Nvidia (NASDAQ: NVDA) has long been a darling of the stock market, consistently outperforming expectations. But the story of how this tech giant came to dominate the semiconductor industry is a fascinating tale of innovation and foresight. In this article – and as the market’s thoughts turned towards the Nvidia stock price target 2025 – get our thinking on why we thinking that Nvidia will keep up its strong performance on into 2025 and beyond.

Nvidia stock price target 2025 and the rise of a tech giant

Founded in 1993, Nvidia initially focused on developing graphics processing units (GPUs) for the gaming industry. However, the company’s visionary leadership soon recognised the potential applications of its technology beyond gaming. This foresight has been instrumental in shaping Nvidia’s trajectory and, consequently, its stock price performance.

The importance of Nvidia’s diversification strategy

By the time Nvidia had established itself as a leader in graphics processing units, the company was already eyeing new horizons. Consider the facts: Nvidia’s expansion into AI, data centres, and autonomous vehicles has positioned it as a multifaceted tech powerhouse, significantly influencing the Nvidia Stock Price Target 2025.

The company’s diversification strategy has been nothing short of remarkable. Nvidia has leveraged its GPU technology to become a key player in the AI and machine learning space. Its data centre solutions have gained significant traction, particularly as businesses increasingly rely on cloud computing and big data analytics. And then, let’s not forget Nvidia’s forays into autonomous vehicle technology have positioned it at the forefront of this emerging industry.

Nvidia stock price target 2025: Analyst optimism vs skepticism

One thing is for certain, there is no prospect of Nvidia’s growth slowing anytime soon, an opinion that is backed up by most analysts. However, many seasoned onlookers see this optimism as potentially overblown. This is the context in which we must evaluate Nvidia’s stock price target for 2025. The bullish sentiment surrounding Nvidia is largely driven by the company’s strong financial performance and its positioning in high-growth markets. Yet, some analysts caution against unbridled optimism, citing factors such as intense competition and potential market saturation.

Factors influencing Nvidia’s future

The same goes for understanding the factors influencing Nvidia’s future performance. Like much of the tech industry, Nvidia’s fortunes are tied to market trends, technological advancements, and the competitive landscape. Insiders say that Nvidia’s ability to stay ahead of the curve will be crucial in maintaining its market dominance and achieving the projected Nvidia Stock Price Target 2025.

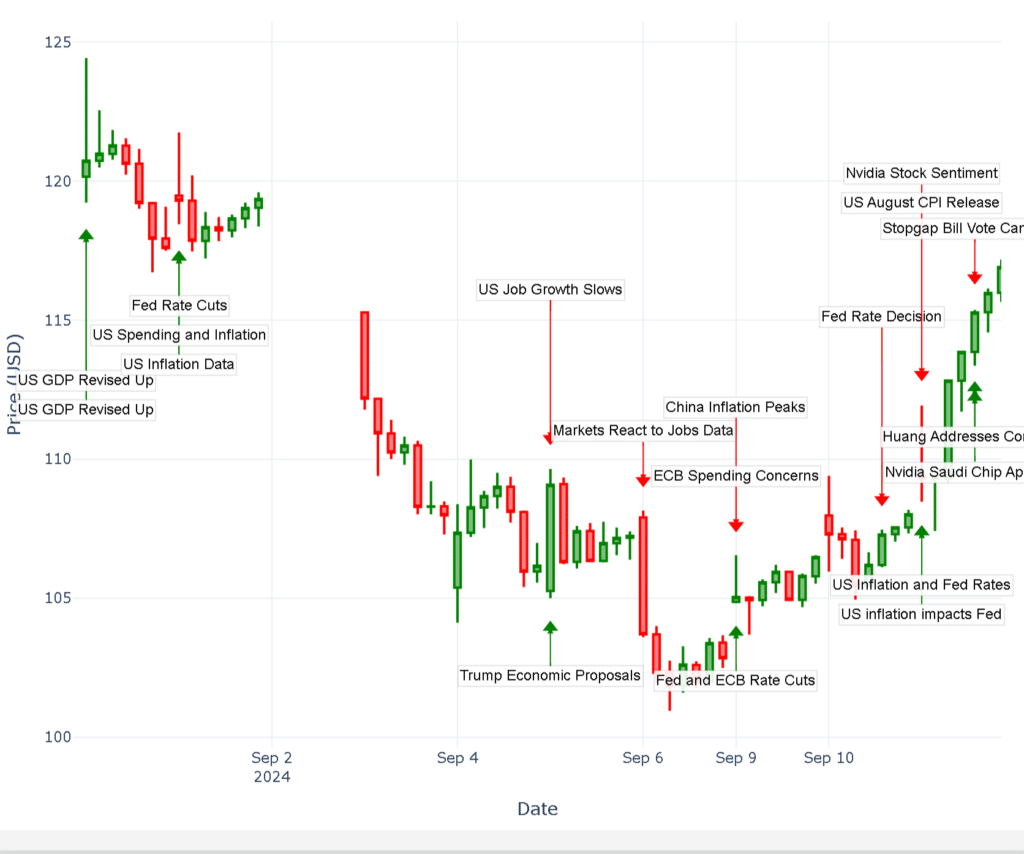

Key factors to consider include:

- Technological innovation: Nvidia’s continued investment in R&D and its ability to bring cutting-edge products to market.

- Market demand: The ongoing growth in demand for AI, data centre, and gaming solutions.

- Competitive landscape: The actions of rivals such as AMD and Intel, as well as potential new entrants.

- Macroeconomic factors: Global economic conditions, trade policies, and regulatory environments.

Above: Insights on factors influencing Nvidia stock price taking from our Trading Co-Pilot

Nvidia stock price target 2025: Innovation as a growth driver

The reason for all this is fairly straightforward: innovation drives growth in the tech sector. Many believe that Nvidia’s robust product pipeline, including its next-generation Ampere GPU architecture, will continue to fuel its success. These are not isolated developments; they represent a broader strategy of diversification and expansion that could significantly impact the Nvidia stock price target 2025.

Nvidia’s commitment to innovation is evident in its substantial R&D investments. In fiscal year 2024, the company spent $8.68 billion on R&D, representing a significant portion of its revenue. This focus on innovation has allowed Nvidia to maintain its technological edge and expand into new markets.

The semiconductor crisis and Nvidia

Why did this happen? The semiconductor crisis has highlighted the importance of companies like Nvidia. Indeed, the recent shortage has only underscored Nvidia’s critical role in global technology infrastructure, potentially boosting its stock price target for 2025.

The global chip shortage has created both challenges and opportunities for Nvidia. While it has faced supply constraints, the increased demand and higher prices have positively impacted its revenue. Moreover, the crisis has emphasised the need for investment in semiconductor manufacturing, potentially benefiting companies like Nvidia in the long run.

Analyst predictions for Nvidia stock price target 2025

It normally just takes a cursory glance at Nvidia’s financials to understand its potential. Such doubts voiced by skeptics quickly withered away when Morgan Stanley recently raised its price target for Nvidia. Then there was also Piper Sandler’s taking it from $120 to $140. Both these moves undoubtedly contribute to an optimistic Nvidia stock price target 2025 with many believing it could reach between $200 and $225, or somewhere in the middle at around $215.

These analyst predictions reflect a growing consensus about Nvidia’s potential for continued growth. The company’s strong financial performance, coupled with its strategic positioning in high-growth markets, has led many analysts to revise their price targets upwards.

Investment timing and growth potential

It may, however, already be too late for investors hoping to catch Nvidia at a bargain price. Of course, this doesn’t mean the stock lacks growth potential. It’s the same with many high-performing tech stocks; the question is not if they will grow, but by how much, especially when considering the Nvidia stock price target 2025. As with all things, investors should consider their risk tolerance and investment horizon when evaluating Nvidia’s stock. While the potential for significant returns exists, the stock’s high valuation may also imply higher volatility.

Looking beyond the hype to a balanced view

The mists created by initial hype are lifting, revealing a clearer picture of Nvidia’s potential going forward. While the road to 2025 may be fraught with challenges, Nvidia’s track record of innovation and adaptability suggests a promising outlook for investors willing to weather potential storms in pursuit of long-term gains, as reflected in the optimistic Nvidia stock price target 2025.

Of course, while the Nvidia stock price target 2025 paints an optimistic picture, investors should approach it with a balanced perspective. Nvidia’s strong market position, innovative culture, and exposure to high-growth markets provide a solid foundation for future growth. However, the tech industry’s dynamic nature and potential macroeconomic challenges necessitate careful consideration and ongoing monitoring of one’s investment strategy.

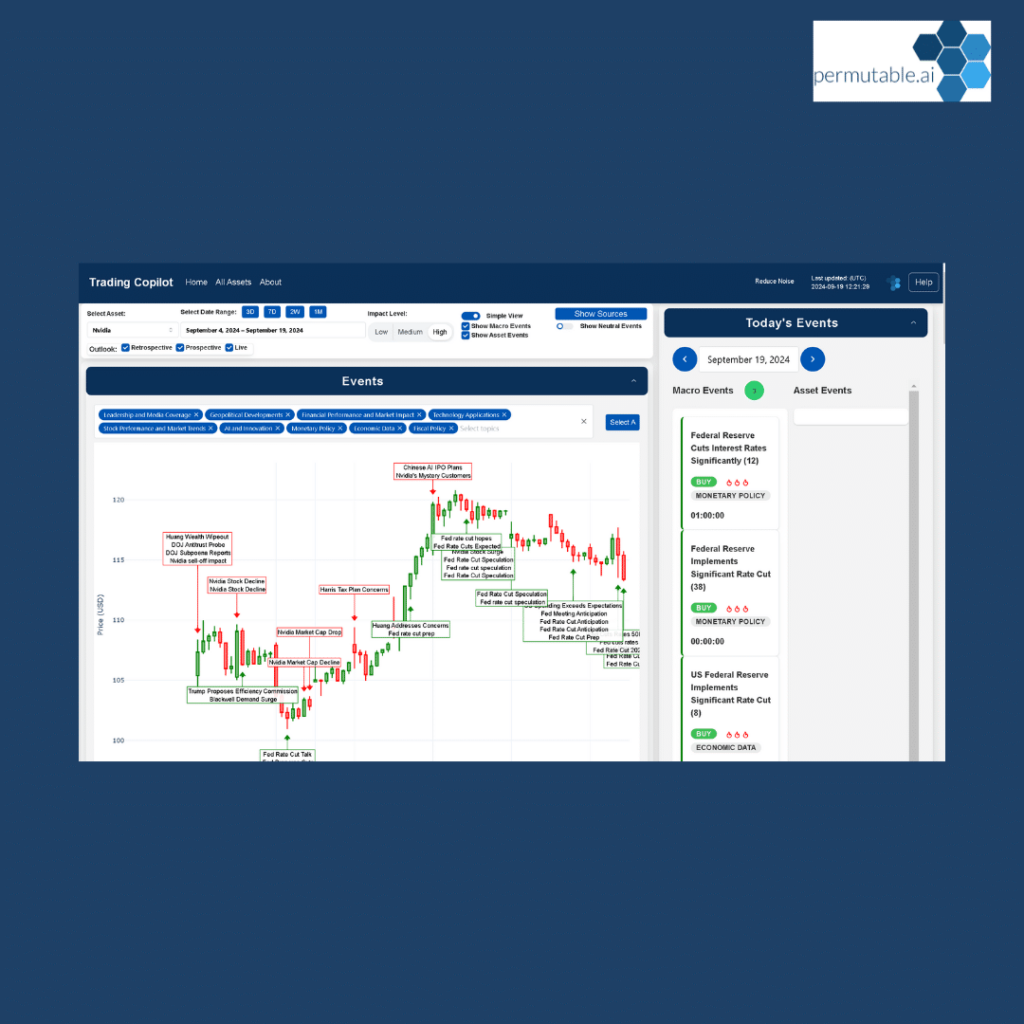

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of trading? Permutable AI’s Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.

Further reading

Looking for more stock price predictions? See below for:

Intel stock price prediction 2025

Nio stock price prediction 2025

Palantir stock price prediction 2030

Microsoft stock price prediction 2025

DJT stock price prediction 2025