In our next instalment in our series of ESG deep dives we take a closer look at the Berkshire Hathaway ESG score according to our data. ESG criteria has gained significant traction in the world of investing. ESG factors are used to evaluate a company’s impact on the world and to determine the sustainability and ethical impact of an investment. As an investor, understanding ESG and its significance is crucial in making informed decisions that align with one’s values and long-term financial goals.

When evaluating a company’s ESG performance, investors consider various aspects such as its environmental impact, social responsibility, and governance practices. This comprehensive approach provides a holistic view of a company’s operations, beyond just its financial performance. By incorporating ESG considerations into investment decisions, investors can contribute to positive societal and environmental change while seeking financial returns.

Investors are increasingly recognizing the importance of considering ESG factors in their investment strategies. As the awareness of climate change, social inequality, and corporate governance issues grows, incorporating ESG criteria into investment decisions has become a mainstream practice. Companies that demonstrate strong ESG performance are often viewed as more resilient and better positioned for long-term success, making them attractive investment opportunities.

Introduction to Berkshire Hathaway

Berkshire Hathaway, led by renowned investor Warren Buffett, is a multinational conglomerate holding company renowned for its diverse range of investments in various industries. The company’s subsidiaries operate in sectors including insurance, utilities, manufacturing, and consumer goods. With its vast portfolio of businesses, Berkshire Hathaway holds a significant presence in the global market and has been a key player in the investment landscape for decades.

Warren Buffett, the chairman and CEO of Berkshire Hathaway, is widely regarded as one of the most successful investors in history. Known for his long-term approach to value investing, Buffett has built Berkshire Hathaway into a powerhouse conglomerate with a strong focus on acquiring and holding interests in well-established companies. The company’s investment philosophy, characterized by a commitment to long-term growth and value creation, has garnered immense attention from investors worldwide.

Exploring the Berkshire Hathaway ESG Score

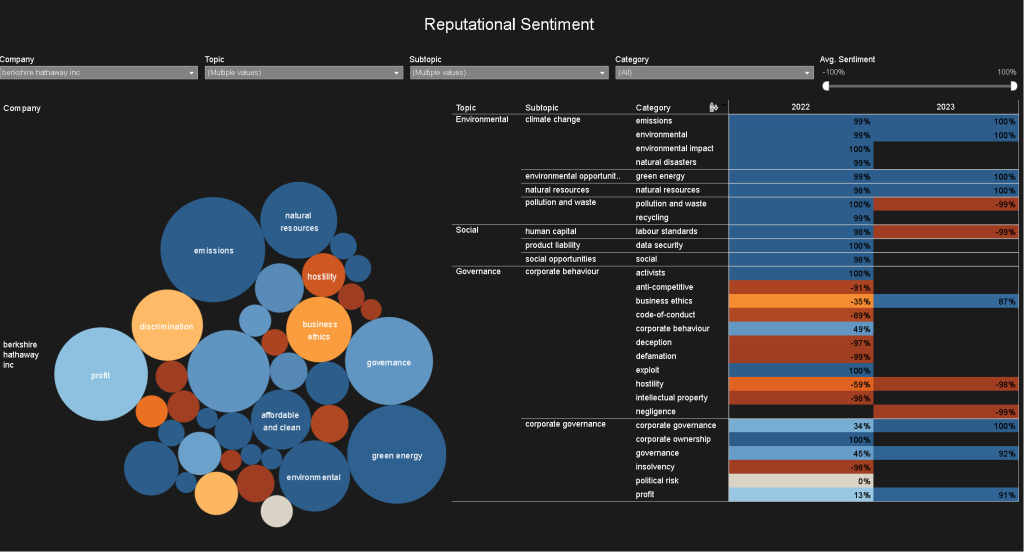

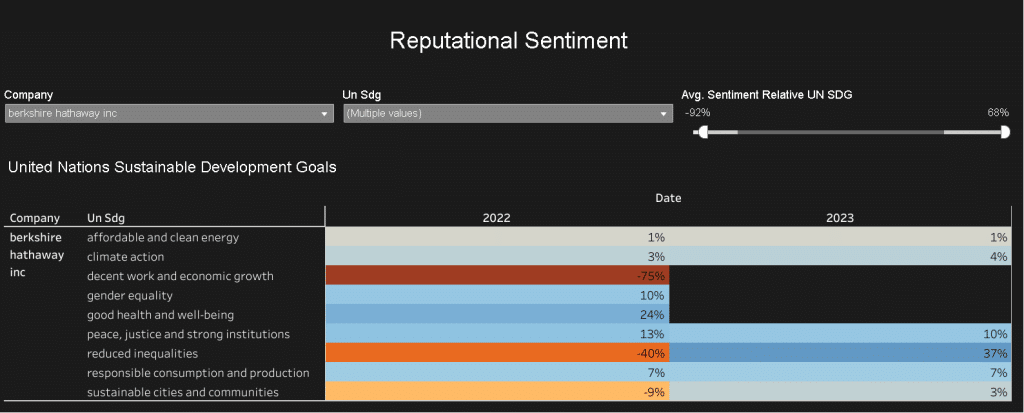

As ESG considerations continue to influence investment decisions, the evaluation of Berkshire Hathaway’s ESG score becomes increasingly pertinent. Assessing Berkshire Hathaway’s performance across environmental, social, and governance factors provides valuable insights into the company’s overall sustainability and ethical impact. Understanding how Berkshire Hathaway measures up in terms of ESG criteria is essential for investors seeking to align their investment choices with their values and principles.

The Berkshire Hathaway ESG score is a reflection of its environmental initiatives, social responsibility efforts, and governance practices. By delving into the company’s ESG score, investors can gain a comprehensive understanding of how Berkshire Hathaway addresses key sustainability and ethical considerations in its business operations. This analysis enables investors to make informed decisions about the company’s long-term potential and its impact on the broader societal and environmental landscape.

Berkshire Hathaway’s ESG rating is based on a number of factors, including its environmental, social, and governance performance. Overall, Berkshire Hathaway has a good ESG rating, with a score of 75 out of 100. This means that the company is considered to be a leader in ESG performance.

Berkshire Hathaway ESG Score Breakdown

Berkshire Hathaway’s environmental score is particularly high, at 90 out of 100 according to our data at time of writing. This is due to a number of factors, including the company’s commitment to reducing its greenhouse gas emissions, its investment in renewable energy projects, and its use of sustainable materials.

The investment firm’s social score of 67 out of 100 indicates that there are areas where the company can improve its social performance. While the company has made progress in recent years, there are still some challenges to address.

One area where Berkshire Hathaway could improve is its labour practices. The company has been criticized for its use of subcontractors and for its lack of transparency about its labour supply chain including allegations of use of child labour.

Additionally, Berkshire Hathaway has been criticized for its lack of diversity in its workforce. The company’s board of directors is predominantly white and male, and its overall workforce is less diverse than the general population.

Despite these challenges, Berkshire Hathaway has taken some steps to improve its social performance. The company has established a code of conduct for its suppliers, and it has pledged to increase the diversity of its workforce. However, more needs to be done to address the specific concerns that have been raised.

Berkshire Hathaway’s governance score of 38 out of 100 in its ESG rating indicates that there are some concerns about the company’s corporate governance practices. While the company has taken some steps to improve its governance in recent years, there are still some areas where it can improve.

One area where Berkshire Hathaway could improve its governance is its executive compensation. The company’s CEO, Warren Buffett, is one of the highest-paid CEOs in the world. In 2022, he received a total compensation of $32.4 million. This is significantly higher than the average compensation for CEOs of S&P 500 companies, which was $13.1 million in 2022.

Additionally, Berkshire Hathaway has been criticized for its lack of shareholder activism. The company’s board of directors is controlled by the Buffett family, and there are few opportunities for shareholders to voice their concerns. In 2021, a group of shareholders tried to pass a resolution requiring the company to disclose more information about its climate change risks. However, the resolution was defeated by a wide margin.

Despite these concerns, Berkshire Hathaway has taken some steps to improve its governance in recent years. The company has adopted a poison pill provision to make it more difficult for a hostile takeover, and it has increased the number of independent directors on its board. However, more needs to be done to address the specific concerns that have been raised.

Hathaway ESG Score: Impact on Investors

The ESG score of Berkshire Hathaway holds considerable significance for investors, as it provides insights into the company’s long-term sustainability and ethical impact. A strong ESG score indicates that Berkshire Hathaway is actively addressing environmental challenges, embracing social responsibility, and upholding high governance standards. This, in turn, reassures investors about the company’s commitment to ethical business practices and its resilience in the face of global challenges.

Investors who prioritize ESG considerations are inclined to favour companies with robust ESG scores, as these companies are perceived to be better equipped to navigate evolving societal and environmental dynamics. Berkshire Hathaway’s positive ESG score can attract a cohort of investors who prioritize sustainable and ethical investment opportunities. Moreover, a favourable ESG score can enhance Berkshire Hathaway’s reputation, potentially leading to increased investor confidence and support.

Berkshire Hathaway ESG Score: Peer Comparison

Benchmarking Berkshire Hathaway’s ESG score against its industry peers provides valuable insights into its relative performance and positioning. By comparing its ESG score with that of similar companies, investors can gauge Berkshire Hathaway’s standing in the context of its industry and identify potential areas for improvement. This comparative analysis facilitates a deeper understanding of how Berkshire Hathaway’s ESG performance aligns with industry norms and standards.

When evaluating our Berkshire Hathaway ESG score in comparison to its peers, investors can discern the company’s strengths and areas of opportunity. Understanding how Berkshire Hathaway stacks up against industry benchmarks enables investors to make informed assessments of the company’s ESG performance and its relative positioning. This comparative analysis empowers investors to make nuanced investment decisions based on a holistic understanding of Berkshire Hathaway’s ESG score in relation to its industry counterparts.

Explore the ESG scores of Berkshire Hathaway’s competitors below:

Berkshire Hathaway is a diversified holding company with a wide range of businesses, so it has competitors in many different industries. Some of its main competitors include:

In the insurance industry:

In the diversified holding sector:

In the specific industries where Berkshire Hathaway has subsidiaries:

Berkshire Hathaway’s Efforts towards Improving ESG Performance

Berkshire Hathaway has demonstrated a commitment to enhancing its ESG performance through various strategic initiatives and endeavors. The company’s proactive approach to addressing environmental challenges, fostering social responsibility, and strengthening governance practices underscores its dedication to continuous improvement in ESG matters. By actively engaging in initiatives aimed at bolstering its ESG performance, Berkshire Hathaway seeks to align its operations with evolving sustainability and ethical considerations.

Berkshire Hathaway’s efforts to improve its ESG performance encompass a range of initiatives, including sustainability targets, community engagement programs, and governance enhancements. The company’s emphasis on transparency, stakeholder engagement, and responsible business conduct reflects its endeavor to elevate its ESG standing. Through these concerted efforts, Berkshire Hathaway aims to solidify its position as a leader in sustainable and ethical business practices, resonating with investors who prioritize ESG considerations.

Berkshire Hathaway ESG Score: Criticisms and Challenges Related

Despite its formidable presence in the investment landscape, Berkshire Hathaway has faced criticisms and challenges related to its ESG score. Some stakeholders have raised concerns about the company’s approach to environmental stewardship, social impact, and governance practices. Criticisms surrounding Berkshire Hathaway’s ESG score highlight areas where the company may need to enhance its efforts and transparency to address the evolving expectations of investors and stakeholders.

Challenges related to Berkshire Hathaway’s ESG score encompass the need for greater disclosure on environmental impact, more robust social responsibility initiatives, and heightened governance transparency. Addressing these challenges is pivotal for Berkshire Hathaway to bolster its ESG performance and align with the evolving expectations of the investment community. By acknowledging and addressing criticisms and challenges, Berkshire Hathaway can strengthen its ESG score and enhance its appeal to a broader spectrum of investors.

Future Outlook for Berkshire Hathaway’s ESG Score

The future outlook for Berkshire Hathaway’s ESG score holds significant implications for the company’s positioning in the investment landscape. As ESG considerations continue to shape investment decisions, Berkshire Hathaway’s efforts to enhance its ESG performance will play a pivotal role in determining its long-term attractiveness to investors. The company’s ability to adapt to evolving sustainability and ethical expectations will influence its standing in the global market.

Berkshire Hathaway’s future outlook for its ESG score hinges on its capacity to address environmental challenges, embrace social responsibility, and fortify governance practices. By prioritizing ESG considerations and integrating sustainable practices into its business operations, Berkshire Hathaway can fortify its position as a sustainable and ethical investment choice. The company’s proactive stance on ESG matters will not only resonate with ESG-focused investors but also contribute to its long-term resilience and success.

Conclusion

In conclusion, evaluating Berkshire Hathaway’s ESG score is integral for investors seeking to align their investment choices with ESG considerations. By comprehensively exploring Berkshire Hathaway’s environmental, social, and governance performance, investors can gain valuable insights into the company’s sustainability and ethical impact. Understanding the factors contributing to Berkshire Hathaway’s ESG score, its impact on investors, and its future outlook provides a holistic perspective on the company’s positioning in the investment landscape.

As Berkshire Hathaway continues to navigate the evolving landscape of ESG considerations, its efforts towards improving ESG performance and addressing criticisms and challenges will be pivotal. The company’s commitment to sustainability, social responsibility, and governance transparency will not only enhance its ESG score but also solidify its appeal to a diverse spectrum of investors. By embracing ESG criteria, Berkshire Hathaway can position itself as a sustainable and ethical investment choice, resonating with investors who prioritize long-term value and positive societal impact.