Tesla, the trailblazing EV manufacturer, has been the subject of intense scrutiny and speculation among investors, analysts, and industry enthusiasts over the years. As the company continues to push the boundaries of innovation and reshape the automotive landscape, the question on everyone’s mind is: What is the Tesla stock prediction 2025?

Tesla stock price prediction 2025: A complex web of factors

Several factors contribute to the fluctuations in Tesla’s stock price, including technology and innovation, market adoption and demand, regulatory environment, competition and industry dynamics, financial performance and growth prospects, and leadership and vision. Thankfully, Tesla has demonstrated a remarkable ability to navigate these complex factors. The good news is that the company’s innovative approach and market leadership position it well for future growth. But there’s a broader point of view here: Tesla’s success is not guaranteed, and investors must carefully consider the risks and challenges facing the company.

Tesla’s historical stock performance

To understand the potential future trajectory of Tesla’s stock price, it is essential to examine the company’s historical performance. Over the years, Tesla’s stock has experienced significant volatility, with periods of rapid growth followed by sharp declines. However, when you take a step back, the data shows that Tesla’s stock price has been on an upward trend, despite the occasional setbacks.

Consider that Tesla’s stock price has experienced a meteoric rise since its initial public offering in 2010. We could go on about the various factors that have contributed to this growth, but it is, we think, this last point that is most significant: Tesla’s ability to consistently innovate and capture market share in the rapidly evolving EV industry.

Tesla today: Current market snapshot

As of today, Tesla’s stock is trading at $253.35, with a current market cap of 794.15 billion. Tesla’s stock has seen varied performance over the past few months. In September 2024, the stock experienced a surge of nearly 5%, fueled by anticipation for Tesla’s Robotaxi Day, where it plans to showcase its Full Self-Driving technology. This event, scheduled for October 10, 2024, is expected to boost investor confidence and could lead to a positive impact on the stock if the presentation goes well.

However, the stock also faced some fluctuations earlier, particularly in response to global economic conditions and investor sentiment surrounding the EV market. As of mid-September 2024, Tesla’s stock was trading at around $209 per share, with mixed analyst ratings—some predicting a decline due to external challenges like tariffs and competition from Chinese EV manufacturers. Overall, the stock has maintained relatively stable ground, but its performance hinges on upcoming events and broader market trends.

Tesla stock price prediction 2025: A closer look

Based on the analysis of various factors, historical trends, and expert opinions, predictions for Tesla’s stock price in 2025 vary widely. The Tesla stock prediction for 2025 is currently $332.36, assuming that Tesla shares will continue growing at the average rate. However, it’s crucial to note that this figure is not set in stone and could change significantly based on numerous factors from time of writing.

Consider that this prediction is based on current market conditions and historical growth patterns. We could go on about the various factors that might influence this prediction, but it is, we think, this last point that is most significant: Tesla’s ability to execute its ambitious plans will play a crucial role in determining its future stock price. To be clear, stock market predictions are inherently uncertain, and investors should not rely solely on these forecasts when making investment decisions. Actually, it’s essential to consider a range of scenarios and continuously monitor Tesla’s performance and market conditions.

Now, here’s a simple question: How might this prediction change in response to major technological breakthroughs or shifts in the competitive landscape? Ultimately, the context for this is the rapidly evolving nature of the EV industry and Tesla’s position within it.

Tesla stock price prediction 2025 and risks on Tesla’s horizon

While Tesla’s growth potential is significant, the company also faces various risks and challenges that could impact its stock price. Setting that aside, let’s focus on some of the key risks: regulatory and policy changes, increasing competition from companies like Rivian, Nio and Lucid to name a few, production challenges and supply chain issues, technological advancements and innovation risks, and reputation and regulatory concerns.

Let’s say that Tesla manages to navigate these challenges successfully. And all that without considering the potential impact of macroeconomic factors and geopolitical events on the company’s performance. Even then, the company’s stock price could still be influenced by factors beyond its control as it has been before in the past.

For instance, global economic downturns, trade tensions, or shifts in government policies towards electric vehicles could all have significant repercussions. We say this because Tesla’s fortunes are inextricably linked to broader market conditions and international relations. What about the possibility of unforeseen technological breakthroughs or disruptive innovations from competitors? These too could dramatically alter Tesla’s market position and, consequently, its stock price. When you take a step back, the sheer number of variables at play underscores the complexity of predicting Tesla’s future stock performance with any certainty.

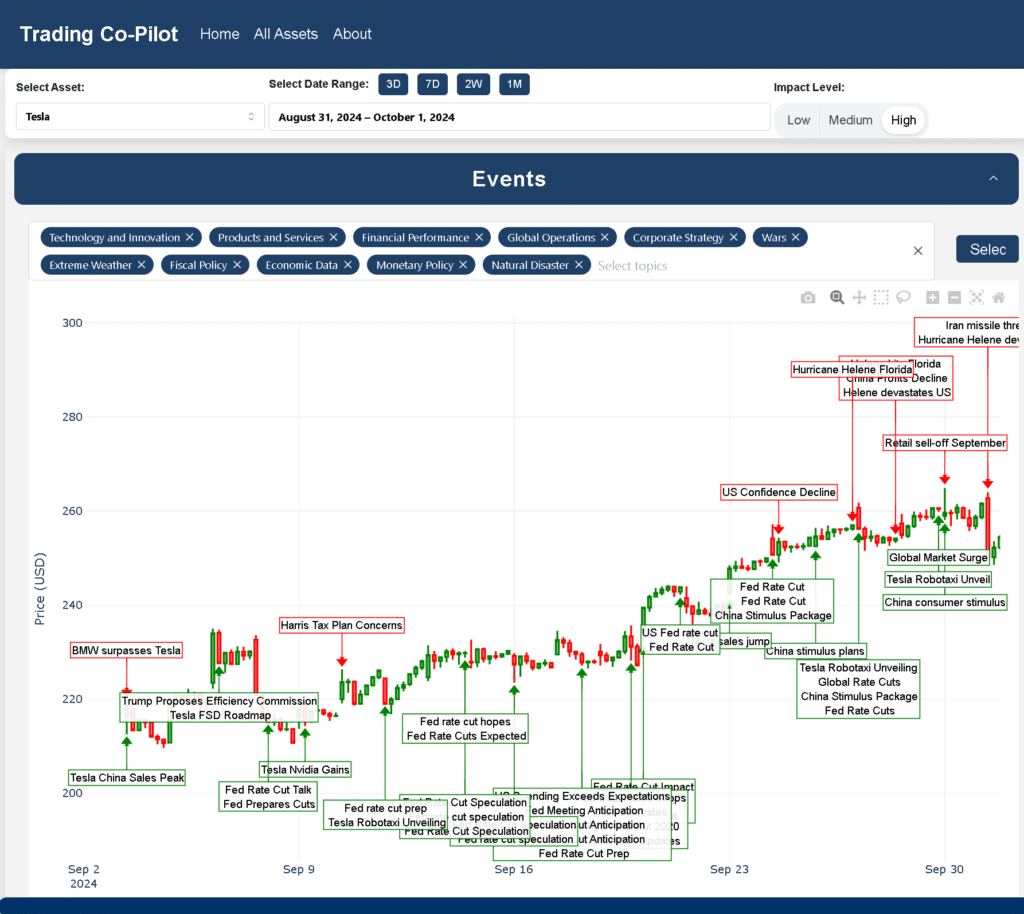

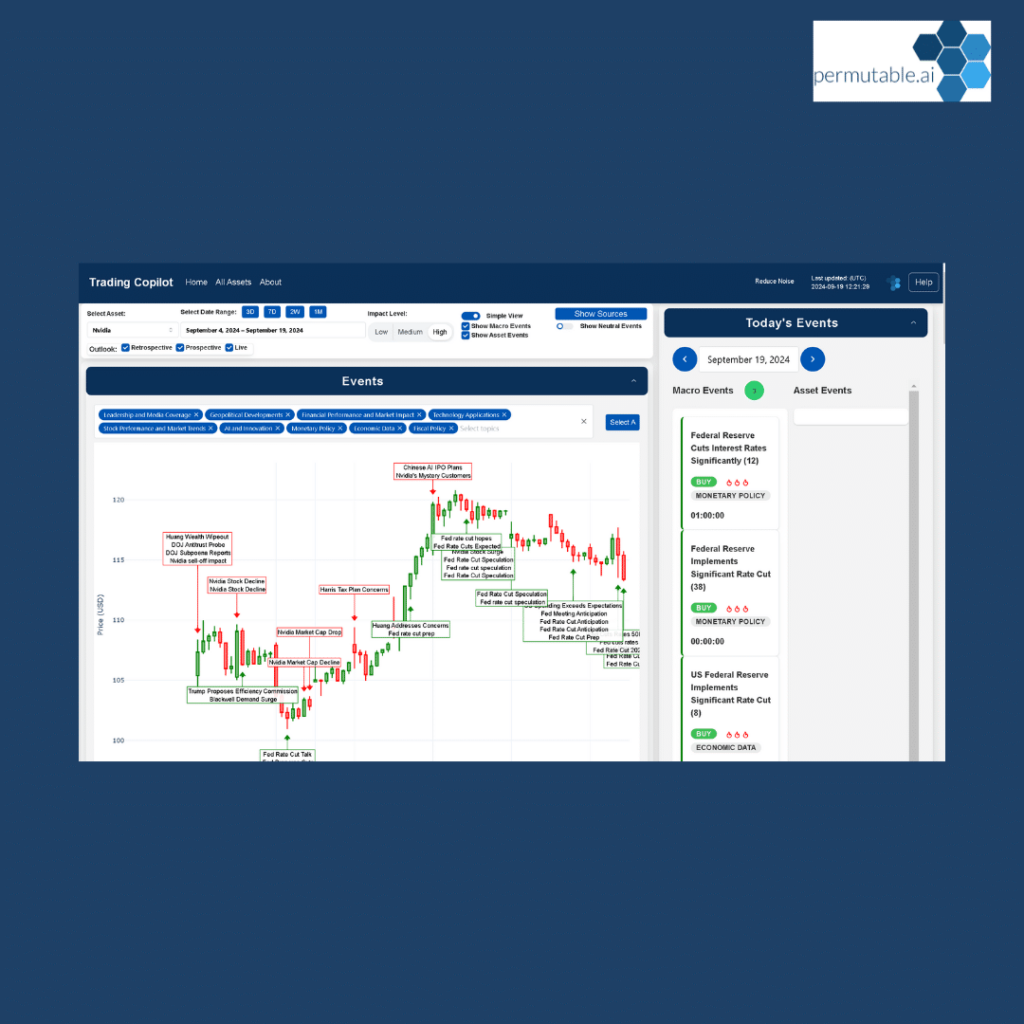

Factors affecting Tesla stock price: Insights from our Trading Co-Pilot

Tesla stock price prediction 2025: Final thoughts

Predicting Tesla’s stock price for 2025 is a complex task fraught with uncertainty. While the current prediction of $332.36 provides a useful benchmark, it’s crucial to approach this figure with a healthy dose of scepticism. The EV market is evolving at a breakneck pace, so much so that some believe that the EV bubble will soon burst. Ultimately, Tesla’s fortunes are inextricably linked to a myriad of factors, both within and beyond its control.

Amid the furore surrounding these predictions, it’s unlikely that any single forecast will prove entirely accurate. But what about the underlying trends and factors that could influence Tesla stock price prediction 2025? The result is something of a disparity between short-term volatility and long-term potential. And so, bruising sentiment in the market can create opportunities for savvy investors who understand Tesla’s long-term prospects.

When all is said and done, the Tesla stock price prediction for 2025 should be viewed as a starting point for discussion rather than a definitive forecast. Investors would do well to keep a close eye on Tesla’s technological advancements, market penetration, and financial performance in the intervening years. After all, in the rapidly evolving world of EVs, today’s predictions could easily become tomorrow’s footnotes.

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of trading? Our Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.

Further reading

Looking for more stock price predictions? See below for:

Intel stock price prediction 2025

Nio stock price prediction 2025

Palantir stock price prediction 2030

Microsoft stock price prediction 2025

DJT stock price prediction 2025