Every seasoned trader understands the importance of having the best stock trading tools for professionals at their fingertips. The truth is, stock trading is a complex and ever-evolving landscape, and having access to the best tools can make all the difference in maximizing your investments and achieving your financial goals. In this article, we’ll explore the best stock trading tools that every professional should consider incorporating into their trading strategies.

The importance of using the best stock trading tools

Every trader worth their salt will tell you that successful stock trading is not just about making the right decisions; it’s also about having the best stock trading tools to support those decisions. The obvious point here is that the best stock trading tools can provide you with valuable insights, real-time data intelligence, and powerful analytics that can help you identify opportunities, manage risk, and make more informed trading decisions.

But also, by leveraging the best stock trading tools, you can enhance your trading strategies, improve your trading performance, and ultimately, increase your chances of achieving long-term financial success. Separately, it’s inevitable that the competition is fierce in the trading world, and having the right tools can give you a crucial edge.

The best stock trading tools: Key features to look for

When selecting the best stock trading tools for your needs, it’s important to consider the following key features:

User-friendly interface

The best tools strike a balance between functionality and usability. A clean, intuitive interface allows traders to quickly access the information and features they need without getting bogged down in complexity. The truth is, even the most powerful tool is of limited use if it’s too difficult to navigate efficiently.

Comprehensive data and analysis

Top-tier trading tools provide access to a wide range of data sources and analytical capabilities. This includes real-time market data, historical price information, fundamental company data, and economic indicators. More important than ever is the ability to synthesize this data into actionable insights. Look for tools that offer advanced charting capabilities, customizable technical indicators, and robust fundamental analysis features.

Customization and personalization

Every trader has a unique approach, and the best tools recognize this by offering extensive customization options. This might include the ability to create custom watchlists, set personalized alerts, or even develop proprietary indicators. The idea is that you can tailor the tool to fit your specific trading style and needs.

Robust security and reliability

When it comes to financial data and transactions, security is paramount. The best trading tools employ state-of-the-art encryption and security measures to protect your sensitive information. Additionally, reliability is key – look for platforms with a track record of stable performance and minimal downtime. After all, a tool that’s unavailable during crucial market moments can be worse than no tool at all.

The best stock trading tools for professionals

Bloomberg Terminal

The gold standard in financial analytics, Bloomberg Terminal provides real-time data, news, and advanced analytics. It’s particularly strong in its breadth of data and the ability to analyze complex financial instruments. Most importantly, it offers a vast network of financial professionals for communication and idea sharing.

TradeStation

A powerhouse for active traders, TradeStation offers advanced charting, backtesting capabilities, and the ability to create custom indicators. The key feature is its EasyLanguage programming, which allows traders to develop and automate their own trading strategies.

Tradier Brokerage

This API-first brokerage platform is a game-changer for algorithmic traders. It allows seamless integration of custom trading algorithms into your workflow.

StocksToTrade

Designed with active traders in mind, this platform offers powerful stock screening capabilities, real-time news integration, and seamless broker integration. One thing above all sets it apart: its ability to scan for stocks based on custom criteria and alert traders to potential opportunities.

Interactive Brokers TWS (Trader Workstation)

This platform is known for its advanced order types and global market access. It’s particularly strong for traders who deal with multiple asset classes or international markets. The best part? Its low commission structure makes it attractive for high-volume traders.

MetaTrader 5

While primarily known for forex trading, MetaTrader 5 also offers stock trading capabilities. Its strength lies in its automated trading capabilities and the ability to run multiple strategies simultaneously. It’s worth remembering that it has a large community of developers creating custom indicators and Expert Advisors.

Permutable AI’s Trading Co-Pilot

Our Trading Co-Pilot (BETA), a cutting-edge trading tool that’s already making waves in the industry. The problem is, many traders struggle to process the vast amounts of information available in real-time. This creates a big problem for making quick, informed decisions.

A bigger game changer is achieving a comprehensive understanding of market sentiment and trends. Let’s start with the issue of information overload. Our Trading Co-Pilot uses advanced AI algorithms to analyze global media and sentiment, providing unbiased, real-time insights into market dynamics. There is some low hanging fruit in terms of macro and fundamental news interpretation, which our tool excels at. There are two questions every trader asks: “What’s happening in the market?” and “What should I do about it?” Our Trading Co-Pilot addresses both with its unique features:

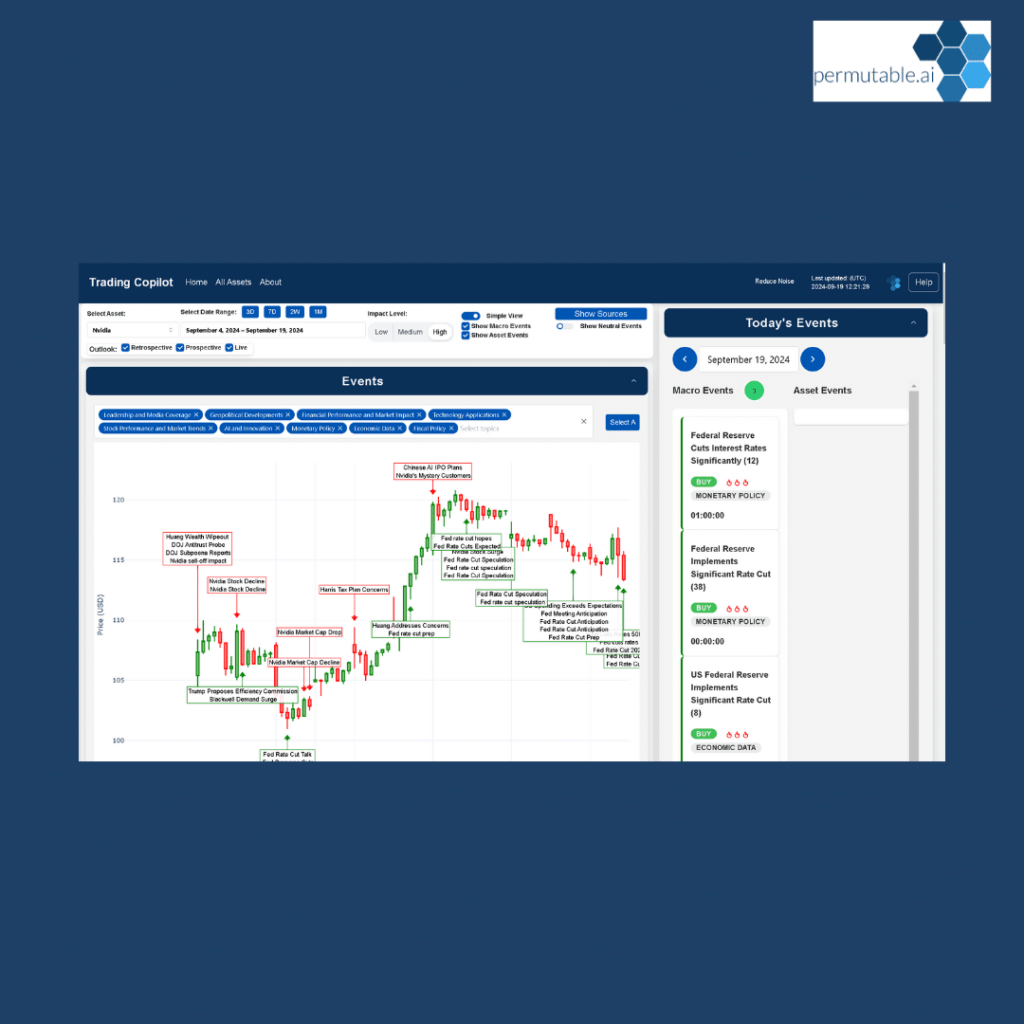

LLM-powered recommendations

Our Trading Co-Pilot leverages advanced Large Language Model (LLM) technology to provide actionable buy/sell signal recommendations for the next day. This feature is especially powerful as it combines AI-driven analysis with practical, forward-looking advice.

Global media and sentiment analysis

In this day and age, information is power. Our tool offers an unbiased, real-time understanding of global media sentiment, helping you stay ahead of market-moving news and trends.

Macro and fundamental news interpretation

Our Trading Co-Pilot doesn’t just present news; it interprets it. By analyzing macro trends and fundamental news, it provides deeper insights into market dynamics.

Unique asset taxonomy

Every asset tells a story, and our tool helps you read it. By creating a unique taxonomy for each asset, the Trading Co-Pilot offers nuanced, asset-specific insights that can inform your trading decisions.

Multiple source integration

To combat information silos, our tool integrates data from multiple premium sources, including Bloomberg, Reuters, and Seeking Alpha. This comprehensive approach ensures you’re not missing crucial information.

Buy/sell directionals

A key feature of our Trading Co-Pilot is the dedicated to buy/sell directionals. The intuitive interface provides a clear, visual representation of our AI-driven recommendations. At a glance, you can see which assets are recommended for buying or selling, along with the strength of each signal. The dashboard is continuously updated, ensuring you always have the most current recommendations at your fingertips.

How to choose the best stock trading tools for your needs

When selecting the best stock trading tools for your needs, consider the following factors:

Trading style and strategies

The obvious point here is that different trading styles require different tools. Day traders, for instance, need real-time data and quick execution capabilities, while long-term investors might prioritize fundamental analysis tools. Separately, consider whether you focus on specific sectors, use technical analysis, or employ particular strategies like pairs trading or options strategies. The idea is that you can choose tools that cater specifically to your approach.

Level of expertise

It’s important to remember that not all trading tools are created equal in terms of user-friendliness. If you’re a beginner, you might want to start with platforms that offer educational resources and intuitive interfaces. On the other hand, if you’re an experienced trader, you might prefer more advanced tools with sophisticated charting capabilities and custom indicator options. The key is to choose a tool that matches your current skill level but also allows room for growth.

Analytical and research capabilities

In this day and age, data is king. Look for tools that provide comprehensive market data, including real-time quotes, historical data, and access to company financials. But also, consider the depth of analysis offered. Does the tool provide advanced charting capabilities? Can it handle complex calculations for options pricing or risk management? The best tools offer a balance of breadth and depth in their analytical capabilities.

Automation and efficiency

More and more, traders are turning to automation to enhance their strategies. If you plan to use algorithmic trading or automated order execution, you’ll need tools that support these capabilities. Even if you’re not into full automation, features like customizable alerts, watchlists, and quick-access trade buttons can significantly improve your efficiency. The point is, the right tools can help you make the most of your trading time.

Cost and pricing structure

The truth is, costs can eat into your trading profits if you’re not careful. Consider not just the upfront costs of the tools, but also ongoing fees like data subscriptions or per-trade commissions. Some platforms offer tiered pricing based on your trading volume, while others might have a flat monthly fee. An often cited rule of thumb is to ensure the potential benefits of the tool outweigh its costs. Remember, the most expensive tool isn’t always the best for your needs.

User experience and customization

At the end of the day, you’ll be spending a lot of time with your trading tools, so user experience matters. Look for interfaces that you find intuitive and comfortable to use. Additionally, the ability to customize your workspace can be a game-changer. This might include features like drag-and-drop chart layouts, custom watchlists, or the ability to create your own indicators. The best tools allow you to tailor the platform to your specific workflow.

The best stock trading tools for professionals – final thoughts

Remember, the competition is fierce in the trading world, and having the right tools can give you a crucial edge. But also, it’s worth noting that the ‘best’ tool is often a personal choice. What works excellently for one trader might not suit another. That’s why it’s often beneficial to take advantage of free trials or demo accounts before committing to a particular platform.

Interestingly enough, many traders find that they need a combination of tools to cover all their bases. You might use one platform for its superior charting capabilities, another for its news feed, and yet another for its order execution speed. The key is to create a toolkit that covers all aspects of your trading process efficiently and effectively.

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of trading? Permutable AI’s Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.