Let’s start with a simple truth: predicting market trends and volatility has always been a bit of a dark art. For years, traders and investors have relied on a mix of experience, intuition, and traditional statistical models to navigate the choppy waters of financial markets. And it isn’t just about making profits; it’s about managing risk and maintaining stability in our global economic system. But then machine learning came along and changed everything.

The limitations of traditional methods in predicting market trends

You might say that we’ve been doing alright with the old methods. After all, markets have functioned for centuries without the aid of artificial intelligence since it came on the scene way back in the 1970s (see our lookback at the evolution of AI in financial markets for more on that) . Yet here’s the rub: as markets become increasingly complex and interconnected, traditional methods are struggling to keep pace. Enter machine learning, the x factor that’s changing the game of predicting market trends and volatility.

The power of machine learning in predicting market trends

The problem isn’t that the old models of market analysis don’t work exactly; it’s that they’re not equipped to handle the sheer volume and velocity of data in today’s markets. Machine learning algorithms, on the other hand, thrive on big data. They can process vast amounts of information, identify patterns that humans might miss, and make predictions with a level of accuracy and timeliness that was once thought impossible.

Quantifying the impact

You may say: but does machine learning really make that much of a difference in predicting market trends and volatility? The short answer is yes, and the evidence is compelling. Studies have shown – and we have also seen firsthand with our own work – that machine learning models consistently outperform traditional statistical methods in this arena. This striking difference hints at a fundamental shift in how we understand and interact with financial markets.

Broadening the scope of data analysis

For starters, machine learning models can analyse a broader range of data sources when predicting market trends and volatility. They’re not limited to historical price and volume data; they can incorporate news sentiment, social media trends and macroeconomic indicators to gauge economic activity. This holistic approach provides a more finely-tuned understanding of the factors driving market dynamics.

Predicting market trends: Capturing complex relationships

Here’s something else we know to be true. Machine learning models are far better at capturing non-linear relationships in financial data. Traditional models often assume linear relationships between variables, which can lead to oversimplification. Machine learning algorithms, particularly deep learning models, can identify complex, non-linear patterns and in particular, relational patterns, that more accurately reflect the intricacies of real-world markets and the entities that comprise them.

Adaptability in a dynamic environment

Now let’s raise a bone of contention which is often cited in relation to the adaptability of these models. Financial markets are dynamic, with patterns and relationships that evolve over time. Machine learning models can be designed to continuously learn and adapt, and in our experience, must be constantly fine-tuned to ensure they remain relevant even as market conditions change. This adaptability is crucial in today’s fast-paced, ever-changing financial landscape.

Towards a new understanding of market volatility

Of course, it’s notable that machine learning isn’t just improving the accuracy of predicting market trends and volatility; it’s also changing how we think about these concepts. By identifying subtle patterns and correlations, these models are helping us develop a more granular understanding of market dynamics. And it is this deeper insight can lead to more effective risk management strategies and more efficient markets overall.

The future of financial market analysis

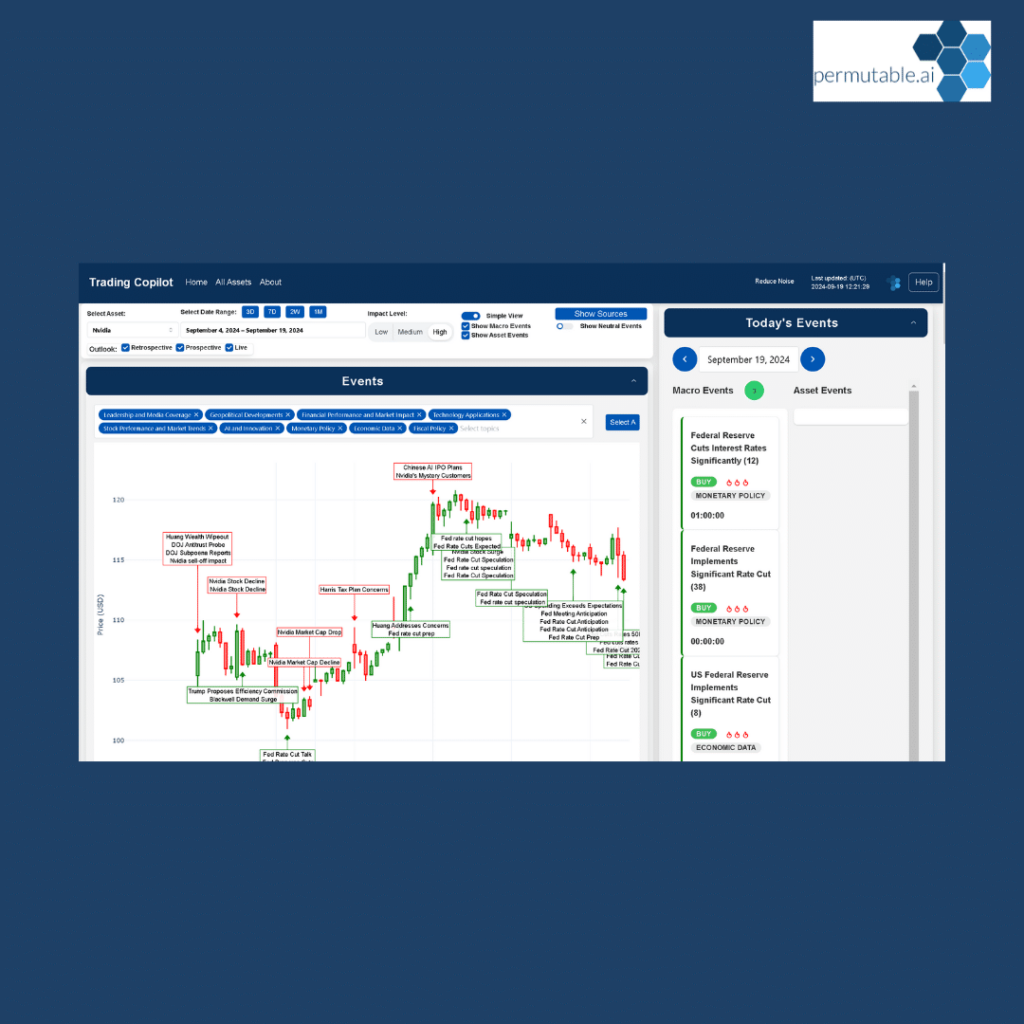

All of this signals that we’re on the cusp of a significant shift in financial market analysis. The integration of machine learning into predicting market trends – as demonstrated in our own Trading Co-Pilot – and volatility is not just an incremental improvement; it’s a significant step change that’s reshaping the field.

Nonetheless, it’s important to approach this technology with a balanced perspective. Machine learning is a powerful tool, but it’s not infallible. It’s important to remember that unless expertly trained and fine-tuned, models can be biased, overfitted, or simply wrong. The key is to use machine learning as a complement to human expertise, not a replacement for it.

Predicting market trends and volatility: The hybrid approach

We have seen time and time again how the hybrid approach can be undeniably powerful – in fact, we see this on a daily basis with our clients who are using our Trading Co-Pilot as well as throughout using it ourselves internally to execute trades. For instance, while machine learning models excel at identifying patterns in data, they lack the contextual understanding and intuition that experienced traders bring to the table. A model might flag a pattern as indicative of increased volatility, but a human analyst might recognise it as a temporary anomaly based on their broader understanding of market dynamics. It’s really when the two combine that the magic happens.

Again and again, we see the same pattern: the most effective approaches combine the strengths of machine learning with human insight. This hybrid approach allows us to leverage the processing power and pattern recognition capabilities of AI while still benefiting from human judgement and contextual understanding in predicting market trends and volatility.

The transformative power of machine learning in predicting market trends

In short, the role of machine learning in predicting market trends and volatility is nothing short of transformative. It’s providing us with new tools to understand and navigate the complexities of financial markets. As we look to the future, it’s clear that machine learning will play an increasingly important role in predicting market trends and volatility. One thing is cleat, those who can effectively harness this x factor will have a significant advantage.

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of predicting market trends? Permutable AI’s Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.