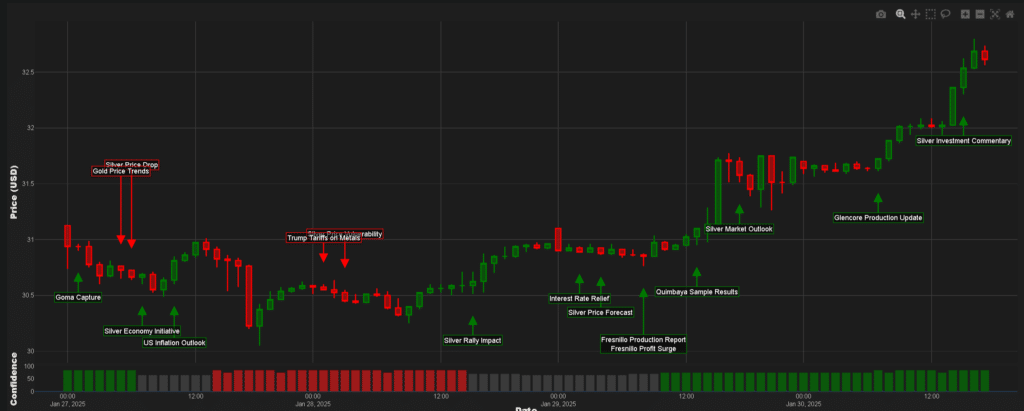

All eyes have been on the silver market rally this week, with prices pushing. So what has been driving this latest upward trend? We break down the narratives that have shaped silver‘s latest upward trajectory.

Early week foundation for silver market rally

The groundwork for this week’s silver market rally was laid on January 27th, when the IDB’s commitment to developing the silver economy in Latin America and the Caribbean set a positive tone for industrial demand expectations. Around the same time, reports of M23 rebels capturing Goma in Eastern Congo highlighted supply chain vulnerabilities in precious metals markets, adding a risk premium to prices. Our analysis shows that these geopolitical tensions, combined with existing supply constraints, created a powerful catalyst for upward price movement.

Emerging momentum

Then, on January 28th, there where Trump’s warnings about potential metal tariffs which created additional market uncertainty. Whether it is these factors or broader macro conditions, the scene was set for a silver market By January 29th, the narrative had evolved significantly. Quimbaya’s announcement of high-grade silver samples coincided with growing anticipation of interest rate relief, creating a perfect storm of positive catalysts. It used to be the case that such news might have limited impact, but in the current environment of supply constraints and monetary policy uncertainty, fueled gains.

Meanwhile, Fresnillo’s report of doubled gross profits, highlighted the sector’s profitability in the higher price environment and suggested mining companies might struggle to rapidly increase output even at attractive price levels. And all of this was underpinned by the continued buying of silver by Commodity Trading Advisors, indicating strong investment interest and continued interest in demand for silver.

To add to this was on January 30th there was Glencore’s production update revealing lower metals output for 2024. There is debate about whether these supply constraints will persist, but looming over the market is a forecasted sizeable deficit throughout 2025. Our Trading Co-Pilot’s sentiment analysis shows that institutional investors are increasingly focused on this supply-demand imbalance, with many adjusting their positioning accordingly.

The compound effect of these developments – from production shortfalls to monetary policy expectations and geopolitical tensions – created a robust foundation for silver prices with a positive outlook. But despite all of this volatility remains an inherent characteristic of precious metals markets, with our analysis suggesting it would be prudent to maintain a positive bias while implementing appropriate risk management strategies.

Navigate silver market events in real time with our Trading Co-Pilot

Every precious metals trader knows that catching the early signals of market movements can make the difference between profit and loss. Our Trading Co-Pilot platform identified and tracked every key development in this week’s silver rally as it unfolded – from the initial IDB announcement to Glencore’s production update (see above chart).

Imagine having instant access to:

- Real-time event detection across 50,000 news sources

- Advanced sentiment analysis of market-moving developments

- Clear visualisation of event impact on price movements

- Comprehensive correlation tracking between related events

- Early detection of emerging market narratives

Currently processing over 10,000 articles daily for commodities markets, with FX markets coming soon, our platform helps traders cut through the noise to identify what really matters. We don’t just aggregate news – we help you understand the evolving narrative behind price movements before they impact your trading decisions.

Ready to experience how Trading Co-Pilot can transform your market intelligence capabilities? We’re currently accepting expressions of interest from enterprise clients. Email enquiries@permutable.ai to schedule your personalised enterprise demonstration (subject to approval), or fill in the form below to learn more about how we’re reshaping market intelligence for traders.