Advanced Micro Devices (AMD) has long been a player in the cut-throat world of semiconductors. Much has changed since its humble beginnings in 1969, and the company now stands as a formidable competitor in the global tech arena. But most industry insiders think that the best is yet to come for this silicon specialist. In this article, get our latest thinking on Advanced Micro Devices stock forecast 2025.

Advanced Micro Devices stock forecast: A look at the current state of play

Over the past few years, AMD has seen a remarkable turnaround. The catalyst for this transformation has been the company’s relentless focus on innovation and market share gains. Separately, the boom in cloud computing and artificial intelligence has created a perfect storm of demand for AMD’s high-performance chips.

Advanced Micro Devices stock forecast: Expert predictions

There is broad consensus that AMD’s stock is poised for growth. The expectation that the company will continue to gain market share from rivals like Intel and NVIDIA underpins many analysts’ bullish forecasts. Some reckon the mood is overly optimistic, but the numbers speak for themselves.

Most analysts predict that AMD could reach an average price of $195.93, with some estimates as high as $265 and others as low as $140. Some forecasts, like those from LongForecast, show more bullish predictions, expecting AMD to hit $277 to $310 by April and May 2025 All of which suggests that the market believes that AMD has plenty of room for growth.

Advanced Micro Devices stock forecast: Driving forces

It has now emerged that several key factors are likely to drive AMD’s performance in the coming years. This is at the core of many analysts’ bullish outlooks:

Innovation

By leveraging its world-class R&D capabilities, AMD continues to push the boundaries of chip design. The company’s ability to innovate is not just a nice-to-have; it’s an absolute necessity in the fast-paced world of semiconductors. AMD’s recent product launches, including the Ryzen 5000 series CPUs and RDNA 2 GPUs, have showcased its commitment to staying at the cutting edge of technology. This trend has ramped up in recent years, with AMD often leapfrogging competitors in terms of performance and efficiency.

Market share

The company’s ability to nibble away at Intel’s dominant position in CPUs has been nothing short of impressive. It’s a version of events that seemed unlikely just a few years ago, but AMD has defied expectations. In the x86 CPU market, AMD has clawed its way from single-digit market share to around 20% in the desktop space and even higher in laptops. This David-versus-Goliath narrative has captivated investors and industry watchers alike, fueling optimism about AMD’s future prospects.

Data centres

The insatiable appetite for cloud computing power plays right into AMD’s strengths. As businesses increasingly shift their operations to the cloud, demand for high-performance server chips has skyrocketed. AMD’s EPYC processors have been gaining traction in this lucrative market, challenging Intel’s long-standing dominance. The data centre segment represents a massive opportunity for AMD, with the potential to significantly boost its revenue and profitability in the coming years.

Gaming

With the rise of e-sports and cloud gaming, AMD’s Radeon GPUs are well-positioned to benefit. The gaming industry has evolved far beyond its niche origins, becoming a global phenomenon with billions in revenue. AMD’s graphics cards are at the heart of many gaming systems, from PCs to the latest generation of consoles. As gaming continues to grow and diversify, AMD stands to reap the rewards of its strong position in this market.

Achieving these goals is no small feat. This requires a laser focus on execution and a bit of luck in navigating the choppy waters of the global semiconductor industry.

Advanced Micro Devices stock forecast: Risks and challenges

It’s easy to forget that, amid the many distractions of recent weeks, AMD faces significant challenges. The same principle applies to AMD as to any tech company: past performance is no guarantee of future success. Due in part to the cyclical nature of the semiconductor industry, AMD must contend with:

The competitive landscape

Fierce competition from deep-pocketed rivals remains a constant threat to AMD’s growth prospects. Intel, despite recent stumbles, remains a formidable competitor with vast resources and a dominant market position. NVIDIA, too, continues to innovate in the GPU space, keeping pressure on AMD’s graphics division. This competitive landscape requires AMD to maintain a relentless pace of innovation and execution to stay ahead.

Supply chain woes

Potential supply chain disruptions have become a major concern for the entire semiconductor industry. The global chip shortage that began in 2020 has highlighted the fragility of the complex supply chains that underpin the tech industry. For AMD, ensuring a stable supply of chips to meet growing demand is crucial. Any hiccups in production or distribution could have significant impacts on the company’s ability to capitalise on market opportunities.

Macroeconomic headwinds

Broader economic factors can have a substantial impact on AMD’s performance. Economic downturns can lead to reduced consumer spending on electronics and decreased corporate investment in IT infrastructure, potentially dampening demand for AMD’s products. Additionally, geopolitical tensions and trade disputes can disrupt global supply chains and create uncertainty in key markets. Navigating these macroeconomic headwinds requires careful planning and adaptability. It’s a version of events that investors must consider carefully. Again, diversification and a long-term perspective are crucial when investing in such a dynamic sector.

Factors influencing AMD stock price according to our Trading Co-Pilot

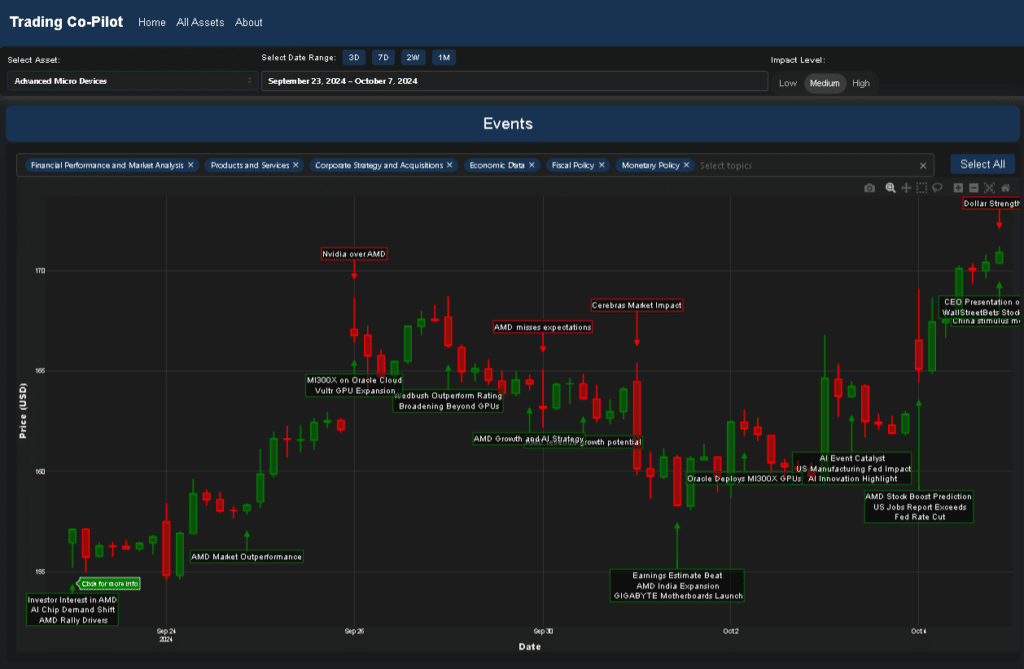

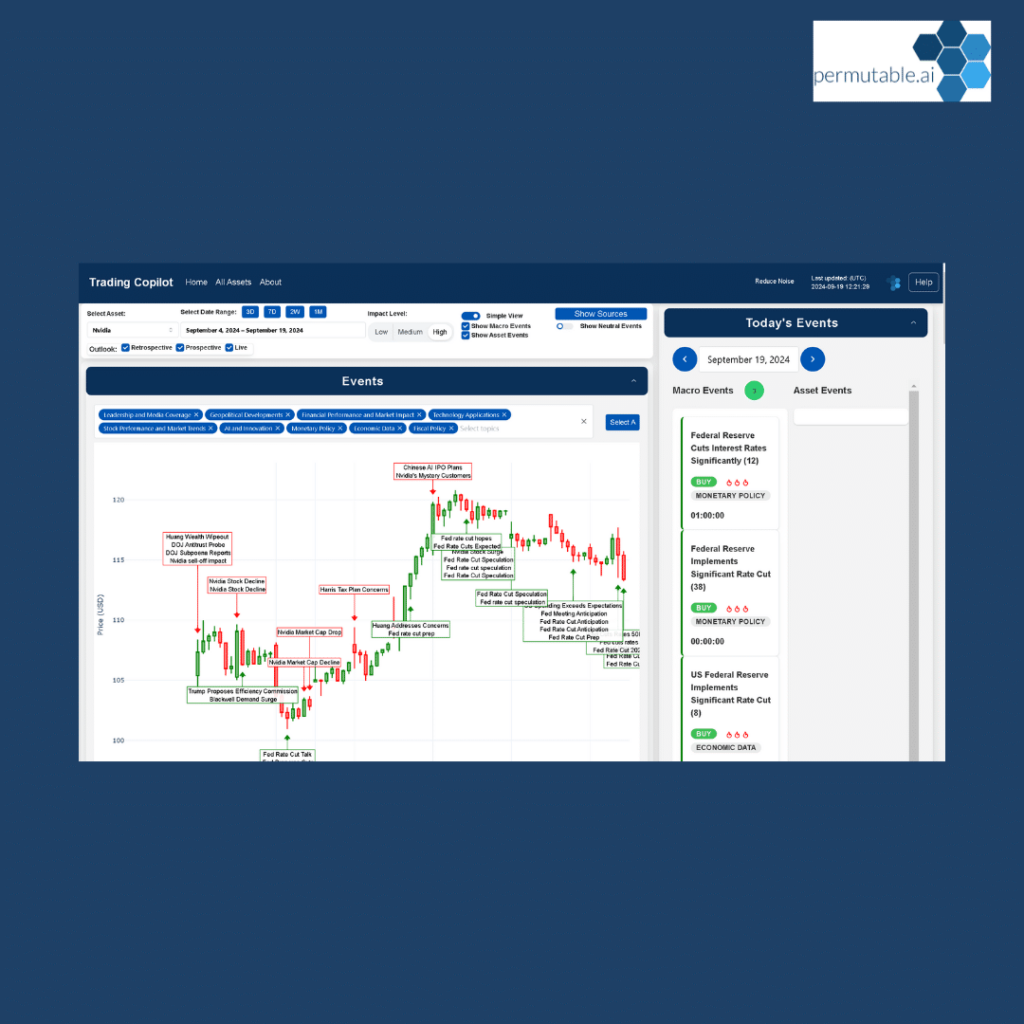

Our Trading Co-Pilot reveals a complex interplay of factors affecting AMD’s stock price. From competitive pressures and product innovations to macroeconomic trends and financial performance, a wide array of elements can sway investor sentiment. Analysing recent stock movements can provide valuable insights into the factors that influence AMD’s share price. With that said, let’s examine some key events highlighted by our Trading Co-Pilot from September 23, 2024, to October 7, 2024.

Above: Factors influencing AMD stock price – insights from our Trading Co-Pilot

Competitive factors

One of the most significant impacts on AMD’s stock in recent weeks came from its primary competitor in the GPU market. The graph shows a sharp downturn labelled “Nvidia over AMD”, indicating a moment when Nvidia gained a competitive edge. This event highlights the importance of staying ahead in the fast-paced world of semiconductor innovation. Even a perception of falling behind can have immediate consequences on investor confidence.

Product launches and partnerships

The announcement of “MI300X on Oracle Cloud” and “Vultr GPU Expansion” shows positive movements in AMD’s stock. This highlights the significance of strategic partnerships and the adoption of AMD’s products by major cloud providers. Such collaborations not only boost revenue but also enhance AMD’s credibility in the enterprise market.

Market performance and growth strategy

News events highlighted as “AMD Market Outperformance” and “AMD Growth and AI Strategy” correlate with upward movements in the stock price. This demonstrated that investors respond positively to AMD’s overall market performance and its strategic focus on high-growth areas like artificial intelligence. The company’s ability to articulate and execute its growth strategy clearly influences investor sentiment.

Financial performance

The graph indicates an event labeled “AMD misses expectations“, which coincides with a downward movement in the stock price. This demonstrates how crucial meeting or exceeding often elevated financial expectations is for maintaining investor confidence. Conversely, the later “Earnings Estimate Beat” corresponds with an upward trend, showing how positive financial surprises can boost the stock.

Industry-wide factors

Events labelled in our Trading Co-Pilot like “Cerebrus Market Impact” and “US Manufacturing Fed Impact” show how broader industry and economic factors can influence AMD’s stock price. These external factors underscore the importance of considering the wider economic context when analyzing AMD’s performance.

Innovation and product launches

The mention of “AI Innovation Highlight” and “GIGABYTE Motherboards Launch” correlates with positive stock movements. This indicates that the market values AMD’s continued innovation and the expansion of its product ecosystem through partnerships with hardware manufacturers.

Macroeconomic influences

The graph shows events like “Dollar Strength” and “China stimulus rumors”, which appear to have varying impacts on AMD’s stock price. This highlights how global economic factors and geopolitical events can influence investor sentiment, even when not directly related to AMD’s operations.

Final thoughts on Advanced Micro Devices stock forecast

As expected, AMD’s stock shows sensitivity to both company-specific news and broader market trends. But most industry insiders think that the long-term trajectory will depend on AMD’s ability to execute its growth strategy, particularly in AI and cloud computing, while navigating the competitive landscape and global economic challenges.

So much of the past, what of the future? There’s a big wheel moving in the right direction for AMD, but beneath the facade, challenges remain. The present state of play suggests a company on the rise, but as with any investment, due diligence is key. In a bizarre twist, the very volatility we see in the short term may present opportunities for long-term investors who believe in AMD’s potential. That leaves the power with investors to make informed decisions based on a comprehensive understanding of these diverse influencing factors.

As we look towards 2025, it’s clear that AMD’s stock price forecast will continue to be influenced by a myriad of factors. Staying abreast of technological advancements, competitive dynamics, and global economic trends will be crucial for anyone looking to invest in this dynamic company. The silicon chip game is far from over, and AMD seems poised to remain a key player in this high-stakes industry.

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of trading? Permutable AI’s Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.

Further reading

Looking for more stock price predictions? See below for:

Intel stock price prediction 2025

Nio stock price prediction 2025

Palantir stock price prediction 2030

Microsoft stock price prediction 2025

DJT stock price prediction 2025

Amazon stock price prediction 2030

Tesla stock price prediction 2025

Nvidia stock price prediction 2025