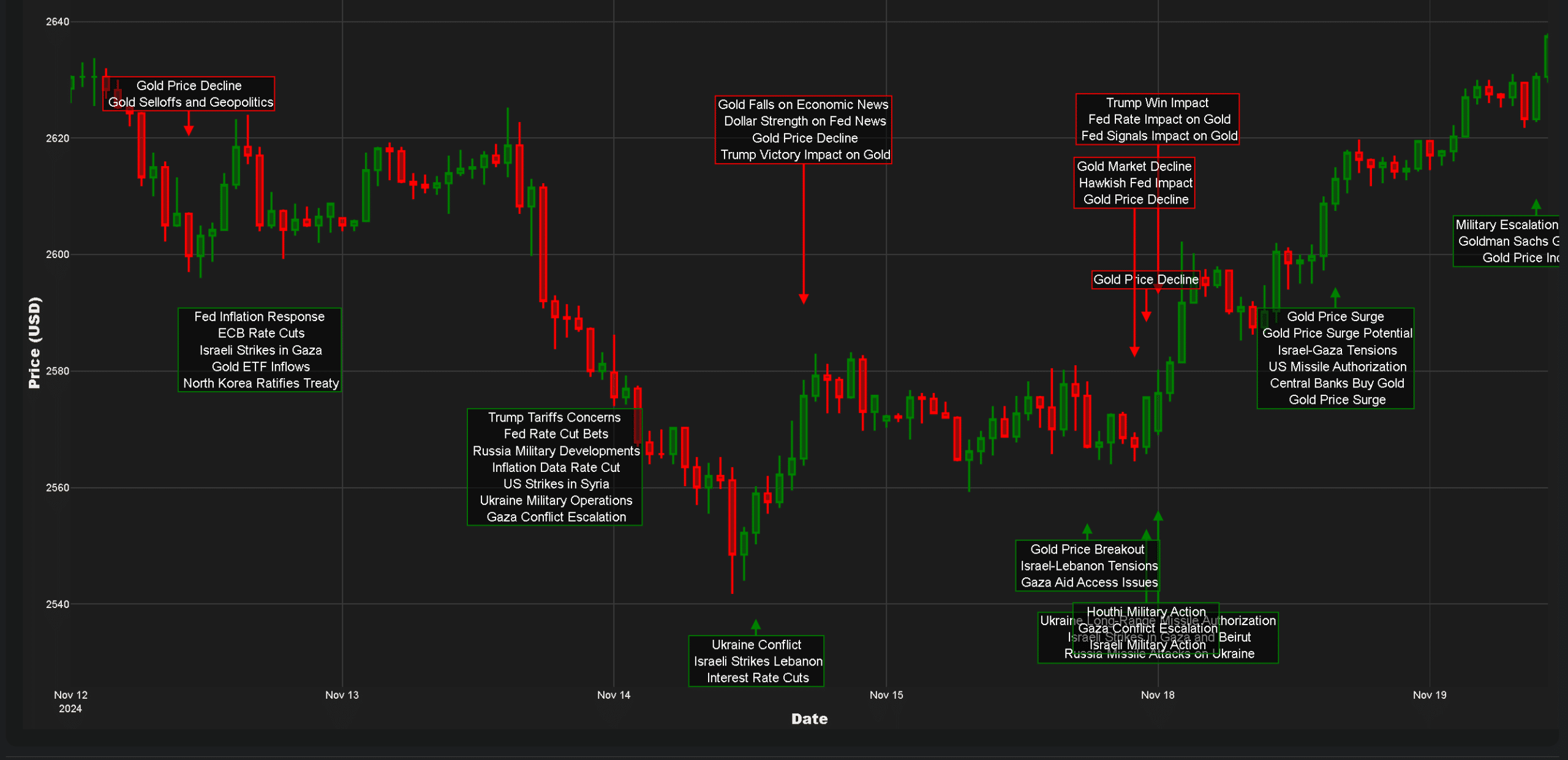

The prospect of significant changes in the gold market has materialised, and our Trading Co-Pilot‘s insights have identified a complex series of technical breakdowns following Trump’s victory. Indeed, from looking at our AI-driven analysis of the latest gold market news, we’re witnessing a fascinating repositioning of traditional safe-haven assets.

Gold market news: Technical breakdown analysis

Speaking of which, our AI detected an immediate bearish divergence post-election as it was unfolding, with gold market news dominated by a substantial selloff. With the precious metal dropping nearly 7% earlier this month, testing critical support levels around $2,550. One explanation, supported by our Trading Co-Pilot’s correlation analysis, is the significant capital rotation towards cryptocurrencies, evidenced by the iShares bitcoin ETF surpassing its gold counterpart in size.

Gold market news and corporate performance metrics

Meanwhile, sentiment analysis of corporate performance has painted a more nuanced picture in the gold market news. Consider the case of Kinross Gold, which exceeded Q3 estimates, while Hudbay Minerals reported record gold production in Manitoba. More broadly, our AI analysis indicates multiple mining companies demonstrated resilience despite market turbulence.

Regional arbitrage opportunities

The clue to this can be found in our Trading Co-Pilot‘s pricing analysis where cross-border arbitrage taking advantage of gold trading cheaper in India compared to the UAE, Qatar, and Singapore. This isn’t the only such example of market dislocation; with premium rates in Asia reaching a four-month peak as price drops attract more customers. By our estimate, based on real-time arbitrage calculations, these opportunities present significant trading possibilities.

Gold market news: Institutional perspectives and geopolitical risk

Then came the Goldman Sachs analysis, which aligns with several of our Trading Co-Pilot’s long-term projections. Our AI models support their “buy” recommendation, particularly considering the anticipated Federal Reserve rate cuts in 2025 and increasing central bank purchases.

But alongside a weakening dollar and stalling rally, our geopolitical risk indicators are flashing warning signals. Want to understand why? The key problem, according to Trading Co-Pilot analysis, is that global tensions, including China’s rise and Putin’s ambitions, continue to influence safe-haven demand. Above all, though, our algorithms suggest the market is entering a critical consolidation phase.

Technical support levels and momentum

We know that many people think that gold’s November dip signals a longer-term bearish trend, and our momentum indicators currently support this view. However, the good news is that our Trading Co-Pilot had identified several potential reversal signals even before most people were becoming aware of that fact. To put this in perspective, despite the recent turbulence in gold market news, our technical analysis shows prices bouncing off the 100-day moving average, suggesting potential support formation.

Institutional flow analysis

Returning to where we began, our AI analysis indicates the Trump victory has fundamentally reshaped market dynamics. But on that front, our institutional flow indicators suggest major players aren’t abandoning gold entirely. Instead, they’re strategically repositioning portfolios, which our Trading Co-Pilot interprets as potential accumulation at lower levels.

Looking ahead

In short, our Trading Co-Pilot‘s comprehensive analysis of the gold market news landscape presents a complex picture of challenges and opportunities. The problem is that traditional correlations are breaking down, particularly regarding safe-haven dynamics. Adding insult to injury, our crypto-gold correlation metrics show the cryptocurrency sector’s growing prominence has introduced new competition for investment flows.

Looking ahead, our Trading Co-Pilot suggest monitoring Federal Reserve policy, geopolitical developments, and institutional buying patterns will be crucial. There is also the question of whether our identified resistance level around $2,600 will hold. Another core principle from our analysis is the importance of watching regional price differentials, which our Trading Co-Pilot flags as leading indicators of smart money flow.

We invite you to think back to previous market cycles – our historical pattern recognition shows gold has demonstrated remarkable resilience during periods of political and economic uncertainty. The fundamental story of gold remains unchanged according to our Trading Co-Pilot insights: it serves as a store of value and hedge against uncertainty. Indeed, as we are entering the age of increased geopolitical tensions and economic recalibration, our Trading Co-Pilot suggests gold’s role in investment portfolios may become even more significant.

Experience AI-driven trading insights across gold markets

Want to harness the same AI insights that spotted these market movements in real-time? Request your personalised Trading Co-Pilot demo to access live gold market analysis and buy/sell signals. Explore our Trading Co-Pilot‘s capabilities or email enquiries@permutable.ai to request a demo or simply fill in the form below to understand how you can transform your gold trading strategy with our award-winning AI platform.