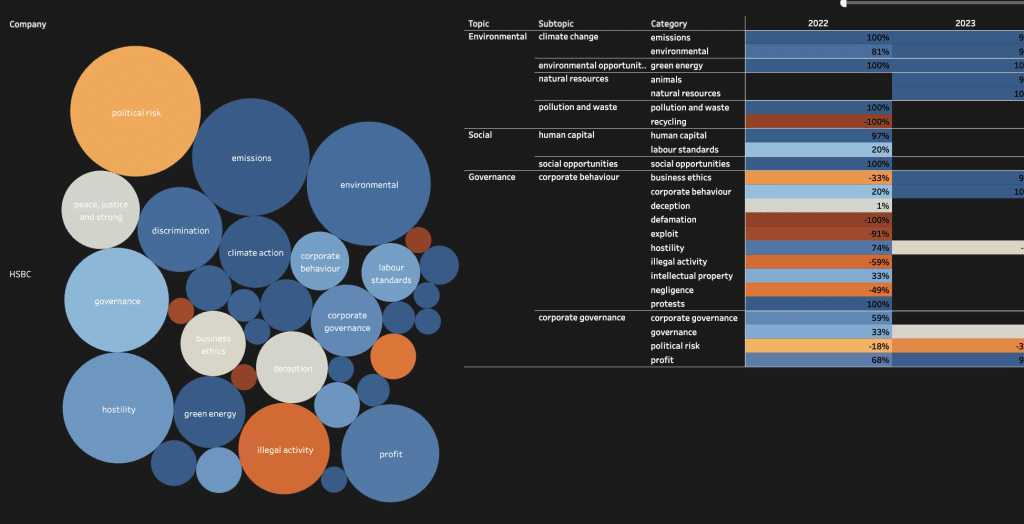

The benefit of ESG to a bank lies in the ability to manage risks, attract investors, and build long-term value. By prioritising ESG integration, banks can better navigate a rapidly changing financial landscape and ensure their business model remains resilient and future-proof. This ties into the impact public sentiment has on a company’s market performance. Public sentiment is increasingly becoming a major driver in investment success. By reigning in the factors affecting a company’s public sentiment you can focus on better long term prospects. Here is a snippet of Permutable’s public sentiment dashboard on HSBC:

Evaluating ESG Funds and Rating Agencies

There are numerous ESG rating agencies, each with its methodology and focus. Some of the most reputable agencies include MSCI, Sustainalytics, and the Carbon Disclosure Project (CDP). However, an emerging leader in the ESG analytics space is Permutable AI, an award-winning platform that provides valuable insights into a company’s ESG performance, helping investors make informed decisions.

While ESG funds are designed to invest in companies with strong ESG credentials, the degree to which they align with sustainable practices can vary. Investors should carefully review the fund’s criteria, methodology, and holdings to ensure that their investments genuinely align with their ESG values. Conducting thorough due diligence and consulting reputable ESG rating agencies, such as Permutable AI, can help investors make well-informed decisions

HSBC’s ESG Initiatives and the Future of Sustainable Banking

HSBC has implemented numerous initiatives to demonstrate its commitment to ESG principles. A few notable examples include:

- Climate Ambitions: HSBC has set ambitious goals to align its financing activities with the Paris Agreement, aiming to achieve net-zero carbon emissions by 2050. As part of this strategy, the bank

has pledged to provide $1 trillion in sustainable financing and investments by 2030.

-

Responsible Lending Policies: HSBC has developed stringent lending policies that take into account the environmental and social risks associated with financing projects. This includes avoiding financing projects that have a significant negative impact on climate, biodiversity, or local communities.

-

Diversity and Inclusion: HSBC is dedicated to fostering a diverse and inclusive workplace, promoting equal opportunities and implementing policies to address discrimination and harassment. The bank’s diversity and inclusion initiatives cover a wide range of areas, such as gender equality, LGBTQ+ rights, and support for people with disabilities.

Comparing HSBC to Other Banks

To better understand HSBC’s ESG performance, it’s essential to compare the bank with its industry peers. The following is a brief comparison of HSBC’s ESG efforts with those of other leading banks:

- Goldman Sachs: Like HSBC, Goldman Sachs has made significant strides in ESG integration. Their ESG report highlights the bank’s commitment to sustainable finance, climate risk management, and diversity and inclusion.

- JPMorgan Chase: JPMorgan Chase is another bank with a strong focus on ESG principles. The bank’s ESG report showcases its efforts to reduce its environmental impact, promote financial inclusion, and ensure robust governance practices.

- Morgan Stanley: Morgan Stanley has been proactive in addressing ESG concerns, as evidenced by their ESG report. The bank has made considerable investments in renewable energy and has implemented responsible lending policies that prioritise sustainability.

The Future of ESG in Banking

As ESG continues to gain momentum in the financial sector, banks like HSBC, Goldman Sachs, JPMorgan Chase, and Morgan Stanley will play a vital role in shaping the industry’s sustainable future. Here are some key trends and challenges to watch for in the coming years:

- Regulatory Changes: Governments worldwide are increasingly implementing regulations that require banks to integrate ESG considerations into their operations. Banks must stay up-to-date with these regulatory changes to ensure compliance and mitigate potential risks.

- Technology Integration: Advancements in technology, such as artificial intelligence and blockchain, have the potential to revolutionise ESG in banking. Banks must be agile and adapt to these new technologies to improve their ESG data collection, analysis, and reporting capabilities.

- Stakeholder Expectations: As stakeholders increasingly demand greater transparency and accountability from banks regarding their ESG performance, banks must enhance their ESG reporting and communication strategies to meet these expectations.

- Green Finance: As the demand for green finance grows, banks will need to develop innovative financing solutions to support sustainable projects and help clients transition to a low-carbon economy.

By proactively addressing these trends and challenges, HSBC and other banks can further enhance their ESG performance, create long-term value for stakeholders, and contribute to a more sustainable future.

Conclusion

In conclusion, HSBC’s ESG review highlights the bank’s strong commitment to sustainability and responsible banking practices. As the financial sector continues to evolve, it’s crucial for banks like HSBC to proactively address emerging trends and challenges related to ESG. By doing so, they can effectively manage risks, attract investors, and contribute to a more sustainable future, ultimately creating long-term value for all stakeholders.

To further explore ESG in the banking sector, check out the following resources:

- Is carbon offsetting greenwashing?

- ESG trends 2023: Outlook, opportunities & challenges

- Carbon risk management

For more information on ESG reports of leading companies, visit the Permutable AI ESG Reports Home Page and explore the reports of companies like Apple, Microsoft, Amazon, Facebook , Nike.