At first glance, learning how to trade with artificial intelligence might seem like something out of a science fiction novel. Dip beneath the surface though, and you’ll find that AI-powered trading is not only real but rapidly becoming the norm in financial markets. At Permutable AI, we’ve been at the forefront of this revolution, and we’re excited to share our insights on how to trade with artificial intelligence effectively.

Understanding why the question “how to trade with artificial intelligence” is on everyone’s lips

Let’s start with the issue of why understanding how to trade with artificial intelligence is gaining such momentum. The obvious point here is that financial markets are incredibly complex, with countless variables affecting asset prices at any given moment. It’s inevitable that human traders, no matter how skilled, will miss important signals or struggle to process information quickly enough. This creates a big problem for traditional trading methods.

But also, the sheer volume of data available today is overwhelming. This is where AI shines. By leveraging machine learning algorithms, AI can process vast amounts of data in real-time, identifying patterns and trends that would be impossible for a human to spot. Not only that, but AI can do this round the clock, without fatigue or emotion clouding its judgment.

How to trade with artificial intelligence: Key considerations

So, how do you actually trade with artificial intelligence? There are two questions you need to consider:

- What type of AI trading system should you use?

- How can you integrate AI into your existing trading strategy?

We’ll unpack this below…..

Types of AI trading systems

When exploring how to trade with artificial intelligence, it’s important to start with the different approaches available. Broadly speaking, there are three main categories:

- Rule-based systems: These use pre-defined rules to make trading decisions. While not as sophisticated as other AI methods, they can be effective for certain strategies.

- Machine Learning models: These learn from historical data to make predictions about future market movements. They can adapt to changing market conditions over time.

- Deep Learning systems: These use neural networks to process complex, unstructured data like news articles or social media sentiment. They’re particularly good at identifying hidden patterns in data.

At Permutable AI, we believe that a combination of these approaches often yields the best results when learning how to trade with artificial intelligence. Our philosophy has always been to use the right tool for the job, rather than trying to force a one-size-fits-all solution.

Implementing AI trading: Challenges and solutions

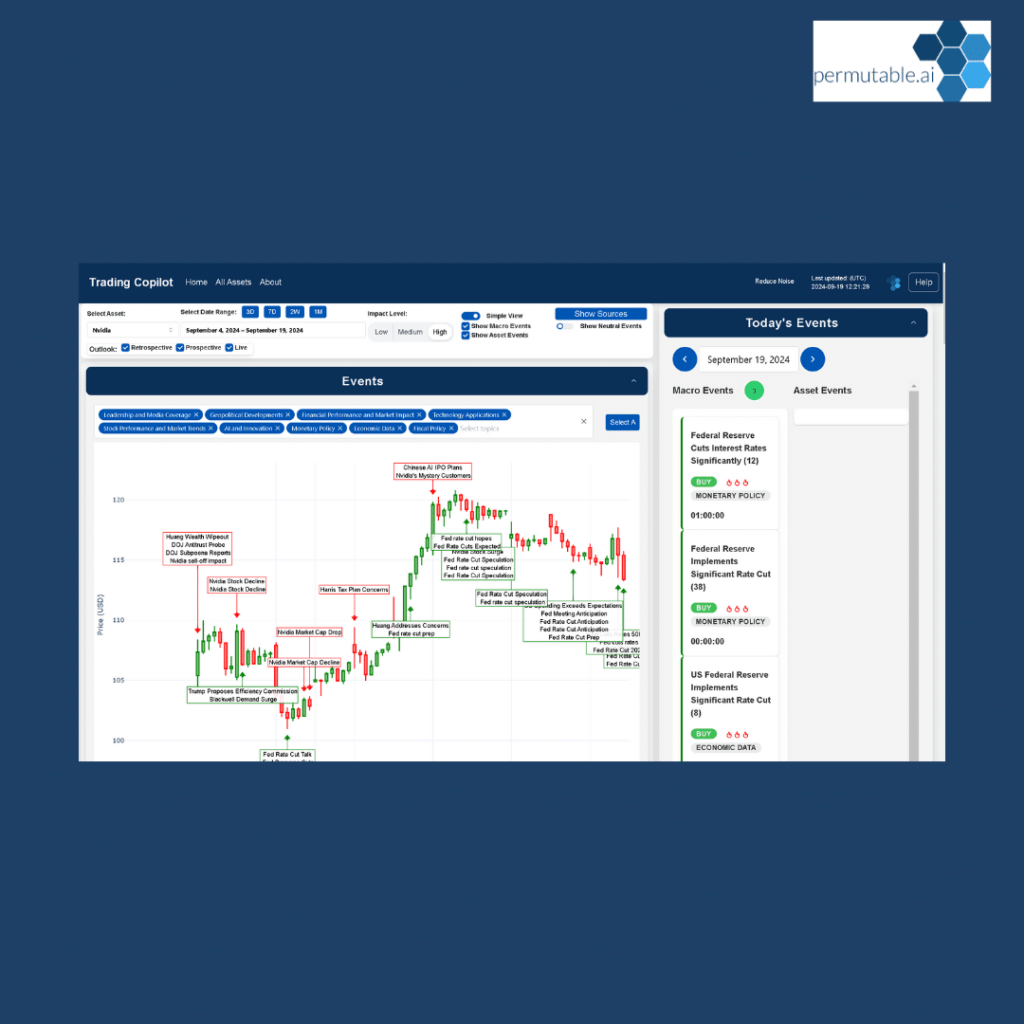

So now the question you are all wanting to ask us…..how hard is it to implement AI trading? Well hey, it’s certainly not a walk in the park, but it’s also not as daunting as you might think. The first major development in how to trade with artificial intelligence is choosing the right platform or tools. There are numerous ready-made solutions available – including our very own Trading Co-Pilot.

But now, let’s remember that AI is not a magic bullet. The problem is, many traders expect AI to instantly boost their profits without any effort on their part. A bigger game changer is achieving a deep understanding of how to trade with artificial intelligence and how it can complement your trading strategy and human expertise. This is exactly how we use our own Trading Co-Pilot in-house and very much where we see the strongest results.

How to trade with artificial intelligence: Starting small

If you plan to incorporate AI into your trading, you may want to start small. There is some low hanging fruit in areas like market sentiment analysis, again – which is all packaged up and available to you through our Trading Co-Pilot, including AI-driven buy/sell directionals. From there, you can gradually expand the role of AI in your trading process.

Beware the regulatory landscape

Meanwhile, it’s crucial to keep an eye on regulatory developments. The world is taking notice of AI trading, and regulations are evolving rapidly. Fortunately, at Permutable AI, we stay on top of these changes and design our systems to be compliant with the latest regulations – so you’re very much in a safe pair of hands with us.

Overcoming fears and misconceptions

Yet the reality is that learning how to trade with artificial intelligence is not without its challenges. A frisson of fear often runs through traditional traders when they first encounter AI systems, and this is to be expected. Of course, there is worry about job displacement or losing control over their trading strategies. These are not idle concerns, but we believe they’re outweighed by the potential benefits of AI being used in collaboration with human expertise, which is very much the basis on which our Trading Co-Pilot has been designed and developed. An often cited rule of thumb is to treat AI as a tool, not a replacement for human judgment. The idea is that you can leverage AI’s strengths while still maintaining control over your overall trading strategy.

Addressing scepticism

Against all that, a sceptic might say that markets are too unpredictable for AI to be truly effective. However, we would say that this is precisely why AI is so powerful in the context of increasingly volatile markets. Take our Trading Co-Pilot for example – it can process and analyse far more information than a human ever could, identifying subtle patterns and correlations and ultimately, providing sound trading strategies and ideas – all in real-time.

The democratisation of advanced trading techniques

The bigger picture, though, is that AI is transforming the entire financial landscape. Central to that revolution is the democratisation of advanced trading techniques. Tools and strategies that were once the preserve of large institutions are now accessible to individual traders. From AI trading algorithms that execute trades at lightning speed to AI-guided investing that helps novice investors make informed decisions, the applications of AI in stock market analysis are vast and growing.

Many wonder, “Can AI pick stocks?” or “Is AI stock trading real?”. Well good news folks, because the answer here is a resounding yes! Artificial intelligence stock analysis has become increasingly sophisticated, with AI-powered investing platforms and apps offering everything from basic stock recommendations to complex portfolio management (again see our buy/sell directionals as part of our Trading Co-Pilot).

For those asking how to use AI to invest in stocks or how to start trading with AI, there are numerous options available. Free AI investing apps provide a low-risk entry point, whilst more advanced artificial intelligence trading tools offer comprehensive tools for seasoned traders. The best AI investment apps combine powerful algorithms with user-friendly interfaces, making it easier than ever to harness the power of AI for investing. Whether you’re using AI to pick stocks or relying on stock market AI analysis for deeper insights, it’s clear that AI is transforming the investment landscape.

Getting started with AI trading

When all is said and done, the most important question is: how can you get started with AI trading? Here are a few steps we recommend:

- Educate yourself: Learn about different AI techniques and how they apply to trading. Understanding the basics will help you make informed decisions.

- Start with a specific problem: Rather than trying to automate your entire trading strategy, focus on a particular aspect where AI could add value.

- Use backtesting: Test your AI models on historical data before risking real money. This will help you refine your approach and build confidence.

- Monitor and adjust: AI models need ongoing monitoring and adjustment. Markets change, and your AI needs to adapt accordingly.

- Stay compliant: Ensure your AI trading activities comply with all relevant regulations.

The future of AI trading

In the wake of recent market volatility, many traders are coming out of a brutal period looking for new approaches. AI trading offers a promising path forward. But it’s not just about using AI to make more money. It’s about making more informed, data-driven decisions. At Permutable AI, we’re excited about the future of AI trading and our Trading Co-Pilot is the glimpse of the future, right here in the present. To find out more request a demo or free trial below.

Your trading is about to take off

Schedule a free enterprise demo to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.