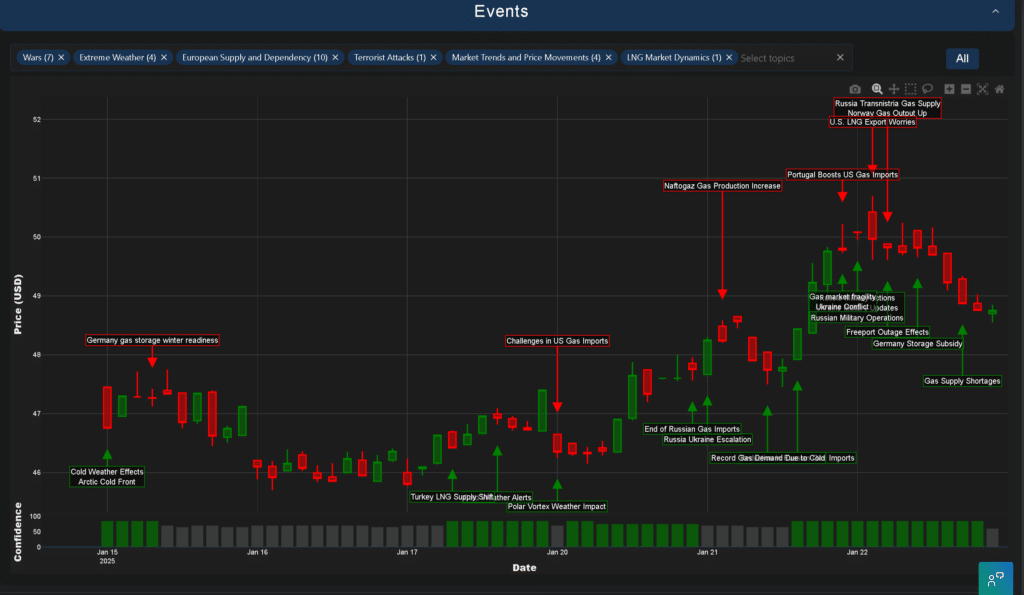

The alarm bells are ringing across European natural gas markets as we move into 2025, with prices displaying particular volatility in the last week. Insights from our Trading Co-Pilot reveal a complex interplay of factors and heightened sensitivity in the market. With that said, let us rattle through some of the key developments that have shaped this week’s trading European natural gas prices, where we’ve seen everything from weather-driven demand spikes to supply chain disruptions creating unique trading patterns – and of course the much talked about Trump LNG effect.

Supply dynamics and market fragility

The point which becomes obvious pretty quickly is that European natural gas prices are being pulled in multiple directions, creating both risks and opportunities for TTF traders. According to sources, Europe may require over 100 additional gas cargoes to replenish its dwindling stocks, highlighting the fragility of current supply chains. Our Trading Co-Pilot’s analysis shows this news triggered a clear price movement, demonstrating the market’s acute sensitivity to supply-related headlines.

Not long ago, this might have seemed manageable, but the recent Freeport LNG outage has led to a surge in TTF natural gas prices, pushing the market into new territory. Our Trading Co-Pilot clearly shows the immediate price impact, with a notable spike following the announcement. Almost everyone we speak to in the industry now acknowledges that traditional supply-demand models need updating to account for this new market reality.

Weather and demand pressures

To add to this, extreme cold weather is expected to drive record gas demand. This concern has three components that our Trading Co-Pilot clearly illustrates: immediate supply pressure showing in rapid price movements, storage depletion rates accelerating beyond normal seasonal patterns, and increased price volatility during weather events. The trouble is, this comes at a time when European natural gas prices are already showing significant sensitivity to supply disruptions.

What’s clear is that cold weather effects, particularly the Arctic cold front, have created distinct trading patterns. What’s more is that the market response to these weather events has been notably more pronounced than in previous years, with particularly sharp reactions during the early morning hours when temperature forecasts are updated. The Polar Vortex impact has been especially notable, creating a new pattern of price behaviour that suggests weather premium is being built into the market at levels we haven’t seen before.

Geopolitical complexities and supply security

And that’s before we address the ongoing Russia-Ukraine conflict escalation. So what’s actually is going on here? Well, the EU has successfully reduced its imports of Russian gas by 75%, but this has created new market dynamics that are clearly visible in our data. It’s the same story on alternative supply sources – Portugal has shifted its gas sourcing away from Russia, increasing imports from the US and Nigeria, yet even now, these transitions are creating their own complex market patterns.

The crisis in supply security is forcing energy traders to develop new risk management strategies. In addition to that, the market has shown particular sensitivity to news about US LNG exports, with significant price movements within hours of major announcements from the new Trump administration.

Supply diversification and market innovation

Just as notably, Germany is considering a plan to subsidise gas storage refills, which could influence market dynamics and supply strategies. Our Trading Co-Pilot data showed an immediate positive market reaction to this news. And then there was the news that Norway’s gas output saw a slight increase in December to consider, though the market response was relatively muted, suggesting TTF traders will be more focused on longer-term supply solutions.

So when it emerged that Russia is preparing to supply gas to Transnistria through Türkiye starting in February, our data showed an interesting market reaction pattern. This method applies equally to understanding the impact of Germany’s storage subsidy plan and other policy initiatives, with clear price movement correlations visible in our data.

Forward-looking market implications

All this means that European natural gas prices are likely to remain volatile throughout the rest of the winter period, as we’ve previously reported on before. Initially, the market’s focus was on storage levels, but now for traders, the key metrics have expanded significantly. In this scenario, our data suggests we can expect continued price sensitivity, with potential for larger movements during extreme weather events or supply disruptions.

Of course, there’s a reason why the market is watching these developments so closely. As with most things in energy markets, the interplay between supply, demand, and geopolitical factors creates complex trading conditions. And yet perhaps the most interesting aspect is how the market is adapting to these new realities.

What we’ve found through our Trading Co-Pilot analysis is that it is the correlation of multiple data points and overlapping factors – whether it be weather patterns to storage levels, or geopolitical developments to infrastructure constraints – rather than single events that is causing price movements.

Despite this challenging environment, the market is adapting to new realities. And while volatility in European natural gas prices may persist, the market is gradually developing new mechanisms for resilience. There is a definite sense that energy traders are becoming more sophisticated in their approach to risk management and trading strategies, for for our clients, integrating our Trading Co-Pilot is becoming an important part of this.

The crisis in market stability has forced innovation in trading approaches, and that’s perhaps the silver lining in current conditions. Whether this narrative holds through 2025 remains to be seen, but one thing is certain: the European gas market continues to offer significant opportunities for the those leading the herd with our AI-powered market insights.

Ultimately, success in this market requires not just understanding individual events but comprehending how multiple factors interact to influence price movements. The data from our Trading Co-Pilot platform clearly demonstrates this evolution, showing precisely how successful traders are those who can integrate multiple data streams into their decision-making processes.

Experience our natural gas market intelligence first hand

Seeing these market dynamics play out in real-time can transform how you trade. Our Trading Co-Pilot platform doesn’t just track events – it helps you understand their interconnected impact on market movements before they happen. With features ranging from advanced event tracking to real-time market movement alerts, we’re offering tools that can bring a new level of sophistication to your Trading strategy.

After a successful first wave, we’re now opening up early access to our advanced market intelligence platform for select additional enterprise users. As part of this exclusive program, you’ll receive premium access to all features of our Trading Co-Pilot and direct support from our team. The past week’s volatility in European gas markets demonstrates why timing and insight matter – and so now is the time to join the growing community of energy traders who are already using our platform to stay ahead of market-moving events.

Ready to transform your trading strategy? Schedule a demo by emailing us at enquiries@permutable.ai or simply fill in the form below to get in touch.

*Early access program is limited to select enterprise clients and subject to qualification.