In this article, we’ll examine the key factors influencing Nextera Energy stock price, the leading U.S. energy company known for its focus on renewable energy sources, such as wind and solar power. Influenced by a variety of factors – both internal and external to the organisation – understanding these factors is crucial for investors, analysts, and industry stakeholders to make informed decisions about the company’s future performance.

Key factors influencing Nextera Energy stock price

Nextera Energy stock is influenced by a range of factors, which can be broadly categorised into the following groups:

- Economic factors

- Regulatory factors

- Environmental factors

- Market demand and supply dynamics

- Financial performance and investor sentiment

- Analyst recommendations

Let’s explore each of these factors in more detail.

Economic factors affecting Nextera Energy stock price

The overall state of the economy has a significant impact on Nextera Energy’s stock price. Factors such as GDP growth, inflation, interest rates, and unemployment levels can all influence the company’s financial performance and investor sentiment. During periods of economic expansion, for example, increased energy demand and higher electricity prices can boost Nextera Energy’s revenue and profitability, leading to a rise in its stock price. Conversely, economic downturns can result in reduced energy consumption and lower electricity prices, putting downward pressure on the company’s stock.

Regulatory factors impacting Nextera Energy stock price

The energy industry is heavily regulated, and changes in government policies, laws, and regulations can significantly impact Nextera Energy’s operations and financial outlook. Factors such as renewable energy mandates, emission control regulations, tax incentives, and permitting processes can all affect the company’s ability to develop and operate its renewable energy projects. Favourable regulatory environments that support the growth of renewable energy can positively impact Nextera Energy’s stock price, while unfavourable regulations can have the opposite effect.

Environmental factors and their impact on Nextera Energy stock price

As a company focused on renewable energy, Nextera Energy’s operations and financial performance are closely tied to environmental factors. The availability and reliability of natural resources, such as wind and solar, can directly affect the company’s ability to generate electricity and meet its energy production targets. Extreme weather events, such as hurricanes or droughts, can also disrupt Nextera Energy’s operations and impact its financial results, which can then influence its stock price.

Market demand and supply dynamics for Nextera energy stock

The demand and supply of Nextera Energy’s stock in the market can also affect its price. Factors such as investor sentiment, trading volume, and market liquidity all play a role in determining the stock’s price. If there is high demand for Nextera Energy’s stock, with more buyers than sellers, the stock price is likely to increase. Conversely, if there is an oversupply of the stock, with more sellers than buyers, the price may decline.

Financial performance and investor sentiment affecting Nextera Energy stock price

Nextera Energy’s financial performance, as reflected in its earnings reports, revenue growth, and profitability, is a key factor influencing its stock price. Investors closely monitor the company’s financial metrics, as they provide insights into its operational efficiency, growth potential, and ability to generate returns. Strong financial performance can boost investor confidence and lead to an increase in the stock price, while poor financial results can have the opposite effect.

Investor sentiment, i.e. the overall mood and perception of the market towards a company, can also significantly impact Nextera Energy’s stock price. Positive sentiment, driven by factors such as the company’s strategic initiatives, industry trends, and market outlook, can lead to increased demand for the stock and higher prices. Conversely, negative sentiment can result in decreased demand and lower stock prices.

Analyst recommendations and their influence on Nextera Energy stock price

Analyst recommendations can also heavily influence Nextera Energy’s stock price. In this case, positive analyst recommendations, which suggest that the stock is undervalued or has the potential for growth, can lead to increased investor interest and a rise in the stock price. On the other hand, negative recommendations, on the other hand, can result in a decline in the stock price.

A look back at recent events impacting Nextera Energy stock

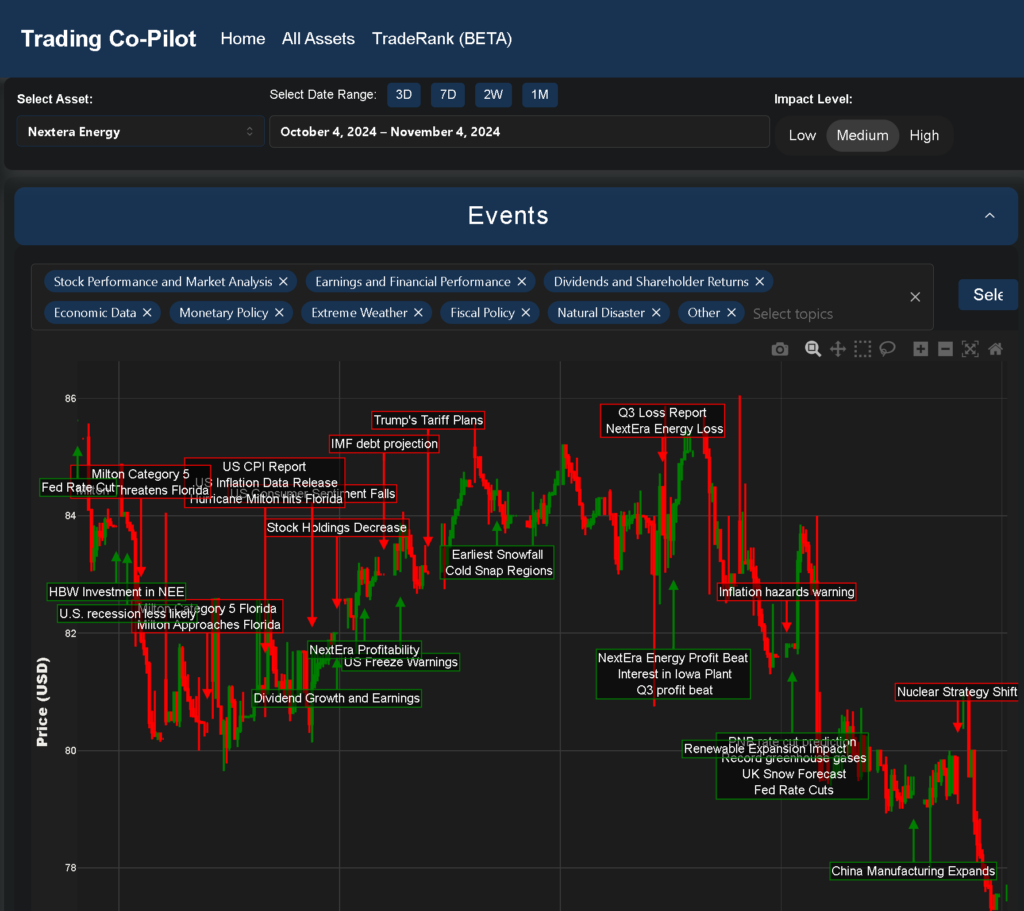

Using our Trading Co-Pilot to review NextEra Energy’s stock performance during October-November 2024 reflects a complex interplay of company-specific events, macroeconomic factors, and industry developments. The most significant impact came from the company’s Q3 loss report, though this was partially offset by positive news about Q3 beating beats in specific divisions and increased interest in their Iowa nuclear plant operations.

Weather events played a crucial role in price volatility, with Hurricane Milton’s impact on Florida operations, early snowfall, and cold snap conditions in key regions affecting potential operational outlook and demand. The company faced additional pressure from stock holdings decreases by a significant investor (Meyer Handelman) while broader economic factors such as Federal Reserve policy developments, IMF debt projections, and Trump’s tariff plans created market uncertainty.

The company’s dividend growth and earnings outlook provided some positive momentum during this period. External factors such as China’s manufacturing expansion and record greenhouse gas measurements influenced investor sentiment by highlighting changing global energy demand patterns and the growing importance of renewable energy solutions.

Final thoughts on factors influencing Nextera Energy stock price

Ultimately, Nextera Energy’s stock price is influenced by a complex interplay of economic, regulatory, environmental, market, financial, and analyst-related factors. By understanding and monitoring these key factors, investors, analysts, and industry stakeholders can make more informed decisions about the company’s future performance and the potential risks and opportunities associated with its stock.

Stay ahead of NextEra Energy stock and market movements

Don’t miss critical events affecting Nextera Energy stock prices. Our Trading Co-Pilot keeps you informed in real-time by monitoring multiple impact factors in real-time including:

✓ Stock performance & market analysis

✓ Earnings & financial Reports

✓ Weather events & natural disasters

✓ Economic d0ata & monetary Policy

✓ Regulatory changes & fiscal Policy

✓ Dividend updates & shareholder returns

Register your interest now to receive targeted alerts and never miss another market-moving event affecting your NextEra Energy investments by filling in the form below.