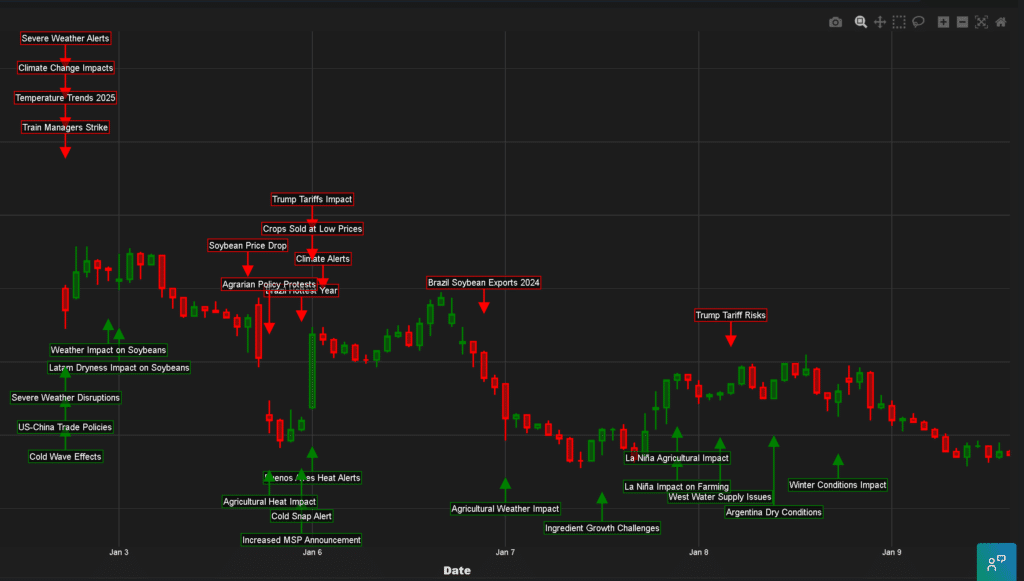

As we enter 2025, soybean prices have been experiencing significant downward pressure in what can only be described as a volatile market, with prices predicted by unpredictable and ever-moving forces that continue to shape the agricultural commodity landscape. The initial rally at the start of the year, which saw prices climb amid optimistic trading sentiment, has given way to a more bearish outlook, raising omnipresent questions about market fundamentals. In this article, we’ll explore the five key reasons behind recent falling soybean prices, with insights and market analysis taken from our Trading Co-Pilot.

1. Weather patterns influencing market sentiment and soybean prices

There’s been a real shift in weather-related market dynamics, particularly in South America. Today, the struggle to reconcile conflicting weather reports from Argentina’s soy belt highlights the market’s complexity. While initial concerns about dry conditions sparked a rally in early January, with prices reaching six-month highs, subsequent rainfall forecasts have contributed to a decidedly bearish sentiment. First, severe dry conditions raised alarm bells about potential yield impacts, but second, improved weather outlooks triggered substantial price corrections, demonstrating how quickly weather conditions can influence market direction.

2. Soybean prices and global trade dynamics

There isn’t any doubt about it – U.S. export sales falling below market forecasts have significantly impacted prices. The latest data shows inspections declining sharply, suggesting either reduced demand or logistical constraints affecting shipments. Either way, the consequence of these disappointing figures has created sustained downward pressure on prices. Together with lower-than-expected demand from key importing nations, there is no question that these trade dynamics are reshaping market expectations for 2025.

3. Supply chain disruptions persist

Next, it appears that once again supply chain issues are plaguing the market, creating additional headwinds for prices. Recent reports have been indicating a decrease in inspections for corn and soybeans, suggesting potential supply chain issues or reduced demand. This disruption echoes challenges seen in previous years, but with added complexity due to evolving global trade patterns

4. Market sentiment shows sharp reversal

The early January rally proved short-lived, with trader psychology shifting rapidly from bullish to bearish. That might be an echo of previous market cycles, however, we’re seeing unprecedented volatility in sentiment. The key here is to understand how these rapid shifts affect price discovery. It transpires that market fundamentals suggested the initial optimism was overextended, particularly given current inventory levels and production forecasts.

5. South American production outlook Improves

And guess what? To add to all of this is the mixed signals from South American production which have been creating additional market uncertainty. Some blame weather volatility, and it’s not an unreasonable concern given the region’s importance to global supply. But it is far more likely that the combination of improved rainfall and existing inventory levels will continue to pressure prices.

Navigating uncertainty in soybean prices

There was a time when soybean price movements were more predictable, but the problem with current market conditions is their increased complexity and volatility. The alleged supply constraints may prove less severe than initially feared, particularly if weather conditions normalise in key growing regions. Yet one thing is clear – the current environment demands careful position management and robust risk assessment. We may well see increased volatility as weather patterns evolve and trade flows adjust.

Want deeper insights into soybean market movements?

As commodity markets become increasingly complex, staying ahead of rapidly shifting soybean dynamics requires sophisticated analytical tools. Our Trading Co-Pilot platform has been specifically designed to address this challenge, delivering comprehensive market intelligence that helps traders make more informed decisions in real-time.

At the heart of our platform is a powerful AI engine that continuously monitors global price movements, weather patterns, and supply chain dynamics along with other key market factors giving you actionable insights that can directly impact your trading decisions.

What sets our Trading Co-Pilot apart is its ability to synthesize multiple data streams into clear, actionable intelligence. Our platform provides the comprehensive view needed for successful trading in today’s volatile market conditions.

Experience why leading commodity traders are already using our Trading Co-Pilot. Our enterprise trial gives you access to all platform features, including comprehensive market coverage, customisable alerts, and dedicated support from our expert team. We’ll work closely with you to ensure seamless integration with your existing trading and ensure a continuous feedback loop. Contact us at enquiries@permutable.ai to learn more or fill in the form below to request a free enterprise trial, subject to approval.